Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 18 November 2020 00:10 - - {{hitsCtrl.values.hits}}

|

| Sunshine Holdings Group Managing Director Vish Govindasamy

|

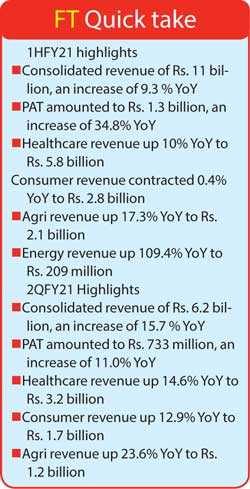

Recording another quarter of sound financial performance in a pandemic-affected economic backdrop, diversified conglomerate Sunshine Holdings (CSE: SUN) posted consolidated revenue of Rs. 11 billion for the six months ending 30 September (1HFY21), an increase of 9.3% YoY compared to the

corresponding period of last year.

Profit after tax (PAT) for the period in review rose to Rs. 1.3 billion, an increase of 34.8% YoY, on the back of the profit arising from the improved performance in the agribusiness sector. The PAT margins increased to 11.7% for 1HFY21 from 9.5% in 1HFY20 mainly due to the margin increase in the agribusiness sector. Net Asset Value per share also increased to Rs. 59.33 as at end 1HFY21, compared to Rs. 56.26 at the end of 1HFY20.

Group’s healthcare business emerged as the largest contributor to Sunshine’s top-line performance, accounting for 53% of total revenue. In comparison, Consumer and Agribusiness sectors of the Group contributed 25% and 19% respectively of the total revenue.

During the second quarter of FY 2020/21 (2QFY21), Sunshine Holdings posted a consolidated revenue of Rs. 6.2 billion (an increase of 15.7% YoY) with a post-tax profit of Rs. 733 million, an increase of 11% YoY compared to the same quarter in last year. During 2QFY21, the Groups Consumer sector acquired 100% shareholding of Daintee Ltd. to further expand its presence, beyond tea, in the local consumer goods sector. Daintee is a market leader in sweets and toffee category in Sri Lanka with 40% market share.

Commenting on the performance, Sunshine Holdings Group Managing Director Vish Govindsamy said as a group, Sunshine has been facing challenges in some of their core sectors and will continue to do so in short to medium term due to the negative economic impact due to the COVID-19 pandemic and  subsequent lockdowns.

subsequent lockdowns.

“However, Group’s robust cost management initiatives, process reengineering efforts backed by digital technologies to ensure overall efficiency and business continuity have helped Sunshine to outdo last year’s results and drive strong performance in 1HFY21, where the Group has been able to rebound from the adverse impacts brought by two black swan incidents—the Easter attacks and the first wave of the present health crisis. We are proud that the Group has remained resilient in the face of such difficulties, and we remain optimithe stic about consolidating our operations to strengthen the overall performance of the Group further. All possible measures have been taken to ensure business sustainability and continuity in the coming months,” Govindasamy commented.

Group’s healthcare segment generated Rs. 5.8 billion in turnover during 1HFY21, representing a growth of 10% YoY on the back of volume growth. Medical devices and retail business within healthcare had a challenging time due to lower occupancy rates in hospitals and a significant reduction in store operating hours due to lockdown during the period in review. However, significant improvement was reflected during 2QFY21 for these sub-sectors. The Group focuses on strengthening the online presence of Heathguard further with restricted operating hours has a result of lockdown measures.

Sunshine’s consumer business, reported a top-line of Rs. 2.8 billion in 1HFY20, contracting 0.4% YoY, and accounted for 25% of group revenue for the period. 1HFY21 has been a challenging period for the domestic branded tea business due to subdued consumer spending and retail price reductions.

The Group’s agribusiness sector, represented by Watawala Plantations PLC (WATA) and Watawala Dairy Limited (WDL), saw a revenue increase of 17.3% YoY to Rs. 2.1 billion. The increase was mainly due to the increase in palm net sale average (NSA) and milk prices. During 2QFY21 Company successfully obtained the world-renowned RSPO certification (Roundtable on Sustainable Palm Oil) – a global standard for sustainable palm oil, effective September 2020. RSPO certification is an assurance to the customer that the standard of palm oil production is sustainable. Palm oil production was at 6.5 million Kg for 1HFY21, down 8% YoY.

Revenue of the Group’s renewable energy business amounted to Rs.209 million in 1HFY21, up 109.4% YoY from Rs.100 million during 1HFY20, as a result of higher rainfall in the catchment areas and optimal operations of all three plants.

Particularly in the context of Sunshine’s performance over the last quarter, Govindasamy expressed strong confidence over the outlook of the Group over the coming year. He said Group’s consumer business would continue to invest behind its brands to scale the domestic businesses with volume growth expected to increase in the next quarter. He said the newly acquired Daintee Limited would be key focus area during the period.

In agribusiness, Sunshine expects prices to be stable in the short term. On the dairy sub-sector, the total milking cows for the period stood at 784, and the Group expects to rationalise the feed cost further and increase selling price due to higher demand for quality milk. Govindasamy also noted that the Group would continue to focus on expanding its renewable energy production capacity through rooftop solar projects.