Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 18 October 2022 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka is economically bankrupt and some may say morally too – Pic by Shehan Gunasekara

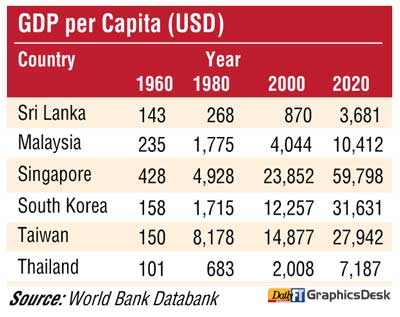

Sri Lanka’s economic conditions have strayed far beyond what any of us would have imagined with conditions progressively worsening over the past 18 months. We have now been quite pathetically downgraded to a lower income country from the middle income country status that we were elevated to over two decades ago in 1997. There is an enduring debate on what, why and how we became a failed state. What is common in all those arguments is that successive governments failed to fix the problem despite familiar signs of froth for decades since Independence.

Decisions of our leaders, politicians, public sector, private sector and a combination of various permutations can be said to be the cause of our failure. A search for a scapegoat is the easiest of all hunting expeditions; however, let’s hope we could learn from those blunders to charter a different path to fix the problem.

Let’s define the problem statement: Sri Lanka is economically bankrupt and some may say morally too!

We boast of high literacy, high Human Development Index (HDI) on par with developed nations, strategic location, and high quality of living in South Asia…but majority of our population is still poor…why?

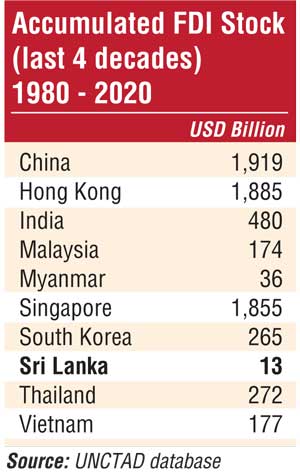

The symptoms were quite obvious; consistently inconsistent policies, indiscriminate subsidies that the State cannot afford, exports have declined as a percentage of GDP, lack of export diversification and value addition. We import twice as we export and we have a twin deficit. Our currency has depreciated systemically over the years, FDIs have never managed to reach anywhere close to its potential (see chart), taxpayers continue to underwrite the losses of state enterprises, rising youth unemployment rate and graduate unemployment continues to haunt us. What is being taught at schools and universities have failed to cater to the current requirements of the corporate world, and impactful education reforms were never done by any successive government.

Our financial institutions, especially banks failed to promote entrepreneurship, which was key for the revival of the economy, especially in the post-war era in particular, there was much hope for a better Sri Lanka and banks could have played a much larger role to support the growth of the economy. The entire banking system is designed around wealth accumulation and ‘not creation’!…Over 65% are in the informal sector, mostly excluded from the banking system notwithstanding we boast of more bank branches than all the supermarket chains put together. We still rely on traditional deposit based or asset backed lending, our BOI law is over 40 years old and does not suit the purpose.

The question we must ask ourselves is whether the standard prescription of fiscal consolidation (reduce Government spending and increase taxes) and inflation targeted monetary policy (raising interest rates and reduce money supply to combat inflation) will work? Or does Sri Lanka’s current predicament call for a complete reappraisal of previously held conventional wisdom?

An IMF bailout is not a panacea for all our ills, we should in parallel charter our own suitable long-term solution with a lot of conviction and not be forced to adopt a cookie-cutter once size fits all approach. Whatever the collaborative solution we charter, it should not hamper economic growth of the country. Afterall, to increase tax revenue to GDP (one of the lowest in the world), economy has to grow and just merely increasing taxes (a short sighted solution) would not give us the desired sustainable outcome.

Once I had the privilege of working closely with the CEO of one of the crown jewels of Dubai. He was a foreign national selected to this top job and he told me how he once in conversation with the ruler of Dubai Sheikh Mohammed bin Rashid Al Maktoum, had said that he has five crown jewels (in no particular order); Port of Jabel Ali, Emirates Airline, Dubai International Airport, Dubai International Financial Centre (DIFC) and the Dubai Duty Free. I am sure, many of you must be surprised to learn of the fifth crown jewel as I was too. Dubai with its liberal policies, a long time Western ally has managed to steer a shrewd but a neutral path to attract significant amounts of foreign capital and talent and more recently gained handsomely from geopolitical disruptions. Dubai is a financial hub where just about anyone can do business with just about anyone else. I believe Sri Lanka too has much to learn from Dubai’s unspoken trade-offs and strategy on international relations. We can leverage Sri Lanka’s non-aligned position in SAARC to better position ourselves to benefit from global trade and investments.

We plan far too many things and achieve very little as we have failed miserably on implementation. Over the years we have seen far too many roadmaps, policy statements, committees but none have been effective and impactful in bringing long-term stability to our economic landscape. Perhaps the only bold measure was the opening of our economy in 1977, albeit people are divided by polarised views on the virtues of such a policy.

What would be the crown jewels of Sri Lanka? My picks would be, Tourism, Port(s), Airport(s) and Port City Special Economic Zone. You may have a different view as to what should be our crown jewels, nonetheless, once the crown jewels are identified, defined and the rationale is agreed, a long-term policy framework should be put in place. Politicians of every stripe should endorse and support this policy framework. Adequate resources including capital and human resources with international expertise should be mobilised to develop the crown jewels.

An implementation plan with medium term (5-10 years) and long-term (10-20 years) goals should be put in place and respective line ministry/agency should be given full authority to implement the said plan. The line ministry/agency should be housed with capable people to deliver and an apex Advisory Committee can overlook the entire development, identify synergies and monitor progress. In establishing the Advisory Committee, the Parliamentary Council (tasked with maintaining Independent Commissions aimed at depoliticising the public service) can nominate, however nominees should not hold any political office and they should possess required expertise and qualifications in said disciplines.

In our quest to develop the crown jewels of Sri Lanka, we will see emerging opportunities for sub-sectors and industries, and economic growth induced tax revenue would put us back on a sustainable recovery path. Governance structure of the crown jewels should be operated more like a private enterprise with a lean structure and strong institutional framework to ensure minimal political interference and eliminate ad hoc policy changes due to change of government. Whilst a tolerable level of political influence may have to be accepted in this neck of the woods, there needs to be a system of governance with accountability and with adequate controls to ensure that our crown jewels retain their unique lustre and serve their purpose in restoring our image as truly the pearl of the Indian Ocean.

(The writer serves in the senior management capacity of one of the largest Public-Private-Partnership Projects in Sri Lanka. The views expressed in this column are his own and not reflective of the organisation he is a part of).