Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 1 June 2016 00:00 - - {{hitsCtrl.values.hits}}

LTL Holdings Group Chairman U.D. Jayawardana

Q: LTL Holdings has been in the news of late. As the CEO of LTL, how do you feel about recent events?

Q: LTL Holdings has been in the news of late. As the CEO of LTL, how do you feel about recent events?

A: President Obama recently told Rutgers graduates, “In politics and life, ignorance is not a virtue.” I have to say the same thing to the critics of LTL. People will not throw stones at a tree without fruits. I have worked with a small team of dedicated people to ensure the growth of LTL to be such a ‘fruitful’ tree. ‘Fruitful’ to its owners, to the nation, to its employees and to society. I am not surprised or upset by all the invective levelled at us. It is not the first time LTL has had to suffer such absurd criticism. This will not be the last either. All these attacks have only made us more determined to achieve even more for the benefit of our nation.

Q: What was the start of LTL?

A: I was a young engineer attached to CEB’s transformer workshop in the late ’70s. At that time our task was to repair the numerous failed or burnt transformers. That was a nightmare. The CEB was calling for tenders and each tender would go to the lowest bidder and a one different from the previous supplier. We had some 70 odd transformer types and each one needed its own spares. Each transformer had more than 50 different parts. Some suppliers had gone bust by the time we asked for spares. Most of the transformers were of very bad quality. They failed very frequently. We could not have spares for all of them. The result was that the CEB could not spread its coverage fast enough. At this time not more than 10% of Sri Lankans had electricity. Transformers were the major bottleneck. It was a problem for us, the CEB management as well as to the Government.

Q: So what did you all do about it?

A: The Engineer in charge of transformers at that time was Channa Amerasinghe, a visionary, who was of the opinion that we have sufficient skills to produce transformers locally. He is the founder of Lanka Transformers. I teamed up with him and with the support of several CEB engineers and Managers at that time we were able to start Lanka Transformers.

Q: How did you all find the money? How much did CEB invest?

A: The CEB initially invested only Rs. 8.5 million. We borrowed Rs. 13 m from the NDB. The entire project to set up the factory at Moratuwa cost only Rs. 25 m. But we were ready with a transformer factory with a capacity to produce 700 transformers for the CEB by 1982. Bonar Long of Scotland trained our local employees on design as well as in manufacture.

Q: Were the CEB’s problems solved after that?

A: Yes, very much. In fact we were the first country in South Asia to have maintenance free transformers by the early nineties. We could provide a steady supply of transformers required for electrification programs that came along with the Mahaweli scheme as well as the 200 garment factory program. I think anybody in CEB will agree that without LTL, the rapid electrification achieved by Sri Lanka, from 10% to near 100% in under 40 years would only have been a dream.

Q: There is the accusation that you enjoy a monopoly for transformers and galvanising. Your stance?

A: I will come to that in a minute. Our first diversification from transformers was for galvanising. We realised that though the CEB gets better transformers, they have to install them on steel structures with very poor quality galvanising, resulting in the structures crumbling due to corrosion. So LTL invested in a galvanising plant in 1990. We brought all German equipment and started to supply superior quality structures to the CEB.

I don’t agree we have a monopoly in either of these. It is just that the CEB buys our transformers and galvanising services at a formula based price rather than calling for tenders. Any other person can import them according to their wish.

Q: How does the formula work? Has it been fair from CEB’s perspective?

A: For transformer and galvanising sales, we have an open book pricing. The CEB is our main shareholder. We provide them with all our input costs for raw materials etc. We are allowed to keep a profit margin of around 7% on sales price, which is based on a fixed return on investment. This formula is approved every year by a very high-powered committee and then approved by its Board. I must say that both transformer and galvanising combined we don’t have more than Rs. 200 million profit from CEB sales. That is only 5% of our total profit and 7% of the revenue of LTL Holdings. The remaining 95% of the profits and 93% of revenue have come from business obtained following competitive bidding procedures both locally and internationally.

In reality more than 60% of our transformer production is now for exports. For the last 10 years we have struggled greatly to earn this place in the global transformer market. The LTL brand is very well recognised and accepted in Asia and Africa as a good quality transformer. We are perhaps the only international brand for a Sri Lankan product next to Dilmah tea. We have routine orders from more than 20 countries. If anybody alleges that we are fleecing the CEB on transformer prices, they only have to compare our prices with global prices. We compete with Chinese and Indian companies in supplying to African countries. So we have no reason to be more expensive than our competitors.

In 2005, the CEB in fact called for a tender due to a procurement restriction to buy from LTL and ended up paying 20% more than our prices at that time. Even in galvanising only 30% of our revenue comes from the CEB. In any case even if we don’t have any business from the CEB, we will not be adversely affected.

Some of our critics have a mistaken belief that LTL is a parasite on the CEB. If you take our 2015 financials, the CEB accounted for only 15% of the revenue. The bulk of our income is derived from power generation in Bangladesh, exports and other foreign projects.

Q: There is an accusation that the CEB has many subsidiaries and they are draining the CEB dry through manipulation of supplies to the CEB. Out of 23 subsidiaries CEB apparently has 15 under your leadership. What do you want to say about this?

A: We were the first subsidiary of CEB. We in turn now have 14 of our own subsidiaries. After that LECO came. LECO has two subsidiaries. I think LTL and LECO are the biggest subsidiaries. Other subsidiaries would have been formed for specific purposes and are not large operations. When people make allegations that the CEB is now only a shell and that CEB is loss making due to the subsidiaries, I think they do so without studying the facts.

A: We were the first subsidiary of CEB. We in turn now have 14 of our own subsidiaries. After that LECO came. LECO has two subsidiaries. I think LTL and LECO are the biggest subsidiaries. Other subsidiaries would have been formed for specific purposes and are not large operations. When people make allegations that the CEB is now only a shell and that CEB is loss making due to the subsidiaries, I think they do so without studying the facts.

For example, in 2015, CEB’s revenue would be around Rs. 185 billion. The CEB made a profit of approx. Rs. 12 b. LTL’s revenue was only Rs. 13 b. Out of our revenue, we had only Rs. 1 b income from the CEB. We have around a 7% profit margin for CEB sales. So if we did not have that profit and sold at cost, CEB will have a further Rs. 70 m profit added to that Rs. 12 b. Is this what is called ‘draining CEB dry’? The problem is that critics make all sorts of accusations against us but they don’t quote figures. We also have a press which readily entertains those who irresponsibly sling mud with impunity. You only need to say the magic word ‘corruption’ and get whatever you say published.

Everybody should understand that the CEB is a huge operation compared to the 23 subsidiaries. The CEB’s profit or loss is not decided by subsidiaries. The CEB by and large has a very professional management and I will vouch that 99% of CEB engineers are not corrupt. So too is the Ministry of Power. There may be inefficiencies, but it is different to many other public institutions in this country on that aspect.

The CEB’s performance depends only on three factors. (a) How much is the tariff it is allowed to charge from consumers? (b) How much does CPC charge for the fuel used for power generation and international price of coal? (c) How much did in rain in the catchment areas in a particular year? Any other factor does not make any significant change on the big picture. The stories you hear are intended for the consumption of the gullible public, and not for the intelligent and discerning.

Q: What is the most important decision you made which became a game changer for LTL?

A: The decision to move into power generation in 1996. We responded to the government’s decision to open up power generation for private investment. We asked and got ABB to agree to increase its share capital at a time Sri Lanka was in the midst of a civil war.

The CEB also invested a further Rs. 87.5 m at that time. That was the last time CEB invested in LTL. We have not got any grants or loans from the Treasury or anybody. In fact we have paid billions as taxes to the Government.

We set up the first private power company in Sri Lanka named Lakdhanavi Ltd. as a subsidiary of LTL. None of our engineers had any experience in power plants. But I had the confidence in them. That is the key. I knew if anybody can do it Sri Lankans can do better given the right leadership. So we completed a 25MW power plant in just under 8 months and successfully operated it for 15 years. That changed our whole profile.

Q: But you were very expensive when compared to other power plants?

A: That is a complete lie. On the same day we signed Lakdhanavi’s agreement with CEB, there was another agreement signed with a foreign company for a similar but larger power plant operating on cheaper fuel (residual fuel) than fuel used by us (furnace oil). However, the CEB agreed to a tariff close to double that of Lakdhanavi.

All the power generation projects we got after that were through competitive bidding as we were the lowest bidder. We participated in an emergency power tender in 2002. We beat more than 10 bidders to be the lowest and set up 70MWs in Embilipitiya and Puttalam. Then there was another tender for 10-year contract in 2003. We bid in a joint venture with the Hemas Group. Our bid was the lowest. So we set up the Heladhanavi 100MW power plant in Puttalam. From 2004 until 2014 when it completed its term, every single year it was the cheapest power plant in the system. We have never got a single project just because we are a subsidiary of CEB but because we were the cheapest at the tender bidding. If we did not participate in any of these tenders, then projects would have been awarded at a higher price to another bidder.

Please ask anybody who disagrees with the facts to show the figures they are talking about.

Q: What was LTL’s involvement in the Kerawalapitiya 300MW Project?

A: The Power Ministry invited a proposal from us to set up Auto Diesel Combined Cycle Power Plant in December 2005. Along with  Lakdhanavi, Mitsubishi of Japan and CATIC of China also submitted proposals to the government for a turnkey contract. There was a properly constituted Cabinet Appointed Negotiating Committee (CANC) and Technical Evaluation Committee (TEC), which studied all three proposals. Only Lakdhanavi had proposed a tri-fuel-enabled power plant after its own research on the latest technology.

Lakdhanavi, Mitsubishi of Japan and CATIC of China also submitted proposals to the government for a turnkey contract. There was a properly constituted Cabinet Appointed Negotiating Committee (CANC) and Technical Evaluation Committee (TEC), which studied all three proposals. Only Lakdhanavi had proposed a tri-fuel-enabled power plant after its own research on the latest technology.

Our proposal was the cheapest and in addition was on a cheaper fuel than of the competitors. Our proposal was selected and approved by the Cabinet. Because we proposed to operate on Heavy Fuel Oil (HFO) rather than auto diesel unlike the other two, we were the obvious choice. Working on the fuel prices in 2006, our proposal would save Rs. 11 b to Sri Lanka every year by operating on HFO.

Many energy pundits filled newspaper columns those days (just like these days) that this will end in disaster saying combined cycle power plants cannot operate on HFO. For the last six years we have operated on HFO and saved more than Rs. 40 b to this country. Have you heard anybody taking about that? Nobody talks about any good done by LTL! Some critics say the project was given to us on a platter. You can see the facts are totally different from baseless accusations.

However the turnkey contract was shelved by the Finance Ministry since they could not arrange funding. We were asked to develop the project as an Independent Power Project (IPP). We proposed a tariff based on a project cost of $ 294.8 m. This also went to a CANC/TEC and the Cabinet. This we financed at very low rates from UK and French banks with guarantees from the Governments of USA, Germany, Netherlands and France.

We set up a separate company called West Coast Power Ltd. (WCPL). We got around Rs. 12.5 b equity from NSB, ETF, EPF, LECO and Lakdhanavi. Actually to enable a guarantee to lenders from the Government of Sri Lanka we had to route NSB, ETF and Lakdhanavi funds through the Ministry of Finance, which is there on paper as a 50% shareholder. But no funds from the Treasury came to this project. WCPL borrowed Euro 152 m on a 12-year loan. That is how we funded the project, which was the biggest project financing and biggest power project done in Sri Lanka. To date the Kerawalapitiya Plant is the only large-scale thermal power plant built by Sri Lankans.

I must place on record our deep appreciation of the many officials of the Power and Finance Ministries who supported us despite all the criticism. I also must say our engineers and employees selflessly worked to complete this project. We had to do all that in less than two years. We commissioned the Kerawalapitiya Project in 2008 and avoided a certain power cut in that year.

Q: But the CEB pays more than Rs. 40 for a unit of Kerawalapitiya power?

A: This is another wild accusation of our detractors. Let me explain. Any IPP has a fixed charge per year and variable charge per unit. We only make the power plant available to the CEB. It is the CEB which decides when to start and when to stop the functioning of the plant.

It is similar when you hire a car. Whether you use it or not you have to pay the monthly rental. In addition if you decide to drive it, you have other costs such as fuel and spares, which depend on how many kilometres you ran. If somebody asks you how much you spent per km, you have to divide the total cost by the number of km. In a month you never ran the car, what is your per km cost? Infinity!

The power plant also is similar. In certain years when there is heavy rainfall, the CEB uses the thermal power plant minimally thus the number of units produced is smaller. When you divide the annual capacity charge by a smaller number you get a high per unit cost. That is how they talk about Rs. 40 per unit cost. But it is a meaningless way of comparing costs. In certain years when the plant ran most of the time, we can show you that our per unit capacity cost was less than Rs. 4. Even now, if this power plant is fully utilised, the per unit cost to the country is less than Rs. 20 in total including the cost of fuel.

Q: Recently LTL was described as a pyramid scheme due to the complicated ownership structure. It was also said that there is a company called LTL ESOT Ltd., which is owned by you and six others, which ultimately controls and profits from LTL operations. Do you accept this?

A: No! It is an utter lie repeatedly uttered by our critics (despite our sending of corrections) who wish to see more and more Sri Lankan youth unemployed in order to exploit the situation politically.

LTL ESOT Ltd. is not a subsidiary of LTL Holdings. It is in fact a shareholder of LTL. As I told you earlier, until 2005 we had ABB-Norway as a shareholder. In 2004, it informed CEB that it wants to quit from LTL due to internal reorganisation. The shares were offered to the CEB, which the CEB declined to buy. ABB was about to sell it to very large multinationals, that LTL was competing with for power projects in Sri Lanka. We knew if they buy LTL shares they will ensure LTL is shut down before long.

So we used a trust mechanism with all employees as beneficiaries and formed LTL ESOT Ltd. in 2004 for this purpose. Six individuals have only seven shares out of a total of 8,530,030 shares, which is 0.000082% stake. As much as 8,530,023 shares are owned by the Trust. Therefore practically the entire company belongs to the Trust created for the benefit of all employees, not the seven individuals.

All my young engineers risked their careers in 2005 guaranteeing to stay in LTL until the loans are settled. Rs. 500 m was a big investment by any standard. So we have to get a return on it after 10 years. Yes, we get 27% of the dividends of LTL since we invested for that. What is wrong with that? But don’t forget for every one rupee that LTL ESOT gets CEB gets three rupees. Whatever LTL ESOT Ltd. gets belongs to all the current employees of LTL, not to me.

Q: How did you finance such a massive transaction with a start-up company? Some people say the CEB gave you money to buy ABB shares without buying it themselves.

A: LTL ESOT Ltd. was established for the specific purpose called a ‘leveraged management buyout’ used to buy shares of ABB-Norway in LTL by employees of LTL. In a leveraged buy-out, employees buy shares of an exiting shareholder. This is a very commonly used financing mechanism in developed economies and even in several Sri Lankan companies employees have become shareholders using this method. The Company’s Act of 1982 specifically provided (sec. 55) for this.

LTL ESOT Ltd. took a loan from NDB through LTL for the purchase consideration of Rs. 512 m. The senior management guaranteed to the bank they would not leave LTL until the loans are settled. How can the CEB give money to me? It is all nonsense. No CEB or LTL assets were mortgaged to get this loan. The loan was fully settled in 2011 with interest.

Q: We are told LTL ESOT Ltd. has huge ‘other income,’ but no revenue generating business. How does it generate its income?

A:Companies used for leveraged buyouts have no operational revenue. Their revenue comes from dividends from the companies in which they invest. Due to requirements of accounting standards dividend income has to be categorised as ‘other income’. We used such income to settle the more than 500 million in loans, which were a huge liability.

It must be noted here that shares from which these dividends come to LTL ESOT Ltd. were owned by ABB from 1980 until 2005. For 25 years this money went to Norway from Sri Lanka as foreign exchange. Nobody was worried about it then. Due to a typical Sri Lankan trait of hypocrisy, everybody wants to question only when Sri Lankans are beneficiaries.

Q: How did the present Chairman of CEB become a shareholder of LTL ESOT Ltd?

A: Well, he was formerly employed at LTL. As I said before, in 2004 to set up the company seven individuals had to subscribe for one share each. The current Chairman of CEB happened to be a senior engineer at LTL at that time and he also was asked to subscribe for one share. So he had one out of 8,500,030 ownership until 2010. In that year he became Vice Chairman of CEB and promptly transferred his share.

Q: Do you have a company called LTL Projects Ltd.? What is the controversy surrounding this company?

A: LTL Projects (LTLP) was created as a fully-owned subsidiary of LTL in 1998. The objective was to compete with foreign multinationals for Power Sector tenders, who were then monopolising such projects at huge costs to Sri Lanka. LTLP acted initially as sub-contractor to ABB for NORAD funded substation and transmission line projects. Then LTLP successfully completed KukuleTx Line, Horana Substation and Vavuniya Substation and qualified to bid of its own by 2002. Unfortunately the Asian Development Bank (ADB) informed LTLP that it is disqualified to bid for the CEB tenders funded by ADB due to the relationship with CEB.

LTL made representation to ADB to exempt LTLP. It was in vain. As a result LTLP did not have any projects for more than two years. The value of the company was reduced to Rs. (minus) 96 million. For LTL Holdings the only option was to wind up or sell the subsidiary. At this stage the employees decided to use LTL ESOT Ltd to safeguard their jobs by LTL ESOT Ltd. buying LTL Projects Ltd. The LTL Board decided to accept the proposal by LTL ESOT Ltd. to buy all one million shares. Though it has ‘LTL’ in front and we and they share a common shareholder i.e. LTL ESOT Ltd., LTL Projects Ltd operates 100% independently of LTL and has a separate CEO and a Board of Directors. None of the LTL Holdings Group employees or its resources is shared with LTL Projects.

Q: Some critics allege that LTL Projects is so successful due to the influence you use at the CEB. They say that LTL Projects offers employment to key officials who retire from the CEB in gratitude.

A:You have to pose that question to the CEO of LTL Projects. I do not get involved in that company’s affairs and do not use any influence at the CEB on their behalf.

Q: What is the future for LTL that you envision?

A: LTL is a great institution for the development of Sri Lanka’s engineering talent. Though a state institution owns us, we operate with a private sector culture and attitudes. We continue to practice best corporate policies as we did when we were under ABB. By now we have laid a firm foundation for LTL to emerge as a global player in the power sector. I believe LTL will reach that goal by the next decade. Then Sri Lanka can be proud to have a company in the stature of Siemens or ABB.

We have great potential in Bangladesh, which has only 45% electrification, and such other countries in Asia. We have great potential in many African countries. I am very positive on what we can do on a global scale. Rather than encouraging us to do that and bring more income to our motherland, most of our critics want to destroy LTL.

Q: How will you describe LTL’s future within Sri Lanka?

A: Sri Lanka has now reached almost 100% electrification. Unless we have a rapid economic development of at least 7%-8% GDP growth, I do not expect tremendous opportunities for LTL in Sri Lanka. We have chosen a path of growth beyond our shores as a result. That is why in 2015, we had only 15% of our revenue from the CEB. We are very proud to be independent of the CEB as a going concern. We will bring this figure to less than 5% within the next five years. This is why it is nonsensical to say LTL bribes all Ministers of Power and Energy. What for? Is it to get 05% of our business?

Q: How do you assess LTL’s contribution to our economy and society?

A: Well, honestly you should not ask that question from me. I think I have contributed more than my fair share to our economy through LTL. But you should get an independent judgment on that.

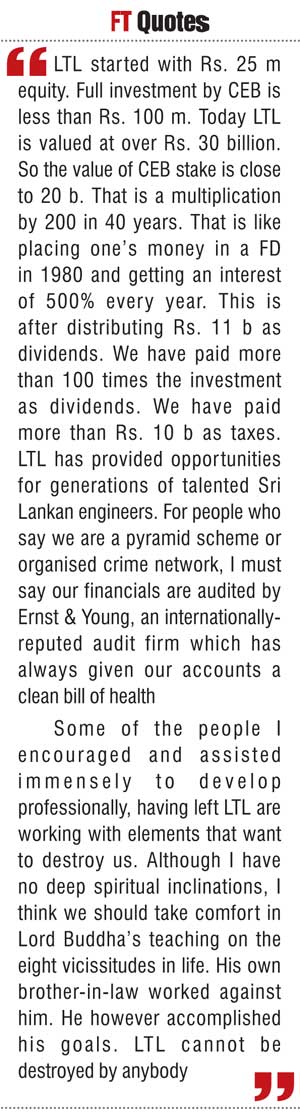

But all I can say is this. LTL started with Rs. 25 m equity. Full investment by CEB is less than Rs. 100 m. Today LTL is valued at over Rs. 30 billion. So the value of CEB stake is close to 20 b. That is a multiplication by 200 in 40 years. That is like placing one’s money in a FD in 1980 and getting an interest of 500% every year. This is after distributing Rs. 11 b as dividends. We have paid more than 100 times the investment as dividends. We have paid more than Rs. 10 b as taxes.

LTL has provided opportunities for generations of talented Sri Lankan engineers to innovate and I think we would have employed more than 500 engineers and a good number of them are now doing extremely well in Australia or Canada or UK having secured well paid employment due to the experience gained here. For people who say we are a pyramid scheme or organised crime network, I must say our financials are audited by Ernst & Young, an internationally-reputed audit firm which has always given our accounts a clean bill of health.

We have won many international and local awards for excellence in engineering, financing, quality and environmental management over the years. On an ongoing basis we sponsor and maintain world class monument lighting projects for many Sri Lankan Buddhist religious places such as Sri Mahabodhi, Ruwanweliseya, Jethawanaramaya and many more. Recently we donated the most modern intensive care unit for Lady Ridgeway Hospital. So I think we have not fared badly by any standards.

Q: How about promoting renewable power in Sri Lanka?

A: We are already there. We have two small hydro plants and a wind power plant. We are now looking at a solar power plant in the Northern Peninsula. However there are many bottlenecks and policy issues to be settled by the government before the private sector decides to invest more in this sector. There are far too many agencies you have to deal with in developing such a project.

Q: As an engineer and entrepreneur and one of the most senior and respected engineers in Sri Lanka today, you have created an institution that will survive you and your legacy. Sitting in that position how do you cope with all the criticism levelled against you and LTL?

A: Well, as I said before, this is not the first time we are experiencing it. I am very used to this. I always think if I were not successful, nobody will talk about us. So they give me the best compliment possible. We will have this in future too. It is how the world is. There is no great company in the world that has not been criticised by ungrateful people.

Some of the people I encouraged and assisted immensely to develop professionally, having left LTL are working with elements that want to destroy us. Although I have no deep spiritual inclinations, I think we should take comfort in Lord Buddha’s teaching on the eight vicissitudes in life. His own brother-in-law worked against him. He however accomplished his goals. LTL cannot be destroyed by anybody. In fact, these developments have fostered great unity among my senior management and that itself will enable us to achieve more in the future. So I have no hatred towards anybody who criticises me.