Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 24 December 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

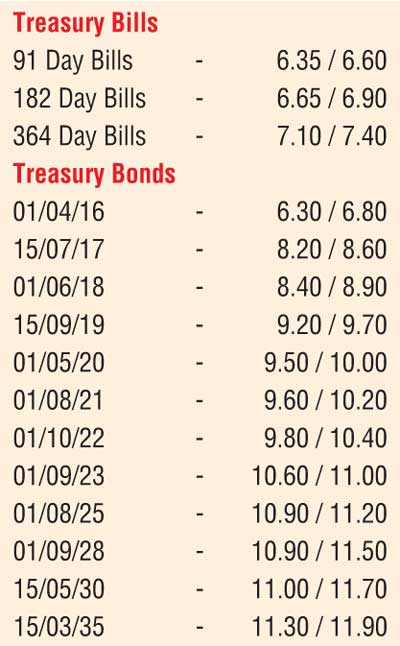

Activity in both the bill and bond markets slowed down considerably during the short week ending 23 December. In the meantime, the weighted average yields at the primary bill auction increased across all three maturities. The yields of the 91 day bill increased by 10 basis points, the 182 day bill by 15 basis points and the 364 day bill by 10 basis points, resulting in an 32,39 and 25 basis point increase over the last three weeks.

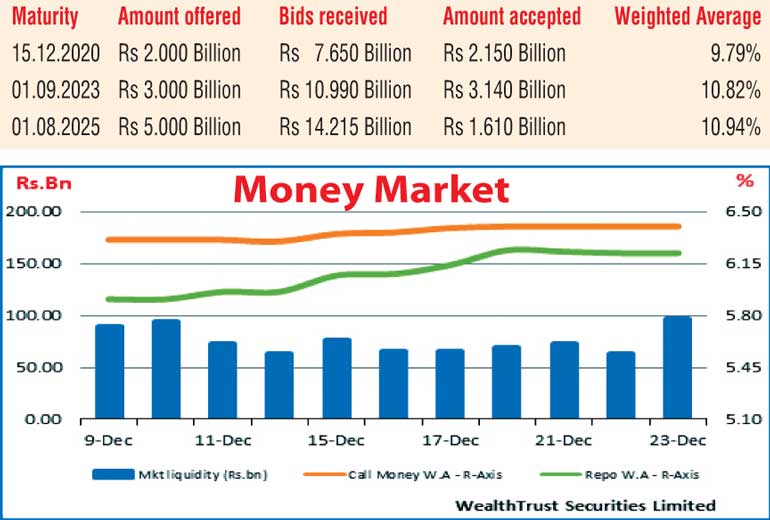

The upward momentum in primary market yields was evident even at Wednesday’s (23rd) bond auction, where the weighted average yields increased significantly by 58 basis points on the 01.08.25, 57 basis points on the 01.09.2023 and 23 basis points on the 15.12.2020, resulting in yields of 10.94%, 10.82% and 9.79% respectively. The total amount of bids excepted at this auction was Rs.6.9 billion against an offered amount of Rs.10 billion.

Meanwhile, the monetary policy announcement for the month of December is due at 19:30 hrs on 30 December.

In money markets, the overnight call money and Repo rates averaged 6.40% and 6.22% respectively, whilst the average surplus liquidity stood at Rs.77.67 Billion.

The OMO department of the Central Bank was seen mopping up liquidity on an overnight basis at a weighted average ranging from 6.13% to 6.14%.

Rupee closes the week steady

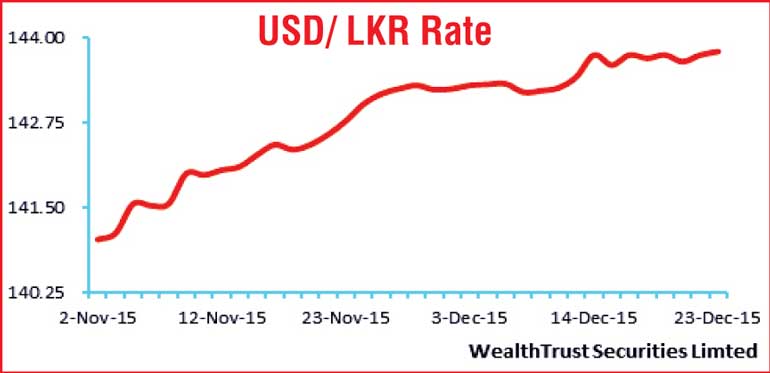

The USD/LKR on spot contracts was seen trading within a narrow range during the week to close the week mostly unchanged at Rs.143.70/85.

The daily USD/LKR average traded volume for the first two days of the week stood at US $ 66.67 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 144.50/60; 3 Months - 145.40/50 and 6 Months - 146.50/70.