Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 9 February 2024 00:12 - - {{hitsCtrl.values.hits}}

The Research Intelligence Unit (RIUNIT) with co-hosts Institute for Political Economy (IPE) this week held a webinar tackling Sri Lanka›s economic challenges through the lens of geopolitics, debt justice and the IMF. The first half explored international concerns, while the second focused on domestic/ internal vulnerabilities. This insightful event offered valuable alternative perspectives on Sri Lanka›s future economic strategy.

The Research Intelligence Unit (RIUNIT) with co-hosts Institute for Political Economy (IPE) this week held a webinar tackling Sri Lanka›s economic challenges through the lens of geopolitics, debt justice and the IMF. The first half explored international concerns, while the second focused on domestic/ internal vulnerabilities. This insightful event offered valuable alternative perspectives on Sri Lanka›s future economic strategy.

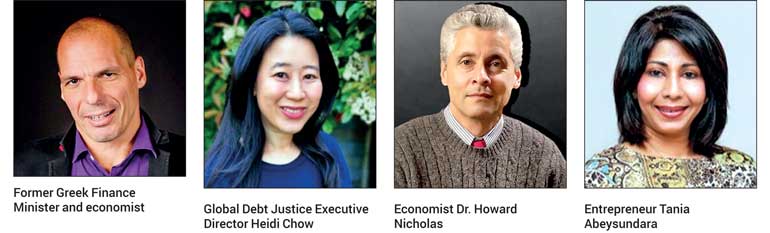

RIUNIT and IPE welcomed a distinguished panel of internationally respected academic personalities and local entrepreneurs who delved into the pressing issues facing Sri Lanka and the world, at present. The expert panel comprised: Former Greek Finance Minister and internationally renowned economist Prof Yanis Varoufakis, Award-winning businesswoman and head of the Federations of SMEs in Sri Lanka Tania Abeysundara, leading economist with over 40 years of extensive teaching experience in the area of business economics and financial markets Prof Dr. Howard Nicholas, Global Debt Justice- fighting poverty and exploitation Executive Director Heidi Chow, and was moderated by the Research Intelligence Unit CEO Roshan Madawela and the Institute for Political Economy co-founder Prof Kanchana Ruwanpura.

Grim picture of global debt crisis

The discussion kicked off with Heidi Chow›s analysis of Sri Lanka’s debt crisis as part of a larger global issue impacting 54 other developing nations. She painted a grim picture of the global debt crisis during the recent discussion and her key points included: (1) The lack of an efficient debt reduction mechanism and how the existing G20 framework for debt restructuring is deemed inadequate, (2) Private Creditor Exclusion: Over 40% of all global south debt repayments are owed through private debt creditors who often avoid negotiations, leaving substantial portions of debt unaddressed and finally (3) how Hamilton Reserves Bank, a private bank based in St Kitts and Nevis are suing for a full repayment of around $250 million worth Sri Lankan bonds as well as the $7 million interest. This could lead to massive profits for the bank if successful, further burdening Sri Lanka›s already dire situation. She added that irresponsible private creditors also need to be held accountable.

IMF deal preserves power of the oligarchy

Prof Yanis Varoufakis delved into the turbulent state of the global economic order, explaining to the audience how the escalation of the new cold war between the United States and China that began with Donald Trump and is now being turbocharged by Joe Biden, is drawing in the European Union and creating a difficult geopolitical landscape for smaller nations like Sri Lanka to navigate a route between the competing forces within this geopolitical quagmire. He linked this geopolitical tension to ongoing conflicts like the war in Ukraine and the situation in Gaza, further compounding the challenges faced by vulnerable countries like Sri Lanka. He also touched on the ‘preposterous’ IMF solution put in place for Sri Lanka and how the IMF imposed a haircut on the country’s pension funds instead of targeting external debt so that foreign collectors would feel less pressured to affect the haircut. This highlights how the Sri Lankan Government has secured an IMF deal that preserves the power of the oligarchy, causing a deeper dependency on the country’s people. So what is the solution? Prof Yanis’ discussion highlights how we, as a nation should have focused exclusively on external debt not internal debt, suggesting that the island would be better off holding direct negotiations with India and China.

With regard to the genocide in Gaza, he called out to the government in Tel Aviv for its horrific crimes and said the enormity of what’s going on has overwhelmed his ability to think and rationalise as a professional and an economist.

In his address, Dr. Howard Nicholas raised concerns about the Central Bank Act and its impact on Sri Lanka’s sovereignty. He argued that the Act centralises decision making within the Central Bank potentially influenced by the IMF and the US, thereby compromising Sri Lanka’s national autonomy. This restructuring process, in his view, fundamentally weakens the country›s sovereignty. Secondly, Dr. Nicholas questioned the rationale for a domestic restructuring mechanism, viewing it as a demand imposed by «foreign predators, “ and warned that it introduces risk to domestic debt and disrupts the entire financial system. Thirdly, he criticised the linking of privatisation of strategic sectors with structural adjustment programs. He feels these sectors, crucial for Sri Lanka›s development, should remain under national control, but are instead being handed over to foreign entities. In closing, Dr. Nicholas addressed the recent news of the Bill and Melinda Gates Foundation offering support to Sri Lanka›s reconstruction efforts and being granted an office within the Presidential Secretariat. He expressed strong concerns, characterising this arrangement as a «complete aberration of sovereignty.

Struggles faced by SMEs

Tania Abeysundara, added her insights on the prevailing situation in the country and the struggles faced by Sri Lanka’s Small and Medium Enterprises (SMEs). She expressed strong criticism of the Government and Central Bank’s economic policies, calling them “unethical, unprecedented, and volatile,” claiming they would only worsen the country’s situation. She described the current environment for SMEs as akin to a “murderous journey,” with businesses feeling threatened by the Government implementing unorthodox policies. SMEs are grappling with numerous challenges, including high bank interest rates, heavy taxes, lack of loan restructuring, forced economic contraction, soaring utility costs, dollar fluctuations, and scarcity, due to unorthodox policies being implemented by the Government. Despite these hardships, SMEs contribute significantly to the economy, generating 52% of GDP and employing nearly 4.5 million people. Abeysundara concluded by emphasising that the Government cannot sustain the country without a healthy SME sector.

Tania Abeysundara, added her insights on the prevailing situation in the country and the struggles faced by Sri Lanka’s Small and Medium Enterprises (SMEs). She expressed strong criticism of the Government and Central Bank’s economic policies, calling them “unethical, unprecedented, and volatile,” claiming they would only worsen the country’s situation. She described the current environment for SMEs as akin to a “murderous journey,” with businesses feeling threatened by the Government implementing unorthodox policies. SMEs are grappling with numerous challenges, including high bank interest rates, heavy taxes, lack of loan restructuring, forced economic contraction, soaring utility costs, dollar fluctuations, and scarcity, due to unorthodox policies being implemented by the Government. Despite these hardships, SMEs contribute significantly to the economy, generating 52% of GDP and employing nearly 4.5 million people. Abeysundara concluded by emphasising that the Government cannot sustain the country without a healthy SME sector.

The Research Intelligence Unit is an advisory firm with a strong presence in the emerging world and has had its Asia HQ in Colombo for the past 21 years. Their market intelligence subscription services and bespoke market research has served to keep their Sri Lankan private-sector clients well equipped to navigate turbulent times. A fiercely independent think tank with pragmatic and innovative ideas, this webinar represents an ongoing series by RIUNIT as part of its efforts to bring a more people centric discussion to local and global economic policy concerns at a pivotal moment in the global geo-political landscape.