Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 26 September 2018 00:00 - - {{hitsCtrl.values.hits}}

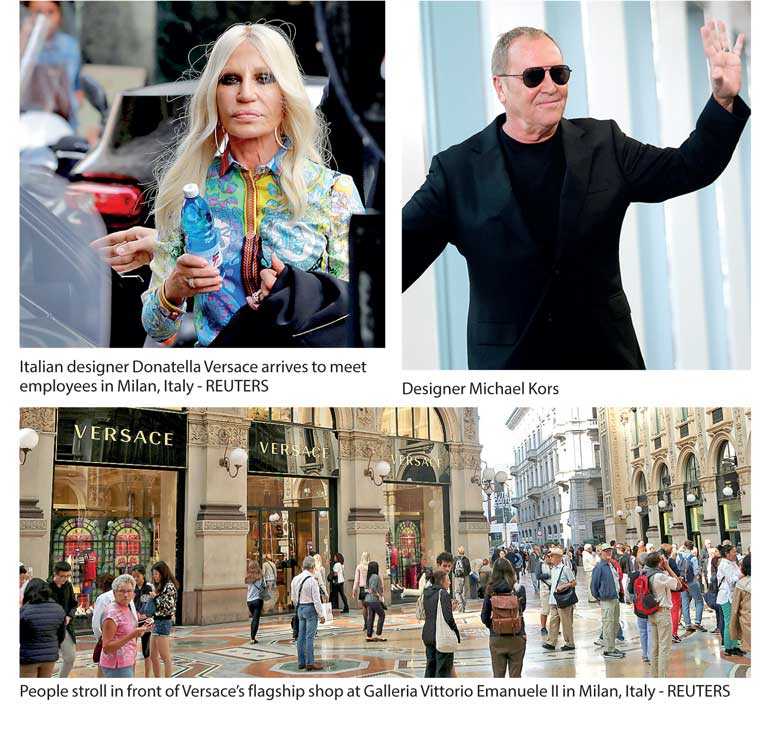

MILAN (Reuters): US fashion group Michael Kors agreed to buy luxury designer Versace for 1.83 billion euros including debt on Tuesday in the latest foreign takeover of an Italian brand.

MILAN (Reuters): US fashion group Michael Kors agreed to buy luxury designer Versace for 1.83 billion euros including debt on Tuesday in the latest foreign takeover of an Italian brand.

Michael Kors, whose namesake label is best known for its leather handbags, has made no secret of its ambition to grow its portfolio of high-end brands after buying British stiletto-heel maker Jimmy Choo for $1.2 billion last year.

The bet on Versace comes as the US group looks to refresh the more downmarket image of the Michael Kors brand and recover some of its pricing power. The combination is also aimed at reviving Versace, which returned to a net profit last year.

Versace, known for its bold and glamorous designs and its Medusa head logo, was one of a clutch of family-owned Italian brands cited as attractive targets at a time when the luxury industry is riding high on strong demand from China.

“We believe that the strength of the Michael Kors and Jimmy Choo brands, and the acquisition of Versace, position us to deliver multiple years of revenue and earnings growth,” John Idol, chairman and CEO of Michael Kors Holdings said.

Michael Kors has agreed to buy all of Versace’s outstanding shares for a total enterprise value of 1.83 billion euros ($2.2 billion), to be funded in cash, debt and shares in Michael Kors Holding Ltd, which will be renamed Capri Holdings Ltd.

US private equity firm Blackstone, which bought 20% of Versace for 210 million euros in 2014, will make a 156 million euro capital gain by exiting its investment, Reuters calculations show.

The Versace family, which owns 80 percent of the Milan-based fashion house, will receive 150 million euros of the purchase price in Capri shares.

“We believe that being part of this group is essential to Versace’s long-term success. My passion has never been stronger,” said Donatella Versace, the sister of its late founder who is its artistic director and vice-president.

Versace CEO Jonathan Akeroyd will remain at the helm of the company, while Donatella Versace will “continue to lead the company’s creative vision”, Idol added.

The deal is expected to close in the fourth fiscal quarter, subject to regulatory approvals.

Budding conglomerates like Michael Kors have been trying to make in-roads into an industry dominated by European players such as Louis Vuitton-owner LVMH and Kering.

“The Versace brand has strong global growth potential which is untapped across all regions, particularly Asia and North America,” Cowen analysts said in a note.

However, giving Versace fresh impetus may not be easy as luxury groups struggle to swiftly adapt to the fast and fickle taste of an increasingly younger customer base, analysts said.

Michael Kors said it plans to grow Versace’s global sales to $2 billion globally, boost its retail footprint to 300 stores from around 200 and accelerate its e-commerce strategy. It also plans to raise the share of higher-margin accessories and footwear to 60% of sales from 35%.

Versace does not disclose financial details, but documents deposited with the Italian chamber of commerce show it had sales last year of 668 million euros and earnings before interest, tax, depreciation and amortisation (EBITDA) of 45 million euros.

Versace is the latest Made-in-Italy name to be snapped up by a foreign company after Rome-based Fendi, celebrity jeweller Bulgari and cashmere maker Loro Piana were all bought by LVMH.

Meanwhile, Gucci is the biggest brand in Kering, which also owns clothes and leather goods maker Bottega Veneta and menswear couture house Brioni.

The Versace buyout will also make it harder for Prada, Giorgio Armani, Dolce & Gabbana, Salvatore Ferragamo and Tod’s to keep up with the might of luxury conglomerates able to withstand shifts in trends.