Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 13 January 2017 00:00 - - {{hitsCtrl.values.hits}}

By Asia Siyaka Commodities PLC

By Asia Siyaka Commodities PLC

Global Supply Review 2016

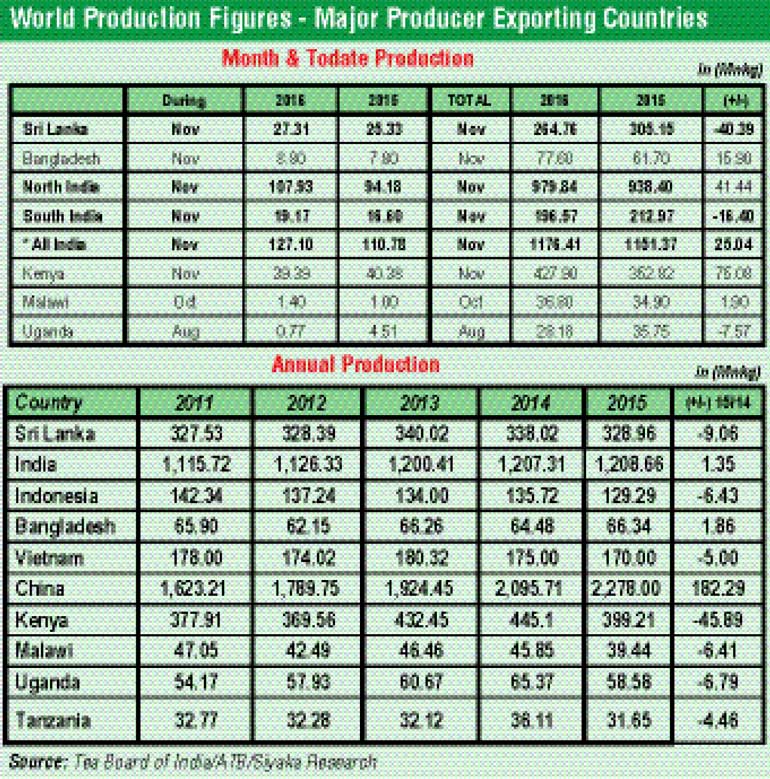

Over the past three years world production of tea grew 6% from 4,990 in 2013 to 5,304 billion kilograms in 2015. A review of ITC data shows Asian tea producers dominated by China and India accounting for around 85% of all teas produced. Over the period Indian production stayed at 1.2 billion but China continued its remarkable growth and increased a substantial 18% from 1.924 to 2.278 billion in 2015. The increase of 354 million kg over the period exceeded Sri Lanka’s highest ever annual production of 340 million kg achieved in 2013. Africa led by Kenya produced 642 million kg in 2013 but slumped to 607 in 2015 as a result of bad weather in that year.

Available production data from major producer exporters in 2016 has Kenya bouncing back and heading for a record production figure of 450+ million kg. India despite losses in the south will achieve a record 1.22+ billion kg. China production, based on interpretation of available export data seems likely to exceed the 2015 record of 2.2 billion kg. Indonesia is projected to record lower harvest in 2016. Sri Lanka will have one of its worst tea crops in recent years with a YoY short all in excess of 40 million kg.

A review of globally traded tea reveals that Asia’s’ two producer giants are also the largest consumers and are overshadowed by African producers who supply the greater volume of tea exported. In 2013 world tea exports totalled 1.864 billion kg and declined to 1.801 billion in 2015. China’s exports declined from 338 to 321 million kg during the period; even though the countries’ production was up 354 million kg. Africa’s contribution was 672 in 2013 but declined with lower production to 626 in 2015. Kenya as the largest African producer declined from 432 in 2013 and 445 in 2014 to 390 million kg in 2015. Other significant producers from the continent also lost about 10% on average YoY 2014. Sri Lanka declined from 338 to 328 million kg. These losses kept world supply of Black Tea tight, but not enough to counter lower buying strength and slackening demand, resulting from negative economic and social conditions in key tea consuming countries. In 2015 the price of tea generally declined worldwide.

The greater volume of tea traded globally is Black Tea with around 21% (372 million kg) of the total of 1.8 billion traded in 2015 being Green Tea. China exported 324 million kg of which 272 million kg (84%) was Green Tea and enjoys a 73% share of the Green Tea traded globally; and is relatively a small player in the Black Tea market. Sri Lanka with shipments of 301 million kg (2.8 green) in 2015, is the major player in the market for Orthodox Black Tea; with Kenyan combined origin Exports of 443 million kg dominating the overall CTC Black Tea segment.

In 2016 Kenya’s all origin exports are heading for a record 450+ million kg. Indian exports could dip marginally below the 2015 high of 228 Million kg. China (83% Green Tea) is projected to improve on its 2015 quantity of 325 million kg. Sri Lankan tea exports projected at around 290 million kg will be lower than 300 million kg for the first time since 2009. Overall world exports of tea would be around 1.81 billion kg.

Sri Lanka Tea Production 2016

Sri Lankan crop losses effectively commenced in H2 2015 and since then production deteriorated continually throughout 2016. Available data for the period Jan/Nov 2016 indicates that the country lost 40 million kg by November against the relatively low 2015 figure; and will likely not improve significantly by December. This YoY crop short fall is the greatest in recent history.

Sri Lanka’s supply of Orthodox black tea to the world has declined since 2013, when annual production peaked at 340 million kg. When considering Q4 2015 against 2014, the country lost 9 Million kg of tea, and this loss has been carried forward in to 2016.The cumulative shortfall since Q4 2015 is likely to be in the region of 50 million kg by December 2016. The greater proportion of production loss has come from the low country; while other elevations too had recorded declining tea production.

Inventory loss due to flooding of buyer warehouses in May 2016, is estimated to a total around 1.7 million kg and artificially restricted supply of selected grade categories, to those buyers and their international clients.

Sri Lanka Production

Outlook 2017

Specialists suggest that La Nina conditions could continue through Q1 2017 and have projected uncertainty over rainfall patterns. Failure of the North East Monsoon in Q4 2016 adds further pressure to the already fragile supply situation. Delayed agricultural practices and low application of fertiliser could have an impact on crop intakes in Q2 2017 as well.

Withdrawal of fertiliser subsidies to RPCs could compel those companies in financial difficulty to restrict application. Higher cost of fertiliser and restricted subsidy to Small Holders will to a greater extent determine production of Ceylon tea in 2017. On the other hand, if tea prices remain buoyant in 2017 we expect small holder farmers and Regional Plantation Companies to be able to afford application of fertiliser.

The full impact of ban on weedicide use is yet to be felt. Implications in the short term are likely to be negative. There is however a sliver of hope that the special committee appointed to consider a more gradual phasing out, might submit a positive report.

Industrial relations remain settled between RPCs and Unions following agreement reached on wages in 2016. Core issues however remain unresolved and could resurface later in 2017 when local government elections are held.

Looking at long term production outlook for Sri Lanka crop, the government has taken some meaningful steps. The IFAD/Government co funded project that has been launched to help farmers replant, is aimed at doubling the TSHADA subsidised replanting area over a 5 year period. The Small Holder sector will need much more investment however, if an accelerated replanting program is to be implemented effectively. A similar ADB initiative funded through the banking system is proving to have limited penetration; with the smallest segment of farming community comprising 75% with holdings below 1 acre of land; finding bankers procedures too complicated and restrictive.

For the RPC sector a $ 70 million fund through a Government/World Bank initiative has been announced. Meanwhile the recent Government Budget proposals to review land allocations to RPCs, though far from clear could have short term implications on agricultural practices on marginal lands / estates.

Over all we believe that Sri Lanka tea production in 2017 could be low during H1. In fact tea production during January-June is projected to be less than the 2016 figure of 154 million kg. In 2015 the national harvest for the period was 172.9 and 173.6 the year before. Assuming the weather improves we expect a strong H2 in 2017.

World Supply Outlook 2017

Sri Lanka Market review 2016

In 2015, globally the supply position weakened as the year progressed. High carryover from 2014 and weak economic conditions in most importing countries kept prices low throughout the year. In 2015 the YoY 2014 shortfall from major producer exporting countries was estimated to be in the region of 100 Million kg, but markets were slow to react.

In Sri Lanka prices opened weak and continued at 2014 Q4 levels, almost till the end of Q2. With availability declining thereafter, prices gradually started picking up.

The market for Low Grown teas dropped to a three year low in Q1and stayed at these levels till March. High Growns however, got off to a hesitant start but picked up mid quarter with the onset of the Western Quality season.

The market for Low Growns was looking for direction in April, but by May prices started picking up. Flood damage disrupted operations of many leading tea companies and the loss of around 1.7 million kg created a grade specific shortfall and Q2 closed on a buoyant note. High Growns held firm at the previous periods closing rates. By May with quality on the wane and volumes up prices declined to the lowest point in June. Compared to the previous year however levels were much higher.

With weather conditions deteriorating availability of Low Grown teas declined steadily. On the demand side winter buying was on the up and prices kept rising and passed 2014 levels by end of the quarter. High Growns passed the same threshold in July and strengthened rapidly to a three year high.

By Q4, both High and Low Growns were selling at unprecedented levels. Availability had declined significantly and this triggered disproportionate price escalation in the tea for price category. The national average in Q4 for High Growns in USD ranged from $ 3.57 to $ 3.77. These were last seen in the same quarter of the El Nino year 2009; albeit at US cents 5 to 15 lower. Similarly Low Grown auction average ranged from $ 3.90 to $ 4.08. These levels were only surpassed in 2013. Needless to say the Rupee equivalent were all time records and were aided by depreciation of the currency overtime.

Market outlook 2017

The rapid shortfall of Orthodox Black Tea from Sri Lanka from mid-June 2016 and some loss of crop from South India triggered price increase at other auction centres. Kenya enjoyed a bumper crop and more than recovered its 2015 losses. Following a sharp correction that lingered till mid-May, Mombasa auction prices picked up thereafter and closed above the years’ opening rates.

Both Sri Lanka and South India will have similar weather conditions which are expected to be uncertain at best during Q1 and probably until mid or end June. Sri Lanka will find the going tougher due to lower fertiliser application and weedicide issues. Kenya and other African producers and North India could have another good year of crop; resulting in high CTC availability.

The supply of Orthodox Black Tea to the Colombo Tea Auction and worldwide could well remain low till June. Sri Lankan exporters’ inventories have been depleted from June 2015 and their clients’ stocks of Ceylon Tea in the value chain too will also continue low. We expect the market for Low growns to be strong at least till May 2017 with a possible flat period till June. Subject to supply and with winter buying setting in thereafter demand will picking up and the market should revive thereafter.

For high grown teas, the new dimension of growing demand for higher elevation BOPF in the domestic market, additional demand during the Western Quality Season, and more settled conditions in some key markets, will ensure that prices remain at competitive levels until May. Therefore prices for all categories will largely be driven by tea production in H2.

Key forces that could influence 2017

Supply in the short and medium term; Sri Lankan producers may earn a short term windfall but the industry will need to respond quickly if its reliability as a supplier begins to be called in to question. India in particular is just waiting to seize its opportunity with subsidies being offered for Orthodox expansion. The market for India’s Ceylon substitutes even though of a lower quality profile, strengthened in 2016 and are likely to attract more interest during Q1 2017. Kenya’s’ rising cost of production and oversupply could compel accelerated exploration of Orthodox alternatives. At the same time Kenya’s small holders are looking at alternative crops for better financial rewards. China’s production gain over the last three years exceeds Sri Lanka’s national production. What will it do next? Can Sri Lanka expand its presence in China? We believe that the country can if indirect barriers are resolved.

Russia as a key market for Ceylon has lost ground. Sri Lankan brands have lost share and domestic brands are gaining ground. Russia’s WTO obligations to Sri Lanka on duty reductions on value added teas had been met by end 2016. This will offer some respite to Sri Lankan brands but could be largely negated by high auction prices and low supply. In Russia legislation to control supermarkets and rising retail prices is in place. Outcomes are not clear as the strengthening of the Ruble would have helped. The strength of the currency will depend on crude oil prices and continuing sanctions.

Iran whose Riyal is under siege from declining oil revenues and continuing sanctions will be apprehensive of Western policy given the shifting political climate. Sri Lanka remains burdened by its oil debts and restrictions of its banking. This market is critical for Low growns but is increasingly looking to India for low price supply.

China is seen as a key growth area for many tea exporting countries and has absorbed larger volumes of Ceylon teas. Growth momentum has slowed however and Sri Lanka will look to ease access at national level. Chinese entrepreneurs however are showing increasing interest in the wide range of Orthodox Black Ceylon teas and potentially Sri Lanka could double its volumes and or earnings in three years. From a value point of view value addition and sale of higher Orthodox teas would be a preferred option.

Political, Social and Economic conditions of Key Middle Eastern and North African markets for Ceylon tea has seen volumes shrink and complicated their business environment. Sri Lanka’s continuing reliance on these countries will leave the market vulnerable when supply improves.

Crude Oil Prices will remain the key element for economies of more than 80% of Sri Lanka’s Ceylon tea importing countries. Projections are that Oil prices could at least remain at current levels. It should help stabilise or strengthen their currencies.

Arab migrants to the West taking with them their culture, food and beverage preferences will increasingly become niches of opportunity for Sri Lanka. For many of them Ceylon tea is part of their staple diet and even as they are bombarded by possibly the widest choice for share of throat they have ever experienced; Sri Lanka could count on their loyalty to Ceylon Tea as a known comfort product.