Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 12 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Asia Siyaka Commodities PLC

By Asia Siyaka Commodities PLC

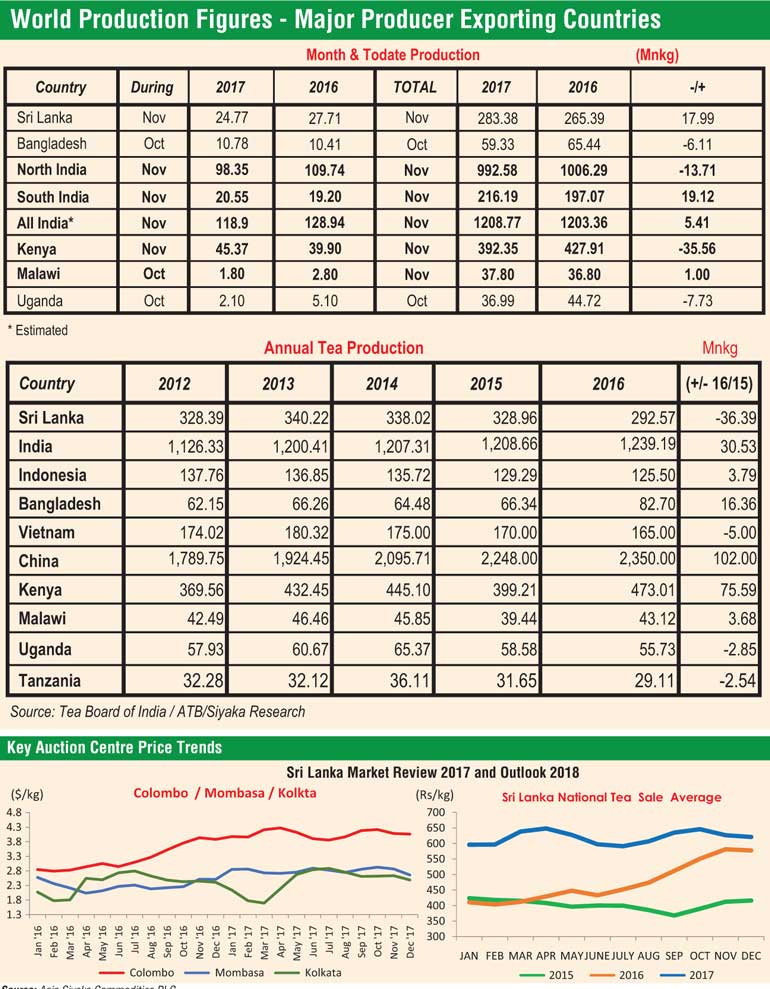

World supply continues to rise with the International Tea Committee estimating 2016 global production to be 5.462 billion kg compared with 5.281 billion the year before. The YoY increase of around 3% is significant when one considers that 2016 was an El-Nino year. Of the projected 181 million gain in 2016 YoY 2015, 55% or 102 million kg has come from the estimated Chinese tea production increases from 2.248 to 2.350 billion kg. Similarly India the second largest producer in the world grew its production from 1.208 billion in 2015 to 1.239 billion in 2016 despite low production in South India. Kenya recovered from a bad 2015 of 399 Million kg to reach a record 473 million kg in 2016. Sri Lanka came out as the biggest loser in that year with production dropping 11% from 328 million kg in 2015 to 292 million kg in 2016 a loss of 36 million kg.

In 2017 a review of available data from the major producer exporting countries shows Sri Lanka up 18 Million kg by November on its low base year.

Total India crop for the same period is up 5 million kg; while South India gained 19 million kg on its low 2016 figure, North India was down 14 million kg. Kenyan production was at a low 392.3 Million kg compared with 427.9 Million kg during the period January – November 2016. The shortfall was 35.5 million kg.

Uganda Crop to October at 37 million kg is down 7 million kg YoY 2016. It is difficult to project China tea production but could rise to 2.4 billion in 2017.

Total Global Green Tea production has risen from 1.736 billion in 2015 to 1.788 billion in 2016. 86% amounting to 1.550 came from China.

China has aggressively driven its production of black and other tea over Green Tea in recent years. In 2010 China produced a total of 1.475 billion kg which grew to 2.350 billion by 2016. (+59%). Of this total, green tea production stood at 1.046 billion in 2010 which increased 48% to 1.550 in 2016. The Black/Other tea category has grown 86% from 429 million kg in 2010 to estimated 800 million kg by 2016. It seems however that most of this production has been consumed locally as the published export figures do not reflect a significant increase of this category. China’s booming economy has produced affluent consumers eager to purchase China’s best teas.

Available data of tea production for the period Jan – Nov 2017 at 283.38 million kg is up 18 million kg 7% on last year’s low figure of 265.39 million kg. Over the three previous years however the 11 month total was 305, 313 and 309 million kg respectively.

The Low country eleven month figure of 181.50 million kg is naturally up on last year’s low quantity of 167.04 million kg but trails 187 million kg in 2015; 194 million kg in 2014 and 189 million kg in 2013.

High Grown production for the period is 59 million kg; sharply lower than 2015 quantity of 70 million kg and 73 million kg the year before. Mediums have followed a similar trend and are at 42 million kg; down from 47.7 and 46.1 in 2015 and 2014.

Looking at the mixed weather and factors such as agricultural practices, fertiliser application and restricted labour; we are not optimistic the Q4 2017 will see high production.

We believe the national total for 2017 will therefore be around 309 million kg. The projected total for Low Growns would be around 197 million kg; High Growns 65 million kg and Mediums 47 million kg.

India is heading for record annual crop of around 1.26 billion against 1.23 billion in 2016. Similarly China, based on historic trend could move up to a record 2.4 billion in 2017 compared with 2.35 billion the year before.

Kenya following early losses should end 2017 at a quantity of around 438 million kg down 35 Million kg on 2016 final total of 473 Million kg. The other significant African Producer Exporters Malawi should be steady at around 43 Million kg with Tanzania 33 million kg and Rwanda 25 million kg. Uganda however following the Kenyan cropping pattern is trailing 2016 and will be around 47 million kg in 2017 against 55.7 million kg in 2016.

From a Sri Lankan perspective the supply of Orthodox Black Tea by the Major Producer exporting countries initially declined in 2016 YoY 2015. Production and exports from Vietnam and North India met some of the shortfall quantitatively but not qualitatively.

Supply of CTC Black Tea in 2017 followed a similar pattern with Kenya having a very poor Q1.

The country will have to contend with unsettled weather, inability to source cost effective weedicides, disruption to regular agricultural practices and high cost of fertiliser. Wage negotiations for RPC estates are expected in Q3. There could potentially be disruption to work particularly in the higher elevations based on historic patterns of Union activity.

If weather holds, Sri Lanka could reach 320 million kg in 2018. Low Growns 200 million kg, High Growns 70 million kg and Mediums 50 million kg, could be achieved if market prices for Ceylon Tea remain buoyant until the 3rd quarter.

In Sri Lanka with elections due in February and cooler dry conditions experienced on the Western side early in the year; we expect production to be restricted during Q1. Much depends on the settling of key issues discussed previously if Q2 and Q3 are to be high cropping periods. We project a total of 320 million kg.

Of the other major Asian producers exporters Vietnam could get back to 170+ Million kg and Indonesia will record nominal growth to about 130 million kg. Globally India and China are likely to hold steady on 2017 numbers as both countries cannot sustain the growth momentum shown in the three previous years. Kenya is capable of bouncing back with potential to reach 470 million. Uganda would benefit from the same weather conditions and increase production potentially to 60 million kg. Other Africans will hold steady.

Despite 2016’s final global production figures showing supply improvement, there was a marked shortfall in the supply of Orthodox and CTC Black tea from many countries.

Crop intake declined in the Southern hemisphere from around mid-year and continued into Q1 2017. Supply chain had little stock. In Sri Lanka supply remained tight throughout the year.

Sri Lanka is heading for a low cropping Q1 in 2018 following a weak Q4 in 2017. Cold dry weather is expected on the Western slopes and in the Low Country, which means supply will remain tight until after Sinhala New Year. Tea production will increase in the 2nd quarter. North India and some other Asian countries will be in winter during Q1.

World exports of tea remained flat at 1.797 billion kg in 2016 compared with 1.793 billion kg in 2015. The highest figure for world exports of tea was 1.897 billion kg in 2013. In that year 37.2% of world production was exported and this has declined to 32.7% in 2016 reflecting higher domestic retention in producer countries.

Of the major tea producer exporters in Asia India, Sri Lanka and Indonesia have recorded lower quantities in 2016 YoY 2015, whilst China shows a little change. Vietnam is the only producer to record significant gains. African exports have grown on the back of a sharp rise by Kenya.

Overall Green Tea shipments dominated by China were marginally lower in 2016.

We project Sri Lanka tea export quantities in 2017 to show little change yoy 2016. India and Vietnam are likely to record gains. Africa is heading for a big drop with projected Kenyan exports in 2017 expected to decline more than 50 million kg YoY 2016.

2018 Supply/Export outlook looks to be very tight in Q1. The pipeline seems to have fed immediate demand with no carry over from the previous year.

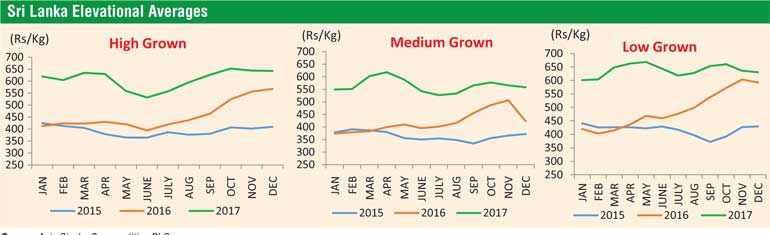

The major export auction centres Colombo, Mombasa and Kolkata all recorded significant gains in 2017 YoY 2016. Price changes at the Colombo auction were more pronounced even as the Rupee depreciated against the Dollar. The US Dollar was around SLR 145 in June 2016 and appreciated to SLR 153 by the same time 2017. The currency generally held these levels thereafter. At the Colombo Tea Auction prices reached record levels that peaked in October for all three elevations and stayed buoyant until December.

Many of Sri Lanka’s key markets are oil income driven. Projections for crude oil prices in 2018 are relatively high as they were in 2017. We have seen a strengthening of currencies in these markets, as their economies recover.

Iran a major buyer of Sri Lankan Orthodox Black teas is having domestic and International issues that could have a negative impact on purchase of Ceylon Tea. On the other hand India is gaining a larger share of the market through increased exports of its own and other origin teas through its “financial package” with Iran. This could have a long term impact for Ceylon’s and Pure Ceylon tea packs.

In Sri Lanka Tourism is on the up and many urban Sri Lankan consumers are being offered BOPF standards by the brands. This is a positive sign.

We expect the market at the Colombo Tea Auctions for Orthodox long leaf teas to maintain the December closing rates until around March 2018.

The market would soften in Q2 subject to supply and could strengthen thereafter.

Prices for liquoring High Growns are projected to be strong through Q1 2018. It is not certain however how the market would behave over the Japan MRL issue. We are confident this matter will be resolved early but there could be a negative impact on price in the immediate short term. Overall we project market levels in Q3 and Q4 to exceed comparable prices of 2016.