Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 23 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Ceylon Tea Brokers Plc

The Sri Lankan tea industry had a challenging year covering production levels, auction prices, and culminating in sharply declining export levels. Our dependency on exportsto oil producing countries that are also facing turbulent declines in their pricing structure for oil has resulted in a lack of predictable stability with regard to maintaining purchase levels fortea.

The only upturn in purchases appears to be from trading centres like Dubai who blend and re-exports and Iraq. Russia the largest importer has reduced its purchases significantly due to the effects of sanctions.Exports to Turkey havealso been affected more recently due to the newly imposed border controls that could curtailaccess into the neighbouringcountries.

The statistics clearly demonstrate the correlation between the decline in the Sri Lankan tea industry and that which is mirrored in the global oil markets. If proactive action is not taken to diversify trade with other regions, the Sri Lankan tea industry could be facing a bleak future.

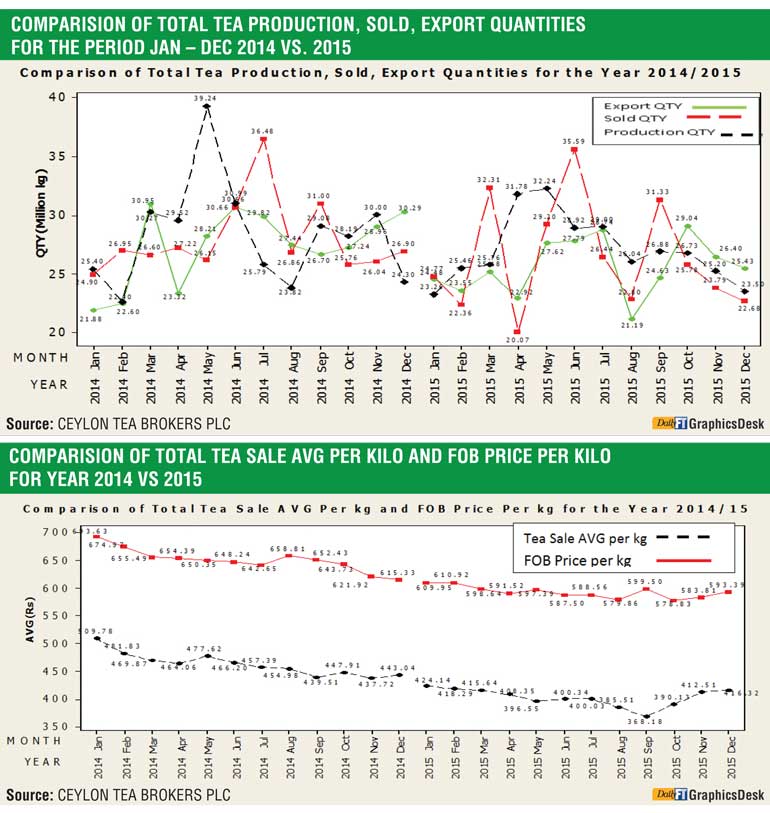

The total tea production of Sri Lankan tea for the year 2015 recorded 328.96 million kilos in comparison to 338.03 million kilos for the same period in 2014 (a differential of -9.1 million kilos).Though production declined by 9.1 million kilos, exports have decreased by  20.91million kilos compared to the same period in 2014;thus creating a surplus of tea remaining unsold/pending exports.

20.91million kilos compared to the same period in 2014;thus creating a surplus of tea remaining unsold/pending exports.

The total national average of teas sold for the year 2015 was Rs. 402.14 per kilo in comparison to Rs. 461.86 (-Rs.59.72)for the same period in 2014.The Rupee and US Dollar equivalent averages shows a decline on the corresponding averages of 2014 as well as 2013. Low Growns having the largest market share with 60% of the production recorded the sharpest decline at (Rs. -71.77)with Mid Growns recording a decrease of (-Rs.47.49) and High Grownsseeing the least reduction of(-Rs.31.98)when compared to 2014. Low Growns averaged Rs 416.32, Mid Growns recorded Rs. 362.57 with HighGrowns at Rs. 388.38 for the cumulative period of January to December 2015.

Sri Lankan tea exports for the period January to December 2015 amounted to 306.97 million kilos. A decline of 20.90 million kilos compared with the same period last year.The FOB average price per kilo for this period stood at Rs. 593.08 in contrast to Rs. 649.37 (- Rs.56.29) when compared to year 2014.

The FOB value of tea bags has moved up in comparisonto the same periodlast year.The FOB value in tea bags recorded Rs.1125.41 per kg for the year 2015 vis-à-vis Rs.1083.73 per kg in 2014 (+41.68). However, its export volumes have decreased. Tea in bulk and packets saw a dramatic price reduction.However, Tea in bulk has seen a sharp rise in volume, probably due to importation by trading hubs (Turkey and Dubai).

Total export earnings for January to December 2015 amounted toRs. 182.05 billion, a sharp decrease from Rs 212.91 billion (-Rs.30.86 billion) realised in year 2014. In terms of the US$ equivalent, based on the respective weighted average exchange rates, export earnings amounted to $ 1.34 billion in 2015 compared with $ 1.63 billionin 2014 a decline of $ 291.54 million.

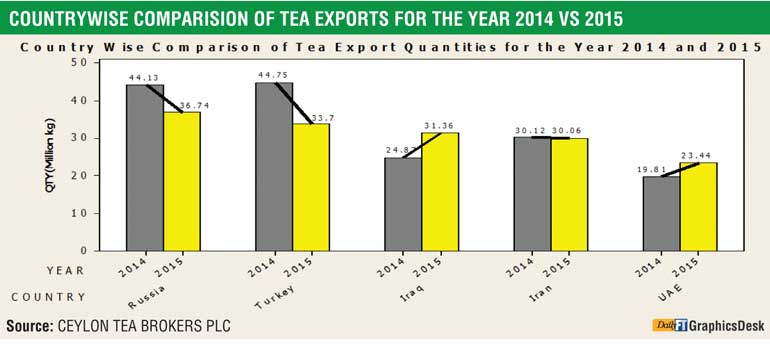

Country-wise overview

Russia: The drop in oil prices have adversely affected the Russian economy. Oil and gas comprise over 60% of Russian exports. Oil has fallen from a yearly average of $97 per barrel in 2014 to around $30 per barrel currently. Average monthly incomes fell 10% to approximately $380 between January and December last year.Approximately half of what they were in 2013. Impact of sanctions,  and thedrop in oil prices, which had an adverse effect on the value of the Russian Ruble together with expenses associated with the conflict in Syria continues to adversely affect the Russian economy in general.

and thedrop in oil prices, which had an adverse effect on the value of the Russian Ruble together with expenses associated with the conflict in Syria continues to adversely affect the Russian economy in general.

The Russian Rubledeclined 24% against the US$ in 2015. Consequently exports from Sri Lanka to this important market recorded a 20% drop in 2015 compared with the previous year. If there is more stability in the political and economic condition globally during the current year there could be an improvement in our market access to this region.

Turkey: Turkey’s recently imposed border closing with Syria and US pressure to further secure blockages in smuggling routes has drastically reduced the purchase of Sri Lankan teas. Local tea imports to Turkey has seen a sharp decline of 33% in the past year. Based on published figures, it can be deduced that the majority of exports from Sri Lanka wereultimately destined to other neighbouringcountries.

Iraq: Iraq seems to be taking over where Turkey left off. Based on the 21% increase in its purchases of Sri Lankan tea this past year it is apparent that they are now major players in the regional supply chain.However, considering the GO-political environment there could be a decline on the 2015 figures during the current year.

Iran: The lifting of the international sanctions against Iran in January 2016 under the Nuclear Accord has witnessed the release of $100 billion of previously frozen overseas assets. Iranian banking is currently reconnecting to SWIFT wire transfer system and the government is currently in the process of signing numerous international agreements. As normal trading patterns are established with the lifting of sanctions, together with improved economic conditions in Iran, there could be a beneficial impact on Sri Lankan Tea exports to this important market.

UAE: Since establishing itself as a tea hub, Dubai UAE has increased its purchases of tea from SriLanka by 15% in the past year.The majority of imports has been in bulk form due to the major component of tea being used for blending and re-exports. With the diversification of Dubai’s economy they are no longer oil dependent, with oil accounting for only 2% of Dubai’s GDP.

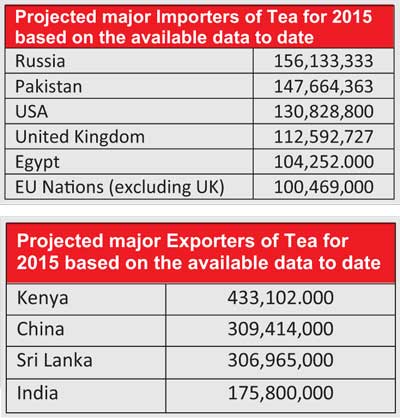

Emerging and potential markets: China, Pakistan and India appear to be increasing their market share in Sri Lanka tea imports which could provide future benefitsto the Sri Lanka tea industry. Sri Lanka currently has a FTA (Free Trade Agreement) signed with Pakistan. Under the TRQS (Tariff Rate Quotas) provided by Pakistan. Sri Lanka can export 10,000 MT of tea to Pakistan free of duty per year. Any quantity over and above this amount will face an MFN Tariff rate. (MFN Tariff rate or the most favoured nation tariff rate is the lowest possible tariff a country can assess on another country).

The global economic forecast: The global economic growth forecast for the year 2016 is projected at 3.6%. The estimated economic growth for Middle East for 2015 is 2.6% in 2015. According to the World Bank, five years of war in Syria and spill-overs to neighbouring countries such as Turkey Iraq, Egypt and Jordan has cost close to an estimated $ 35 billion in output.

Emerging market economies are expected to a continued growth slowdown due to several factors such as lower commodity prices and tighter external financial conditions.

The growth in advance economies for the year 2016 is expected to be 2.4% up from 2.1% in 2015. An economic recovery in the Euro area is predicted due to domestic demand, lower fuel prices and easy financial conditions.

The US Dollar: The interest rate hike by the US federal reserve in 2015 significantly strengthened the US$ against the emerging currencies. Therefore, the currencies of major importers of Sri Lankan tea such as Ruble (Russia), Riyal (Iran) and Lira (Turkey) depreciated substantially against US$.

Though the Sri Lankan Rupee fell 9% in 2015 against US$ the expected gains in rupee value terms on tea exports could not be harnessed due to the depreciation of the tea importing country currencies against the US$.

China’s impact on commodity prices: China the world’s second biggest economy ($ 11.2 GDP in trillions of US$) and is the largest consumer of energy in the world. The China’s economic slowdown in 2015 resulted in lower commodity prices globally (China is the biggest consumer of commodities globally). Therefore, GDP’s of the oil dependent countries such as Russia, Iran, Saudi Arabia, etc.,were severely affected and in turn had a direct impact on the Sri Lanka tea industry.

Sri Lanka whilst being in the top category of tea exporters andability to access to any great extend market share in some of the leading tea importing countries appears to be lacking. Further current importersof Sri Lanka tea have been reducing their purchase volumes which in turn adversely affect our export revenue.As oil prices continue to plummet and with the impact of sanctions on some of these countries the ability to control the outcome of tea sales is further reduced. Therefore moving forward it is imperative to establish a viable solution that stabilises and ensures the continuous evolution and revenue generation of Sri Lankan Tea exports. Upon studying the above referenced figures in global tea sales it is apparent that Sri Lanka is lacking access to vital markets that could be the key to a growth in the localtea industry as well as secure far greater profitability.

Moving forward it isimperative that the Sri Lanka tea industry seeks to significantly diversify its interests in the export sector by extending its horizons Westward towards such nations as The United States and the European Union, as well as market leaders such as Egypt and Pakistan together with China which is an emerging market for the import of black tea. Additionally it is fundamental that relationships with current importers are maintained so as to ensure prevention of further loss to competitors such as India and Kenya, who despite adverse market trends have continued to expand their global tea sales. It also appears that Sri Lanka would lose its position as Russia’s biggest tea import destination to India in 2015 (upto Sept total exports Sri Lanka 26,570 MT, India 32,000 MT).

A tea hub such as that which has been established in Dubai with the necessary safe guards and regulations could benefit the expansion of our tea industry enabling significant trade with a wider cross section of countries globally. It will also enable diversification by augmenting blending, packaging, marketing and product innovation industries in this sector and provide additional manufacturing and sales potential.

Globalisation has generated an unprecedented level of international interaction that cannot be ignored. If the Sri Lankan tea industry intends to keep up with the resulting competition, it is vital that it does not rest on its historical laurels and seeks to command a significant presence as a diversified market leader in all aspects of the expanding global tea market. This would ultimately benefit all stakeholders of this great industry that continues to be a major factor in the Sri Lankan economy.