Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 16 November 2015 00:00 - - {{hitsCtrl.values.hits}}

Softlogic Holdings Plc Chairman Ashok Pathirage has emphasised that a clear policy director will be to galvanise the economy and the private sector.

Softlogic Holdings Plc Chairman Ashok Pathirage has emphasised that a clear policy director will be to galvanise the economy and the private sector.

“With a clear policy direction we believe that implementing an investor-friendly policy measure would not only galvanise the economy but also encourage a robust corporate sector,” Pathirage has said in his review accompanying Softlogic Holdings’ interim results for the second quarter.

The company reported strong earnings for the second quarter as well as the first half.

Following are highlights of Softlogic Holdings’ performance.

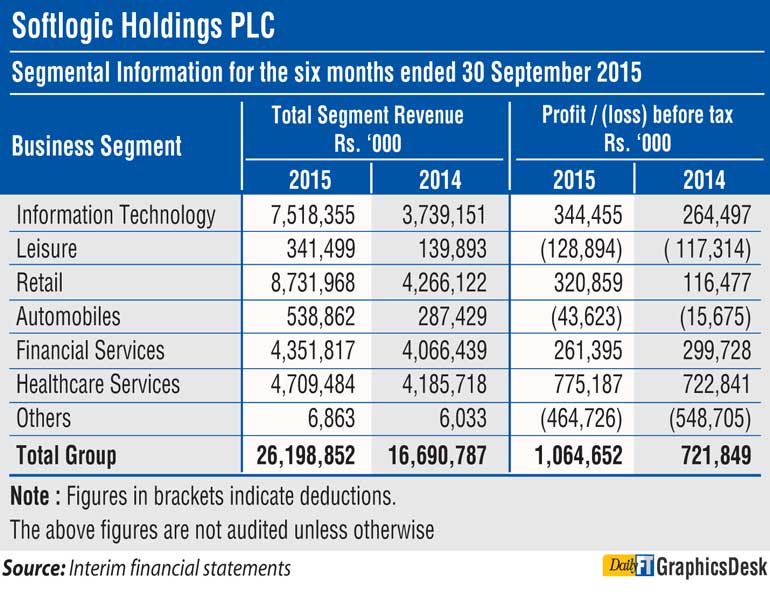

The group exhibited a strong performance, recording revenue growth of 57.0% to Rs. 26.2 b with second quarter consolidated revenues increasing a 52.2% growth to Rs. 13.2 b. The retail sector led the consolidated revenue, post-acquisition of Odel, with a contribution of 33.3% for 1HFY16 followed by ICT, especially its mobile phone items, with 28.7%, Healthcare Services with an impressive 18.0% and Financial Services contributing 16.6%.

Consolidated Gross Profit increased 39.5% to reach Rs. 4.4 billion during the second quarter of the financial year with cumulative first half Gross Profit increasing 43.4% to Rs. 8.7 Bn. Despite the group’s expansion, a significant improvement in operational cost margin was noted during the period with the quarterly cost margin improving to 23.6% from 30.2% and cumulative operating cost margin also improving from 28.5% to 23.6% following stringent cost discipline and synergies.

Nonetheless, administration and distribution costs naturally increased to 32.7% and 21.7% to Rs. 4.9 b and Rs. 1.3 b respectively for the first half of the financial year. The quarter reported a marginal decline in distribution costs to Rs. 648.3 Mn while administrative costs increased 25.3% to Rs. 2.5 b.

Operating profit achieved a growth of 90.0% to Rs. 1.5 b during the quarter witnessing a strong margin growth to 11.4% from 9.1% in the corresponding quarter. Cumulative operation profit increased 73.7% to Rs. 2.9 b with margin (OPM) improving from 10.1% last year to 11.2%.

The Healthcare and Leisure sectors were adversely affected by the rupee depreciation due to the foreign currency denominated debt in the books. Nonetheless, the Leisure sector’s foreign currency receipts constituting a natural hedge are also encouraging.

A decline of 55.2% in finance income to Rs. 547.7 m was registered during the cumulative period with quarterly finance income also reducing 66.3% to Rs. 264.1 m. This reduction was a reflection of falling market interest rates and volatile stock market performance on the investment portfolio of Asian Alliance Insurance Plc (unrealised fair value gains).

As such, change in insurance contract liabilities declined marginally during the cumulative period to 860.5 m (quarterly decline of 16.9% to Rs. 401.3 m). Finance expenses increased 15.7% to Rs. 771.4 m during the quarter despite a significant increase Group activity levels while a 19.1% increase to Rs. 1.6 b was noted during the first half of the financial year. Growth of 13.9% in other operating income to Rs. 435.0 Mn during the first half of the financial year was primarily led by a new source of income at Softlogic Finance Plc as fees received for new loans.

For the first six months of FY15/16, Group EBITDA increased by 64.4% to Rs. 3.8 b against Rs. 2.31 b made in the corresponding period of FY 14/15. EBITDA margins improved to 14.52% against 13.89% during the comparative periods. This amply demonstrates the group’s increasing efficiency in managing resources.

Group PBT stood at Rs. 1.1 b after witnessing a steady increase of 47.5% for the cumulative period. The quarter too registered a growth of 39.1% to Rs, 593.7 m in PBT. Profit for the period during the six months of FY2015/16 improved 18.4% to Rs. 685.4 m while the 2HFY16 reported Rs.381.2 m (up 7.7%). A gradual improvement in the performance of the fully-owned subsidiaries of the company has been evident in the recent months with equity-holders earnings moving upwards.

Information and Communication Technology

Information and Communication Technology more than doubled its revenue to Rs. 7.5 b during the 1HFY16 with the quarter registering a strong 88.2% increase in turnover to Rs. 3.7 b. This sector’s contribution to the Group topline for 1HFY16 continued to improve to 28.7% from 22.4% in the comparative period. This segment’s operating profit improved 16.6% during the first half of FY2015/16 to Rs. 487.6 m (16.6% group contribution). The quarter reported a segmental operating profit of Rs. 231.5 Mn which is a 10.1% growth making 15.4% of the Group operating profit.

Sector PBT improved 30.2% to Rs. 344.5 m during the cumulative period (Rs. 167.2 m during 2QFY16, up 31.8%). ICT sector PAT increased 16.4% to Rs. 253.8 m during the 1HFY16 with quarter marking a growth of 12.6% to Rs. 122.4 m.

This significant improvement in the ICT business was driven by Samsung mobile handsets, the flagship company, Softlogic Mobile Distribution Ltd., which commenced operations in November 2014. The success of the mobile segment will be further boosted with the launch of the HTC handset range in September 2015. The islandwide distribution channel and the unparalleled customer care and after-sales service are key strengths supporting the newly initiated brands. Nokia and Microsoft Lumia handset sales continued with its steady market inroads with Samsung leading during the period under review. Group’s B2B IT segment also progressed well.

Retail

Retail sector doubled its topline during the first half of the financial year to Rs. 8.7 b and contributed 33.3% to group turnover (25.6% contribution in the corresponding period). The quarter registered a strong growth of 98.9% to Rs. 4.4 b consequently Odel Plc’s acquisition in September 2014.

Increasing footfalls at existing stores and incremental revenues from new stores/brands demonstrates strong potential for this segment. Operating profit reached Rs. 784.7 m during 1HFY16 (Versus Rs. 335.3 m in 1HFY15) while the quarterly operating profit of the sector grew to Rs. 427.6 m (up 136.8%).

Despite the sector’s accelerated expansion, synergies and cost controls helped witness significant improvements in operating profit margins during the cumulative period to 26.8% from 19.9% in the comparative period. Sector’s PBT improved significantly to Rs. 210.0 m (up 274.5%) for the quarter pushing up the cumulative PBT by 175.5% to Rs. 320.9 m. Sectoral PAT for the quarter reached Rs. 151.5 m (up 163.7%) while cumulative PAT increased 61.7% to Rs. 230.4 m.

The Consumer Electronics opened its 14th Max showroom in Rajagiriya, taking its cumulative retail space to 281,818 sq.ft as of today with 218 total showrooms.

The Branded Apparel and Accessories division launched the latest eyewear collection of leading global brands at Odel recently. In this regard, Luxottica, a global leading brand in fashion eyewear and Bodyshop were set up. We also have signed distributorship agreements with ‘Jack & Jones’, ‘Vero Moda’ and ‘Only’.

Burger King recently opened its eighth restaurant at Liberty Plaza, Colombo 3.

The Furniture segment opened its first flagship store for ‘Natuzzi’, a leading global luxury furniture brand, in July 2015.

Healthcare Services

Healthcare Services maintained impressive performance during the six-month period. The Sector added Rs. 4.7 b to Group topline (18.0% contribution), which is 12.5% growth during 1HFY16.

The quarter reported 15.0% increase to Rs. 2.4 b (i.e. 18.2% contribution to the Group topline). Central Hospital Ltd. led the revenue contributory ranking with 35.1%, Asiri Surgical Hospital Plc (29.6% of Group revenue) and Asiri Hospital Holdings Plc (27.6% of Group revenue). Operating profit (OP) of the sector was Rs. 506.5 m during the quarter with the cumulative OP of Rs. 1.0 b. Sector PBT stood at Rs. 374.5 m (up 12.6%) during the quarter with the 1HFY16 reporting Rs. 775.2 m. Sector PAT for the cumulative period was Rs. 659.0 m.

The Kidney Transplant Unit of the Central Hospital Limited commenced on 15 October 2015. This purpose built state-of-the-art offers services to both donor and recipient, and consists of a dedicated medical and nursing staff that is committed to deliver the highest safety and quality patient care. 151-bedroom Kandy hospital has commenced construction of the building and the hospital is expected to be operational within a period of two-and-a-half years.

Financial Services

Financial Services segment saw a 4.6% growth in topline to Rs. 2.2 b during 2QFY16 with its contribution to the Group revenue constituting 16.7% while cumulative sector revenue registered a 7.0% to Rs.4.4 b. The sector’s PBT achieved Rs. 1.1 b for 1HFY16 while the quarter reported a PBT of Rs. 171.6 m.

Asian Alliance Insurance Plc saw its YTD total GWP at Rs. 3.1 b with Life premiums increasing by Rs. 582 m while General premiums increased by Rs. 174 m. This reflected an increase in GWP of 33% on a consolidated basis where Life and general operations grew by 40% and 21% respectively, versus industry growth rates of 20% for Life operations and 5% for GI operations.

Softlogic Finance Plc saw Loan Advances growing 4.6% compared to the previous year with SME loans contributing Rs. 6 b to the overall asset base, while Customer Deposits increased 7.6% to Rs 12.9 b, with Total Assets of the company recording Rs. 20.5 b.

Softlogic Stockbrokers contribution to the financial services profits were hampered due to unfavourable trading conditions witnessed in the Colombo Stock Exchange during the period under review.

Automobile

A strong turnaround in revenues was noted in the automobile sector during the period under review. An improvement of 87.5% to Rs. 538.9 m was evident during 1HFY16 with quarterly revenue improving 58.2% to Rs. 242.0 m. The King Long bus sales contributed significantly to the sector revenue. Softlogic Automobiles Ltd. will be selling its 50th luxury coach for year 2015 in November.

The Service and Accident Repair segment, which worked closely with group’s insurance subsidiary, performed well during the period. The liberation of the currency market in September has led the rupee to depreciate in recent times. Monthly average for August was Rs. 133.9/USD whilst October monthly average was Rs. 140.9/ USD.

This had an impact on the selling price of the vehicles during the quarter. The full deposit margin requirement against Letters of Credit opened for the importation of cars has had an impact on the industry as a whole.

However, there was a minimal impact on new vehicle sales following the announcement of vehicle loan facility increment from 70% to 90% in October. We expect the Company to return to profitability in the next few coming quarters.

Leisure

Leisure sector registered a significant improvement in turnover with 144.1% increase in revenues to Rs. 341.5 m during the first half of the financial year whilst the quarter saw an improvement of 68.8% to Rs. 210.5 m.

Ceysand Resorts was the prime driver of the sector performance. The resort performed well in line with expectations with the off-peak September quarter achieving occupancy of 72%.

The fit-out of the guest rooms at Movenpick City Hotel is well underway while construction activity in September 2015 was elevated as the project is reaching completion targeted for 1Q16. The hotel’s Swiss General Manager is now on board with the Operating Supplies and equipment procurement process commencing. We envisage the hotel to be fully operational by June 2016.

Future outlook

With a clear policy direction we believe that implementing an investor-friendly policy measure would not only galvanise the economy but also encourage a robust corporate sector.