Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 14 June 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

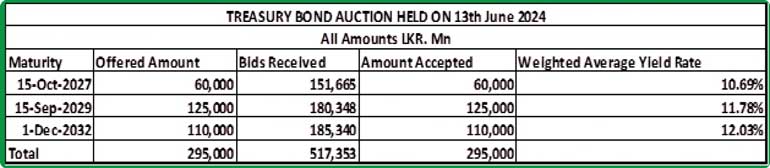

The historical Treasury bond auction conducted yesterday reflected a positive outcome as the total offered amount of Rs. 295 billion was fully raised at the 1st phase in competitive bidding. The total bids received exceeded the offered amount by 1.75 times, a notable achievement given the scale of the auction.

The historical Treasury bond auction conducted yesterday reflected a positive outcome as the total offered amount of Rs. 295 billion was fully raised at the 1st phase in competitive bidding. The total bids received exceeded the offered amount by 1.75 times, a notable achievement given the scale of the auction.

The 2027 tenor 15.10.27 was seen recording an impressive weighted average rate of 10.69% against a pre-auction rate of 10.70/90 on similar maturity while the 2031 tenor of 01.12.2031 too recorded an impressive weighted average rate of 12.02% against a pre-auction rate of 11.85/95 on liquid 15.05.30 maturity. The 2029 tenor of 15.09.2029 fetched a weighted average rate of 11.78%.

An issuance window for all three maturities is open until close of business of day prior to the settlement date (i.e., 4.00 pm on 14.06.2024) at the Weighted Average Yield Rates (WAYRs) determined for the said ISINs at the auction, up to 10% of the respective amounts offered.

Meanwhile, the secondary bond market yesterday started off on a strong note with the IMF Executive Board completing the 2024 Article IV Consultation and Second Review under the 48-month Extended Fund Facility with Sri Lanka, providing the country with immediate access to SDR 254 million (about $ 336 million) to support its economic policies and reforms. The IMF commended Sri Lanka’s economic reforms and policy measures aimed at stabilising the economy and enhancing fiscal resilience. The review highlighted progress in key areas such as fiscal consolidation, revenue mobilisation, and structural reforms. The IMF emphasised the importance of continued efforts to maintain macroeconomic stability, address vulnerabilities, and promote sustainable growth.

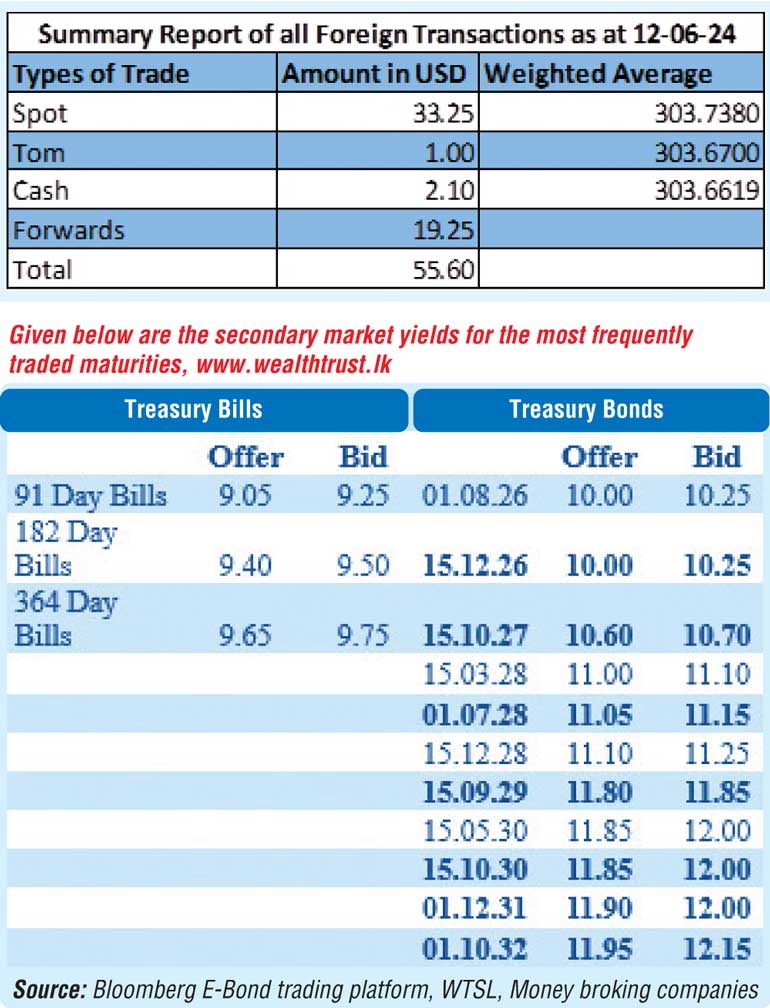

The activity centred on the liquid maturities of 2028’s (i.e., 15.03.28 and 01.07.28) as its yields were seen dipping to intraday lows of 11.00% each during morning hours of trading against its previous day’s closing levels of 11.10/25 and 11.15/35 respectively.

However, activity was seen shifting to auction maturities subsequent to the announcement of the auction results as the 15.09.29 maturity was seen trading down from an intraday high of 11.90% to a low of 11.78%, with notable buying interest observed. Additionally, the 15.10.27 and 01.12.31 was seen changing hands at the rate of 10.70% and 12.00%.

The total secondary market Treasury bond/bill transacted volume for 12 June was Rs. 115.61 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.68% and 8.73% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight reverse repo auction for Rs. 19.24 billion respectively at the weighted average rates of 8.57%.

The net liquidity surplus stood at Rs. 144.88 billion yesterday as an amount of Rs. 0.03 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 164.15 billion being deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 303.85/303.95 as against its previous day’s closing level of Rs. 303.80/304.00.

The total USD/LKR traded volume for 12 June was $ 55.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)