Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 1 July 2016 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

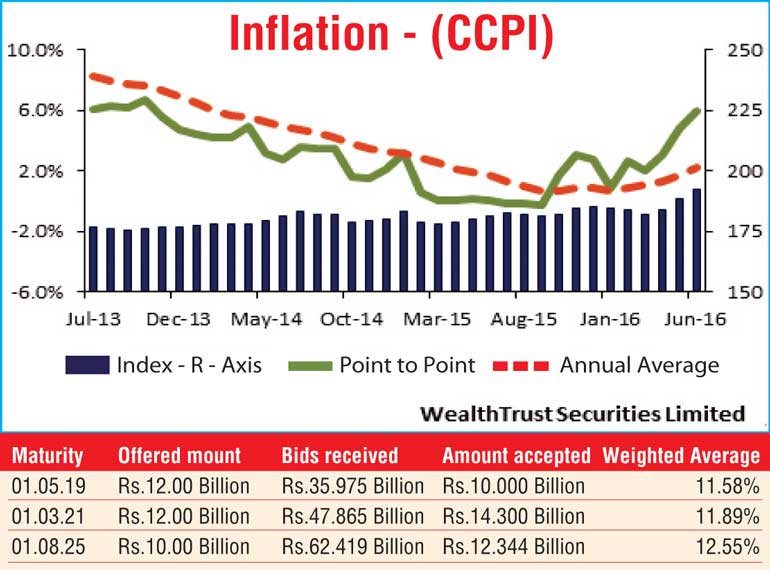

The three Treasury bond auctions conducted yesterday were seen recording weighted averages well below market expectations, continuing the same trend witnessed at its Monday (27 June) auctions as well.

The 9.01 year maturity of 01.08.2025 recorded a weighted average of 12.55% in comparison to a similar maturity of 15.03.2025 which recorded an average of 12.64% on Monday while the 4.08 year maturity of 01.03.2021 recorded a weighted average of 11.89% in comparison to a 4.05 year maturity of 15.12.2020 which recorded a weighted average of 11.93% on Monday as well.

Nevertheless, the weighted average on the 2.10 year maturity of 01.05.2019 was seen increasing by 03 basis points to 11.58% against its Monday’s average. In total an amount of Rs.36.6 billion was accepted on all three maturities against its total offered amount of Rs.34 billion.

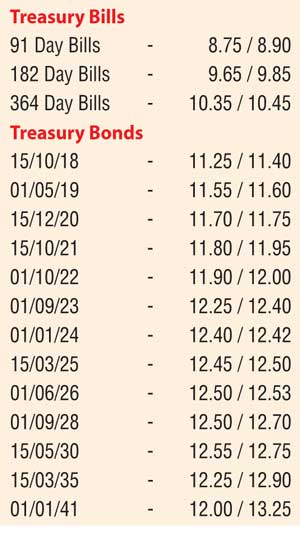

In secondary bond markets, yields decreased across the yield curve mainly on the liquid maturities of 15.12.20, 01.01.24, 15.03.25 and 01.06.26 to intraday lows of 11.74%, 12.40%, 12.48% and 12.50% against its days opening highs of 11.78%, 12.45%, 12.50% and 12.55%.

Furthermore, inflation as measured by the Colombo Consumer Price Index (CCPI) was seen increasing to a 32-month high of 6.00% on its point to point while its annualised average increased to a 15-month high of 2.20%.

Meanwhile in money markets yesterday, the overnight call money and repo rates remained mostly unchanged to average 8.20% and 8.06% respectively as market liquidity remained at a net surplus of Rs.13.83 billion.

Rupee continues appreciating trend

The USD/LKR rate on the active one week forward contract appreciated for a third consecutive day to close the day at Rs. 146.00/25 against its previous day’s close of Rs. 146.30/60. The total USD/LKR traded volume for 29 June was $ 48.75 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 146.25/45; three months – 147.70/20; and six months – 149.95/35.