Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 2 August 2016 00:15 - - {{hitsCtrl.values.hits}}

Industry analysts are warning that efforts by the Government to impose higher taxation would significantly erode the tobacco industry’s value added component to the State.

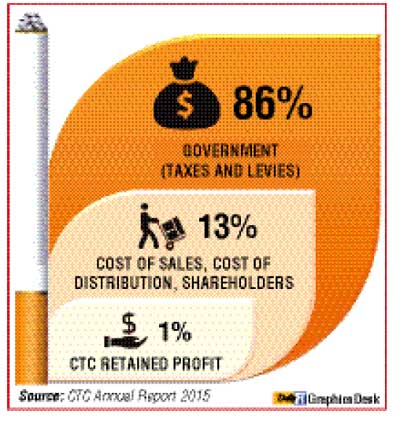

In 2015, the Ceylon Tobacco Company Plc’s Value Added to the State via excises and taxes was a staggering Rs. 91.6 billion, up by 24% from the previous year. The 2015 value amounted to 7% of the state’s total tax revenue and 88% of the value generated by  CTC.

CTC.

Plans by President Maithripala Sirisena and Health Minister Rajitha Senarathna to further tax cigarettes, are coming at a time when prices are among the highest in the world and third highest in Asia.

According to the WHO Report on the Global Tobacco Epidemic (2015), Sri Lanka falls among countries with the highest tax incidence in the world. The report also indicates that developed countries such as America, Japan, Singapore and Australia have far lower tax incidences when compared to Sri Lanka.

Industry analysts aid excessive excise duty always lead to a volume decline thereby endangering a higher Government revenue. As per data, the industry lost almost 25% of volume from 2011 to 2014 which demonstrates that the demand for tobacco products is not inelastic and could end up resulting in lower tax revenues for the Government when consumers migrate to beedi or smuggled products.