Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 21 April 2020 00:00 - - {{hitsCtrl.values.hits}}

Chamila Samarakkodi is an entrepreneur with 30 years of experience in the fashion and apparel manufacturing industry. Today, he leads Design Studio’s manufacturing plants in Anuradhapura and Kurunegala which are Board of Investment-listed companies that provide state-of-the-art training and employment to over 2,500 rural employees, in addition to the group’s head office in Colombo. His end-clients are primarily UK high street retailers including Primark, ASDA, Topshop, Sainsbury’s, ASOS, River Island, Oasis and Urban Outfitters, exclusively producing high-end ladies soft and tailored garments. The clothing industry has consistently faced instability over the past few years after its slow recovery from the last global financial crisis. Economic headwinds have eroded even the mightiest industry participants globally. The UK’s most recent shockwave,

Chamila Samarakkodi is an entrepreneur with 30 years of experience in the fashion and apparel manufacturing industry. Today, he leads Design Studio’s manufacturing plants in Anuradhapura and Kurunegala which are Board of Investment-listed companies that provide state-of-the-art training and employment to over 2,500 rural employees, in addition to the group’s head office in Colombo. His end-clients are primarily UK high street retailers including Primark, ASDA, Topshop, Sainsbury’s, ASOS, River Island, Oasis and Urban Outfitters, exclusively producing high-end ladies soft and tailored garments. The clothing industry has consistently faced instability over the past few years after its slow recovery from the last global financial crisis. Economic headwinds have eroded even the mightiest industry participants globally. The UK’s most recent shockwave,

Brexit, thrust both retailers and suppliers into new and uncharted territory –

decreasing

the buying power of clients and creating a ‘price-war’ situation for manufacturers in Sri Lanka.

But no event in modern history has caused implications as severe as that of the COVID- 19 outbreak, which is in danger of tearing the very seams of the fashion trade. For the first time in memory, we have witnessed the effective cancellation of an

entire fashion

season: Spring/Summer 2020 is no more. As a result, there are unavoidable financial blows to every supplier involved. Finished garments have been cancelled, gathering dust in warehouses and retiring as dead stock.

Hard losses

“Our clients are all closing down stores and cancelling all orders indefinitely, including those that are already a work in progress in our factories, as the UK goes into a

lockdown state. Cessation of all trading operations until the health crisis situation is resolved – including the cancellation of all future contracts as our clients attempt to

safeguard their business continuity, sustainability and resilience – puts all of us manufacturers in a period of great uncertainty over the next six months,” admits Chamila. And there is no mercy from the desperate buyers either – he goes on to evidence the plight the local industry faces by quoting a recent article off Drapers, the fashion retail sector’s premier magazine: “Industry-wide, suppliers are forced to absorb direct losses and accrued liabilities. Even the most trusted retailers are simply unable and unwilling to foot any part of the bill. … The devastating effects of these cancellations are being further amplified by forced extended payment terms – non-negotiable, of course. There is little concern for the suppliers that have been – and post-pandemic will continue to be – the mechanics of billion-pound retail businesses.”

Nation-wide impact

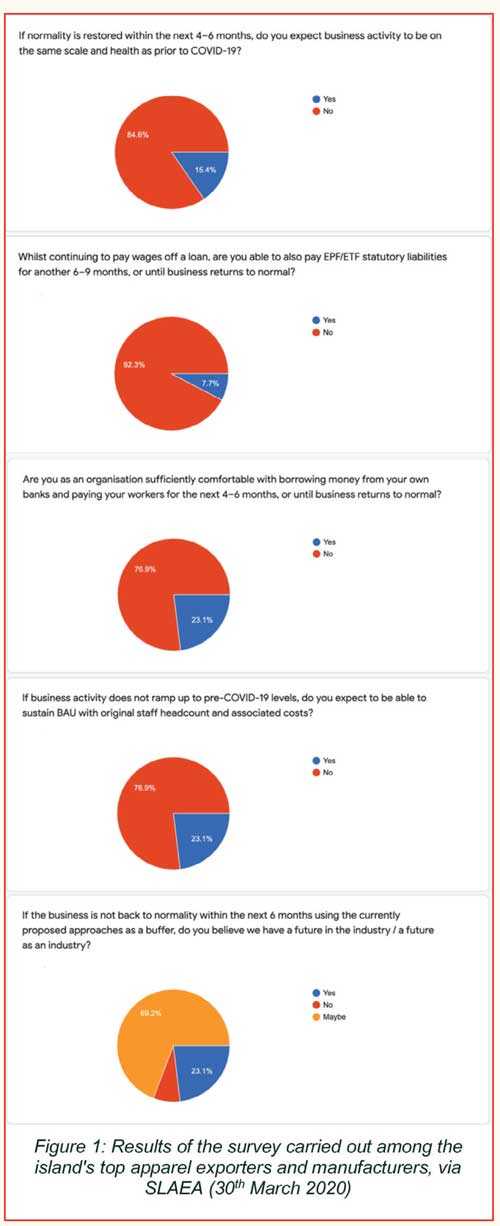

In an internal survey carried out among the members of the Sri Lanka Apparel Exporters Association (SLAEA) representing the island’s premier apparel manufacturers and exporters, it was made evident that there is already a struggle to service salaries and other statutory payments over the next 6 months at minimum – or even longer, depending on how the current unprecedented situation plays out – due to the non-availability of funds.

For a group of key players that have persevered through numerous challenges when apparels first kicked off in the country, there is an overarching sense of uncertainty around if there is even a future for the industry post-COVID-19 if adequate buffers aren’t put in place and support provided – and these leaders are certain ramping back up to merely the same scale and health their organisations used to be at will be a slow and tedious process, even after normalcy is restored.

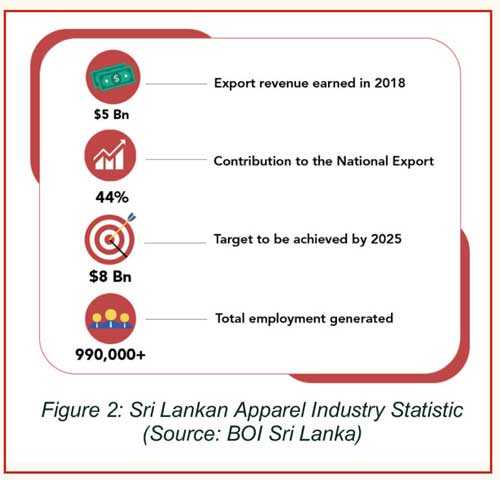

“For context, the apparel industry accounts for about half of our country’s total exports, and employs over 15% of the local workforce,” explains Chamila. He goes on to highlight that this is the only case in Sri Lanka of a single industry providing mass employment to its citizens, in addition to being the country’s second largest FOREX earner for over 8 years with a 2025 target of $ 8 billion that is at risk – “This is what’s at stake and why the government should be worried.”

He notes with grave concern, “In speaking to many of my colleagues and peers in the industry, I have understood that the gravity of COVID-19’s implications to our organisations are far severe to what we make it out to be in our communications to the authorities, including the Sri Lanka Apparel Exporters Association (SLAEA) and Joint Apparel Association Forum (JAAF-SL) leadership.”

Numerous manufacturers – majority being BOI-approved ventures – have already written to the Department of Labour, banks, creditors and so on but believes the urgency and severity of the situation has not been fully appreciated yet.

Chamila believes this is an exceptional situation where the government must intervene to safeguard the continuity of one of its largest revenue and employment generators who are already at the point of bankruptcy.

Priorities

Traditionally, many organisations are in the habit of painting a strong and stable image of themselves – particularly true in our culture – but there’s nothing traditional about the challenges we are all collectively faced with today. Hence, Chamila affirms now’s the

time for transparency and to be upfront on this evolving situation.

“Right now, our priorities are the well-being of our 2500+ people – our greatest asset – many of whom are the sole breadwinners of their family; and to keep our business alive until BAU can be resumed,” he declares. The company provides extensive vocational training and upskilling, employee benefits and other forms of social responsibility to them, their families and the localities their factories operate in – including annual sponsorship of school stationary and other needs for the children of their staff, medical insurance and employee counselling, provision of visual and hearing aids, a death donation fund, free meals and transport, and many direct/indirect emoluments to the local citizenry.

“This is not possible without a few sacrifices up front though, for which we need the support and approval of the government and its institutions”, claims Chamila. “For

instance, we really want to protect all of our employees and have them with us once business resumes – but we can’t do that unless we are allowed temporary lay-offs and

other short-term measures.”

He mentions that his organisation alone works with six other outsourced manufacturing partners with a cumulative workforce of an additional 3,500 employees, to demonstrate just how many lives could be changed forever, here.

Government bailout

It’s been almost a month since the more serious implications of COVID-19 kicked in, and after having really put in both individual and concerted efforts to try remediate the pitfall too deserves equal attention. Industries need to be safeguarded via a plan of action, or the country will collapse post-COVID despite having been saved from the virus.”

Chamila laid out the following straightforward requests and proposed solutions which he

thinks will ensure the industry has a future in the aftermath of the coronavirus crisis:

1. Salaries

1.1. All manufacturers have paid salaries for the month of March, due on 10 April 2020, by way of collecting all available cash-in-hand at their disposal. Even this required certain pay-cuts to have been made.

1.2. Manufacturers have no means to provide for the remaining timeframe of 6 months at minimum until trading resumes and we are all back in business.

1.3. As such, we request the Government to join hands with us and make arrangements to provide some form of allowance for our employees during this period.

1.4. We require permission to initially work on a pro-rata basis for less than the full work week, once we are back in business and are still ramping up to full capacity. This is because securing adequate work from clients will take time.

2. Statutory payments

2.1. As we face difficulty paying core salaries alone, we request abolishing statutory payments – i.e. EPF and ETF – for the next six to nine months.

2.2. Rescheduling ongoing non-payments of EPF to be paid back in 24 months, with at least a six to nine-month grace period and no penalties enforced. This is due to no trading taking place over the next six months, and an unclear landscape of how

the business and the situation will progress during and after this

period.

3. Employment contracts

3.1. We request laying off a fraction of our staff for the next six to nine months unpaid, i.e. on

furlough.

A small price to pay

When asked if these concessions that are sought after will be a tough call for the authorities to make, Chamila instead says it’s a no-brainer. “Real jobs of real people who need them the most, are at stake here – and we cannot look after them and protect their employment if we aren’t allowed to make some drastic changes in the interim to cushion the shock waves we are facing today,” he cautions.

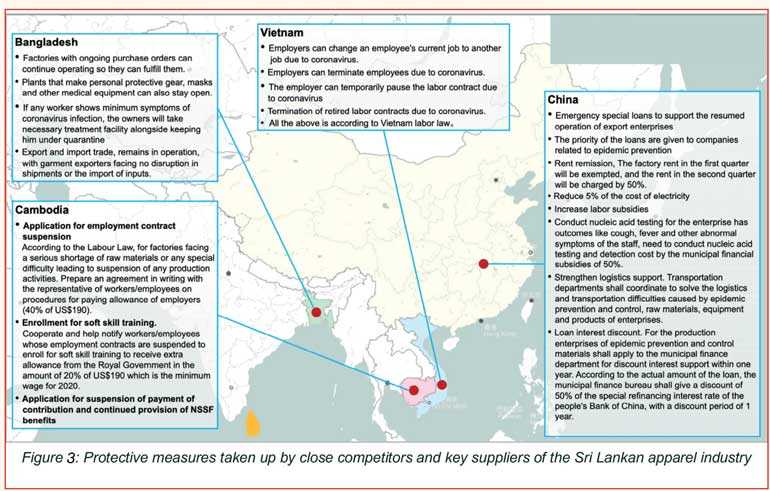

Chamila says there are plenty of examples of incentives similar to what he is proposing being implemented in other countries where the apparel industry is dominant – and shared a number of best practices his partners abroad and their governments have taken up, as illustrated.

Sri Lanka is already knee-deep in increasingly fierce competition with suppliers in Vietnam, Cambodia and Indonesia. “This is no time to experiment, test your confidence and pride, or do nothing,” he said.

Chamila ended on a (potentially) positive note, however, saying he and the industry as a whole would be sincerely grateful if the above propositions are actioned. He says, “We are confident that, with the support of the right parties and if we work together to take the right approach, we will survive through this period and come out as preferred suppliers of choice once global trading resumes – and more importantly, enable all of our employees to resume working with us with minimal disruption to their livelihoods.”