Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 14 February 2019 02:25 - - {{hitsCtrl.values.hits}}

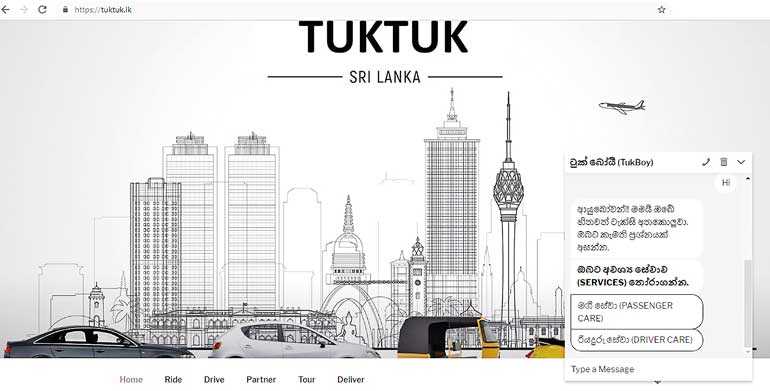

Sri Lanka’s post-war era emerging investment banker Frontier Capital Partners – that transferred some of the country’s prominent group companies to conglomeration in the post-war era from 2009 to 2019, in a decade has recently released a newly developed advanced Artificial Intelligence (AI) ChatBot assistant titled ‘TukBoy’.

|

Nishan Sumanadeera |

According to the company officials the ‘TukBoy’Chatbot has been developed using world’s leading Artificial Intelligence (AI) based Super Computer IBM Watson’s technology along with the support of English, Sinhala and Tamil languages.

“As a person at my age who has already seen the world transforming with technology in the last five decades so far, only a few millionaires or billionaires as investors will look at the future and current global trends and then encourage youngsters in an economy to come up with new products to disrupt the conventional business landscape of an emerging economy by taking the technology to poor, middle class and the emerging middle class,”Frontier Capital Partners Founder and Managing Partner Nishan Sumanadeera pointed out speaking on the new product’s investment logic of his company.

“Carefully studying the future trends of the world and other countries and the potential of AI technology we took a step forward in investing in the AI based Virtual Assistant industry or the famous Chatbot industry just few months ago. Now we have come up with an AI Chatbot product that caters to over 22 million commuters in Sri Lanka with all three languages,”Sumanadeera further added.

“We further intend to develop this in many languages as possible in time to come. I hope this will help Sri Lanka’s future generations and current countrymen as well as commuters or even tourists visiting Sri Lanka on making proper and efficient decisions on affordable and convenient transportation solutions to reach their destination,” Sumanadeera said further elaborating on the AI Chatbot – ‘TukBoy’s features.

“Although we are an island, we could develop all three sectors in transport including air, sea, and inland to take Sri Lanka’s economy forward. I believe transportation is Sri Lanka’s and the world’s largest industry. If we take Sri Lanka’s economy that is worth with a $ 87 billion or Rs. 13 trillion GDP, our one million tuktuk drivers alone who arefrom middle class control 10% of our economy with an income generation of over $ 8 billion or Rs. 1.3 trillion or Rs. 1,300 billion every year and they pay direct and indirect taxes amounting to over Rs. 60,000 every month from their earnings worth over Rs. 100,000 a month. So I along with my team at Frontier Capital have taken a step forward to transform this middle class or the average poor countrymen through taking technology to grassroots to increase their wealth,”Sumanadeera further explained.

He said that Sri Lanka has over one million or exactly 1,139,524 tuktuks or the three-wheelers and over four million or exactly 4,044,010 motor cycles registered according to the Department of Motor Traffic in 2017 alone. Sumanadeera further pointed out that he and his team haveinvested over Rs. 150 million, four years ago in a technology based transport company – TukTuk in Sri Lanka which has now grown up to over Rs. 1 billion in value giving life and earning potential for over hundreds of thousands among one million tuktuk drivers and four million motor cyclists in the country apart from other vehicle owners and drivers.

A leading investment banker in post-war Sri Lanka, Sumanadeera is a multifaceted professional with over 20 years of experience in investment banking, corporate law and accounting whilst he and his investment bank Frontier Capital Partners facilitated the conglomeration conversion of three major companies – Lankem Group, LOLC Group and Softlogic Group – in post-war Sri Lanka from 2009-2013. Frontier Capital Partners led by Sumanadeera and team in 2009 facilitated the C.W. Mackie sale for Lankem Group worth over Rs. 1.4 billion, in 2010 Confifi Hotel Group sale for LOLC and Browns group worth Rs. 2.5 billion and in 2011 Softlogic Holdings’ proposed acquisition of Asian Alliance Insurance worth over Rs. 3.3 billion and in 2013 a placement of 10% shareholdings of National Development Bank (NDB) for a consortium of investors including the Softlogic Group.

“I am willing to take this initiative to other industries and release more AI products to various industries including banking, insurance, tourism, economic analysis, education industry and healthcare sectors in next five years,” Sumanadeera said adding that he would invite his international partners and other foreign investors to take part in this projects to put in seed capital.

Artificial intelligence (AI) is the simulation of human intelligence processes by machines, especially computer systems. Artificial intelligence (AI) also can automate a large number of processes and increasingly, the technology is streamlining human intervention between clients and systems.