Saturday Mar 01, 2025

Saturday Mar 01, 2025

Friday, 12 November 2021 00:00 - - {{hitsCtrl.values.hits}}

By KPMG

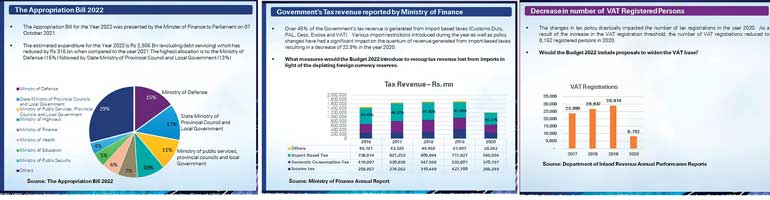

The Appropriation Bill 2022

The Appropriation Bill for the year 2022 was presented by the Minister of Finance Basil Rajapaksa to Parliament on 7 October 2021.

The estimated expenditure for 2022 is Rs. 2,505 billion (excluding debt servicing), which has reduced by Rs. 315 billion when compared to the year 2021.The highest allocation is to the Ministry of Defence (15%) followed by State Ministry of Provincial Council and Local Government (13%)

Government’s Tax revenue reported by Ministry of Finance

Over 45% of the Government’s tax revenue is generated from import-based taxes (Customs Duty, PAL, Cess, Excise and VAT). Various import restrictions introduced during the year as well as policy changes have had a significant impact on the quantum of revenue generated from import-based taxes, resulting in a decrease of 22.9% in the year 2020.

What measures would the Budget 2022 introduce to recoup tax revenue lost from imports in light of the depleting foreign currency reserves?

Decrease in number of VAT-registered persons

The changes in tax policy drastically impacted the number of tax registrations in the year 2020. As a result of the increase in the VAT registration threshold, the number of VAT registrations reduced to 8,152 registered persons in 2020.

Would the Budget 2022 include proposals to widen the VAT base?

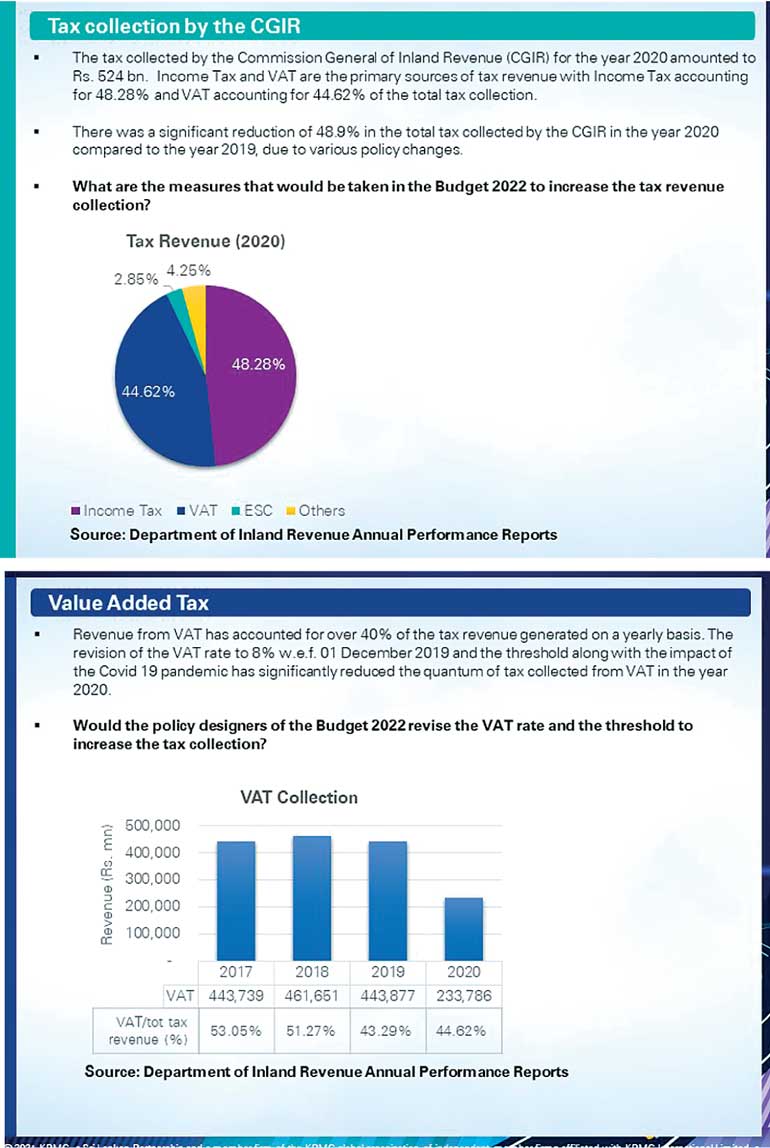

Tax collection by the CGIR

The tax collected by the Commission General of Inland Revenue (CGIR) for the year 2020 amounted to Rs. 524 billion. Income Tax and VAT are the primary sources of tax revenue with Income Tax accounting for 48.28%, and VAT accounting for 44.62% of the total tax collection.

There was a significant reduction of 48.9% in the total tax collected by the CGIR in the year 2020 compared to the year 2019 due to various policy changes.

What are the measures that would be taken in the Budget 2022 to increase the tax revenue collection?

Value Added Tax (VAT)

Revenue from VAT has accounted for over 40% of the tax revenue generated on a yearly basis. The revision of the VAT rate to 8% w.e.f. 01 December 2019 and the threshold along with the impact of the COVID-19 pandemic has significantly reduced the quantum of tax collected from VAT in the year 2020.

Would the policy designers of the Budget 2022 revise the VAT rate and the threshold to increase the tax collection?

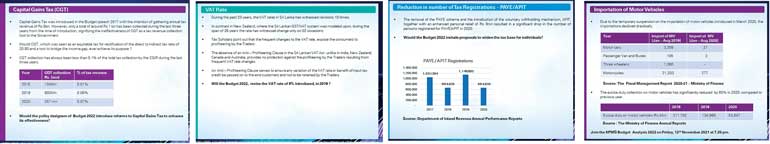

Capital Gains Tax (CGT)

Capital Gains Tax was introduced in the Budget speech 2017 with the intention of gathering annual tax revenue of Rs. 5 billion. However, only a total of around Rs. 1 billion has been collected during the last three years from the time of introduction, signifying the ineffectiveness of CGT as a tax revenue collection tool to the Government.

Would CGT, which was seen as an equitable tax for rectification of the direct-to-indirect tax ratio of 20:80 and a tool to bridge the income gap, ever achieve its purpose? CGT collection has always been less than 0.1% of the total tax collection by the CGIR during the last three years.

VAT Rate

During the past 23 years, the VAT rates in Sri Lanka have witnessed revisions 10 times.

In contrast in New Zealand, upon which the Sri Lankan GST/VAT system was modelled upon, during the span of 35 years, the rate has witnessed change only on two occasions.

Tax Scholars point out that the frequent changes to the VAT rate, expose the consumers to profiteering by the traders.

The absence of an Anti – Profiteering Clause in the Sri Lankan VAT Act, unlike in India, New Zealand, Canada and Australia, provides no protection against the profiteering by the Traders, resulting from frequent VAT rate changes.

An Anti – Profiteering Clause serves to ensure any variation of the VAT rate or benefit of input tax credit be passed on to the end-customers and not to be retained by the Traders.

Will the Budget 2022 revise the VAT rate of 8% introduced in 2019 ?

Reduction in number of Tax Registrations - PAYE/APIT

The removal of the PAYE scheme and the introduction of the voluntary withholding mechanism, APIT, together with an enhanced personal relief of Rs. 3 million resulted in a significant drop in the number of persons registered for PAYE/APIT in 2020.

Would the Budget 2022 include proposals to widen the tax base for individuals?

Importation of Motor Vehicles

Due to the temporary suspension on the importation of motor vehicles introduced in March 2020, the importations declined drastically.

The excise duty collection on motor vehicles has significantly reduced by 60% in 2020 compared to previous year.

Foreign Currency Reserves and Mandatory Conversion Rules

The Government has provided tax exemptions for interest on foreign currency deposit accounts and foreign currency earnings from foreign source income and services to persons outside Sri Lanka in order to incentivise foreign currency earnings.

The Central Bank of Sri Lanka (CBSL) introduced the mandatory rule of immediate conversion of 25% of the foreign currency export proceeds to LKR in February 2021. This was amended in March 2021 to 25% conversion within 14 days of receipt.

Due to lobbying by many exporters, the rule was further changed to a mandatory conversion of 10% within 30 days of receipt.

However, due to the depletion of the foreign currency reserves, the rules were changed to mandatory conversion of 25% within 30 days of receipt on 28 May 2021. Further, the monetary board could provide an exception for identified exporters to convert a lower percentage subject to a minimum of 10%.

With effect from 28 October, the Government has mandated the conversion percentage to be 100% for both exporters of goods and services subject to the specified criteria set out in the Gazette No. 2251/42 dated 28 October 2021.

As per the above Gazette, the residuary of the export proceeds to be computed by the reduction of permitted payments, including foreign currency debt-servicing expenses, outward remittances for current transactions, investment in Sri Lanka Development Bonds in foreign currency, restricted to 10% of export proceeds, payments for purchases of goods and services in relation to such exports.

As per CBSL, the foreign currency reserves at the end of 2019 was $ 7.6 billion, which depleted to $ 5.7 billion in 2020. The forex reserves as of end August 2021 is $ 3.5 billion.

Will there be further measures in the Budget 2022 in order to address the depleting foreign currency reserves?

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.