Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 24 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Asia Securities

The World Health Organization (WHO) has identified Sri Lanka as being in stage 3 of contagion, which means that currently any new patients found are largely clustered at small community groups. To stop the shift to stage 4 (community transfer) the Government of Sri Lanka has proactively taken several aggressive steps, including extending curfew in identified hotspots like Colombo, Kandy, Kalutara and

Gampaha.

This lockdown has undoubtedly helped curb the spread of COVID-19. However, the inevitable consequence of lockdowns, both locally and in our key export destinations, is a material economic cost; production and services have largely come to a temporary halt. Asia Securities’ recent Macroeconomic update attempts to estimate the GDP impact of COVID-19 by analyzing the impact of the pandemic on key sectors, the Government’s key fiscal and monetary measures, and the impact on Sri Lanka’s informal sector.

We attempt to quantify the overall impact on GDP growth based on various pandemic containment scenarios. The results, unsurprisingly, suggest a high probability of the country’s most severe economic slowdown in modern times, not unlike the expectation for many other developed and developing nations across the world. With several unknowns affecting forecasts at this point of time, no historical analysis is meaningful for a direct comparison to the COVID-19 situation.

As such, Asia Securities has used a triangulated top-down and bottom-up approach using quantitative and qualitative analysis, to put forward three possible scenarios; each depends entirely on the containment time and a reasonable return to “business as usual” both here at home in Sri Lanka, as well as in key export markets. Our top-down approach, which primarily looks at the overall impact on key sectors in the economy estimates a 5.0% - 5.4% YoY decline in GDP growth for 2020. This decline will be driven by the Industrials and Services sectors, which will see the highest impact stemming from productivity disruptions and global demand softening.

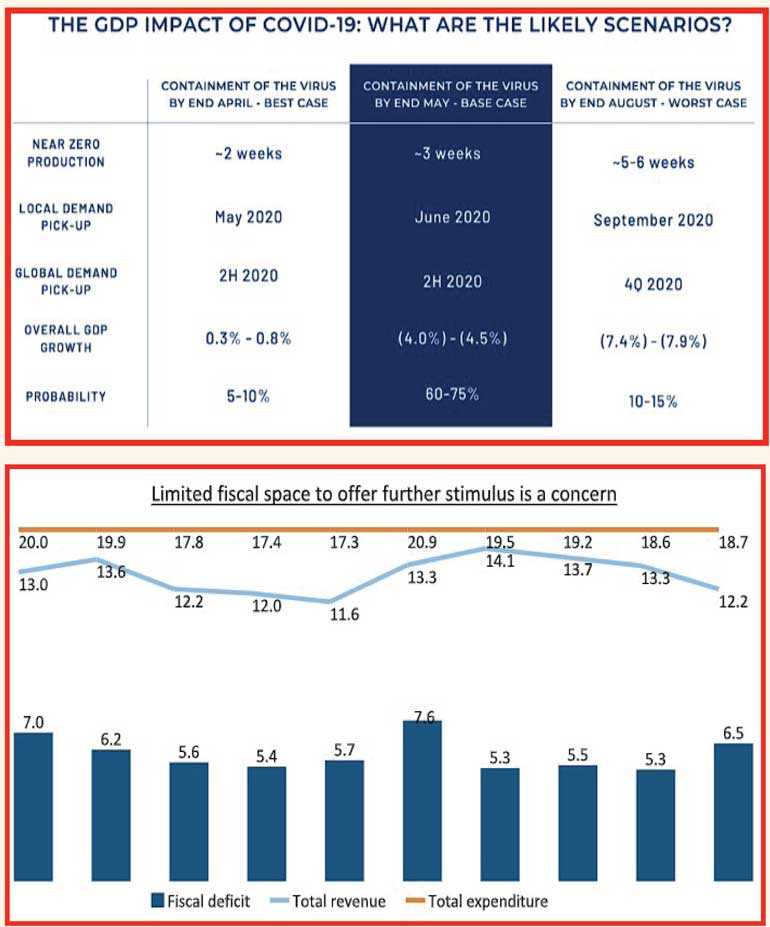

Meanwhile, our bottoms-up approach combines input from our dedicated sector analysts covering manufacturing, consumer, financial services, and leisure sectors. The most likely scenario on this basis is an estimated 4.0% - 4.5% YoY decline in GDP growth for 2020. The table below summarises the COVID-19 containment and demand pick-up assumptions, as well as the resulting GDP outlook estimates for each forecast scenarios.

Our best-case scenario forecasts real GDP in 2020 to be effectively similar to last year’s, with mild growth of 0.3-0.8%. This would be an exceptionally good outcome. Our most-probable case forecasts GDP to contract 4.0-4.5% in real terms. This is in a similar range to where we see some of our international partner firms and international rating agencies forecasts for several major economies.

The 3 scenarios for growth

In Scenario 1 (best-case), we assume that the virus will be contained by the end of April with a near-zero case number to continue for nearly two weeks. While local demand is expected to pick up by the end of May, we expect a gradual end market pick up from 2H 2020 on the external front. This scenario which sees a GDP growth of 0.3-0.8%, however, is the least probable. We estimate a 5-10% probability of this scenario unfolding.

Scenario 2 (base-case) in which, say the virus is contained by the end of May (factoring in a second-wave of infections, similar to countries which have already contained the virus), which may indicate that there is a 60-75% probability of a GDP contraction of 4.0-4.5% YoY. This is based on the assumption of near-zero case number for nearly three weeks, which results in a largest impact on the Industrial sector. This scenario also hinges on the expectation of an end market pick up in the second half of the year for the industrial sector, which is expected to see a 19.7-23.0% decline in 2Q 2020.

Scenario 3 explores the worst case, in which the virus containment arguably may take between five to six months, and a near-zero case number will continue for nearly 5-6 weeks. Local demand normalisation will take 4-5 months, and on the external front, we can expect a gradual end market pick up in the fourth quarter. This scenario estimates a 7.4-7.9% GDP decline. We estimate a 10-15% probability of this scenario unfolding.

Fiscal stimulus is the correct move

Nearly 59% of Sri Lanka’s labour force receives some form of a variable income, and this income is currently under threat from lost business days. The current slowdown in economic activity and its impact on the informal sector calls for much needed fiscal assistance, which the government has proactively taken steps towards.

The Government’s measures to impose price controls on essential items, introduction of food cards for lower-income households, and delayed payment periods for utility bills and other payments are all forward-looking policies which may help negate the fallout felt by those who are part of the informal sector.

However, in our view, the Government will be a key player in ensuring that businesses do not face structural closures. In addition to supporting informal sector workers, protecting the operational viability of businesses will be key to minimising the risks of rising unemployment and declining production.

Limited fiscal space remains a concern

In 2019 the fiscal deficit increased to 6.5% of GDP, up from 5.3% in 2018, as a result of lower government revenue and higher expenditure. Outstanding government debt increased 8.3% YoY to LKR 13tn, with foreign debt accounting for 49.1% of total debt. Lower direct taxes which are still in place, are expected to add to the mounting pressure on the fiscal deficit, which was already under duress following the sweeping tax cuts rolled out in November 2019 and January 2020. However, the recent revisions to PAYE (renamed as Advance Personal Income Tax) and corporate taxes will support government revenue to some extent.

Last month, the Government took measures to finalise a $ 500 million 10-year loan from China Development Bank and has plans of extending this to a further $ 700 million in May. While we expect this to help the Government’s funding stress, additional funding from the IMF and the World Bank may help create some fiscal space for further support. In our view, re-negotiation of payment schedule is a key area the Government should focus on, during this point in time. While the Government has taken several pertinent measures to curtail the spread of COVID-19 in the country, swift implementation of fiscal assistance will be a key factor in avoiding a steeper, structural decline.

Conclusion

Clearly, the current unprecedented situation is fluid, and a range of outcomes related to the spread of the virus and containment could lead to a change in the economic forecasts. In addition, the pace of recovery in several key export markets, also impacts the outcome of our forecasts. While both the Government and Central Bank have stepped up to help ease the impact of the pandemic on the economy and country, we believe the Government’s fiscal stance is more effective in navigating the current scenario.

The largest threat to our highest probability scenario comes from limited fiscal space. While more stimulus could cushion the GDP impact, we have limited visibility of additional funding available for the Government to afford more fiscal loosening in the near term.

Any suggestion of additional sources of fiscal capacity for the Government will be a major positive, and in our view, can shift our growth outlook from the highest probability scenario of a 4.0-4.5% YoY GDP contraction to something closer to our best case scenario of 0.3-0.8% GDP growth. It is without doubt that the current dynamics are unprecedented, and fast changing. Any upside or downside surprises will have a material impact on our forecasts

with certainty.