Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 7 February 2022 00:00 - - {{hitsCtrl.values.hits}}

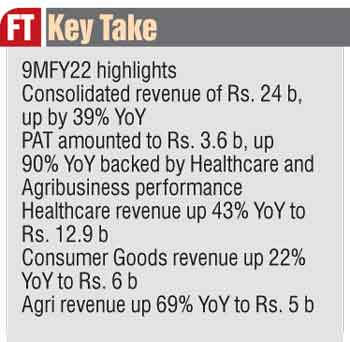

Fuelled by strong growth in all business sectors, diversified Sri Lankan conglomerate Sunshine Holdings PLC has reported impressive growth in top and bottom-line performances during the first nine months of the current financial year (9MFY22).

Fuelled by strong growth in all business sectors, diversified Sri Lankan conglomerate Sunshine Holdings PLC has reported impressive growth in top and bottom-line performances during the first nine months of the current financial year (9MFY22).

During this period, the Group posted consolidated revenue of Rs. 24 billion, up by 39% Year-on-Year (YoY). Group’s Profit After Tax (PAT) also increased by 90% to Rs. 3.6 billion, compared to Rs. 1.1 billion reported during the same period last year.

Group revenue, from Healthcare, Consumer goods, and Agribusiness sectors, contributed 54%, 25%, and 21%, respectively. The Healthcare sector recorded YoY growth of 43%, while the Agri sector revenue was up by 69%. Consumer goods sector recorded a 22% increase in revenue compared to 9M FY20/21, mainly driven by the acquisition of Daintee Ltd., in FY21.

Gross profit margin for 9M FY22 stood at 34%, a marginal increase of 40 basis points against the same period last year. The gross profit improved by Rs. 2.3 billion up 40% YoY, in line with revenue growth and EBIT closed at Rs. 4.5 billion, an increase of 53% YoY.

Sunshine Holdings Chairman Amal Cabraal said: “The notable growth in our top and bottom lines is attributable to the strong contributions from all our business sectors and the execution of well-articulated strategies amidst tough market conditions that impacted the Group. However, in the short to medium term, we expect the operating environment to be challenging due to the negative economic impact caused by the pandemic.”

“Sunshine has reimagined our business processes to be agile and resilient to any disruption, and continue to serve our customers amidst challenges. As a Group, all possible measures have been taken to ensure business sustainability and continuity in the coming months,” Cabraal added.

The Healthcare sector recorded a revenue of Rs. 12.9 billion during 9MFY22, a significant increase of 43% YoY backed by the improved performance in Pharmaceutical and Medical Devices segments and the contribution from the addition of Akbar Pharmaceuticals. EBIT for the sector was Rs. 1.3 billion.

Pharmaceutical manufacturing division Lina has received GMP certification for the new factory and plans to supply Metered Dose Inhalers to the Government in the near future. Healthguard Pharmacy sales have been driven by wellness products and new customers as well as online sales.

The Consumer Goods sector reported a 22% YoY increase in revenue to close at Rs. 6 billion in 9MFY22. The revenue increase is mainly driven by the addition of the confectionery business segment via the acquisition of Daintee. The PAT of the sector decreased by Rs. 72 million (-24% YoY) in comparison to the same period last year due to lower profitability in Daintee. The company’s tea brands have over 45% volume market share in branded tea locally.

Agribusiness sector revenue increased by 69% YoY during 9MFY22 to Rs. 5 billion and EBIT increased to Rs. 2.8 billion from Rs. 1.5 billion driven by the improved performance in the palm oil segment backed by the growth in NSA. PAT of the Agri sector closed at Rs. 2.7 billion for 9MFY22, up by Rs. 1.4 billion compared to the same period last year. PAT of the Dairy segment stood at Rs. 38 million compared to a PAT of Rs. 52 million during the same period last year due to higher feed costs.