Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 30 August 2024 00:06 - - {{hitsCtrl.values.hits}}

In a significant move to demystify the intricacies of tax compliance, the International Chamber of Commerce (ICC) Sri Lanka’s Research, Knowledge Mobilisation and Taxation Committee hosted an enlightening webinar on Advanced Personal Income Tax (APIT). The event was a resounding success, drawing in over 1,000 participants.

The webinar, which was held on 3 June, was aimed at individual taxpayers and was part of ICC Sri Lanka’s initiative to foster a deeper understanding of the APIT system. The session provided a platform for discussing the practical aspects of monthly compliance and offered strategies to maximise tax benefits.

The webinar featured Inland Revenue Department Commissioner M.L.S.P. Gunathilaka as the keynote speaker. Expert panellists included KPMG Tax and Regulatory Principal Rifka Ziyard and Ernst & Young Tax Principal V. Shakthivel, with Committee Chair Dr. Nadee Dissanayake serving as the moderator.

The Committee is delighted to present a summary of the key takeaways, innovative perspectives, and implications derived from the webinar. DailyFT proudly sponsored the media coverage for the webinar, highlighting the event’s significance and extending its reach to a broader audience.

The diverse audience, including financial professionals, tax consultants, and individual taxpayers from various sectors, engaged actively in the discussions.

The webinar covered a spectrum of topics in relation to personal income tax such as understanding exemptions and valuation of taxable benefits for monthly tax deductions and keeping abreast of recent amendments in tax legislation and circulars issued by Inland Revenue in relation to the same.

The interactive Q&A sessions underscored the participants’ eagerness to the topic, reflecting a high level of engagement and a desire for practical knowledge.

The expert panellists provided actionable insights, which were highly appreciated by the attendees. The Research, Knowledge Mobilisation and Taxation Committee expressed its satisfaction with the outcomes of the webinar.

The key takeaways and innovative perspectives shared during the event are expected to have significant implications for individual taxpayers.

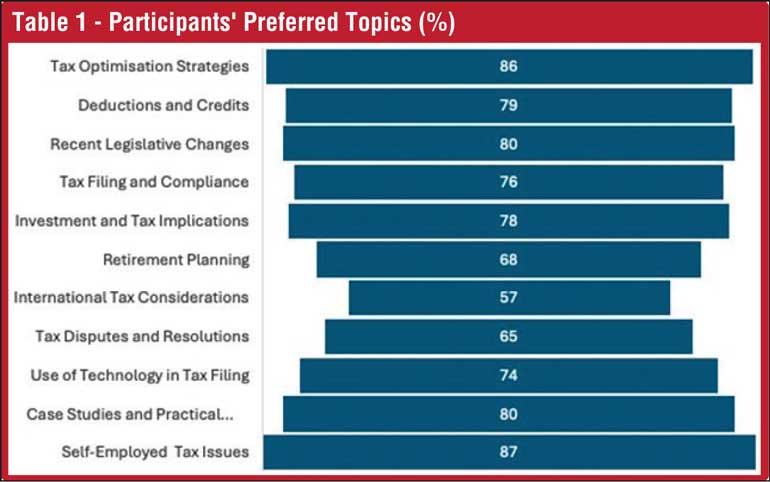

Feedback from the attendees was captured in Table 1, which outlined Participants’ Preferred Topics. The data revealed a strong inclination towards understanding tax issues for individuals, staying updated with legislative changes, and making the most of deductions and credits.

The responses from the APIT webinar attendees, as shown in Table 1, indicate a definite preference for a variety of subjects essential to efficient tax administration and compliance. Subjects including self-employed tax concerns, tax optimisation tactics, recent legislative changes, and deductions and credits received a significant number of responses, which highlights the necessity of focused educational efforts and policy considerations. Additionally, the thorough examination of participant preferences reveals a number of important topics that need more focus from legislators and tax administration. Tax authorities can provide more assistance to individual taxpayers in managing intricate tax matters and guaranteeing adherence by tackling these domains.

This strategy will improve communication, promote more strategic tax planning, and eventually lead to a more equitable and productive tax environment. In order to accommodate taxpayers’ changing requirements and enhance overall tax administration, the webinar feedback is an invaluable resource for fine-tuning tax policies and processes.

The insights gleaned from the webinar are not only beneficial for taxpayers, but also serve as a valuable resource for policymakers and tax administrators. By addressing the highlighted areas, tax authorities can enhance support for taxpayers, ensuring better communication, informed tax planning, and a more equitable and efficient tax system. The ICC Sri Lanka’s Research, Knowledge Mobilisation and Taxation Committee will be facilitating more knowledge awareness sessions on varied topics in a strategic manner.