Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 4 January 2023 00:10 - - {{hitsCtrl.values.hits}}

For the last 10 years, the Sri Lankan economy has been used to facing shocks and getting back on track. Be it the three-decade war, Tsunami, Easter attacks, or the ousting of the former president, but this time around that collateral damage is severe.

Poor decision-making

Sri Lanka becoming a failed state globally and shaming every Sri Lankan living on the planet, was due to three key reasons: poor policymaking by successive governments, corruption that has not been booked, and the low share of voice of the business chambers. This is the bitter truth and it holds ground even today.

There are many examples to cite but a contentious issue highlighted on poor decision making by policymakers is the $ 12.3 billion loans taken from private creditors and the $ 7 billion loans taken from China which is 6.2% of debt to the Central Government. Many of the projects that are funded by Chinese capital are invested on projects which have zero ROI. Many of them are white elephants that the poor taxpayers have to pay for. The Nelum Kuluna, the Mahinda Rajapaksa Convention Centre are cited the most at every forum. A point to note is that it is the same group of households that got impacted due to the Easter attacks, economic crisis and the current hyperinflation too. This is the same consumer group that will have to pay the increased PAYEE tax that comes to effect from January 2023.

It is important for Sri Lanka to do a self-evaluation as to why we demonstrate poor leadership even though we are saying that Sri Lanka is the hub for education and that the highest literacy rate in the South Asian region is Sri Lanka. A week will not pass by in Colombo without a ‘business conference hinging on education’ and the newspapers flashing those to attend and the key discussion points. However we continue to see poor decision making by the public sector whilst the private sector chambers remain silent.

The best case in point we saw in 2022 was the move to make Sri Lanka an organic farming country against the advice of the top agricultural experts and academia. Many forgot that almost two-thirds of the population directly or indirectly is dependent on the agricultural sector. Banning the import of synthetic fertiliser cost Gotabaya Rajapaksa the seat of the President of Sri Lanka, is a fair statement to make. Sri Lanka had very few alternatives and finally had to import rice due to the ramification of the decision of banning synthetic fertiliser.

Ceylon tea in 2022 registered a 20% decline in production output due to the fertiliser ban impacting the harvest. The then Chairman continued to support the decision on the fertiliser ban even when the whole industry was against the decision. This explains the root of poor decision-making.

Some speculate that the current financial crisis in Sri Lanka is due to the shock on the agricultural sector in the backdrop of the COVID pandemic wiping away tourism earnings and the rising oil prices due to the Ukrainian war. Be that as it may, the current failed state situation is due to poor decision-making instigated by the political leadership. This is the reality that we have to change in 2023.

Another, questionable poor policy decision was the increasing money supply by 42% during the period December 2019 and August 2021. This resulted in inflationary pressure that catapulted prices to increase by 85%. To bring this argument to a close, the final straw of bad policy was the slashing of personal income tax and corporate tax rate in 2022. This resulted in the revenue generation in the country dropping from 15% of GDP to a crazy 8% that brought Sri Lanka to its knees.

To summarise, the current economic shock is different to the ones before and the collateral damage to the country is severe. The people who should be held accountable are the political leadership together with the public sector policymakers and the business chambers who remain silent.

Consumer reality 2022

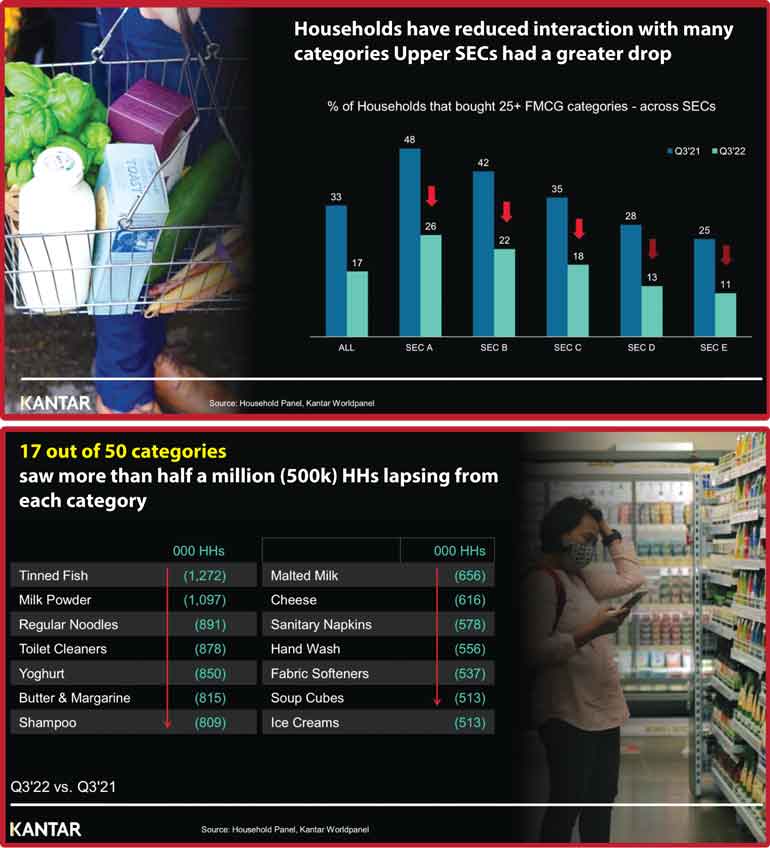

If we go to data, we see the collateral damage at the consumer end. As per the latest data from the respected research company Kantar, we see how across the board all walks of life have to tighten their belt. For instance, normally a typical socio economic classified consumer (i.e. a professional working in senior management) has scaled down from typically buying 48 categories to 26. A movement in lifestyle by reducing the products one uses at home by 46%. At the lower end of the pyramid the scaling down is as high as 50% which is the reality.

If we dig deeper, we see how almost 1.1 million households have moved out of purchasing a key category like milk powder. This is very serious given that milk powder is the category that gives nourishment to children. In a recent press conference by the Ministry of Health Promotions Bureau it was revealed that children who are stunted on growth has increased from 7% to 9.2% with 18,420 children being in the malnourished squadron on a representative cross section sample. Children who are below weight have increased from 12.2% to 15.3% which are indications of a bigger problem at hand. This is the reality we are up against.

Kantar research also throws out the fact that out of the 50 categories that a typical household buys products in a supermarket almost 17 have moved to be a lapsed category with almost half a million households from Sri Lanka moving out of the category.

A point to note is that this consumer behaviour is seen prior to the new PAYE tax that will come to effect from January, 2023. Which means that we will see a further erosion of the products and services that will be used by consumers by March, 2023.

World in recession

The latest view from global experts is that the world is already in a recession with the US, EU and China slowing down in growth. Sri Lankan economy is predicted to crunch by 9.3% in 2022 whilst another 3% in 2023 which means that we are already in the recession. IMF Managing Director Kristina Georgieva has stated that one-third of the world’s economies are in recession. Sri Lanka is in this segment. With the new PAYEE tax coming into play in Sri Lanka the disposable income will further reduce and the demand for goods and services will shrink. Some speculate that almost 30% of new households will move out of the Full Cream Milk Powder category. Which means that half the country’s population will not be users of this important product category. This can get aggravated if COVID-19 spreads from China to the world. I guess WHO will have to get firmer on their request for the ‘real ground reality’ so that it can be curtailed rather than driving the world to a further issue.

Next steps – Sri Lanka

We see the collateral damage at a consumer end due to poor decision making in Sri Lanka. The unilateral decision not to go to the IMF was a point I did not highlight before but could have averted the above challenge. The former Governor of the Central Bank confidently voiced that a home grown solution is preferred to solve the country’s problems. This again was poor decision making from an entity like Central Bank – that has the best brains in Sri Lanka.

Whilst we can see the challenges, a point that we are missing is that the IMF upped the growth number of India from 6.7% to 7.2% last week which means that the Indian economy is on high gear. The good news is that Sri Lanka has an FTA with India and now we are moving to a deeper integration of the economy with the service sector inclusion to the current FTA and the routine activity like a direct air link from South of India to North of Sri Lanka, the ferry service that will also come to play between the two counties can lead to many opportunities for expanding Sri Lanka’s economy. The question is if there is a political will and if the private sector chambers will support such macro growth agendas.

(The writer can be contacted on [email protected]. He is a driver of AI for brand mapping in Sri Lanka, Maldives and Pakistan.)