Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 15 July 2022 00:58 - - {{hitsCtrl.values.hits}}

Thulci Aluwihare

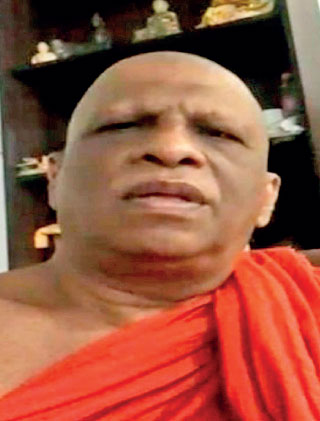

Rev. Prof. W. Wimalaratana

Moderator Prof. Sirimal Abeyratne

By Bhadraja Mullegangoda

By Bhadraja Mullegangoda

This article represents the views aired in the fourth seminar of a monthly seminar series organised by Sri Lankan Economic Association (SLEA), which was held on 28 May via Zoom platform. CHEC Port City Colombo Ltd. Assistant Managing Director Thulci Aluwihare made the presentation on “Colombo Port City: A game changer in Sri Lanka to Navigate through Turbulence Times”. The discussant was SLEA President Professor Rev. W. Wimalaratana. The views expressed in the article are those of presenters and do not reflect views of SLEA.

Historical landscape of FDIs in Sri Lanka

Sri Lanka has a grey history of attracting FDIs compared to our peers in the region. When looking at the composition of FDIs during the period of 2015-2019, majority of FDIs channelled to port and telecommunication related projects. The peak of inflows was recorded in 2108, $ 1.61 million, while $ 828 million received by Hambantota Port.

Hard infrastructure and port related FDIs could have limited effect on the GDP, and it could diminish over a very short period of time. Also, FDI inflows have been historically driven by reinvested earnings. Following facts provide a strong indication of scarcity of FDIs for greenfield projects in the emerging sectors in Sri Lanka.

nOver the five-year horizon (2015 to 2019) FDI for BOI enterprises in the service sector has recorded a negative growth (CAGR of -3%).

nService sector contribution to the FDIs has decreased from 26% to 19% in the same period.

nA significant difference could be observed between BOI approved contracts and actual contracted projects. The most influencing factors for this difference are delays arising from obtaining line agency approvals and land approvals.

In the regional lens, Sri Lanka has only managed to attract $ 13 billion as FDIs during the last 40 years (1980-2020). Front runners were China and Hong Kong accounted for $ 3.8 trillion while our close peers India, Malaysia and even Myanmar had attracted $ 480,174, and 36 billion respectively.

Further adding to this, each country had enhanced their policy planning to capture a higher share of greenfield FDIs for their identified strategic sub-sectors, for instance, ICT sector in Singapore, electronics in China, textiles in Vietnam, and communications in India.

Consequently, the incompetence of Sri Lanka to attract fair amount of FDIs is controversial, thus both tangible and intangible factors have affected for this relegate over these years. So, the question mark is, could the Port City function as a walking-skeleton to change this historical position of FDIs, specifically in a situation of dried-up foreign reserves?

Port City special economic zone: A game-changer

According to the investment bolster in the Port City, in the marina district, 50% (4.4 Hectares) was released to investors while Colombo financial centre, the first mixed use complex is scheduled to break ground in the third quarter of this year. It is a $ 500 million investment commitment by an international consortium. When looking at the environmental impact, three rounds of environmental impact assessments (EIA)are conducted with public comments.

A well-known fact is that Sri Lanka has a very sluggish environment of doing business. In this context, the Port City has set up special mechanisms to mimic the adverse effects of this implausible investment atmosphere.

Port City special economic zone (SEZ), enacted in May 2021, and the act established a single window investment facilitator to promote, administer, and regulate business activities within the port city. The primary objective of the SEZ is to augment the ease of doing business to promote export services and FDIs.

The SEZ has established special activities to diminish the risk factors of starting a business, constructing permits, obtaining utilities, and registering the property. For example, the company set-up process is digitalised to compact the timeline to two to three days. Also, many initiatives including green channel for Visa, investment protection, incentives for businesses and employees etc., have been taken by considering modern elements which are shaping the international investors’ confidence.

The main feature of the SEZ is the ability to act as an economic ring fence, therefore the larger macroeconomic shocks of the country would have a fewer impact on Port City. Some of the approaches are, transactions based on foreign currency, liberalised controls on current and capital accounts, and other regulatory measures. Further, banks in the Port City are regulated by the Monetary Board and Port City Economic Commission to omit the old provisions of banking act in the country.

Importantly, Port City also has other initiatives to protect negative implications due to alteration of future laws and regulations which is a burning issue for both local and foreign investors. Alongside these measures, a PWC independent study revealed, once a Port City is fully operational, it could add $ 13 billion to the annual GDP of Sri Lanka.

The discussant opined these types of necessities required to be implemented in identified strategic locations to attract FDIs. For instance, Katchatheevu island which ceded in 1974 to Sri Lanka by then Prime Minister Indra Gandhi, could be a good preference for similar kind of initiatives, which could be employed in participation with Indian investors.

The Discussant welcomed the move from the act, which permits business to convince operations outside of the port city until hard infrastructure is completed, thus an FDI fast-tracking move and it could be an opportunity for the central government to create ecosystems. E.g., the Government could establish a dedicated seamless administrative area for Port City businesses.

Consequently, Port City could be a pilot ground to assess the measures to detract from the cumbersome investment environment in Sri Lanka. Further, this could be an opportunity to open country doors for foreign professionals whereas it is exceedingly difficult to find employment opportunities in Sri Lanka for other nationals.

According to the act, the President has the power to nominate, terminate, and determine the members of the Economic Commission. This kind of centralisation is unfavourable for economic activities since it could create an “invisible political hand”. It is unlikely to achieve the goals of a port city with a likewise institutionalisation process. Another highlighted point was the requirement of fast-tracking the deliverables of the Port City to capture a fair share of regional growth in the emerging Asian market.

The presenter points out that the central Government of Sri Lanka could roll out or adopt progressive policies and procedures in the SEZ for other counterparts in the country, where it could be beneficial not only for conglomerates but also for local SMEs. E.g., Study and implement the digitalised process of registering a business and obtaining land approvals. So, the learning from policies and procedures in SEZ is important, specifically to deviate from the present economic and political crisis in the country. Accordingly, then only the Port City would be a game changer for Sri Lanka.

(The writer is an Assistant Secretary of Sri Lanka Economic Association (SLEA). He is working as a Researcher.)