Friday Mar 13, 2026

Friday Mar 13, 2026

Monday, 31 May 2021 02:46 - - {{hitsCtrl.values.hits}}

|

Sunshine Holdings Group Managing Director Vish Govindasamy

|

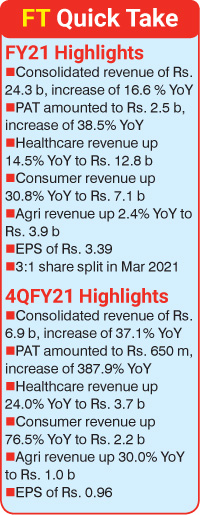

Diversified Sri Lankan conglomerate Sunshine Holdings has recorded resilient revenue and profit growth in a pandemic-affected macroeconomic environment, reporting notable top-line and bottom-line performances growth during the year ended 31 March (FY20/21).

The group’s Healthcare and Consumer sectors led growth while healthcare segment remained the major contributor to total Group revenue in FY21.

Sunshine recorded a consolidated Group revenue of Rs. 24.3 billion for the year ended 31 March, an increase of 16.6% over last year. Profit After Tax (PAT) for the period in review also increased to Rs. 2.5 billion, an increase of 38.5% YoY, and profit margins have also increased to 10.4% compared to last year’s 8.8%. These improved results stem from revenue growth, margin increases in key sectors and strategic measures taken by the group to rationalise operating cost and lower finance expenses.

The group’s Healthcare business emerged as the largest contributor to Sunshine’s revenue, accounting for 53% of the total, while Consumer Goods and Agribusiness sectors of the group contributed 29% and 16%, respectively of the total Group revenue. The gross profit closed at Rs. 7.7 billion up 25.2% YoY compared to the previous year, backed by the contribution from the Consumer goods and Agribusiness sectors. The group EBIT closed at Rs. 3.5 billion, an increase of 21.2% YoY.

Profit After Tax and Minority Interest (PATMI) increased by 32.7% YoY to Rs. 1.5 billion; the Healthcare sector made the largest contribution to PATMI, accounting for 37% of the total while Agribusiness accounted for 30% of the total. Net Asset Value per share increased to Rs. 23.48 as at end March 2021, compared to Rs. 18.75 at end March 2020.

For increasing exposure to its core sectors, which are defensive in nature, and maintaining a healthy balance sheet, Sunshine Group’s Fitch rating was upwardly revised to ‘AA+(lka)’; Outlook Stable, from ‘A(lka)’ in January 2021 (reaffirmed in March 2021).

Commenting on the performance, Sunshine Holdings Group Managing Director Vish Govindsamy said as a group, Sunshine has been facing challenges in some of its core sectors and will continue to do so in the short to medium terms due to the negative economic impact due to the COVID-19 pandemic and subsequent lockdowns.

“However, Group’s robust cost management initiatives, process reengineering efforts backed by digital technologies to ensure overall efficiency and business continuity have helped Sunshine to outdo last year’s results and drive strong performance in FY21, where the group has been able to rebound from the adverse impacts brought by a tough macroeconomic business environment. We are proud that the group has remained resilient in the face of such difficulties, and we remain optimistic about consolidating our operations to strengthen the overall performance of the group further. All possible measures have been taken to ensure business sustainability and continuity in the coming months,” Govindasamy commented.

During the period in review, Group’s Healthcare sector grew its revenue by 14.5% YoY to Rs. 12.8 billion. The sector achieved growth in Pharma, Medical Devices and Retail subsectors with significant improvement in the second half of the year owing to the recovery from COVID-19 lockdown.

Pharma and Medical Devices sectors achieved the highest per quarter revenue during the last quarter while Healthguard, the retail arm of the Healthcare sector, witnessed an increase in sales in the mid of FY21 which was predominantly driven by the increase in health and wellness consciousness of consumers with the spread of COVID-19 in the country. The Pharma subsector which contributed 66% to Healthcare revenue, grew 14.8% YoY in FY21. Reported PAT for healthcare amounted to Rs. 824 million in FY21, up 61.6% YoY at a margin of 6.4%.

Group’s Healthcare sector merged with Akbar Pharmaceuticals in January 2021, making it Sri Lanka’s first fully integrated Healthcare company with the addition of pharma manufacturing and R&D operations. Post-transaction, Sunshine Holdings owns 72% of Sunshine Healthcare Lanka Ltd., which was previously a fully owned subsidiary, whereas Akbar Brothers Ltd. owns the remaining 28% shares.

Spearheaded by brands like ‘Zesta’, ‘Watawala Tea’, ‘Ran Kahata’ and ‘Daintee’, the Consumer sector continued its impressive growth by posting revenues of Rs. 7.1 billion in FY21, an increase of 30.8% YoY and accounted for 29% of group revenue for the period. The revenue growth was predominantly due to the addition of the confectionary business via the acquisition of Daintee during the second quarter. PAT from the Consumer segment increased by 57.2% YoY, to stand at Rs. 467 million for FY21. Post-acquisition, Daintee contributed Rs. 185 million to the bottom line.

The group’s Agribusiness sector, represented by Watawala Plantations PLC (WATA), saw a revenue increase of 2.5% YoY to Rs. 3.9 billion due to an increase in Palm Oil net selling average (NSA) and milk prices. The Dairy segment, which commenced operations in 2018, made profits in FY21 contributing to 4% of the Agribusiness sector PBT. In addition to the increase in NSA, the profitability of the dairy segment was further driven by lean management and rationalisation of feed cost, despite the increase in commodity prices of key raw materials during 4Q. PAT for the Agri sector increased by 120.2% to Rs. 1.6 billion.

In the Agribusiness sector, the dairy business under Watawla Dairy Ltd. (WDL) raised$ 2 million in equity from SBI Japan for an 11% stake in the company in May 2021. The proceeds will be utilised to expand dairy operations and strengthen the balance sheet of WDL.

Revenue for the Renewable Energy division amounted to Rs. 440 million in FY21, up 40.8% YoY from Rs. 313 million during FY20 as a result of favourable weather conditions in the Hydro segment and the expansion of the rooftop solar projects. In April 2021, the group divested its stake in the Mini Hydro Power business, under Waltrim Hydropower Ltd. to Aitken Spence PLC with the aim of refocusing on its core sectors.