Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 4 November 2015 01:01 - - {{hitsCtrl.values.hits}}

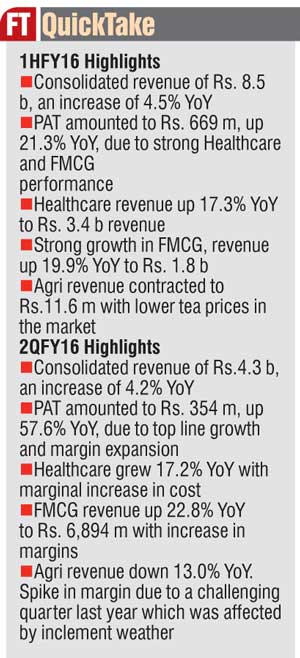

Sunshine Holdings PLC has reported consolidated revenues of Rs. 8.5 b for the half year ended 30 September (1HFY16), up 4.5% YoY. PATMI grew 9.5% YoY to stand at Rs. 334 m for 1HFY16, on the back of a 21.3% YoY growth in PAT to Rs. 669 m despite challenges in the Agri sector.

All segments, apart from Agri (38.2% of Group Revenue) which contracted 11.6% YoY, contributed towards top-line growth during 1HFY16. Group’s Healthcare sector (40.2% of Group Revenue) grew 17.3% YoY, and FMCG (18.5% of Group Revenue) grew 19.9% YoY against the same period last year.

For 1HFY16, PAT amounted to Rs. 669 m up 21.3% YoY, which trickled down to Profit After Tax and Minority Interest (PATMI) which went up by 9.5% YoY to Rs. 334 m. PAT from both Agri and FMCG sectors has a lower impact on the group PATMI due to lower effective holding. Healthcare still remains the largest contributor to PATMI in 1HFY16 with LKR180m, which represents 54.0% of total PATMI.

Net Asset Value per Share increased to Rs. 40.78 as at end 1HFY16, compared to Rs. 39.24 at the beginning of the year (FY15).

Business Segments

Healthcare

Healthcare Revenue for 1HFY16 grew 17.3% YoY, exceeding management expectations, to stand at Rs. 3.4 billion. The Healthcare segment has overtaken Agri to be the biggest contributor to Group Revenue, accounting for 40.2% of the total. EBIT margin for 1HFY16 increased by 10 bps to 7.9% on the back of tight cost control, despite supply-side pressure from business partners. 2QFY16 EBIT margin expanded to 8.3% against 7.9% during the same quarter last year due to higher productivity.

The Pharma sub segment which made Rs. 2.3 billion in revenues (66.3% of Healthcare Revenue) grew 16.5% YoY over 1HFY15. Strong growth in this segment has outperformed the overall market which grew 4.8% YoY as reported by IMS. The company’s Pharma segment is the 2nd biggest player in the country with 11.7% share of the market. Growth in other sub sectors were: Surgical (+15.2% YoY), Retail (+17.8% YoY), Diagnostics (+38.6% YoY), Wellness (+25.7% YoY) respectively.

PAT for Healthcare amounted to Rs. 180 million in 1HFY16, up 16.6% YoY, but margins remained flat at 5.3% where GP margin pressure from suppliers were countered by higher productivity and tight control in overheads.

FMCG

The FMCG sector reported revenues of Rs. 1.6 billion in 1HFY16, up 19.9% YoY, on the back of both volume and price growth, and the sector accounted for 18.5% of Group Revenue for the period. The branded tea business within FMCG sold 1.7m kg of branded tea, up 11.1% YoY, primarily driven by their largest brand ‘Watawala Tea’ – which is the number one selling Tea brand in Sri Lanka.

PAT from the FMCG segment grew 85.1% YoY, to stand at LKR228m in 1HFY16, with a margin of 14.4%, compared to 9.3% in the same period last year. The huge spike in profitability is attributable to lower raw material costs, resulting from depressed Ceylon Tea prices which affect the FMCG business favourably.

Agribusiness

The sector represented by Watawala Plantations PLC (WATA) saw revenue contract by 11.4% YoY to Rs. 3.3 billion, on the back of a 22.3% YoY contraction in Tea revenue, despite an 8.8% YoY increase in volumes. The segment was adversely affected by the weak market prices in the Colombo Tea Auction stemming from lower demand from key export markets. The Palm Oil sub sector grew by 5.3% YoY for 1HFY16, with volumes similar to 1HFY15. PAT for 1HFY16 amounted to Rs. 262 m, similar to that reported for the same period last year.

Loss for the Tea segment amounted to Rs. 243 m in 1HFY16, compared to a loss of Rs. 199 m in 1HFY15 on the back of lower sales. Palm Oil segment which made Rs. 467 m PAT for 1HFY16, continued to be the largest contributor to WATA profits and managed to cover the losses in both Tea and Rubber.

Other

Packaging revenues amounted to Rs. 169 m, up 22.1% YoY in 1HFY16, against Rs. 137 m in the same period last year. This performance is in line with management expectations for the segment, with the printed sheet business ramping up its contribution to Revenue. PAT amounted to Rs. 7 m in 1HFY16 compared to a loss of (LKR7m) in 1HFY15 as a result of improved capacity utilisation coming from new export orders.

Revenue for the Renewable Energy division amounted to Rs. 62 m in 1HFY16, up 34.8% YoY from Rs. 46 m during same period last year, due to heavy inter-monsoon rainfall and improved plant and grid stability. The mini-hydro plant, which is in its second year of operation, made PAT of Rs. 21 m for 1HFY16, compared to Rs. 2 m in 1HFY15.