Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 31 May 2021 00:14 - - {{hitsCtrl.values.hits}}

By Ceylon Tea Brokers Plc

The first quarter of the Sri Lankan tea industry saw an upward momentum with an increase in elevational averages, production and exports when compared to the same period in 2020.

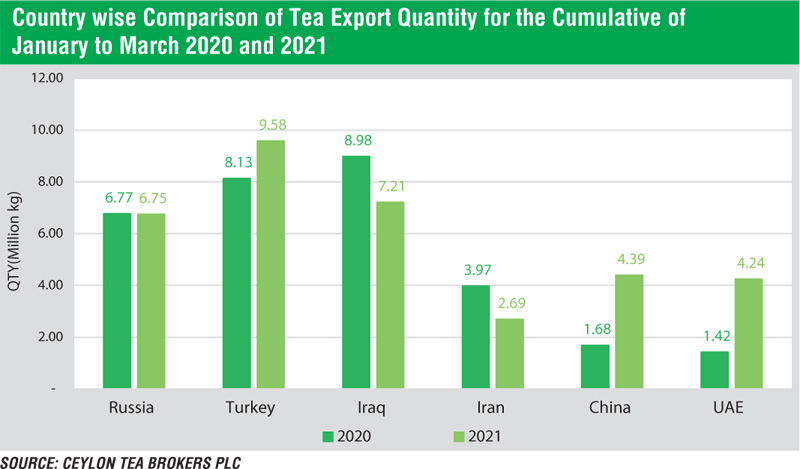

Turkey, Iraq and Russia continued with strong demand for Sri Lankan tea and were the top 3 importers for the period January-March, 2021.

The COVID-19 impact led to restrictive containment measures involving social distancing, remote working and the closure of commercial activities that resulted in operational challenges.

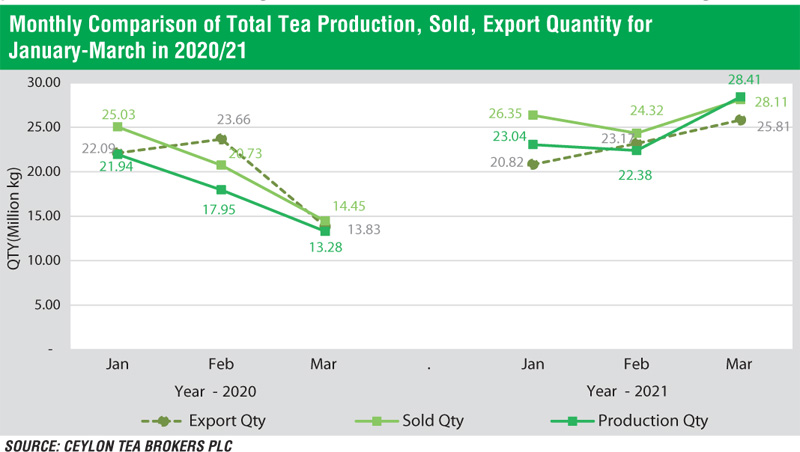

The total tea production of Sri Lankan tea for the first quarter 2021 recorded 74.03 million kg in comparison to 53.68 million kg in 2020 (+20.35 m kg). High, Medium and Low Growns shows an increase in volume comparison to the same period last year. The CTC High, Medium and Low Growns shows an increase in volume in comparison to the period January to March 2020. Production and exports increased by +20.35 million kg and +10.31 million kg respectively when compared to the same period in 2020.

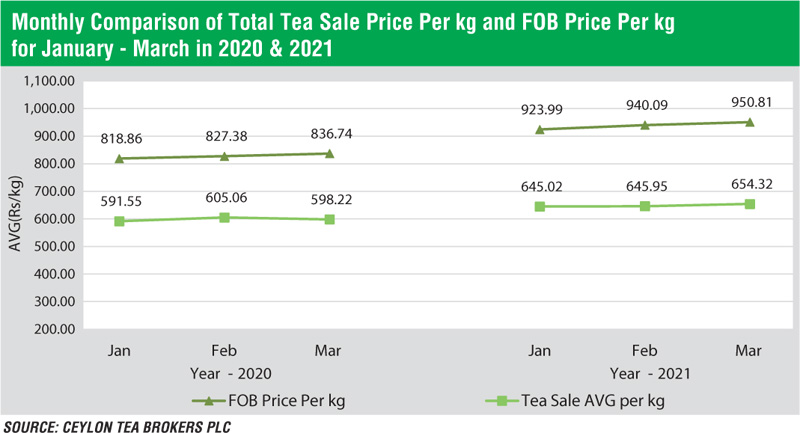

The total national average of teas sold for the period January to March 2021 was Rs. 648.63 ($ 3.35) per kilo in comparison to Rs. 594.81 ($ 3.26) (+Rs. 53.82) for the same period in 2020. Low Growns averaged Rs. 674.50 ($ 3.48); Mid Growns recorded Rs. 588.49 ($ 3.04) with High Growns at Rs. 619.22 ($ 3.19). The averages for High, Medium and Low Growns in Rupee and Dollar terms shows an increase for the period January-March 2021 when compared to the corresponding period last year. Low Growns with the largest market share with 62.30% of the production recorded an increase of (+Rs. 46.14), Medium Growns recorded an increase of (+Rs. 67.67) whilst High Grown recorded an increase of (+Rs. 65.03) when compared to the first quarter 2020.

Sri Lanka Tea Exports for the period January-March 2021 amounted to 69.89 million kg vis-à-vis 59.58 million kg recorded for the same period last year (+10.31 m kg). The FOB average price per kilo for this period stood at Rs. 938.97 in contrast to Rs. 826.39 (+Rs. 112.58) when compared to the corresponding period last year. The FOB value of Tea Bags has gained in comparison to the same period in 2020.

The total revenue realised for the period January-March 2021 from tea exports was Rs. 65.62 billion ($ 0.34 b) compared with Rs. 49.23 billion ($ 0.27 b) recorded for the period January to March 2020. It’s an increase in Rupee terms (+Rs. 16.39 b) and Dollar value (+$ 0.07 b) compared to the same period last year. Also, teas in packets and bulk showed an increase in FOB Value.

Country-wise analysis of exports shows that Turkey emerged as the largest importer of Sri Lanka tea for the period of January-March 2021 followed by Iraq and Russia. Tea exports to Turkey have increased by 1.44 m/kg. However, Iraq and Russia have dropped by -1.78 m/kg, -0.02 m/kg respectively whilst tea exports to China have increased by +2.71 m/kg and UAE increased by +2.83 m/kg compared to the same period in year 2020.

Global tea market

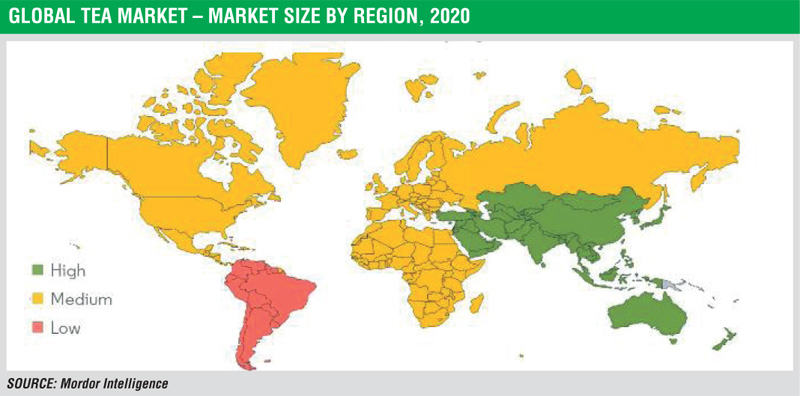

The global tea market is expected to witness a CAGR of 4.7%, during the forecast period (2020-2025). The global tea market is characterised by the black tea segment holding a prominent share. However, the maximum growth is estimated for green and herbal flavoured tea.

Currently growth in tea consumption is driven by rapid growth in Per Capita Income particularly in the developing countries of Asia-Pacific. At present Asia-Pacific has the largest market for tea consumption.

The world’s major tea-producing countries are currently witnessing healthy production levels. The COVID-19 pandemic is inflicting high and rising human costs worldwide and necessary protection measures are severely impacting economic activity whilst the Sri Lankan tea prices are currently at healthy levels the industry could be cautiously optimistic going into the third quarter.