Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 10 April 2018 00:24 - - {{hitsCtrl.values.hits}}

Under the Guest Presenter Program of the NCE Sudattha Silva – Deputy Director of Customs (ICT) and U. Liyanage – Assistant Director General delivered a presentation on the above topic to the Council Members of the NCE at its monthly meeting held last Thursday 15 March.

U. Liyanage provided overall background of the automation project while the detail presentation was made by Sudattha Silva. In his comprehensive and professional presentation Silva provided valuable information on the services available to traders (both importers and exporters) currently under the automation of customs services through the “Customs Single Window” followed by an outline of the projects that are in the process of implementation under the “National Single Window”.

Detailing the current services related to automation he stated that it is necessary for the Customs to facilitate the trading activities of both importers and exporters, although they have different requirements, where-in the information provided through the system could be shared by the six major border agencies related to trade.

The improvements related to provision of services under the system was not specifically focused on exporters although automation has enabled both importers and exporters in trade facilitation for economic development.

He stated that the two main objectives of Automation were (a) To collect customs revenue (b) To control trading activities at the border, by securing it, to curb irregular trading activities for National benefit and Security. As such facilitation and control have two opposite interests wherein facilitation is relatively easy to provide, while control is difficult.

Outlining the sequence of events related to automation, he stated that in 1993 Sri Lanka Customs was one of the first governmental organisations to automate its functions under the “ASYCUDA Version 2.5” which is the abbreviation for ‘Automated System for Customs Document Administration’. In 1998 the system was upgraded to ASYCUDA ++ with many new added features where a trader could communicate directly with customs through the system. However, at that time the telecommunication system was not geared for the expansion of facilities to integrate the services of other border organisations.

In 2003, the import and export cargo clearance operations of the Board of Investment (BOI) were connected to ASYCUDA. Hitherto BOI operations had been conducted manually, maintaining an independent data base, although it was not conducive to have two separate data bases, one by the BOI, and the other by the Customs, covering trade transactions. Thereafter in 2011, the system was further upgraded to ‘ASYCUDA World’ with the addition of many new features which were essential for the implementation of a ‘Single Customs Window’. Under ‘ASYCUDA World’ traders were enabled to submit documents directly to Customs online.

Further all transactions related to other regulatory border agencies were harmonised with Customs. The system was also extended to enable declaration of transactions by “Customs Brokers”, although initially brokers were reluctant to connect directly to the system. However, right now every broker is connected to the system under a registration and licensing mechanism, to provide customs declarations.

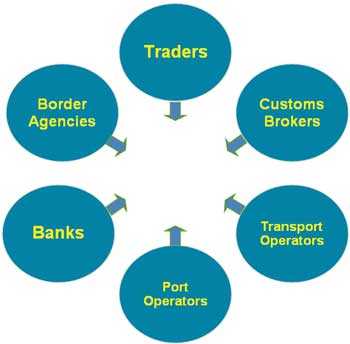

Currently, the entities and activities connected to the Customs Single Window are as follows:

The Presenter went on state that the Challenge for customs was the integration of other Border Agencies into the system and the harmonisation of their functions. This process was initiated by firstly integrating to the system the Tea Blend Sheet which function was hitherto carried out by the Tea Board, independently. For this purpose the necessary technical interface was developed by the Customs Officials to enable connection to the ASYCUDA System.

Currently, electronic submission of the following documents to the system by the Border Agencies has been facilitated. These include (a) import and export licenses issued by the Department of Import and Export Control which was included in 2016 (b) Tax waivers and exemptions (c) Certifications and approvals (d) Recommendations.

Summarising the above services, the Presenter stated that the following projects have been implemented.

The Presenter went on to state that as of 2017 only 57 enterprises have used the online payment system out of 19,000 active importers and over 3,000 active exporters.

He emphasised that the challenge for the system is prevention of the export of restricted goods, while facilitating compliant exporters. In this regard he mentioned the challenge for the prevention of export of restricted goods such as Tea Refuse, Copper Scrap, and Kotala Hibutu.

Finally, the Presenter outlined the projects to be implemented in terms of the Trade Facilitation Agreement (TFA) of the World Trade Organization (WTO) which was signed by the Government in 2013, and came into effect from 1 April 2017. In terms of this Agreement a National Trade Facilitation Committee has been set-up Co-Chaired by the Department of Commerce with representation of all trade related agencies including the Customs. Under this Agreement the projects to be implemented are as follows:

Silva concluded his presentation by stating that the ‘National Trade Facilitation Committee’ is expected to provide the blue print for the establishment of the National Single Window, which blueprint is expected from the World Bank by June this year. It will enable the connection and integration of the trade related activities of all border agencies that are connected to the single window.

Further as stated above under the ‘National Single Window’ traders will be able to submit a single application through the ‘National Trade Portal’ or in other words will facilitate submission of a single document. In this regard it is to be noted that the USA had taken seven years to implement this system. According to Silva the Customs has recommended the setting up of a National Authority to implement the National Single Window since the cost involved is very high, and therefore will not enable a private entity to undertake the task.