Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 29 April 2016 00:00 - - {{hitsCtrl.values.hits}}

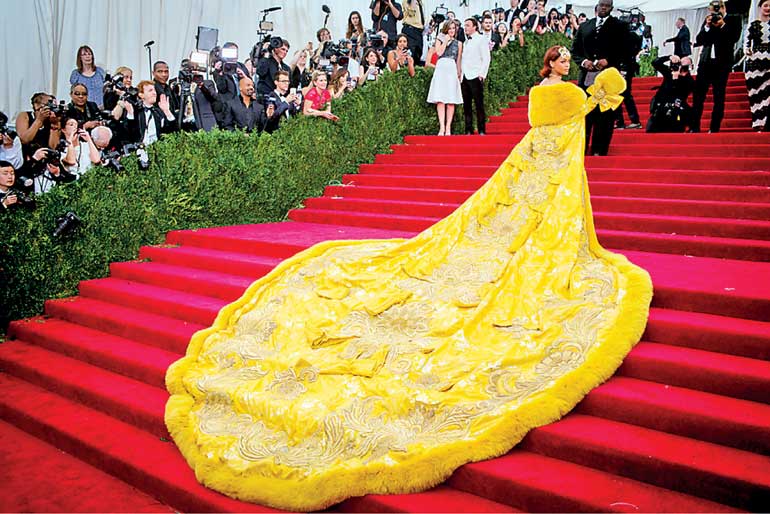

Singer Rihanna, wearing a dress by the Beijing-based designer Guo Pei, arrives at the Metropolitan Museum of Art Costume Institute Gala 2015 celebrating the opening of “China: Through the Looking Glass” in Manhattan, New York May 4, 2015. REUTERS

Singer Rihanna, wearing a dress by the Beijing-based designer Guo Pei, arrives at the Metropolitan Museum of Art Costume Institute Gala 2015 celebrating the opening of “China: Through the Looking Glass” in Manhattan, New York May 4, 2015. REUTERS

SEOUL (Reuters): Fashion brands from South Korea, China and Japan are becoming serious rivals of their Western peers as Asian consumers become increasingly confident in their own style and take pride in buying home-grown labels.

Asian consumers are the world’s biggest spenders on high-end fashion, representing around half of total buyers.

Most of them are under 35, Internet-savvy and increasingly on the hunt for small, cool, original brands that will make them stand out and look different from their parents, fashion executives and retailers say.

High quality is no longer the preserve of Western luxury brands, fashion experts say, and Asian brands are attracting attention as they experiment with new textiles and materials, facilitated by their local manufacturing base.

This growing threat from the east is likely to add misery to big luxury brands such as Prada, Kering’s Bottega Veneta and Tod’s, already suffering from plunging sales, partly due to excessive price increases, over-exposure in certain markets such as China and mega-brand fatigue.

Chinese fashion brands, such as Ms Min and Comme moi, are the fastest-growing contemporary design labels sold at department store Lane Crawford, which has outlets throughout China and Hong Kong, its Chairman Andrew Keith told Reuters. Lane Crawford also sells Korean menswear brands such as Woo Young Mi and expects to start selling Korean womenswear soon.

“You sense there is a pride about seeing China develop its own creative community and seeing China emerge as a creative force,” Keith said in an interview on the fringes of the Conde Nast luxury conference in Seoul.

Lane Crawford has seen its pool of Chinese labels grow over the past four years to more than 30, from just four. 20% of Chinese-designed clothes bought online are shipped outside of China “mainly to Chinese nationals living abroad who want access to these brands,” Keith said.

He estimates that his average customer in mainland China is 25 while in Hong Kong the average age is 35-40.

Also high on Asians’ shopping list are Japanese brands, such as Sacai and Tsumori Chisato, many of them older and better established than South Korean or Chinese labels. Lady Gaga regularly wears Japan’s Roggykei, created in 2006 by two graduates from Osaka College of Design.

Unique style

Seoul, Tokyo and Shanghai all have fast-expanding fashion weeks, sponsored by local industrial groups, showing dozens of budding brands. Some labels have also moved West and started showing at Milan and Paris fashion weeks and opened shops there.

Beijing-based designer Guo Pei, whose yellow long cape dress was worn by Rihanna at the Met Gala last year, started showing at Paris Couture week in January, while Chinese shoe brand Stella Luna, whose stilettos cost more than 500 euros ($ 565), has three free-standing shops in Paris.

Chinese-born designer Yiqing Yin, whose creations are sold in China, New York and Paris, has won several European fashion awards and has been hailed by the international fashion press as one of the most promising designers of her generation.

Popular Korean brand SJYP, run by duo Steve Jung and Yoni Pai, sells in Europe and the United States, including at Selfridges in London and Opening Ceremony in New York and Los Angeles, while Chinese-born Uma Wang, a graduate of London’s Central Saint Martins design school, sells in China and in Europe, including at l’Eclaireur in Paris. She also shows at Milan Fashion week.

“Before many Asians thought luxury goods had to come from the West,” said Lee Seo-hyun, president of Samsung C&T’s fashion division and daughter of Samsung Electronics Chairman Lee Kun-hee.

“But they are becoming more sophisticated and discerning and now more people are interested in local designers who have their own point of view and unique style.”

Samsung C&T, affiliated to Samsung Electronics, maker of Apple rival Galaxy smartphones, is one of the biggest corporate investors in Seoul’s up-and-coming fashion scene.

Every year, it gives $ 100,000 to two or three designers to help them develop their collection and since 2005 has invested $ 2.7 million in 19 design teams through the Samsung Fashion & Design Fund.

Samsung’s fashion unit has a stable of brands, ranging from Korean brand Bean Pole to Belgian fashion label Ann Demeulemeester.

Erwan Rambourg, author of the book ‘The Bling Dynasty’ and luxury goods analyst at HSBC, says Asian brands, even if they are still small and not widely distributed yet, are fast becoming serious competitors for Western brands.

Korean cosmetics have long been popular with Chinese customers and Rambourg notes that popular South Korean television series such as ‘My Love from the Star’ and ‘Descendents of the Sun’, and Korean pop music acts such as Big Bang and Girls’ Generation, have helped boost South Korea’s image as a trend-setter throughout Asia.

While Asian consumers have embraced American culture, Korean pop culture is closer to Chinese culture, says Rambourg.

“Koreans’ self-esteem and self-confidence has been boosted by the power of ‘K culture’ and this is also why Korean and other Asian brands have started to become more popular,” said Sung-Joo Kim, one of Korea’s most high-profile female entrepreneurs. She owns and runs German luxury leather goods brand MCM, known for its $ 700 studded logo-embossed canvas backpacks.

Kim, who previously developed Gucci’s Korean business, also pointed out that Asian brands cater better to Asian women’s more petite shape than Western brands.

“Can we make ‘made in Asia, designed in Asia’ become cool, I think yes we can because the stigma that Asian brands had is disappearing and we have all the right ingredients and the manufacturing base,” said Joowon Park, director at Seoul-based Simone Fashion Company. It manufactures for Western brands including Coach, Michael Kors and Kate Spade.

Asian brands are also attracting interest from Western buyers.

Awaiting a flight back to Paris at Seoul airport, Maximilien, 39, who works in fashion advertising, bought a $ 400 studded bag for his wife from Korean brand Youk Shim Won, with a girl in funky sunglasses painted on one side.

“This is so original, don’t you think?” he said.