Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 3 December 2015 00:00 - - {{hitsCtrl.values.hits}}

![]()

By Ceylon Tea Brokers Plc

The third quarter of 2015 has seen a further decline in tea auction prices. There is a substantial decrease in exports mainlyon account of a significant drop to the destinations within the conflict zones.On the other hand the strengtheningof the Russian Ruble has generated an increase in demand from this country with Russia re-establishing itself as the leading export destination for our teas.

Turkey, the second largest buyer from Sri Lanka, has seen a drop in the third quarter probably due to border closings that have shut off routes to Syria.Iraqi imports of Sri Lankan tea has remained steady throughout the year thus far.Iran’shopes for sanction removal, pending its US nuclear deal, seems to have fostered additional interestfor tea imports.Furthermore the re-alignment of the Rupee against the US Dollar has made the Colombo Auction prices attractive for international buyers.

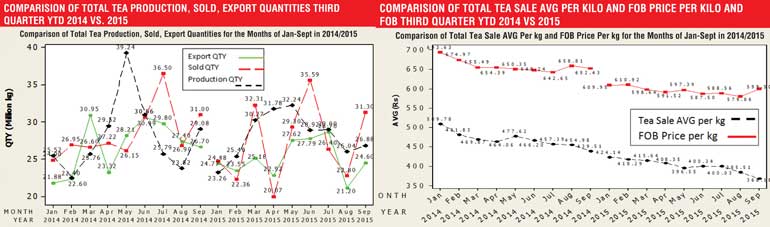

The total production of Sri Lankan tea upto the end of the third quarter of 2015 recorded 252.69 million kilos in comparison to 255.55 million kilos for the same period last year (a differential of -2.85 million kilos).Though production remains almost on par, exports have decreased by 15.28 million kilos compared to the same period last year;thus creating a surplus of tea remaining unsold/pending exports.

The total national average of teas sold for the year 2015 upto third quarter was Rs. 401.08 per kilo in comparison to Rs. 467.68 (Rs.-66.60)for the same period last year.The Rupee and US Dollar equivalent averages shows a decline on the corresponding averages of 2014 as well as 2013.

Low Growns having the largest market share with 60% of the production recorded the sharpest decline at (Rs. -80.99)with Mid Growns recording a decrease of (Rs. -50.42) and High Growns seeing the least reduction of(Rs.-35.39) YOY. Low Growns averaged Rs. 416.70, Mid Growns recorded Rs. 362.12with HighGrowns at Rs. 383.61 for the cumulative period of January to September 2015. It is notable that Western High Growns have seen an upswing in the third quarter 2015 compared to the previous quarter.

Sri Lankan tea exports for the period January to September 2015 amounted to 226.09 million kilos. A decline of 15.28 million kilos compared with the same period last year.The FOB average price per kilo for this period stood at Rs. 595.95 in contrast to Rs. 657.58 ( Rs. -61.63) YOY for the same period.

The FOB value of tea bags has moved up in comparisonto the same period last year.However, its export volumes have decreased. Tea in bulk and packets saw a dramatic price reduction.However, tea in bulk has seen a sharp rise in volume, probably due to importation by trading hubs (Turkey and Dubai).

Total export earnings for January to September 2015 amounted toRs. 134.74 billion, a sharp decrease from Rs. 158.72 billion (Rs. -23.98 billion) realised last year.

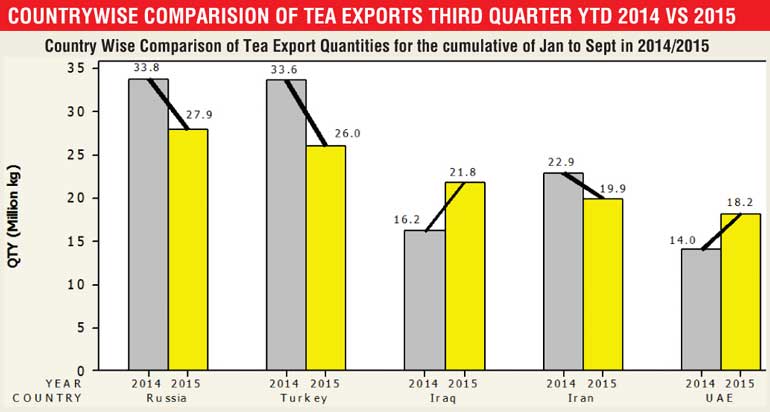

Country-wise comparison

Russia: The Russian Ruble has stabilised with the hope of long-term sanction removal. However drop of oil prices has adversely affected the Russian economy. Russia regained its position as the No. 1 tea importer with a significant increase in the purchases of Sri Lankan tea during the third quarter of 2015.

Turkey: Lost its No. 1 position to Russia in the third quarter. In the recent past, Turkey has tightened border security that could have resulted in a lack of access to the routes of neighbouring nations, which would have in turn impacted the tea imports from of Sri Lanka.

Iraq: Iraq has seen the highest increase in the imports of Sri Lankan tea YOY by an upswing of 5.57 million kg in the third quarter to date making it currently the third highest purchaser in the local tea sector.

Iran: The Iran nuclear deal seems to be in place and the lifting of the sanctions could take place as early as next year. In anticipation of outcome,Iran has increased their purchases of Sri Lankan tea in the Third Quarter.

UAE: Since establishing itself as a blending and re-export hub for tea, UAE has significantly increased its purchases from the Sri Lankan tea market. Due to the nature of blending where value addition is done in Dubai, the majority of the imports from Sri Lanka have been in bulk form.

Conclusion

The Sri Lankan tea industry is facing an uphill challenge to maintain its market share in the near future. Due tobeing dependent on countries within theconflict zonesor due to restrictions placed by sanction.

Global economic growth is projected at 3.3% in 2015. It is expected that there will be a gradual pick up in advanced economies and a slowdown in emerging markets and developing economies. In 2016, growth is expected to strengthen at 3.8%. An economic recovery in Euro area is expected in 2016 by the IMF. The growth projections have been revised upward for many European country although lower commodity prices and tighter external financial conditions are set to slowdown the emerging markets and developing economies. The slowdown in the Chinese economy has had a further impact on commodity market.

OPEC and IMF

According to an IMF Report most OPEC nations are facing an uncertain future. Iran’s break-even oil price is estimated at $ 72 which means thatit could only survive on cheap oil for less than 10 years.Iraq has virtually no fiscal buffer and the country is grappling with internal strife. Oil Producing countries are therefore significantly on the economic decline due to dependency on oil exports that contribute to most of their GDP and the lack of diversification with regard to other areas of economic activity.

Consumer trends

Sri Lanka also needs to research consumer habits in their export destinations. Taste preferences, consumer habits, new trends have to be researched in order to cater to the needs of the consumer. Demographic segmentations in a market need to be closely analysed in order to cater to specific trends. RTDs (Ready to Drink Teas) are globally gaining popularity. In the US, one of the largest global importers of tea, 48.25% consist of RTDs. With the general increase in busy lifestyles RTDs are gaining popularity globally.

Tea hub: The new budget proposals for 2016, has announced the possibility of liberalising imports for blending and re-exporting. Sri Lanka has lost ground to value addition centres like Dubai in the recent past. These new possibilities however could help Sri Lanka to gain a higher market share in the world’s largest importing countries such as USA, UK, Pakistan andEgypt, etc. where our exportsarecurrently minimal. Expansion should however be conducted with appropriate regulatory controls that would create a framework that does not dilute the reputation and quality of Ceylon Tea.

Europe: More than four years of armed conflict in Syria have caused thousands of people to flee to Europe. Therefore, there would be an increase in demand for tea in this region.

Annual tea imports for consumption (2014):

After assessing the current state of the Sri Lankan tea industry, it is apparent that in moving forward change is a vital component to foster growth and create stability. Therefore itis imperative that the industry as a whole addresses the possibilities of garnering new markets through such mechanism as creating a blending hub and production of varied tea products (e.g. RTDs and artisanal teas)whilst consolidating our existing markets.

(Courtesy: Ceylon Tea Brokers Plc)