Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 14 February 2017 00:00 - - {{hitsCtrl.values.hits}}

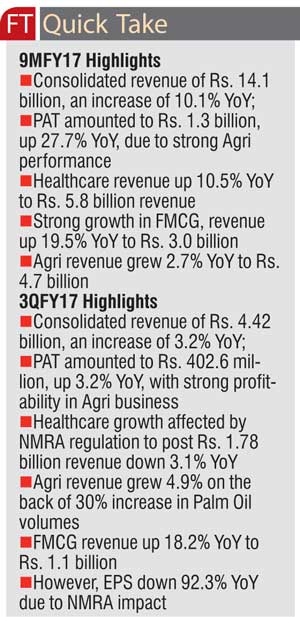

Sunshine Holdings Plc yesterday reported consolidated revenue of Rs. 14.1 billion for the nine months ended 31 December 2016 (9MFY17), up 10.1% YoY.

PAT grew 27.7% YoY to stand at Rs. 1.3 billion for 9MFY17, however PATMI declined -12.6% YoY mainly due to a reduction in Healthcare segment profits caused by the implementation of NMRA price controls. Healthcare continued to be the largest contributor to group revenue, accounting for 41%. Agri was the second largest with 34% followed by FMCG at 21% of the revenue. For 9MFY17, PAT amounted to Rs. 1,338 million, up 27.7% YoY, with Profit After Tax and Minority Interest (PATMI) coming down -12.6% YoY to Rs. 446 million due to a loss in the Healthcare business on account of price control, with a one-time stock loss of Rs. 123 million. As a result Agri was the largest contributor to PATMI in 9MFY17 with Rs. 245 million, which represents 55% of total PATMI.

Net Asset Value per share increased to Rs. 45.04 as at end 9MFY17, as compared with Rs. 42.78 at the beginning of the year.

Healthcare

Healthcare revenue for 9MFY17 grew 10.5% YoY, led primarily by growth in the retail segment accounting for 41% of Group turnover for the period. The EBIT margin for 9MFY17 contracted by 430 bps to 3.3%, mainly on account of the price control imposed under the NMRA regulation leading to a one-time stock correction loss of Rs. 123 million.

The Pharma sub-segment, which represents 66.6% of Healthcare revenue, grew at only 6% YoY due to the impact of reduced prices. The company’s Pharma segment is the second-largest player in the country, holding 12% share of the country’s total market share. Growth in other sub-sectors comprised Surgical (+19% YoY), Retail (+34% YoY), Diagnostics (+6% YoY) and Wellness (+16% YoY).

PAT for Healthcare amounted to Rs. 91 million in 9MFY17, down -66% YoY, representing a margin of 1.6% in 9MFY17.

FMCG

The FMCG sector reported revenue of Rs. 3.0 billion in 9MFY17, up 19.5% YoY on the back of volume and price growth, accounting for 21% of group revenue for the period in review. The domestic branded tea business within the Group’s FMCG segment sold 2.88 million kilogrammes of branded tea, improving 8% YoY, driven by Sunshine Group’s largest brand Watawala Tea, and their converter brand Ran Kahata.

PAT from the FMCG segment saw a contraction of 27.5% YoY, to stand at Rs. 249 million in 9MFY17, with a margin of 8.3%, compared to 13.6% in the same period last year. Low tea prices in the same period last year led to the high margins in 9MFY16. 3Q performance saw rising tea prices affect margins. Business expansion investments pertaining to scaling up of the Zesta Connoisseur brand across Shangri-La properties worldwide continued at a steady pace supporting positive improvements to the Group’s operating margins.

Agribusiness

The Agribusiness sector represented by Watawala Plantations Plc (WATA) saw revenue growth of 2.7% YoY to Rs. 4.7 billion, despite an 8% YoY contraction in tea revenue. The Palm Oil sub sector reported an increase of 47% YoY for 9MFY17. Tea production was affected by bad weather, even as the company continues to focus on its strategy of growing quality teas to curtail losses. Palm Oil volumes were 15% higher than the same period last year.

The company managed to obtain a higher price for its CPO during 9MFY17, which positively contributed to both the top line and bottom line of the Agri sector. PAT for 9MFY17 amounted to Rs. 1,014 million, against Rs. 439 million in the same period last year. Growth in profits was mainly attributed to a reduction in losses in the Tea subsector and a parallel increase in profits from the Palm Oil subsector. The Tea subsector recorded a net loss before tax of Rs. 27 million for 9MFY17 compared to a net loss of Rs. 172 million in the same period last year.

Meanwhile, the Palm Oil segment, which made Rs. 1,057 million PBT for 9MFY17 against Rs. 575 million last year, continued to be the largest contributor to WATA profits and managed to cover the losses in Tea.

Other

Packaging revenues amounted to Rs. 251 million, down 4.2% YoY in 9MFY17, against Rs. 262 million in the same period last year. PAT amounted to Rs. 2.9 million in 9MFY17 lower than Rs. 13 million recorded in 9MFY16.

Revenue for the Renewable Energy division amounted to Rs. 68 million in 9MFY17, down 35% YoY from Rs. 104 million during the same period last year as a result of the change in weather patterns. The mini-hydro plant, which is in its third year of operations, made a loss of Rs. 10.16 million for 9MFY17, compared to a profit of Rs. 41.8 million in the same period last year.