Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 26 January 2022 02:08 - - {{hitsCtrl.values.hits}}

By Ceylon Tea Brokers

The Sri Lankan tea industry for the period January-December 2021 shows an increase in production and exports whilst recording a decline in national average when compared to the same period in 2020.

The Sri Lankan tea industry for the period January-December 2021 shows an increase in production and exports whilst recording a decline in national average when compared to the same period in 2020.

COVID-19 negatively affected industry across the globe. Measures implemented to try and curb the spread of virus disrupted business systems and routines. The tea industry was no exception from the struggles that the global business market is currently experiencing, with restricted product access, lack of production, loss of income, and uncertainty are some of the factors that affected the tea industry globally.

Furthermore, macro-economic factors continued to fundamentally challenge the tea industry framework with fluctuations in supply and demand, currencies, political climate in importing countries and policy decisions severely affecting the industry.

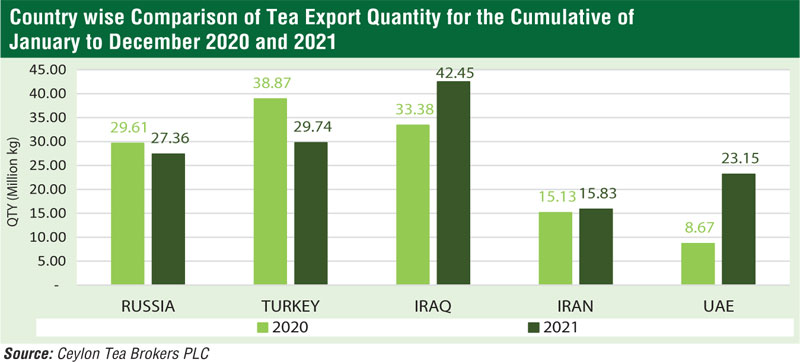

Iraq, Turkey and Russia continued with strong demand for Sri Lankan tea and were the top three importers for the period January to December 2021.

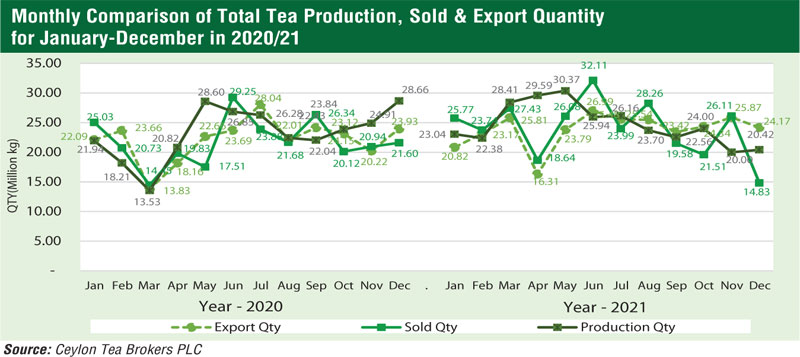

The total tea production of Sri Lankan Tea for the period January to December 2021 recorded 299.34 million/kgs in comparison to 278.85 million/kgs in 2020 (+20.49 million/kgs). High, Medium and Low Growns show an increase in volume comparison to the same period in 2020.

Also, the CTC High, Medium and Low Growns recorded an increase in volume compared to the same period in 2020. Production and Exports increased by +20.49 million/kgs and +20.45 million/kgs respectively when compared to the same period in 2020.

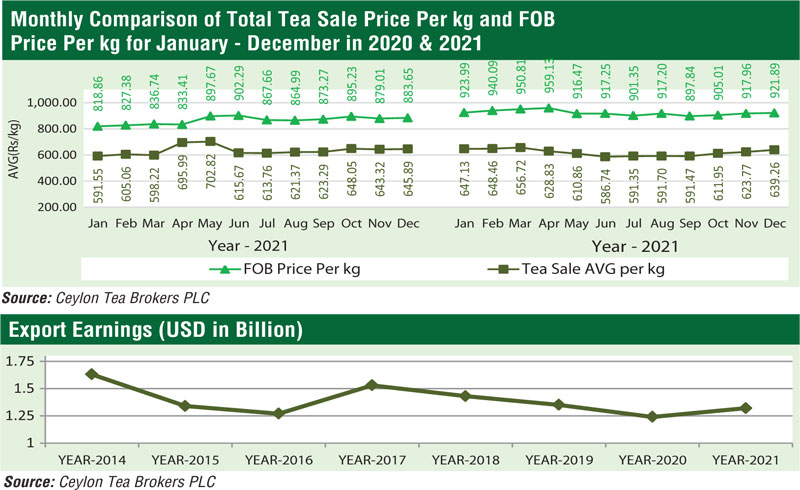

The total National Average of Teas sold for the period January to December 2021 was Rs. 615.44 ($ 3.10) per kilo in comparison to Rs. 628.21 ($ 3.39) for the same period in 2020, which recorded a decrease of -Rs. 12.77. Low Growns averaged Rs. 644.23 ($ 3.24); Mid Growns recorded Rs. 550.80 ($ 2.77) with High Growns at Rs. 587.13 ($ 2.95).

For the period January to December 2021 the averages for High Grown shows an increase in rupee terms whilst the Medium and Low Growns show a decrease. In dollar value all three elevations witnessed a decrease. Low Growns with the largest market share with 61.19% of the production recorded a decrease of -Rs. 22.09. Medium Growns recorded a decrease of -Rs. 3.14 whilst High Growns recorded an increase of +Rs. 6.23.

Sri Lanka Tea Exports for the period January-December 2021 amounted to 286.02 million/kgs vis-à-vis 265.57 million/kgs recorded for the same period last year (+20.45 million/kgs). The FOB average price per kilo for this period stood at Rs. 920.76 ($ 4.63) in contrast to Rs. 866.70 ($ 4.67), which shows an increase in the rupee term (+Rs. 54.06) and decrease in dollar value (-$ 0.04) when compared to the corresponding period in 2020. The FOB value of Tea Bags has gained in comparison to the same period in 2020.

The total revenue realised for the period January-December 2021 from Tea Exports was Rs. 263.35 billion ($ 1.32 billion) compared with Rs. 230.17 billion ($ 1.24 billion) recorded for the period January to December 2020. It’s an increase in rupee terms (+ Rs. 33.18 billion) and dollar value (+$ 0.08 million) compared to the same period in 2020. Also, teas in Packets and Bulk showed an increase in FOB Value.

Country wise analysis of exports shows that Iraq emerged as the largest importer of Sri Lankan tea for the period of January-December 2021 followed by Turkey and Russia. Tea exports to Iraq have increased by 9.08 million/kgs. However, Turkey and Russia have dropped by -9.12 million/kg and -2.25 million/kg respectively. Tea exports to the UAE increased by 14.48 million/kg whilst Iran has increased by +0.71 million/kg and China increased by +0.11 million/kg compared to the same period in 2020.

In terms of the USD equivalent, based on the respective weighted average exchange rates, export earnings amounted to $ 1.32 billion in 2021 in comparison to $ 1.24 billion in 2020, $ 1.35 billion in 2019, $ 1.43 billion in 2018, $ 1.53 billion in 2017, $ 1.27 billion in 2016, $ 1.34 billion in 2015 and $ 1.63 billion in 2014.

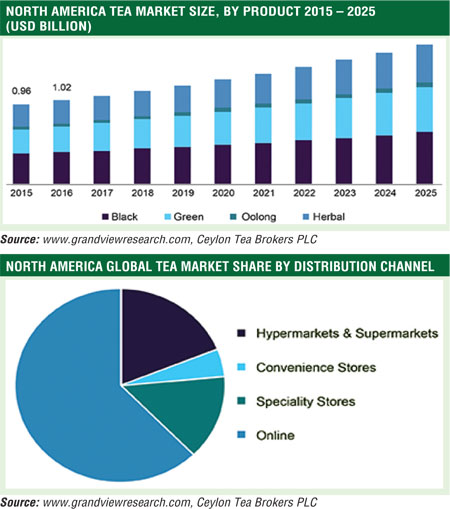

North American tea market

The global tea market size was valued at $ 12.63 billion in 2018 and is expected to expand a CAGR of 5.5% from 2019 to 2025.

Online distribution channel is anticipated to expand at the fastest CAGR of 5.9% over the forecast period. The rise of online apps coupled with availability of discounts and easy product delivery has positively impacted the supply chain of the market.

The Sri Lanka tea production saw a gain in comparison to 278.49 million/kgs (in 2020) after a volatile end to 2021 due to the ongoing pandemic. The year 2022 could be looked on a more positive note. The world economy is poised for a modest rebound this year. The growth in 2022 could be stronger if the pandemic de-escalates, a decline in downturn in major economies and reduced financial disruption would pave the way for a healthier year. Therefore, a reasonable level of optimism should prevail if all factors affecting growth are reasonably stable.