Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 5 February 2016 00:00 - - {{hitsCtrl.values.hits}}

The TJL Group, the region’s largest knit fabric manufacturer, yesterday announced its third quarter financial results, delivering its strongest quarter ever.

The TJL Group, the region’s largest knit fabric manufacturer, yesterday announced its third quarter financial results, delivering its strongest quarter ever.

The Company delivered an impressive year on year bottom-line growth of 79%; a testament to its first full quarter as a Group; consolidating the performances of its subsidiaries Ocean India Ltd. (OCI) and Quenby Lanka Ltd. (QPL).

The Group’s consolidated revenue was Rs. 5.6 billion, a 39% over the previous quarter, and 48% over last year. The increase in gross profit could be directly attributed to consolidation, the improved margins achieved during the quarter under review, through envisaged sourcing synergies coming in to play and cost management strategies as well as TJL’s fast growing value added product portfolio.

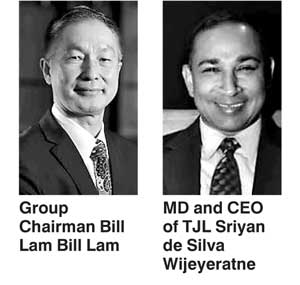

Group Chairman Bill Lam said that under the single Group operating structure, the teams have succeeded in working cohesively, executing at Group levels and ultimately delivering results that speak for themselves.

“Amidst the reality of an increasingly challenging global space we continue to pursue every new opportunity; leveraging our new regional footing and providing flexible and better solutions to a broader-based customer portfolio, through which we are confident of sustaining our performance and increasing shareholder value,” he said.

Textured Jersey Lanka PLC’s (TJL) standalone performance during the period under review, recorded a net profit of Rs. 402 million, which was a 7% growth delivered on a topline of Rs. 3.9 billion. Furthermore, the bottom-line growth was despite the cost of investments on strategic initiatives.

TJL also chose to take a loss of income due to non-renewal of its operational technical service agreement with OCI, since the companies are now consolidated. The Group’s gross margin growth of 103% is driven by the sustained growth of their acquired entities that were successfully turned around in the first half of the financial year, increased value-addition to their customers and astute execution down the entire Group structure.

TJL MD/CEO Sriyan de Silva Wijeyeratne said that Group was on target towards establishing a well-balanced retailer and vendor base and customer demand was strong for its cutting edge Innovations, both in the fabric and print space.

“Customers have responded positively to our broader solutions and stronger innovation capabilities. No doubt we are operating in an increasingly competitive industry, both globally and locally, but though challenges persist, we have proved our resilience in continuing to pursue new opportunities, and we are confident of our ability to sustain the growth momentum,” he said. “The team has consolidated our new subsidiaries and their teams exceptionally well, and we are seeing fantastic momentum in those areas,” he added.

The end results currently have delivered a nine-month performance of Rs. 1,347 million exceeding the 12-month performance of the previous Financial Year 2014/15, and thereby doubling the TJL consolidated Earnings Per Share from 0.57 in 3Q FY 2014/15 to 1.02 in 3Q FY 2015/16.

The Chairman said that the Group remains committed to a strong balance sheet, “TJL has optimised its working capital and remained unleveraged with a net cash surplus of Rs. 2.1 billion. Despite its total acquisition and cash outflows, it has continued to increase its cash reserves during the year.”

TJL’s strong cash position has delivered its shareholders a 20% interim dividend growth, to Rs. 0.6 per share.

With its acquisitions concluded during the first half of 2015/16, TJL has successfully merged strengths and expertise as a Group, continuing to forge ahead towards fulfilling their long-term business aspirations and profitability growth.

The CEO says that TJL will continue their focus on innovation, execution excellence and on-time delivery, which they would maintain at the highest levels.