Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 12 January 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

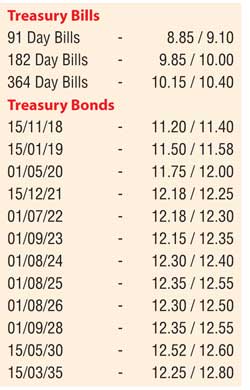

Activity in the secondary bond market moderated considerably yesterday with yields edging up marginally on two way quotes with most market participants seen on the sidelines.

Meanwhile in money markets, the Open Market Operations (OMO) Department of Central Bank was unsuccessful in draining out liquidity by way of outright sales of Treasury bills as no bids were received. The overnight call money and repo rates remained mostly unchanged to average 8.29% and 8.53% respectively as net surplus liquidity increased further to Rs.75.56 billion yesterday.

However, the OMO department of Central Bank was seen mopping up an amount of Rs.70.72 billion on an overnight basis by way of a Repo auction at a weighted average rate of 7.43%.

Rupee dips

once again

Meanwhile in Forex markets, the USD/LKR rate on the two week and one month forward contracts depreciated marginally yesterday to close the day at Rs.150.60/70 and Rs.151.00/15 against its previous day’s closing levels of Rs.150.35/50 and Rs.150.85/95.

The total USD/LKR traded volume for the 10th of January 2017 was US $ 104.43 million.

Some of the forward USD/LKR rates that prevailed in the market were 3 Months - 152.55/70 and 6 Months - 154.90/10