Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 23 October 2017 00:47 - - {{hitsCtrl.values.hits}}

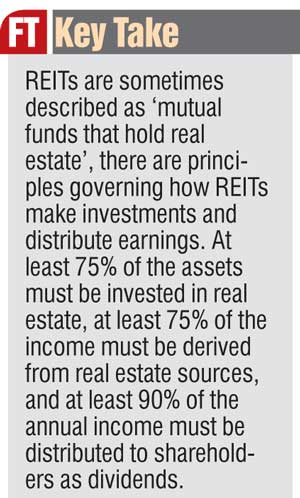

Real Estate Investment Trust or REITs are investments that hold various types of real estate assets and allow shareholders to share the returns generated from those properties; either in profits or losses.

A drone view of the Agriculterra Farmland in Puttalam

A ‘REIT’ is a company that owns or finances real estate. REITs give their investors the opportunity to participate in large-scale real estate transactions by purchasing shares of the company that owns or finances them. In many countries that have REIT structures and legislation, the REITs do not pay tax at the company level, and so they avoid the double-taxation problems that many corporations face.

Though Sri Lanka is yet to get legislation for REITs, there has been a significant interest in developing one to facilitate investments towards real estate assets.

REITs offer exposure to real estate assets without the high transaction and management costs associated with direct purchases. Furthermore, it makes it possible to purchase smaller and more liquid allocations. In other words, instead of buying an entire property worth thousands or millions of Rupees, REIT investors can purchase just a few shares that can be bought and sold back easily.

Expatkey Properties who have been in the real estate advisory and consulting business since 2003 have launched the Agriculterra REIT. This is private REIT, which Expatkey hopes to list once regulations are in place. The Agriculterra REIT is a specialised farmland owning vehicle.

“REITs are often promoted based on their portfolio diversification benefits as the returns typically have marginal correlations with traditional equities. Farmland is a real asset tied to a megatrend – rising global food demand and thus Agriculterra REIT,” Expatkey Properties Director Ehsan Zaheed said.

Traditionally REITs often focus on a particular type of property, such as apartment buildings, shopping malls, office buildings, or warehouses. Farmland REITs are a relatively recent development and this, the first of its kind in Sri Lanka.

Portfolios of Farmland REITs

The Agriculterra farmland REIT acquired land, which is currently leased to Puttalam Farms Ltd. The land is primarily cultivated with coconut and other crops.

Agriculterra plans to expand to the other provinces of Sri Lanka, beginning in the North Western province and intending to expand to the Eastern province. These farmlands are also developed for agri/eco tourism purposes.

Buying a farm

A growing number of private investors in recent years have bought Sri Lankan farmland as an investment, attracted by rising land prices and the asset’s “haven” status.

Investing in farmland fund

Investors who do not want to get their hands dirty or don’t have the large upfront sums needed to buy farmland, can instead invest in a farmland REIT.

Investors get the opportunity to receive attractive annual returns on top of the appreciation of the underlying farmland – their capital investment is improving the quality of all while growing healthy food and creating a lot more jobs in the local community.

Farmland assets not only yield good long-term returns but also produce an essential need for society and, in many cases, create sustainability for the farming ecosystem in this country. Expatkey is a boutique firm offering advisory for investments and diversification in real estate assets since 2003 for Sri Lanka.