Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 22 September 2015 00:07 - - {{hitsCtrl.values.hits}}

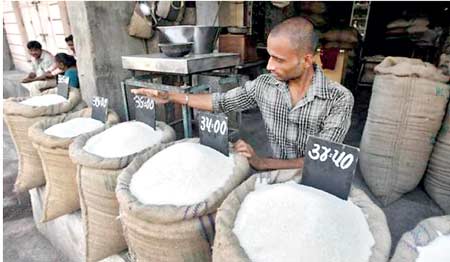

Reuters: India announced new rules on Friday making it compulsory for sugar producers to ramp up exports to at least 4 million tons in the forthcoming crushing season, to cut stockpiles as the country is set to produce a surplus for a sixth straight year.

India is the world’s biggest sugar producer after Brazil and much higher exports would help clear huge sugarcane dues to farmers. But it would also add to a global glut and could further depress prices , which are languishing at seven-year lows.

The new crushing season starts on Oct. 1. In the current season, India exported 1.3 million tons.

Abinash Verma, director general of the Indian Sugar Mills Association (ISMA), said producers wouldn’t be able to export a combined 4 million tons unless they receive more government help.

For many producers in India, the world’s biggest consumer of sugar, exports are not viable because global prices are lower than local prices, he said.

Sugar prices in India are trading nearly a fifth higher than global prices due to a government decision to raise cane prices, to support farmers, which has pushed up production costs. The government approved a subsidy of 4,000 rupees ($60.86) per ton for exports of raw sugar in the current marketing year ending on Sept. 30, but has not said whether it will continue the subsidy after September.

Many mills could not produce raw sugar for exports this year because the decision on a subsidy had been delayed until February. Verma said the planned increase in exports will push up sugar prices in India, which jumped 2 percent after the announcement.

India is likely to start the 2015/16 season with carry forward stocks of 10.2 million tons and is expected to produce 28 million tons of sugar against local demand of around 25.2 million tons, estimates ISMA.

India’s food secretary said last week the government was working on a multi-year plan to boost sugar exports, targeting markets in Africa, China and neighbouring countries, confirming a Reuters report last month.

Sugar producers must report their exports to the government, which has the power to act if export rules are violated.

The new export requirement will quickly bring down inventories, which have been rising, the Mumbai-based head of a global trading firm said, on condition of anonymity.

“The government should also make it clear whether it is going to extend the subsidy for next season’s exports. It will help mills in signing deals in advance,” he said.