Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 10 January 2025 00:00 - - {{hitsCtrl.values.hits}}

By Forbes and Walker

Overview

The year 2024 continued to show promise as Sri Lanka progresses on its path to economic recovery encouraged by positive developments.

Reflecting on significant events from the past year, both locally and globally, 2024 could be aptly called “The year of reclaiming change”. In a historic milestone, Sri Lanka elected its first President from outside of the traditional ruling parties since gaining independence in 1948.

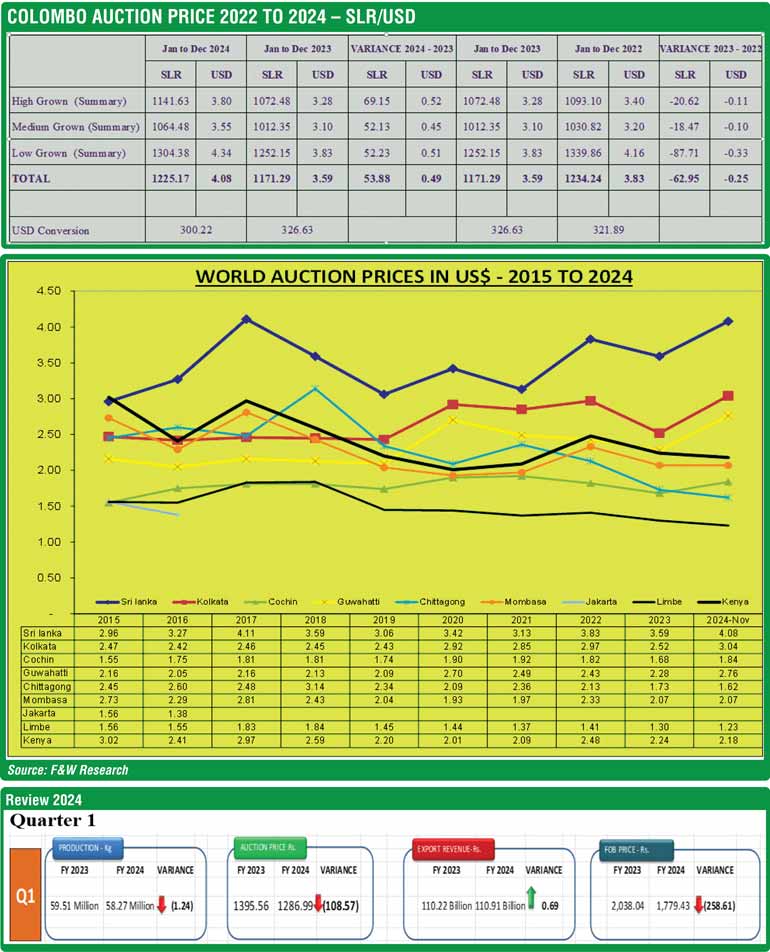

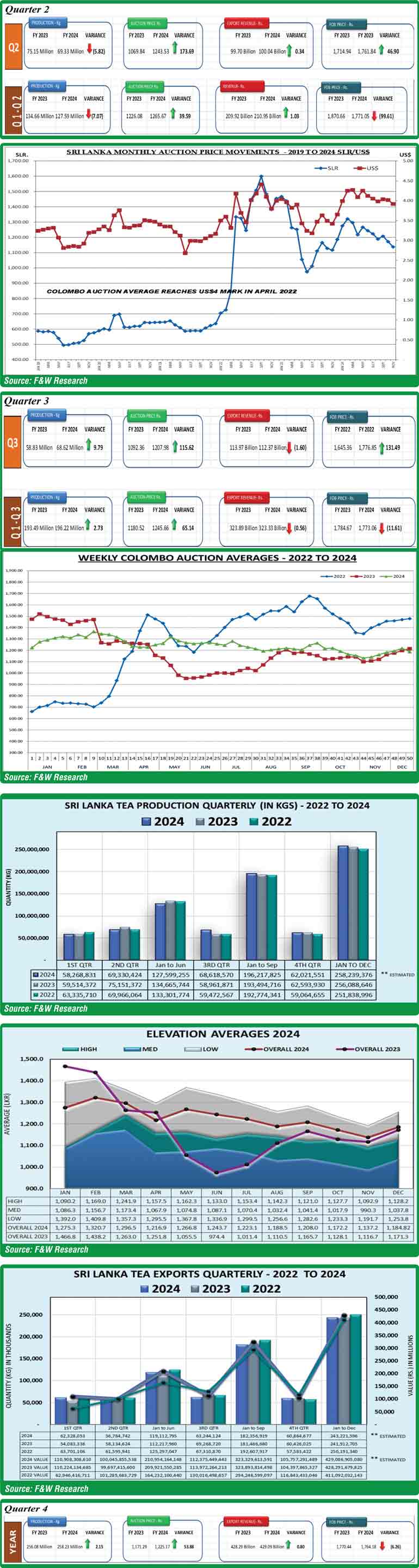

The momentum in tea value, which began building in the latter part of the previous year, was evident across all elevations. This growth was driven by moderate crop intake and production during the first two quarters. The appreciation of the rupee significantly influenced price corrections in the third quarter, after which prices remained firm.

The Western and Uva quality seasonal teas were well-received, driven by steady prices and strong demand for the better-quality teas, whilst the others eased selectively. Low grown teas experienced a similar trend demand-wise and the volatility in the currency continued to impact on rupee tea prices.

Provisional tea industry performance in summary – 2024

Review 2024

Quarter 1

Production: Q1 for the year 2024 recorded a total of 58.27 M/Kg, a decline of 1.24 M/Kgs vis-à-vis 59.51 M/Kgs recorded in the corresponding period of 2023.

Auction averages/prices: Tea sale average for the 1st quarter declined against the same period in the previous year, with the auction average for the period at Rs. 1,286.99 recording a Rs. 108.57 decrease vs. Rs. 1,395.56 of January-June 2023.

Exports: Revenue earned for Q1 of Rs. 110.91 billion recorded an increase of Rs. 0.69 billion year-on-year in comparison with January-March 2023 earnings of Rs. 110.22 billion.

Quarter 2

Production: April-June 2024 recorded a total of 69.33 M/Kgs, showing a negative variance of 5.82 M/Kgs vis-à-vis 75.15 M/Kgs recorded in the same period of 2023.

Auction averages/prices: Q2 auction price witnessed an increase of approximately 16% and recorded a sale average of Rs. 1,243.53 vis-à-vis Rs. 1,069.84 in the corresponding period of 2023. This was mainly due to the lower to moderate production in the given period.

Exports: Revenue earnings for the second quarter witnessed a marginal increase and totalled Rs. 100.04 billion in comparison with previous year’s figure of Rs. 99.70 billion. This was mainly owing to the improvement in demand mostly from the Middle East/Euro-Asian sectors, with a comparative increase in freight charges in other tea producing regions against Sri Lanka.

Quarter 3

Production:

July-September 2024 recorded a total of 68.62 M/Kgs, an improvement of 9.79 M/Kgs

vis-à-vis 58.83 M/Kgs recorded in the same period of 2023.

Auction averages/prices: Q3 auction price witnessed an increase of Rs.115.62, recording a sale average of Rs. 1,207.98 vis-à-vis Rs. 1,092.36 in the corresponding period of 2023.

Exports: Revenue earnings for the third quarter showed a decline in comparison with previous year’s figure of Rs. 113.97 billion vis-à-vis Rs. 112.37 billion of July-September 2023. Domestic issues faced within major importer countries mostly impacted by currency fluctuations affected tea prices in the quarter gone-by.

Quarter 4

4th quarter met with good demand predominantly in keeping with the year-end purchasing (i.e. Winter buying). However, following the strengthening of the LKR, overall pricing in rupee terms remained weaker, whilst in USD terms tea prices did record an appreciation during the period under review. Furthermore, one noticeable factor in this quarter was the distinct classifications of the better teas vis-à-vis its poorer counterparts. Well-made teas saw a clear differentiation in pricing against the average teas with variances in average prices ranging from $ 1.5 to $ 2 and widening further following rushed crops in the last two months of the 4th quarter.

Agriculture sector performance

Sri Lanka’s gross domestic product expanded by 4.7% in the second quarter with the agriculture sector expanding by 1.7% in the quarter from the previous year. Analysing agricultural production up to August 2024, it is observed that YoY tea, fish and paddy production has increased, however Rubber and coconut production has declined compared to the last.

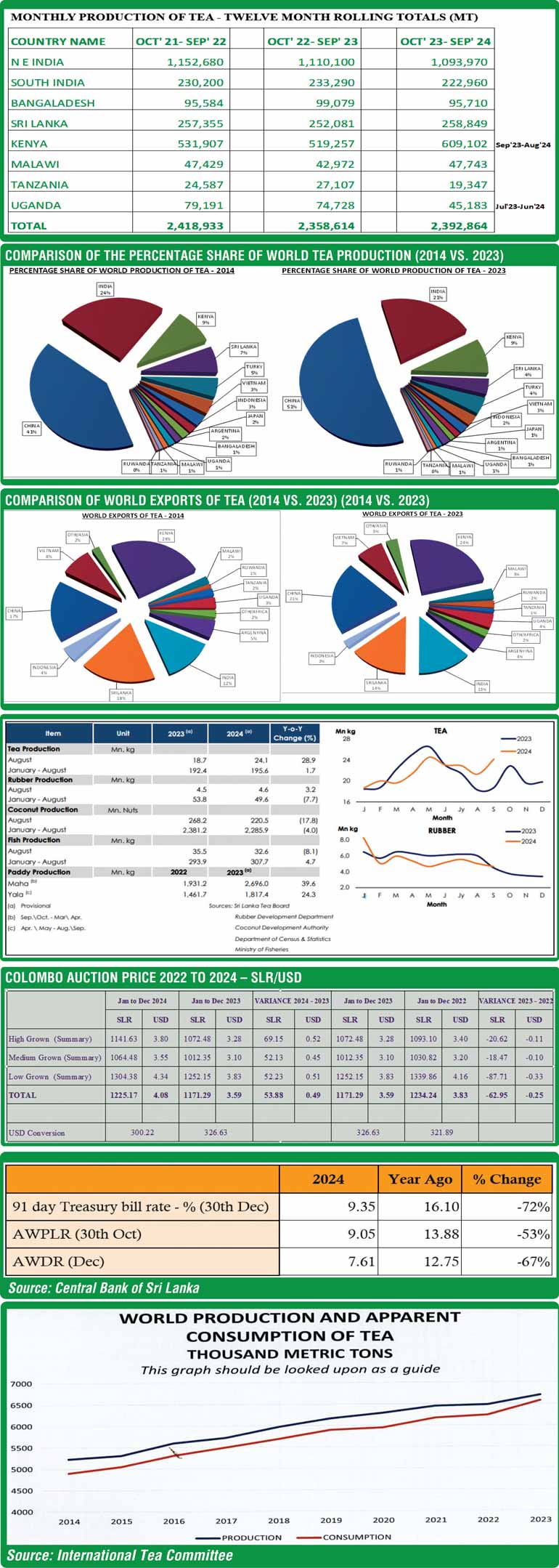

Interest rates

Interest rates on borrowings reduced significantly in 2024 with the key Average Weighted Prime Lending Rate (AWPLR) reducing 483 basis points from a year ago.

Exchange rates

Sri Lankan Rupee which exhibited some volatility initially with depreciation pressure lingering, saw a clear appreciation towards the second half of the year which was halted only by the CBSL accumulating USD reserves by buying dollars from the market.

Meanwhile, reflecting cross-currency movements, the Sri Lanka Rupee appreciated against other major currencies, such as stated below during the year up to 29 November 2024. A 10% appreciation of the currency against the US Dollar and a 26% appreciation against the Ruble could impact future tea prices.

Global supply and demand

In analysing the global tea production statistics, it is evident that the African region has continued to record an increase in production, whilst notable declines would be from Bangladesh and India – particularly from the North Indian region which records almost a negative 60 M/Kgs year-on-year. World tea production statistics available up to October/November 2024 indicates a deficit of around 30 M/Kgs year-on-year. However, this shortfall, which is of CTC origin, would have minimal impact on the Sri Lankan tea industry.

Sri Lanka is likely to end 2024 with total tea production recording a marginal gain of approximately 4 M/Kgs and totalling 260 M/Kgs. Notwithstanding that the country’s production was well in excess of 300 M/Kgs a decade ago, in the more recent past the industry has been struggling to achieve even a 300 M/Kgs which would be the requirement for the supply of Ceylon Teas to its traditional markets.

Global tea production has been increasing by around 2.6 %, whilst global consumption has been growing by around 2.5%. Therefore, it is evident that if there is an excess/surplus of tea and it would be reasonably conclusive that this excess would comprise of average/poor-quality teas, particularly considering the volume of tea which remains unsold from the African region over a long period of time arising from a minimum price that has been in force for these teas. We are reliably informed that the minimum price has now been done away with and the stocks of old teas are being released to the market.

Tea consumption in India, which accounts for about 20% of global demand, is expected to rise by 3%-4% over the next two to three years. This presents a significant opportunity for Sri Lankan tea due to its close proximity and trade relations.

Chinese consumption is likely to grow with a preference for black tea. The market for quality loose tea is expected to dominate, despite the rise in ready-to-drink products before the pandemic.

Iran shows promise for tea prices, particularly with the recent “Tea for Oil” deal with Sri Lanka.

Perhaps a concerning factor may be a decline in tea consumption from Russia due to economic struggles and sanctions. Türkiye, with a saturated market and high per capita consumption, may experience stagnation in imports due to economic challenges.

Outlook for the year 2025

From a Sri Lankan perspective, consequent to the decline in tea crop over the last several years and the 2024 deficit in Indian tea production, there is possibly a shortfall created or tight supply situation of orthodox large leaf teas.

In addition, the 1st quarter being a lean cropping period in most producer countries, combined with Sri Lanka experiencing its Western quality season, we could predict tea prices to remain buoyant during Q1 and perhaps even in the first half of Q2. Thereafter, much would depend on the supply dynamics of world tea production.

Needless to say, the parity of the LKR vs. USD, particularly as the country intends to gradually relax the restrictions on import of vehicles etc., will also impact rupee tea prices.

However, factors such as climate change, input costs, mechanisation and wages, Government policies and use of fertiliser etc., affecting tea production in Sri Lanka would enable us to project with cautious optimism an annual 280 M/Kgs for the year 2025.

In summary, the tea market in 2025 is expected to see modest growth in production, with significant opportunities in key markets like India and China. However, economic challenges and weather uncertainties could impact overall market dynamics. The focus on quality and sustainability will be crucial for maintaining competitiveness in the global market.