Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 15 November 2019 00:00 - - {{hitsCtrl.values.hits}}

By J.A.A.S. Ranasinghe

The traditional pepper export market is badly hit by the over production of pepper by the pepper producing countries and the wrong economic policies of the present Government and the two main contenders of the SLPP and UNP have taken the woes of the pepper cultivators as a high priority issue in their election campaigns in order to garner more votes. Whilst one contender has pledged to establish an authority for the pepper industry, the other contender has agreed to impose a minimum farm gate price with a basket of numerous relief measures to the poverty-stricken pepper cultivators all over the country.

It appears that both contenders of the presidential race appear to have not grasped the nitty-gritty issues faced by the pepper industry, especially in the context of the world pepper market and it is absolutely essential to study the behaviour of the world market for pepper, if a genuine redress is to be given to the local pepper cultivators.

Pepper is the most widely used spice in the world and known as ‘King of the Spices’. Pepper crop is native to South Asia and historical records reveal that pepper is originated in South India. Peppercorns were a much-prized trade good often referred to also as ‘black gold’ and used by as a form of commodity money. Vietnam (35%), Indonesia (16%), Malaysia (6%), India (16%), and Brazil (10%), China (9%) are the main pepper producers in the world with the percentages to the world production. Sri Lanka’s contribution to world production of pepper is 4%.

Pepper is largely produced as black pepper which is the dried whole fruit. White pepper is produced by removing outer pericarp and pepper is also available in crushed and ground forms. A small amount of green and ripened pepper is pickled in brine and dehydrated green pepper and preserved red pepper also traded. Pepper oil and oleoresins are also extracted marketed as value-added products. Pepper is mainly used as a spice and flavouring agent in the food industry. It also has industrial uses in perfumery and pharmaceutical industries.

Pepper production

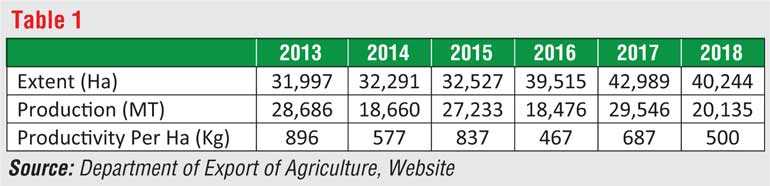

In Sri Lanka, pepper is mainly cultivated in low and mid country wet and intermediate agro-climatic zones. The total extent of pepper in Sri Lanka is about 40,244 ha and Matale, Kandy, Kegalle, Badulla, Ratnapura, Monaragala, and Kurunegala are the major pepper growing districts. The annual production of pepper for the year 2018 is to be in the region of 20,135 Mt.

The figures contained in the given table speak themselves of the pathetic downfall of the pepper industry. The extent of land under pepper cultivation is on the decline compared to 2018. This may be partly due to the lack of remunerative prices for pepper. The pepper production has witnessed an appreciable downward trend by 10,000 Mt compared to 2018. The pepper cultivators appear to have abandoned their lands for want of a remunerative market. It is reported that price of dry pepper had reduced to Rs. 425 per kg and a raw pepper to Rs. 125 per kg, which was not adequate even to cover the labour cost.

The Government that promised to provide a guaranteed price of Rs. 1,000 per kilo and encouraged farmers to cultivate pepper had mercilessly left them in the lurch. Thousands of labourers are reported to have lost their livelihood income, as the pepper cultivation has become a non-lucrative cultivation for the farmers. Insiders say that the extent of pepper cultivation would reduce to 30,000 Ha from next year onwards, unless the Government resurrects the pepper industry by giving them a remunerative market, enhanced incentives and sound extension services.

According to the Department of Export Agriculture (DEA), the prices of Sri Lankan pepper is mainly dependent on its demand at the international market. With a surge of production all over the world, inevitably the prices of pepper have plummeted to unprecedented levels and Sri Lanka is also caught up in this vicious cycle. As a result, India, the biggest buyer of Sri Lankan pepper has paid unbelievably low prices since the beginning of 2017.

These price fluctuations have taken a dramatic downward trend intermittently. The dollar value offered for Sri Lankan pepper in March 2017 i.e. $ 10,885 per ton has declined to $ 7,300 in December 2017 by 31%. It has further plummeted to $ 5,500 per ton by August 2018 recording a decline rate of 49% and $ 5,000 by end of April 2019. However, it is a matter for solace that this downward trend has seen a marginal upward trend to $ 5,300 per ton by September 2019.

Productivity

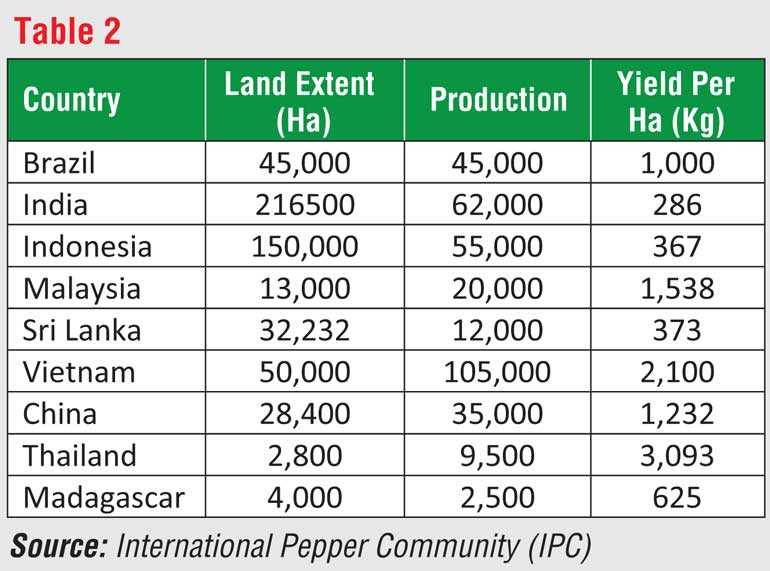

The sad episode is that the yield (productivity) of the pepper cultivation is on a remarkable downward trend. An analysis of the statistics compiled by the International Pepper Community (IPC), an intergovernmental organisation of pepper producing countries comprised of India, Indonesia, Malaysia, Sri Lanka, Vietnam, Philippines and Papua New Guinea indicate that the national yield (Sri Lanka) of the pepper has reached a low level of 373 kg by the year 2004 (almost 15 years ago).

In the year 2018, Sri Lanka has been able to maintain an average yield of 500 kg. It will be a mistake for the authorities to be lulled into a false sense of complacency over the increase of the productivity levels, simply because the productivity during the period 2004-2019 has increased only by 8.5 kg. When compared to Brazil, Malaysia, Vietnam, Thailand productivity levels prevailed in 2014, this is a rather unsatisfactory level.

The main pepper producer in the world, Vietnam has offered unconscionable low prices at the international pepper market, owing to their overproduction which in turn had a deleterious impact on Sri Lankan pepper exports. What is noticeable here is that Sri Lanka’s pepper production saw a sizable increase aggravating the woes of the pepper cultivators during this period.

Black pepper market

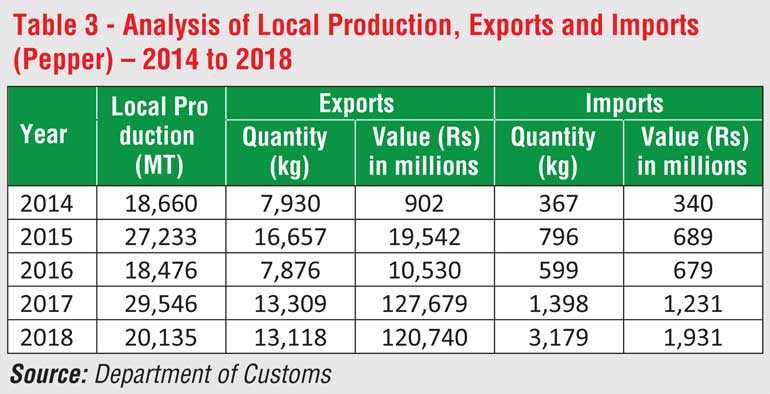

A lesser known fact is that the export of pepper especially black pepper is a thriving business. It is reported that 13,118 Mt of black pepper has been exported in the year 2018 earning a foreign exchange of $ 143 million to the national coffers. India, Germany, Kuwait, Spain, USA, and Egypt are the bigger export markets and the average selling price per one kg is around Rs. 482. If the local consumption of pepper on a hypothetical basis is around 10,000 Mt, only 10,135 Mt is available for export market out of the total production of 20,135 Mt in the year 2018.

However, the official statistics indicate that 16,660 Mt of pepper has been exported to the aforesaid foreign countries. Thus, one could safely assume that the import of pepper from neighbouring countries has filled this vacuum to a sizable amount. But the question arises is how can there be a drastic decline of the local prices of pepper, since the local production is not at all sufficient for export market. If this is the factual scenario, the local prices of pepper should invariably go up from the present market of Rs. 400 per kg giving more price advantageous to the pepper growers. But it has happened in the reverse!

It is my candid view that the local production of pepper i.e. 20,135 Mt is more than adequate to meet domestic use and the hotel trade. If that is the case, what is the rationale of importing pepper from foreign countries from Brazil, India, Indonesia, Vietnam, Singapore, United Arab Emirates, China, Germany, etc. incurring heavy foreign expenditure? In the year 2018 alone, Sri Lanka has imported 3,179 Mt of pepper from the above countries, when adequate stocks (7,017 Mt) are available in the local market.

Farmers allege that the import of low-quality pepper from neighbouring countries has flooded the local market and it is one of the reasons why the demand for local pepper has seen a visible decline. The fear entertained by the local farmers that the import of pepper from foreign countries has had a deleterious impact on local production of pepper has a valid justification. Thus, the pepper farmers accuse the Government of its wrong economic policies and practices that seriously affected the traditional pepper export crop market thus ruining the local pepper industry.

However, there is a silver line in the horizon as the IPC predicts that the world consumption of pepper to go up by 10% to 400,000 Mt by the turn of this year. It is a big opportunity for India and Sri Lanka to regain the lost ground because the Indonesian crop has been badly hit by rain.

Market manipulation

Probably the invisible hand of a market manipulation cannot be completely ruled out by the main players in the local market to gain maximum financial benefits. There could be a situation where a significant portion of the import of pepper is being dumped into the local market through illegal means to enjoy price benefits from both ends. In the case of rubber industry, it has already happened. The latex importers under the pretext of importing latex for their value-added industries are alleged to have pumped a sizable quantity of latex to the open market thus killing the livelihood income of the rubber smallholders.

It must also be added on that Sri Lanka is in a distinctive advantageous position because it has entered into the Indian spice market via SAFTA agreement, which provides tariff concessions. Unfortunately, India is offering low prices for Sri Lankan pepper. Simultaneously, India is believed to have restricted the importation of our pepper, because cheaper pepper can be bought from Vietnam.

Secondly the adulteration of Sri Lankan pepper with low quality pepper from foreign countries has lost its reputation so far it has maintained in international market. Fortunately, the Sri Lankan Government has timely realised the threats with the importation of low-quality pepper as a result of adulteration and taken a decision to remove the concessions it has given to spices including pepper for re-export purposes under TIEP to secure foreign markets.

The biggest black pepper manufacturer, Vietnam cannot enter the Indian market because of tariff restrictions. It may be due to this reason that Sri Lanka imports pepper in large scale from Vietnam and re-export to India. It is now understood that Indian authorities have realised that Sri Lanka has exported pepper more than her capacity to India taking undue advantage of the SAFTA agreement. It has therefore compelled India to restrict the entry of pepper from Sri Lanka bringing more constraints to indigenous pepper industry.

Naturally, Indian pepper industry is up in arms over the increase in black pepper imports from Sri Lanka despite local prices in the neighbouring countries falling below the minimum import price (MIP) fixed by the Indian government. Kerala Chapter of the Indian pepper Spice Traders, Growers, Planters Consortium allege that a large volumes of Sri Lankan pepper started arriving since August 2019. This happened at a time when pepper prices in Sri Lanka crashed from $ 3,800 to $ 2,800 per ton, while the MIP in India was $ 7,000 per ton (Rs. 500) per kg.

Around 700 tonnes is reported to have moved from Sri Lanka at the MIP and more consignments are expected to arrive in September taking the total volume to 1,000 tonnes. The Indian government imposed the MIP to protect the interest of the pepper farmers in India and they believe that the entry of the Sri Lankan pepper mostly imported from Vietnam has ruined the Indian pepper industry. Hence, it is inevitable for the Indian government to impose more restrictions in the months to come causing more economic and financial hardship to Sri Lankan pepper growers

Challenges

It would be a daunting task to revive the pepper industry given the enormous challenges faced by the industry. It boggles one’s mind whether the DEA which operates as a rigid bureaucratic institution with a limited budget is equal to this task, unless a new institutional set up with a development-oriented approach is set in motion with the knowledge of the experts of the industry. The immediate priorities of the new authority will be (a) to shift its focus from a mere commodity to value added commodity which can successfully enter into high-end markets of USA and European Union. (b) Improvement of the quality characteristics of pepper such as maturity, bulk density, moisture content, appearance, cleanliness of the product (c) Process improvement to be enhanced by the introduction of new machinery and equipment such as dryers, sterilisation treatment plants, testing equipment (d) capacity building of the numerous players from point of cultivator to export market (e) establishing quality standards (f) extension services to be strengthened with much focus on research findings (g) increasing awareness of the stakeholders with more emphasis on quality standards.

The above article provides a deep insight into the global black pepper market with special reference to Sri Lankan pepper industry. It will be a herculean task for the presidential candidates to foray into the complexities of the local pepper industry and take meaningful measures to extricate pepper farmers from the bottomless abyss, unless an out of box approach is adopted for the revival of the pepper industry. Both presidential contenders must realise that the mere rhetoric announced at the election platforms will have to be translated into a pragmatic action plan after coming into power.

(The writer is a Productivity Specialist/Management Consultant.)