Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 23 June 2015 00:05 - - {{hitsCtrl.values.hits}}

By Ceylon Chamber |of Commerce

The Sri Lankan tea industry enjoys an international reputation for its high quality, with a world export market share of 17.4% in 2014. However, the long-term economic viability of the tea industry is in doubt, in the midst of some critical issues like the rising cost of production, low productivity, low value addition, weak global positioning, labour shortages and changing climatic conditions. The depressed auction prices, prevalent at present, are now adding to the sector’s  struggles.

struggles.

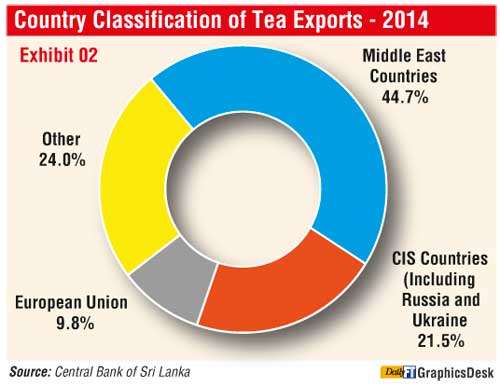

Producers have sounded warning bells that the prevailing auction prices in Colombo are below the cost of production. In comparison to the peak price levels experienced in January 2014, the current price levels are significantly lower in all three elevations, for all types of tea. The average prices as at April 2015 for High Grown, Mid Grown and Low Grown teas has declined by Rs. 74.30, Rs. 72.61 and Rs. 117.40 respectively. The overall national average during the same period has declined by Rs. 101.43. The decline in overall averages is significant, considering the normal fluctuation in prices experienced by the industry (Figure 1).

The manufacturing industry catering to the processing of smallholder leaf has suffered as well. The trading gains enjoyed by the processing sector in 2013 have been completely negated by the trading losses experienced in 2014. Consequently, the bought leaf processing sector has experienced negative cash flows and a strain on the working capital. The regional plantation companies that grow and process teas too have encountered similar challenges with the majority of the companies facing severe cash constraints.

The depression in the auction prices is due to the de-valuation of the Russian currency by 100% due to sanctions and lower oil prices, shortage of hard currency in Ukraine due to Ukraine-Russia conflict, economic sanctions on Iran, continuing Syrian crisis, and the ongoing unrest in Libya, Egypt and Iraq.

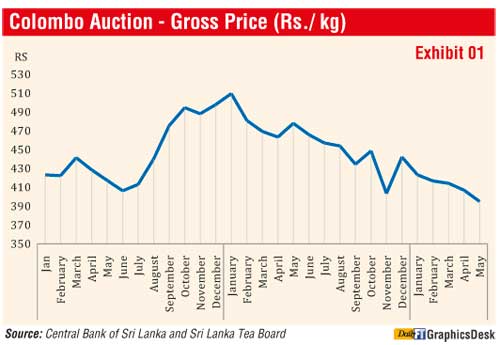

The Middle East and the Commonwealth of Independent States (CIS countries), which includes Russia and Ukraine, accounts for more than 65% of Sri Lanka’s tea exports (Figure 2). The currency depreciation of these importing countries, especially the Russian Ruble (Russia is the second largest importer of Sri Lankan tea with a share of 13.4% in 2014) and the inordinate delays experienced in receiving funds for exports to Middle East, Russia and Ukraine, have seriously affected the financial position of the tea exporting community. These negative effects have severely impacted tea purchases by these countries, and have naturally depressed auction prices.

The Middle East and the Commonwealth of Independent States (CIS countries), which includes Russia and Ukraine, accounts for more than 65% of Sri Lanka’s tea exports (Figure 2). The currency depreciation of these importing countries, especially the Russian Ruble (Russia is the second largest importer of Sri Lankan tea with a share of 13.4% in 2014) and the inordinate delays experienced in receiving funds for exports to Middle East, Russia and Ukraine, have seriously affected the financial position of the tea exporting community. These negative effects have severely impacted tea purchases by these countries, and have naturally depressed auction prices.

Given the current adverse situation, the tea industry has made some proposals for the Government’s consideration, which could provide immediate short-term relief to the sector.

Allocate the collected duties and CESS to fund soft loans to tide over this period. Currently there is a promotional levy  of Rs. 3.50 per kg on all tea exports, Bulk Tea Duty of Rs. 6 per kg and a CESS of Rs. 4 per kg.

of Rs. 3.50 per kg on all tea exports, Bulk Tea Duty of Rs. 6 per kg and a CESS of Rs. 4 per kg.

The Government can explore the possibility of negotiating export documentation and payments for tea exports using the positive relationship that it has now developed with the USA and other Western nations.

The Sri Lanka Tea Board should monitor sales and ensure that offerings of tea for sale by a processing unit is within the approved capacity of such entities to circumvent any unauthorised teas being sold through the system. Granting permits for constructing new factories should be approached with caution as current installed capacities of factories exceed the availability of raw material/green leaf.

It is important that both the Government and the industry work together to mitigate the adverse effects of the depressed prices whilst addressing the more critical issues to reduce the long term vulnerability of the sector.