Thursday Feb 26, 2026

Thursday Feb 26, 2026

Friday, 9 June 2017 00:00 - - {{hitsCtrl.values.hits}}

Ceylon Tea Brokers Plc Chairman and industry veteran Chrisantha Perera has shared some key insights in to the performance of tea sector in 2016 as well as listed useful suggestions on the way forward. The Daily FT reproduces some relevant excerpts from Perera’s review in the company’s Annual Report for the financial year ended on 31 March 2017.

Ceylon Tea Brokers Plc Chairman and industry veteran Chrisantha Perera has shared some key insights in to the performance of tea sector in 2016 as well as listed useful suggestions on the way forward. The Daily FT reproduces some relevant excerpts from Perera’s review in the company’s Annual Report for the financial year ended on 31 March 2017.

The company had a more successful year in 2016/17 compared with 2015/16, although the Sri Lanka tea industry continued to experience challenging times. Tea prices at the Colombo Auction appreciated fairly sharply, particularly as the year progressed in the backdrop of a sharp fall in Sri Lanka’s tea production compared to previous years. Tea prices also benefited from higher oil prices that encouraged greater demand from the Middle East countries and Russia who are the two most important market segments for ‘Ceylon Tea’.

Tea export earnings

Tea export earnings

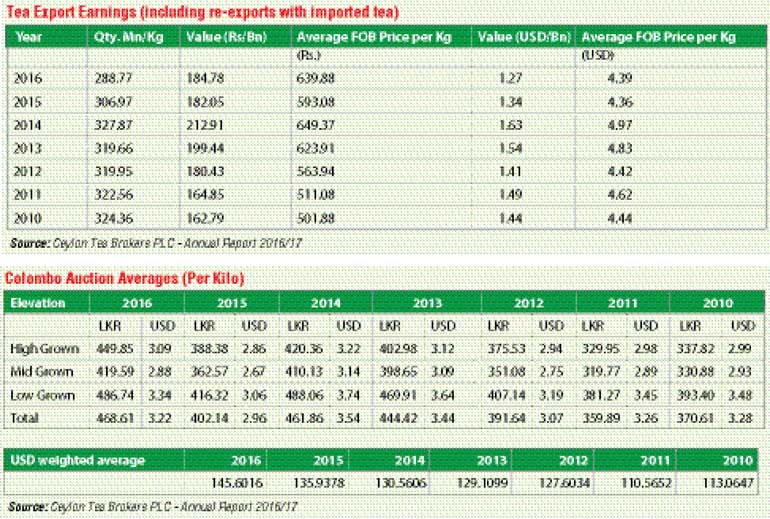

Following the decline in production, tea export earnings during the calendar year 2016 amounted to $ 1.269 billion representing 12.3% of total export earnings compared with $ 1.340 billion amounting to 12.7% of export earnings in 2015.

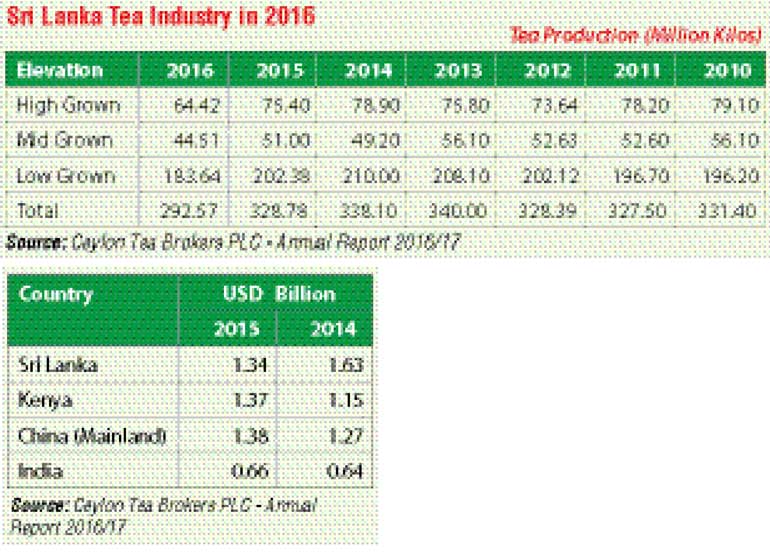

The above table reflects the disappointing scenario of the declining trend in our national tea production, which has dropped to under 300 million kilos and is the lowest for over a decade barring 2009. This substantial drop was partly due to adverse weather conditions and as importantly, the restriction placed on the availability of weedicide and consequent curtailment of necessary agricultural practices and inputs, were contributory factors to this extremely poor performance. All three elevations recorded lower figures.

This trend continued during the first two months of 2017, although there was a welcome increase in our national crop for March. It is too early to predict whether this pattern will be maintained for the rest of the year and we can only hope that the total tea crop for 2017 will at least record a figure over the psychological barrier of 300 million kilos.

The single most redeeming feature on the performance of Sri Lanka’s tea industry last year has been the increase in the auction averages compared to 2015 both when expressed in Sri Lanka Rupee and the USD equivalent. Following the limited availability of tea, together with improved demand from some of our main markets, prices have moved up further during the first four months of 2017. At the time of compiling this Report, the todate auction averages for the current year are at all time highs both in terms of rupees as well as the USD equivalents.

This encouraging sign however should be tempered with a word of caution in that if the availability of tea out of Sri Lanka continues to be limited, at some point, we may lose our market share in the more important importing countries due to a lack of regular and adequate supply. In spite of the higher average FOB price per kilo reflective of the higher auction prices, the total volume of exports have declined following the drop in production. Increase in value has compensated for the drop in volume in respect of Rupee earnings from tea, which amounted to Rs. 184.78 billion in 2016, marginally more than the Rs. 182.05 billion in 2015. The disappointing factor however is that the total value of exports in terms of USD has declined to $ 1.27 billion, which is the lowest since $ 1.15 billion in 2009.

As per the information available to us, the following gives a comparative table of export earnings for the calendar years 2014 and 2015 in respect of the four major tea exporting countries.

The 2016 export earnings in respect of the other countries in the above table are not available at the time of compiling this Report. However, it is likely that our established position of being the highest value exporter over the previous decade or more, which we lost in 2015, will be further eroded by our disappointing performance in 2016 with the total value of export earnings amounting to only $ 1.27 billion.

According to information available to us, we find that India has emerged as the leading exporter to Russia overtaking Sri Lanka, which held this position in the recent past. Another feature is that Pakistan was the single largest tea importing country in 2016 with approximately 170 million kilos surpassing the imports by Russia with approximately 150 million kilos. Unfortunately, in spite of the existing Free Trade Agreement between Sri Lanka and Pakistan, our exports to Pakistan continue to be minimal and in fact are even lower than what India exports to Pakistan. It should also be pointed out that China and India, in spite of being the two largest consumers of tea in the world, have been generally increasing or at least maintaining their tea export earnings over the past few years.

Reading through the statistical performance of our tea industry in 2016, other than for the substantial increase in Colombo Auction Averages which in turn has reflected in higher FOB earnings, there is little cause for encouragement. As mentioned earlier in this Report, prices by itself without adequate volume of the correct type of tea required by international markets will reduce Sri Lanka’s stature in this rapidly expanding global market. In our view, it is time that all segments of this great industry gets together with the Sri Lanka Tea Board and strategise a way forward to ensure that we re-establish and enhance our previous eminent position as the largest value exporter for tea.

Repeating something that was mentioned in my last year’s message is that the total global value of tea exports in a calendar year exceeds $ 7 billion. The total retail value, where tea has now moved from a mere commodity to a beverage, exceeds the export value by at least ten fold. How do we ensure that we continue to get a greater share of the final retail value of this most popular beverage next to water is what we should collectively deliberate and endeavour to achieve.

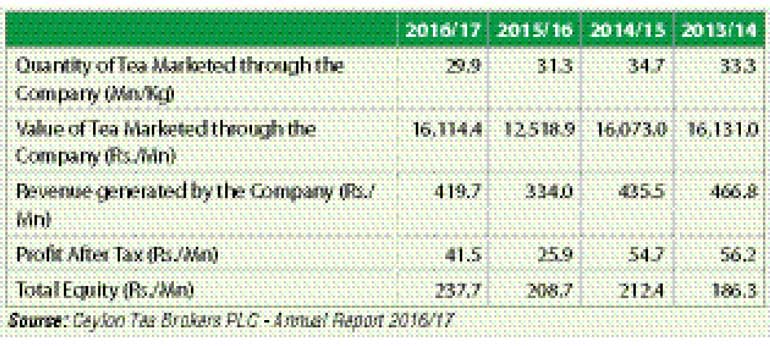

Company performance

The performance of Ceylon Tea Brokers Plc in FY2017 reflects an encouraging improvement compared with 2015/16, although still falling short of the results achieved in 2014/15 and 2013/14. Some details, which would be of specific interest to our shareholders, are set out below.

The efforts of our Management Team deserve commendation for the above performance. Quite apart from the increase in values, it is noteworthy to point out that even the quantity of tea marketed by the Company has recorded only a marginal decline compared with the national production that has dropped by 36 million kilos in 2016 against 2015. This demonstrates the improvement in our market share which in turn underlines the efficient service levels of our team that has enabled us to achieve this position. The challenging task ahead is for us to maintain and further improve on these results through a professional and quality service expected of a tea broker.

Warehousing project

The company has acquired the total equity of Logicare Ltd., which has the leasehold rights for a 4.5 Acre land in the Muthurajawela zone. Our intention is to construct a state of the art warehouse complex with modern equipment in the said premises suitable for the storage of tea. The complex initially would have a storage capacity of 60,000 Sq. Ft. and the total project cost including the acquisition cost of Logicare Ltd., would be approximately Rs. 600 million.

Dividend

The company’s policy has been to distribute approximately 50% of the profit after tax to shareholders as Dividend and transfer the balance to reserves. Following this policy, the Directors declared on 24 April 2017 an interim Dividend of 17.5 cents per share amounting to a Total Dividend payout of Rs. 19.95 million including the Dividend Tax. The Dividends were paid to the registered Shareholders as at 4 May 2017. This Dividend compares favourably with 12.5 cents per share amounting to a total payout of Rs. 14.25 million for the financial year 2015/16.