Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 15 February 2016 00:05 - - {{hitsCtrl.values.hits}}

CSE Chairman Vajira Kulatilaka told the Swiss forum that the time was right to invest in Sri Lanka, especially in listed equities and debt.

CSE Chairman Vajira Kulatilaka told the Swiss forum that the time was right to invest in Sri Lanka, especially in listed equities and debt.

Through a presentation rich with charts and tables for easy comprehension, the CSE Chief said Sri Lanka’s growth performance had far exceeded that of global economies between 2013 and 2015 and the trend would continue.

He said the country had sustained single-digit inflation over the past three years owing to prudent demand management and benign supply conditions. This has been buttressed by supportive monetary and exchange rate policies.

Focusing on specific opportunities for capital market investors, the CSE Chief also gave a snapshot of the Government securities market, noting it to be the largest and most liquid market in Sri Lanka. According to him, the outstanding Rupee denominated Government securities market was worth Rs. 4.2 trillion or nearly $ 30 billion. This is several times bigger than the equity market, which is worth around $ 20 billion.

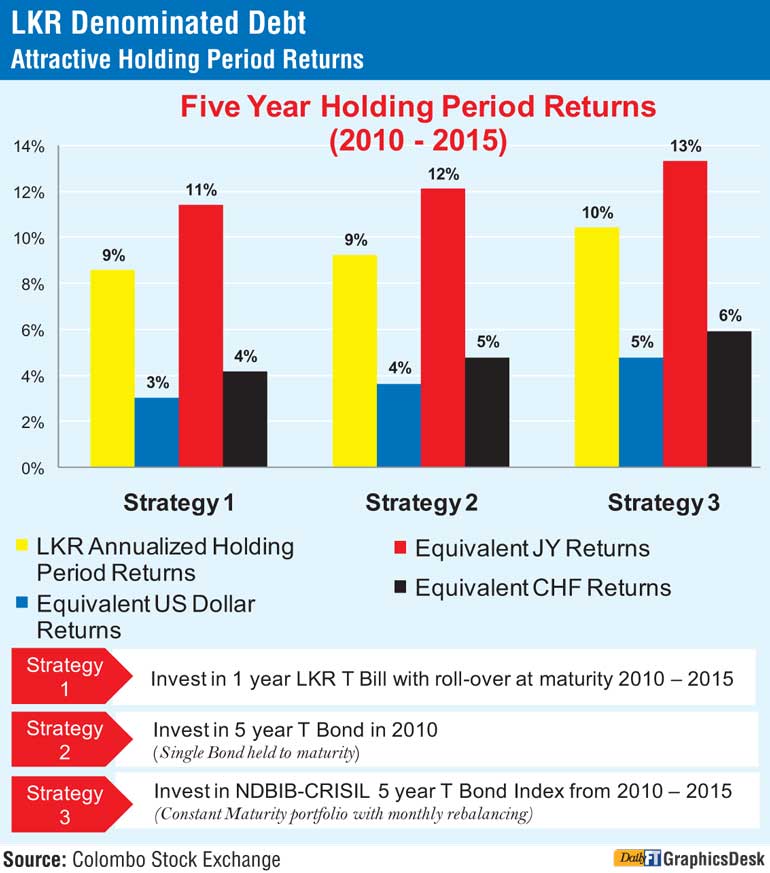

He also showed how Government securities had provided attractive holding period returns. Giving three different investment strategies, he said returns ranged from 8-10% with equivalent US Dollar return ranging from 3-6%. In Swiss Francs the returns ranged from 4-6% and in Japanese Yen it was 11% and 13%.

Focusing on the CSE, the Chairman said it was aspiring to be the preferred choice for debt instruments among Sri Lankan corporates. The highest ever listed debt raising of Rs. 83 billion in 2015 was emphasised as it comfortably surpassed the previous best of Rs. 68 billion, established in 2013.

With regard to listed equities, the Swiss forum was told that the $ 21 billion market capitalisation is influenced by 294 listed companies drawn from 20 sectors. “The CSE offers attractive valuations, good diversification opportunities amidst increased market participation,” Kulatilaka said.

He also revealed that CSE ASPI continues to significantly outperform major global indices such as the MSCI World, Dow Jones, FTSE100 and DAX. Additionally, it has significantly outperformed most regional indices such as MSCI Emerging Market Index, Jakarta, Thailand, Philippines, Hanoi and Mumbai.

Given the fact that Sri Lanka has a relatively low market cap to GDP of 32%, the CSE Chief said there was also significant potential for further growth. This is considering the fact that Indonesia’s market cap to GDP is 48%, India’s 74%, Philippines 92%, Thailand’s 115% and Singapore’s 245%.

What perhaps most excited participants at the Swiss forum was Sri Lanka’s attractive valuations compared with regional competitors. The Price Earnings Ratio at the CSE is 14.7%, against the 23% of Singapore, 20% of India, 19% of Thailand, 17% of Philippines and 16% of Malaysia. “Sri Lanka’s year on year Earnings Per Share growth has outperformed most of its peers between 2013 and 2014 too,” Kulatilaka said.

It was pointed out that Sri Lanka had low correlation with major global indices, suggesting the CSE was less impacted by global volatility.

This led to Colombo remaining stable despite the downward turn of many regional indices in 2015. It was emphasised that foreign turnover at the CSE has been on the rise since 2011 with the 2012-2014 period enjoying heavy inflows although 2015 saw a reversal of this.

He also listed some new developments at the CSE. Under market regulation, he said a new SEC Act, which will result in an improved regulatory framework, is in the offing. Under risk management, the establishment of a Clearing Corporation to act as a central counter party for all secondary market transactions benchmarking IOSCO best practice standards and introduction of world-class risk management to the market were explained.

In terms of diversification of product range, Kulatilaka said the CSE would introduce a range of new products such as Real Estate Investment Trusts (REITs), Structured Warrants, Exchange Traded Funds (ETFs) and equity related derivative products.

To improve governance, the CSE was progressing with plans for demutualisation and on market infrastructure, a new back office and order routing system for brokers, upgraded ATS, CDS and surveillance system and Information Security improvements, ISO certifications and upgrades to exchange Infrastructure were cited.

The CSE has also adopted the Global Industry Classification Standard (GICS) to classify listed companies on the CSE. The recent achievement of the CSE joining the United Nations Sustainable Stock Exchanges (SSE) initiative was also highlighted, reinforcing Sri Lanka’s overall commitment to sustainability.

With regard to Unit Trusts, the CSE Chief said the industry’s Assets Under Management (AUM) in UTs grew six-fold over the past three years. He said the benefits to foreign investors in unit trust include: a good way to diversify investment, low management fees, investments can be liquidated at any time, wide range of funds available including equity growth, fixed income, balanced portfolio funds, and Shariah-compliant funds, dividends, capital gains and sales proceeds from unit trusts are tax free, direct investments in unit trusts in foreign currency need not be channelled through an SIA, investors are protected by trustees, who act to safeguard the interests of unit holders and most unit trust management companies in Sri Lanka are backed by stable banks or financial institutions.

“Be a part of Sri Lanka’s growth story. It is a sound investment decision stemming from strong capital market fundamentals,” Kulatilaka emphaised.

This is justified by the fact that there are attractive valuations/returns backed by lower risk through strong market fundamentals. He also said the CSE was a good diversification opportunity - little or no correlation to global markets and low equity market capitalisation to GDP ratio indicates strong growth potential and corrective measures taken to address liquidity constraints.

He said under the new political and governance culture, Sri Lanka was positioning itself as Asia’s most welcoming nation for investors.

“The Government is making investments easy and the country provides best in class returns in addition to relaxed rules for repatriation of returns as well as the 2016 Budget unveiling a host of investment-friendly measures,” the CSE Chairman added.