Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 21 December 2017 00:00 - - {{hitsCtrl.values.hits}}

By Forbes

and Walker Tea Brokers

Tea industry 2017 in retrospect

Year 2017 will go down in history as one of the better years for the tea industry, particularly in terms of prices, a fitting tribute to the sesquicentennial year of the tea industry.

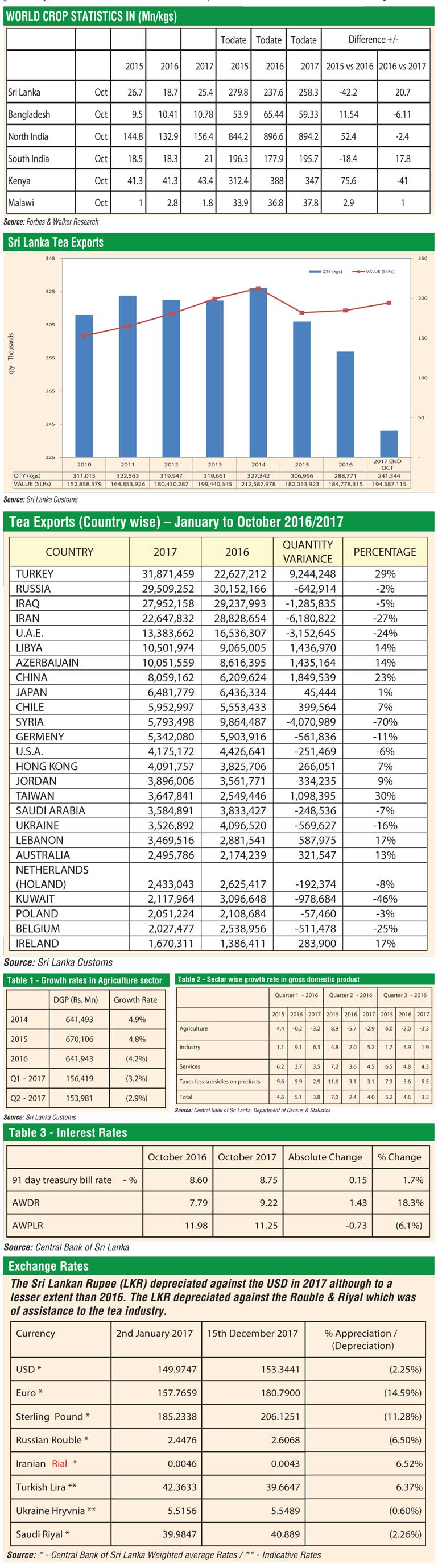

Production statistics for 2016 indicated an increase globally of approximately 70M/kgs YOY. However this was mainly recorded from countries that produce CTC teas. From a Sri Lankan perspective, during 2016 a deficit of 36.2M/kgs was recorded comprising mainly of Orthodox Teas.

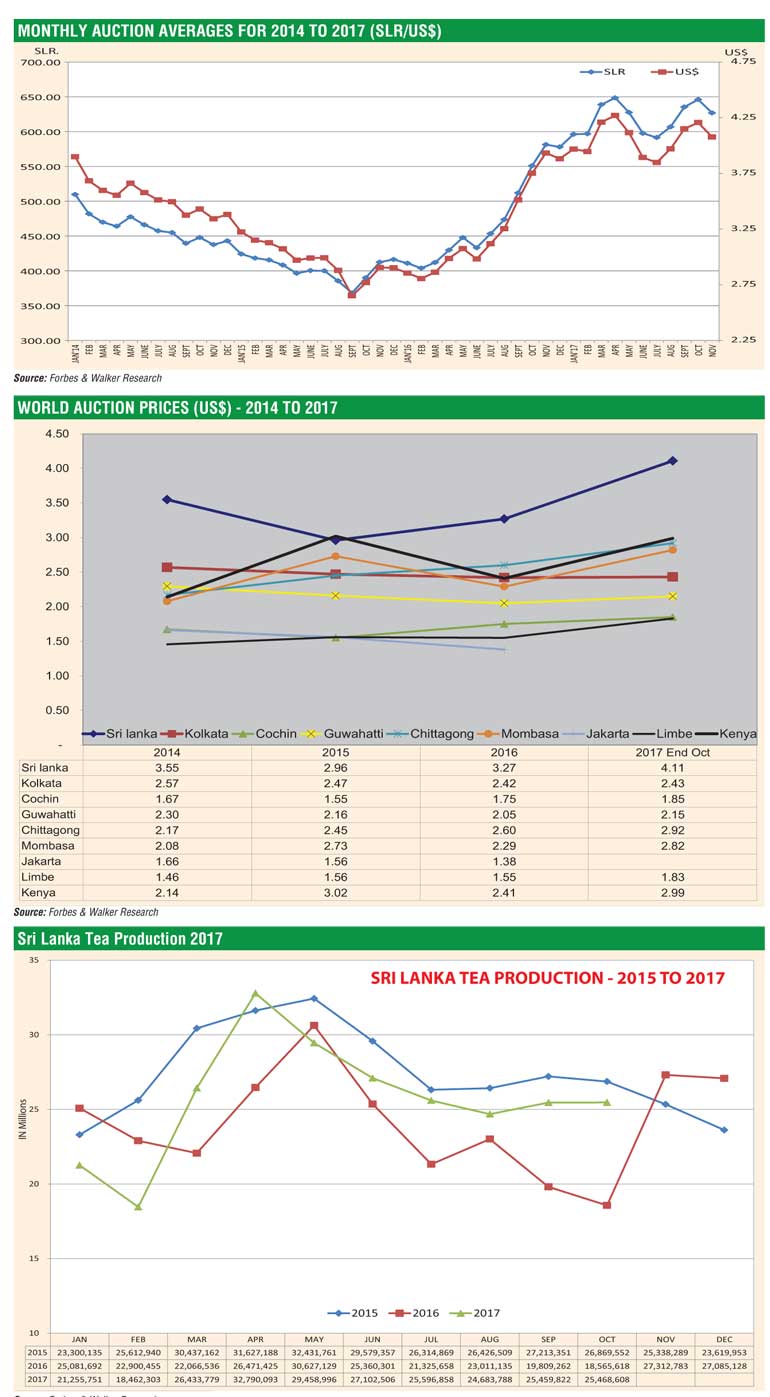

In analysing the global supply scenario, even at the time of compiling this report, a deficit in production is evident from a few key producer countries, comprising mainly of CTC Teas, whilst Sri Lanka’s tea production shows an improvement during 2017. This global shortage in production was a key factor for the prices to continue at exceptionally high levels during 2017.

Yet another factor for the prices to sustain at these levels was the strengthening of oil prices, which had influence on some key importing countries of Sri Lankan Teas.

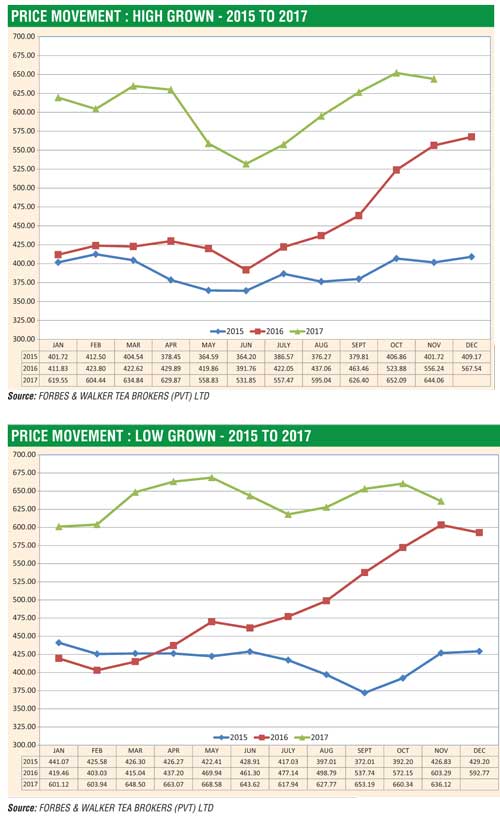

The 1st quarter commenced with auction volumes maintaining 6½-7M/kgs, and with the onset of dry weather, total volumes declined to 6M/kgs during February. In March, a further drop in auction volumes were recorded. From the commencement of the 01st quarter conducive conditions were reported for quality manufacture from most High and Mid Grown planting districts. Consequently Western planting areas showed a fairly significant improvement in quality and by early February, seasonal quality teas were on offer from Western and Nuwara Eliya regions.

Prices too saw a fairly significant increase with High/Mid grown averages reaching record levels commencing January and continued throughout February and March. Commencing early March, even “the tea for price category” (including Uva/Udapussellawas) saw a fairly significant improvement in prices.

Meanwhile, Low Growns commenced the quarter at fairly attractive levels with the January auction averages realising Rs. 601.12 a gain of Rs. 181 m vis-à-vis Rs. 419.46M of January 2016. This trend was maintained throughout the quarter and by February and March a further increase in prices were witnessed for Low Grown Teas. Here again, this was evident at the lower end of the market where prices saw a sharp increase.

Consequently, the 01st quarter total auction average reached 608.03 highest ever and more importantly showing a gain of Rs. 198.82 compared to Rs. 409.21 recorded during the corresponding quarter of 2016.

In the 01st quarter of 2017 production stood at 65.1M/kgs vis-à-vis 68.02M/kgs of 2016 showing a decrease of 2.8M/kgs. The biggest decrease was recorded from High Grown elevation followed by Mid Growns, whilst Low Growns remained static.

In analysing the exports for the 01st quarter of 2017 of 68.4M/kgs vis-à-vis 74.4M/kgs of 2016, recorded a deficit of 6M/kgs YOY. However, the total value of Rs. 52.6 b for the 01st quarter of 2017 recorded a gain of Rs. 7.5 b vis-à-vis 45.07 of 2016. FOB unit value too during the 01st quarter reached Rs. 769.87, a gain of 164.49 vis-à-vis 605.37 of the 01st quarter of 2016.

At the outset of the 02nd quarter auction volumes increased from around 5½ M/kgs of the previous quarter to 6M/kgs. This trend continued until Mid-May when auction volumes moved up to 8M/kgs and thereafter declined marginally to maintain around 7-7½ M/kgs to end the quarter.

As is customary with the commencement of the monsoon, overall quality showed a decline. Consequently prices too declined in keeping with quality. Better Western BOP/BOPF which were attracting phenomenal prices during February and March declined sharply. Meanwhile, prices at the bottom end declined but to a lesser extent.

Nuwara Eliyas at the commencement of the quarter saw prices declining from the previous quarter and by early part of May, a fairly substantial drop in prices was witnessed and this trend continued till the end of the quarter. A similar trend was witnessed in respect of Uva/Udapussellawa BOP/BOPF with prices showing a fairly significant drop in May, until the latter part of June. Towards the end of June however, a slight improvement was witnessed in prices particularly for the Uva BOP/BOPF.

Meanwhile liquoring Leafy Teas from High/Mid Growns continued to attract good demand with prices in April strengthening compared to the latter half of the previous quarter. However during the months of May and June consequent to the drop in quality, prices showed a marginal decline. Yet there was good demand for the better liquoring types.

Meanwhile, Low Grown prices continued to strengthen from April with both Leafy and Tippy grades gaining in value. This trend continued until end of May and by early part of June with quality levels showing a decline, coupled with high volumes on offer a slight decline in prices was witnessed .This was mainly in respect of the Tippy varieties. Leafy grades continued to sustain price levels with grades such as OP1s and BOP1s strengthening during this period.

In the 02nd quarter price levels were quite steady and more importantly showed a growth compared to the 01st quarter. The 02nd quarter auction average totalled Rs. 622.45. When compared to 608.03 realised during the 01st quarter, a gain of Rs. 14.42 compared to the previous quarter. It is also relevant 02nd quarter averages showed a significant gain of Rs. 183.53 vis-à-vis 438.87 .realised during the 02nd quarter of 2016.

The 02nd quarter production totalled 89.3M/kgs vis-à-vis 83.8M/kgs of the 02nd quarter of 2016 showing a gain of 5.5M/kgs. All elevations showed a growth with Low Growns recording the biggest gain compared to the corresponding period of 2016.

Total exports during the 02nd quarter of 2017 totalled 70.2M/kgs showing a decrease of 1.7M/kgs vis-à-vis 72M/kgs of 2016. However it is relevant to note the total value realised of Rs. 57.7 b during the 02nd quarter of 2017 showed a substantial increase of Rs. 13.5 b compared to Rs. 44.2B of 2016. Consequently the FOB value too realised Rs.822.10, a substantial gain of 207.56 vis-à-vis 614.54 of the 02nd quarter of 2016.

At the commencement of the 03rd quarter Auction volumes maintained around 6½ M/kgs which was quite significant compared to the corresponding period of 2016. These levels were maintained throughout most of the quarter and by early September, auction volumes recorded a decline to just under 6M/kgs to end the quarter.

With the commencement of the 03rd quarter prices for western BOP/BOPF improved and this trend continued with plainer types in particular showing a significant gain and continued through the latter half of August. During the month of September too overall demand showed no appreciable change with price levels maintaining at attractive levels. Nuwara Eliya BOP/BOPF too met with better demand with prices showing an increase. This was evident from the inception, and in September fairly sharp gains were recorded.

Meanwhile quality of offerings from Uva/Udapussellawa region showed an improvement and with the onset of the quality season a substantial gain in prices were witnessed for brighter liquoring teas. This trend was maintained until the latter half of September when a drop in prices commenced in keeping with quality.

High/Mid grown Leafy Teas met with good demand with the better teas in particular recording price increases during August and September whilst the others met with less demand and showed a fairly significant drop in prices. Low grown prices, particularly the Leafy BOP1s/OP1s continued to strengthen and maintain throughout the quarter whilst Tippy varieties such as FBOP/FF1s and FBOPF too showed a progressive improvement and gained substantially towards the latter half of the quarter. However at the bottom end, OP/OPAs met with less demand and prices declined to end the quarter at much lower levels.

The 03rd quarter auction average for 2017 of Rs.610.28, showed a decrease when compared to Rs.622.45 realised during the 02nd quarter, however it is noteworthy that the 03rd quarter average of Rs.610.28 showed a significant gain of Rs.132.67 vis-à-vis Rs.477.61 of the 03rd quarter of 2016.

Meanwhile production during the 03rd quarter of 2017 totalled 75.7M/kgs showing an increase of 11M/kgs vis-à-vis 64.7M/kgs of the corresponding period of 2016. Once again Low grown elevation showed the highest increase with High/Medium Growns too showing a reasonable growth compared to the corresponding period of 2016.

Exports for the 03rd quarter of 2017 totalled 77.1M/kgs vis-à-vis 76.2.kgs of the 03rd quarter of 2016 showing a gain of 0.8M/kgs. In value terms total revenue realised of Rs. 63 b showed a staggering increase of Rs. 14.7 b compared to Rs. 48.2 b of the corresponding period of 2016. Consequently, the FOB value for the 03rd quarter of 2017 realised Rs. 817.12 vis-à-vis Rs. 632.60 of the 03rd quarter of 2016 showing a gain of Rs. 184.52.

The 04th quarter commenced with Auction volumes maintaining around 6M/kgs and continued around 6M/kgs up until the end of the quarter. Prices for Western BOP/BOPF continued strong in October and the market strengthened further towards the latter half of October. Although there was a slight drop in prices towards November, these prices levels were maintained up to early part of December. Nuwara Eliyas too met with good demand and prices for BOP/BOPF’s gained during the early part of October. Meanwhile Uva/Udapussellawas were irregular and declined marginally. Low Growns continued to attract good demand with Leafy/Tippy varieties maintaining attractive levels, through October up to middle of November, thereafter a slight drop was recorded in respect of Leafy Teas particularly for the OP/OPAs and by end of November, PEKs too declined fairly sharply. Further, the bottom end of the market continued to weaken from the inception of the quarter with prices easing.

Even though a slight set back in Auction prices is evident, 2017 will end on a high note in terms of prices. Therefore, it is reasonable to assume that we are on course to achieve the highest ever auction averages in 2017.

Colombo tea auction price movement

January-November cumulative average for 2017 totalled Rs. 617.96 vis-à-vis Rs. 461.99 of January- November 2016 showing a substantial gain of Rs. 155.97. High grown average totalling Rs. 598.60 had a gain of Rs. 155.89 vis-à-vis Rs. 442.71 of January- November 2016 whilst Medium Growns averaging Rs. 563.87 for January-November 2017 had shown a gain of Rs. 149.74 vis-à-vis Rs. 414.13 of January-November 2016.

Low Growns totalling Rs. 637.83 too show a substantial gain of Rs. 157.7 vis-à-vis Rs. 480.13 of January- November 2016. These figures also show a substantial gain in USD terms compared to the corresponding period of 2016. Further, these levels are significantly higher compared to 2015 levels both in SLR/USD terms and are the highest ever recorded thus far.

Sri Lanka tea production 2017

January-October cumulative production totalled 258.3M/kgs vis-à-vis 237.6M/kgs of January-October 2016, showing a gain of 20.6M/kgs (an increase of 8.7%). High Grown production for the period totalled 53.8M/kgs vis-à-vis 51.9M/kgs of the corresponding period of 2016, thus showing a gain of 1.86M/kgs (3.6%), Mediums totalling 37.2M/kgs show a gain of 2.4M/kgs vis-à-vis 34.7M/kgs of January-October 2016, whilst Low growns, totalling 165.0M/kgs, show a gain of 15.9M/kgs vis-à-vis 149.0M/kgs of (10.73%). From the statistics set out above, it is reasonably conclusive that once 2017 data is tabulated- total annual production would be in the region of 305M/kgs.

Sri Lanka tea exports for the period of January-October 2017 totalled 241.3M/kgs showing a marginal decrease of 4.3M/kgs vis-à-vis 245.6M/kgs of January-October 2016. It is however relevant to note that total revenue realised of Rs. 194.3 b for January-October 2017 show a substantial gain of Rs. 40.9 vis-à-vis Rs.153.4 b of January-October 2016. Consequently, the January-October 2017 FOB value realised Rs. 805.43 recording an increase of Rs. 180.81 vis-à-vis Rs. 624.62 of January-October 2016.It is also reasonable to conclude that 2017 revenue will improve on the previous best of Rs. 212.5 b realised in 2014, thus creating a new record.

Sri Lanka tea exports

The figures given comprise of the largest importers of Sri Lankan tea for the period of January-October 2017 compared with January-October 2016. Turkey has regained the number one position with 31.8M/kgs up from 22.6M.kgs from the corresponding period which is approximately 29% higher. This in fact shows a complete reversal compared to the corresponding period and it is evident that re-exports from Turkey to neighbouring countries have somewhat re-developed.

Russia being our prime importer for a considerable period of time is in 02nd position. With a steady intake, although the figures show a marginal decrease, Iraq has retained the 3rd position with total imports amounting 27.9M/kgs, with the situation improving in Iraq, we could expect increased volumes in the coming months. Iran is occupying the 4th position with 22.6M/kgs, a substantial decrease of 6.1M/kgs compared to the corresponding period of 2016.

Meanwhile China totalling 8M/kgs has shown a fairly significant gain compared to 6.02M/kgs imported during 2016, whilst war-battered Syria has taken its toll with imports totalling only 5.7M/kgs compared to 9.8M.kgs of the previous year, a significant drop. On the other hand destinations such as Azerbaijan, Taiwan and Lebanon together has shown a fairly significant increase for the period of January-October 2017 compared to the corresponding period of 2016.

Sri Lanka macro economic update 2017

One of the main challenges in Sri Lanka in 2017 was facing Mother Nature. In January, the Disaster Management Centre reported that over 700,000 people were affected by the drought which prevailed at that time. This figure increased to over a million by February and continued through March and April. However, the downpour which fell in late May wreaked havoc across four districts as landslides and floods affected over half a million people and left over two hundred dead and scores missing. The worst affected districts were the tea growing regions. The situation turned back to a drought and a report published by the United Nations said Sri Lanka has been experiencing a lack of rainfall which has developed into what was believed to be the worst drought in forty years. Quoting statistics of the Disaster Management Centre, the United Nations, in its report said, as of 19 September, close to two million people were estimated to be affected by the drought across 17 districts.

Economic growth: Agriculture was hit hard by the extreme weather conditions. This is already on the back of a decline in agricultural output in 2016. If the trend of the published data continues we may see another year of negative growth in the agriculture sector setting us back to perhaps the 2013 levels. The overall growth is in positive territory due to the industrial sector doing well. However without the extraordinary taxes levied in 2015 the momentum has slowed to growth of below 4%.

Inflation: Inflation – as measured by the NCPI – increased to 8.6% in September 2017 against 4.7% the previous year. The 12 month annual average inflation (NCPI) as at September too had increased to 6.8% from only 4.0% in previous year. The NCPI was updated with 2013 kept as the base year. We have now seen a cumulative 23.3% increase in prices in less than 4 years. This year being one of the highest contributors to the increase.

Interest rates: The rates in 2017 were mixed. The Treasury bill rates remained constant against 2016 while the prime borrowing (AWPLR) rates declined. However, bank deposit rates (AWDR) increased significantly.

Exchange rates: The Sri Lankan Rupee (LKR) depreciated against the USD in 2017 although to a lesser extent than 2016. The LKR depreciated against the Rouble and Riyal which was of assistance to the tea industry.

The share market: The Colombo stock exchange had a better year than 2016. The All Share Price Index, S&P Sri Lanka 20 index and the market capitalisation all showing growth as at the end of October. The market gained Rs. 276 billion for the 10 months ending October 2017, driven mainly by foreign buying.

Trade: Exports and Imports saw increases in 2017 (up to August) with exports improving by 13.1% (7.6% in USD terms) while imports increased by 15.15% (9.6% in USD terms). This however, resulted in the balance of trade being impacted by Rs. 141 billion to show an increased deficit of Rs. 939 billion as at the end of August 2017. Tea, rubber and mineral exports saw increases which contributed well to the economy while fuel and wheat were the main increases on the import side. The balance of payments account ended with a significant increase in the deficit to show a deficit of $ 1.4 billion for the 1st half of 2017. This compares unfavourably against a deficit of only $ 643 m by the 1st half 2016.

Government finance: The total outstanding Government debt stood at Rs. 10.1 trillion as at end June 2017 increasing from 9.4 billion at the beginning of the year. An increase of 8.2% in a half year period. The total outstanding government debt as at December 2014 was Rs. 7.4 trillion. A deterioration of 36% over the past two-and-a-half years.

The gross official reserves of the country improved by $ 1.2 billion in the nine months ending September 2017, taking the figure up to $ 7.3 trillion as at the end of September 2017.

Outlook for 2018

In the backdrop of a buoyant year for tea prices – the year 2017 ended amidst much uncertainty with Russia, the country’s largest importer placing a ban on tea exports with immediate effect. Needless to say, in these circumstances projecting a possible market outlook for the year ahead would have a strong element of ‘crystal ball gazing’. Be that as it may, we are confident that the two countries with its long standing relationship would resolve matters shortly.

Subject to a timely resolution of what could otherwise have a significant impact on the Sri Lankan tea industry the robust market condition that prevailed in 2017 is likely to continue up to the 01st half of 2018 given the supply and demand scenario that exists and is likely to emerge during the year ahead.

From a Sri Lankan perspective, the carry forward shortfall in crop and the continued low volumes in 2017, although higher than in 2016, was still a significant shortfall vis-à-vis 2014/2015. Globally, the excessive production in 2016 emanating from the African Region (mainly of CTC origins) would by now be wiped off with the sharp decline in 2017 volumes from this region and to a lesser extent from Bangladesh and India. Therefore, it would be reasonable to conclude that the year 2018 will begin with a tight supply scenario which is unlikely to be regularised up until the 02nd half of 2018 as the 01st quarter is generally considered a lean cropping period in most producer countries.

Global tea consumption is considered to be growing steadily, driven by China and India, which two countries possibly account for approximately 50% of the world Tea consumption. Tea – due to its low cost – would be less exposed to economic cycles which augurs well for its growth as a cheap but yet healthy beverage. In addition to China and India, the United States, though a small market at present, is expected to increase its consumption primarily in instant tea and iced tea and to a lesser extent green tea, fruit tea, herbal tea and other specialty varieties.

From a Sri Lankan perspective, its prime destinations for exports such as Syria, Iraq and Libya which were virtually under siege due to internal conflicts in the last few years have shown signs of recovery. These three countries together import approximately 50M/kgs per annum from Sri Lanka. Therefore with the trading conditions improving, imports from these countries are likely to grow, subject to stability in crude oil prices. The stability in oil prices would remain relevant to Russia and other Middle Eastern markets as well.

Considering these market conditions and in particular the supply restrictions, we expect the current trend in prices to continue and therefore are confident of satisfactory prices for the 01st half of 2018.

Unfortunately a prolonged spell of reasonably high prices generally results in producer countries endeavouring to step up production at the expense of quality. If this happens it would result in a surfeit of poor quality teas during the 02nd half of the year which in turn could result in a drop in prices particularly for the ‘Tea for price category,’ which may have a cascading impact across the entire price spectrum. On the other hand, should all major producer countries concentrate on harvesting the optimum crop without losing sight of the importance of quality manufacture, in the current supply and demand scenario, barring any unforeseen circumstances such as economic downturn in the elements of the major tea importing countries, we could confidently predict yet another good year for the Sri Lankan tea industry.