Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 27 April 2018 00:00 - - {{hitsCtrl.values.hits}}

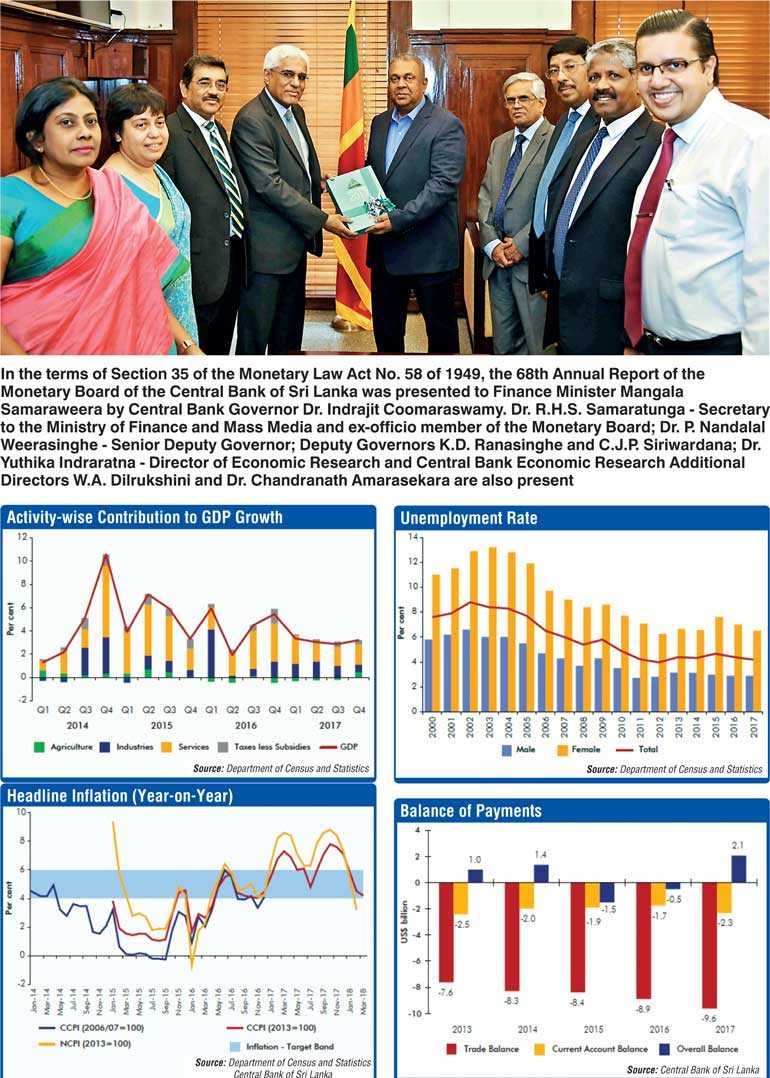

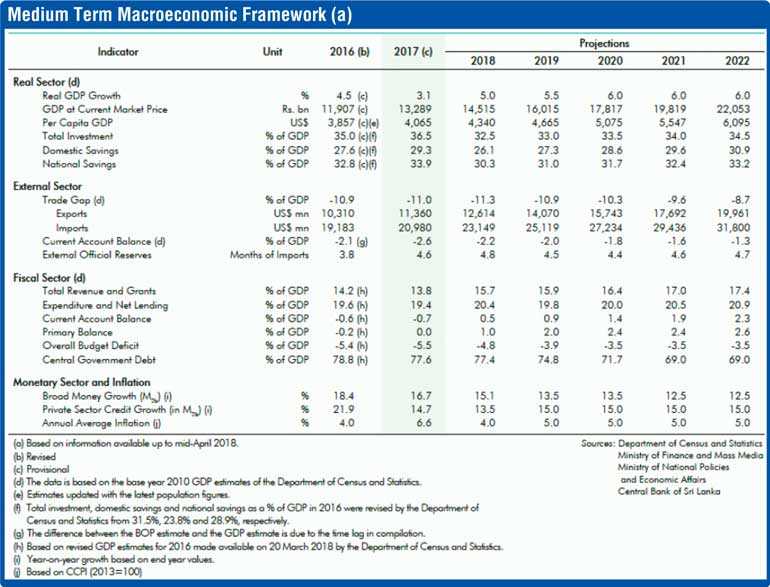

The stabilisation policy measures taken by the Central Bank and the Government in the past two years resulted in a number of notable improvements, although real economic growth faltered and recorded a multi-year low during 2017.

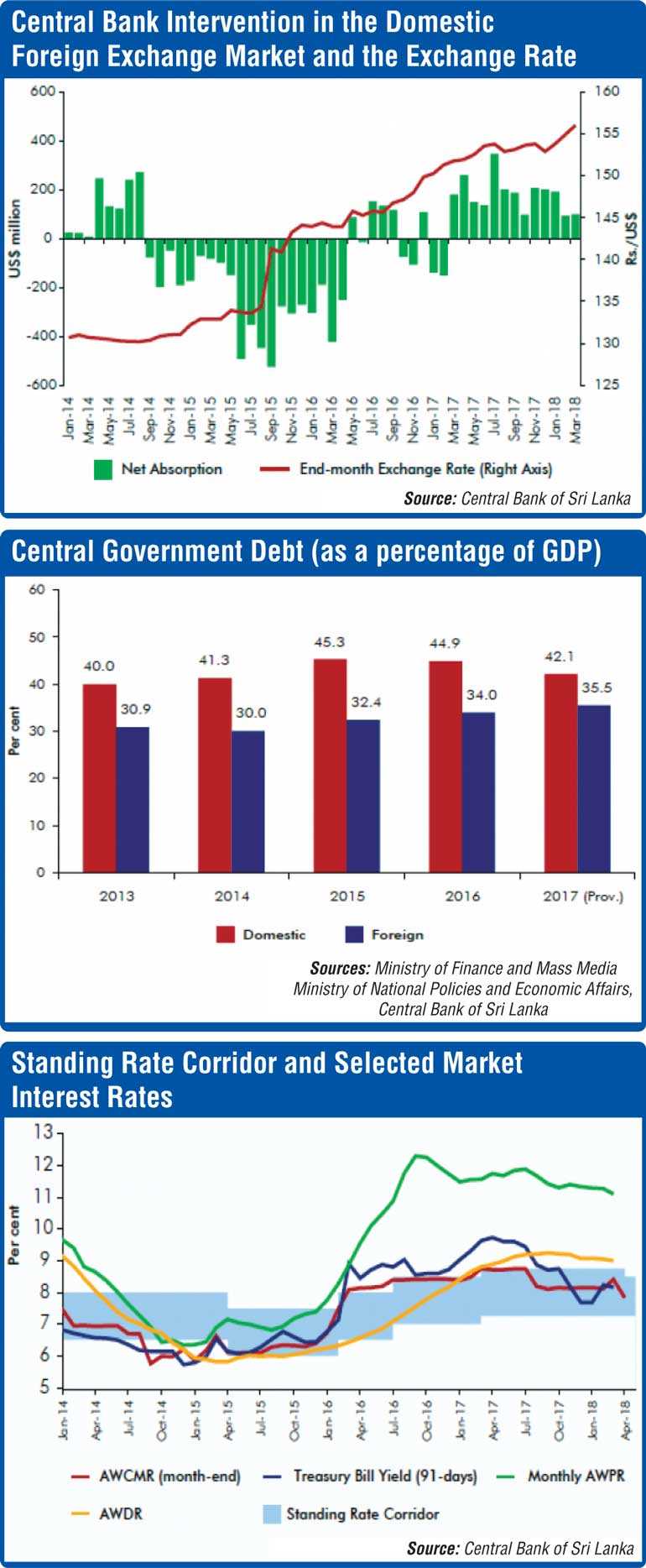

The monetary policy stance of the Central Bank, which was gradually tightened since end-2015, was tightened further in March 2017 by raising the key policy interest rates of the Central Bank by 25 basis points.

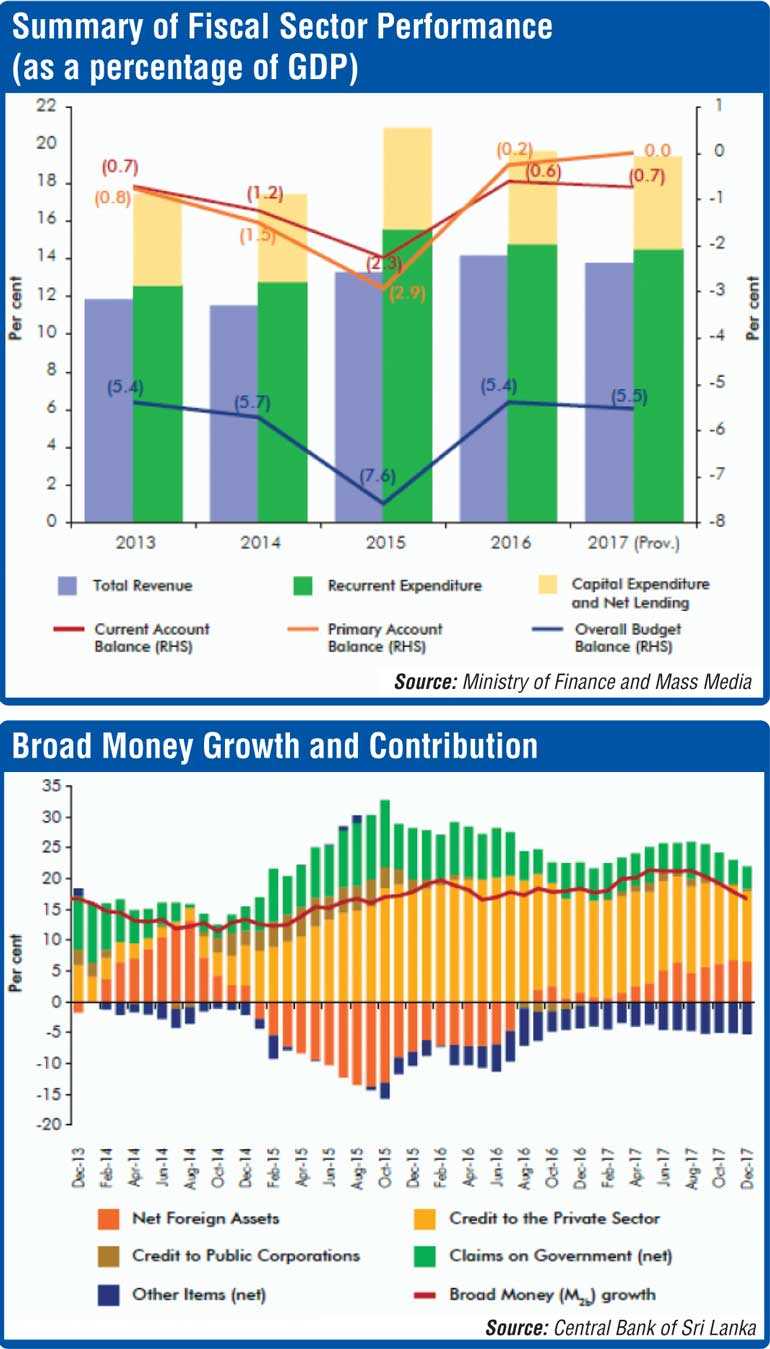

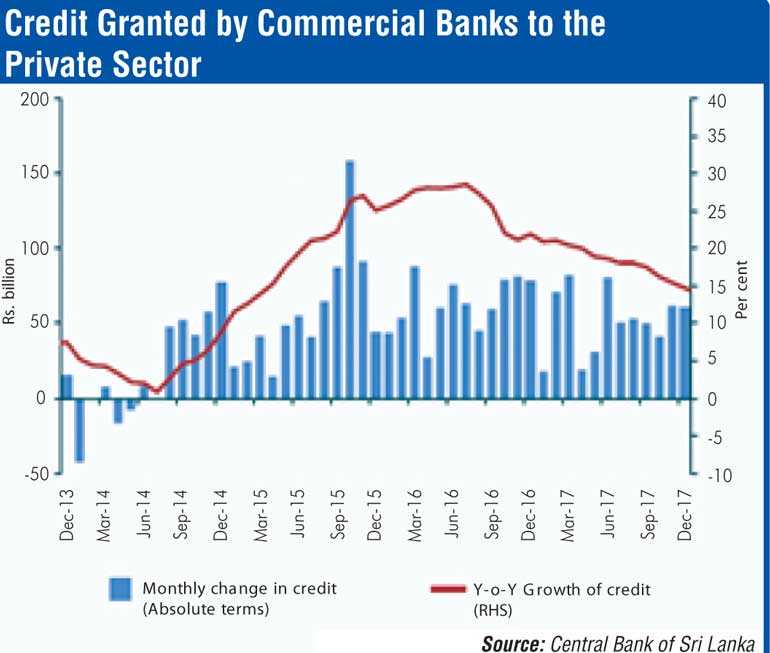

Increasing market interest rates were allowed to stabilise at high levels. Nevertheless, the improvements in relation to the government securities market, which corrected some distortions that prevailed in 2015 and 2016, resulted in a significant decline in the yields on government securities, thus exerting a downward effect on some market interest rates towards the end of the year. The high nominal and real interest rates, together with supportive macroprudential measures, prompted a gradual deceleration in the growth of monetary aggregates in 2017.

This deceleration was effected via more active open market operations (OMOs) through which the Central Bank maintained appropriate levels of liquidity in the domestic money market by reducing the Central Bank holdings of government securities substantially in order to offset the impact of the rapid buildup of net foreign assets (NFA) of the banking system due to net purchases of foreign exchange inflows by the Central Bank.

While active OMOs helped the Central Bank to maintain short-term interest rates, particularly the interbank call market rate, at desirable levels, the enhanced monetary policy communication strategy helped anchor inflation expectations, despite higher than expected headline inflation driven by supply side disturbances.

Several measures were introduced to deepen and develop the domestic foreign exchange market further during the year. Such measures helped the Central Bank to purchase a significant amount of foreign exchange from the domestic market without creating excess volatility in the exchange rate, while facilitating a market-based exchange rate aligned with macroeconomic fundamentals. Consequently, gross official reserves increased to $ 8 billion by end-2017 with an accompanying qualitative improvement.

The overall balance of the balance of payments (BOP) recorded a surplus of $ 2.1 billion in 2017 after two years of deficits, as a result of significant inflows to the financial account. Substantial inflows were observed in the form of debt capital, while foreign direct investment (FDI) recorded the highest ever inflows in 2017 supported by improving investor sentiments.

In the external current account, although earnings from exports increased to the highest levels recorded, the increase in imports, mainly arising from drought-related imports of petroleum and rice as well as increased importation of gold, caused a wider trade deficit.

Although inflows on account of services exports including tourism, and workers’ remittances continued to cushion the impact of the widened trade deficit to some extent, the current account recorded a deficit of 2.6% of GDP during the year.

The Sri Lankan rupee depreciated against the US dollar by 2% during the year, while the real effective exchange rate indices also depreciated, raising the competitiveness of the currency. Such a fairly-valued currency in real terms is expected to enable a gradual adjustment of the current account deficit of the BOP in the period ahead.

In relation to public finance, the revenue-based fiscal consolidation program continued, resulting in increased tax revenue as a percentage of GDP as well as a surplus in the primary account, which reflects the difference between revenue and non-interest expenditure, for the first time since 1992 and only the second time since 1955.

Nevertheless, revenue collection was lower than expected, while government spending was affected by the need to provide relief to the people affected by inclement weather conditions, and also by the rising interest payments. This resulted in an expansion in the overall budget deficit to 5.5% of GDP. While the surplus in the primary account helped reduce central government debt as a percentage of GDP to a certain extent, relatively high real interest rates in the government securities market compared with real GDP growth contained further favourable adjustment in public debt dynamics.

The continued generation of higher primary surpluses, together with increased real GDP growth and moderate real interest rates, is expected to generate favourable public debt dynamics at a faster pace in the future.

Adverse weather conditions and their spillover effects continued to affect real economic activity, and the economy surprised to the downside by recording a growth of 3.1% in real terms. This was significantly below projections of the Sri Lankan authorities as well as international agencies. In spite of the low real GDP growth, the economy created sufficient employment opportunities that induced a further reduction in the unemployment rate to 4.2% during the year.

In terms of expenditure, growth was supported by the expansion of both consumption and investment expenditure in 2017, while net external demand continued to weigh on growth negatively. Both services and industry-related activities, which together account for 92.4% of gross value added, recorded growth rates of below 4%. The agriculture-related activities recorded a negative growth for the second consecutive year, although estimates for Quarter 4, 2017 indicated a recovery in the sector.

Headline inflation displayed twin peaks during the year, with the first peak in March 2017 and the second in October 2017, and remained above the desired mid-single digit levels in most months due to double digit food inflation.

However, core inflation moderated gradually during the year, as monetary policy measures to contain inflation took effect. With the moderation of food inflation, headline inflation decelerated considerably by the first quarter of 2018, and the favourable inflation and inflation outlook as well as the weak real GDP growth prompted the Central Bank to signal an end to the tightening cycle of monetary policy, by lowering the upper bound of the policy interest rate corridor by 25 basis points in April 2018.

Financial sector performance

Meanwhile, with the exception of a few small non-bank financial institutions, the financial sector performed well amidst measures taken by the authorities to ensure the stability of the financial sector and to strengthen financial markets and related infrastructure. Several initiatives were taken to address possible forbearance in regulation and supervision, particularly in relation to non-bank financial institutions and primary dealers in government securities. Stronger enforcement mechanisms were introduced to take prompt action against any non-compliance of regulations. The rule-based and transparent auction mechanism for government securities helped reduce the volatility in interest rates and helped the smoothing out of bunching up domestic debt maturities. The new Active Liability Management Act (ALMA) is expected to provide greater flexibility in managing future bunching of both domestic and external debt.

Furthermore, the Extended Fund Facility program with the International Monetary Fund (IMF-EFF) progressed, with the economy achieving the end year targets in relation to net international reserves, the Government’s primary balance and inflation.

Addressing the weak growth performance of the economy through the implementation of required growth supporting reforms will remain a priority. Sri Lanka has advanced gradually to reach a per capita GDP of $ 4,065 by 2017, establishing itself as a middle income economy.

However, the country can progress further only if policymaking remains rational with a long-term focus on greater public good, while minimising policy swings motivated by short-term political gains. Therefore, it is essential that the envisaged reforms are institutionalised to ensure their sustainability, enabling the country’s unhindered progression under increasingly challenging global and domestic conditions. In this regard, notable progress has already been achieved in terms of implementing the Inland Revenue Act (IRA), enacting the ALMA and the Foreign Exchange Act, and reaching a consensus with regard to improving the independence of the Central Bank and facilitating the move towards flexible inflation targeting (FIT) by 2020.

Much remains to be done in relation to strengthening public financial management and ensuring fiscal sustainability through the adoption of binding fiscal rules, and also with regard to the implementation of a trade and investment facilitation framework that could enhance the country’s overall productivity and effectively link the Sri Lankan economy to global production networks.

The formulation and implementation of policies must also take into consideration the effect of such policies on the vulnerable segments of the population as it is the poorest of the society who suffer most from failed policy experiments.

Several existing and emerging challenges need to be addressed for the country to achieve high economic growth and sustainable economic development over the medium term and beyond. Whilst the commitment of the Government is essential to implement the envisaged reforms, increased private sector participation in productive economic activity is also vital in the country’s progress as a middle income economy.

Proactive policy measures implemented in a timely manner with increased consistency and focus will enable effective and sustainable utilisation of resources resulting in an efficiency driven growth process, which would facilitate improved welfare of the general public in the country.