Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 3 June 2021 00:00 - - {{hitsCtrl.values.hits}}

What we are experiencing today is the deepest-ever financial crisis in the history of this country. The tradition of undisciplined, irresponsible governance of public finance over the years has led the country to an unprecedentedly vicious cycle of exponentially increasing national debt

This article, which is written as an update to the booklet ‘Mulya Agadhayak Abiyesa’ (on the brink of a financial precipice) that was written by me in 2016, is intended to urge the Government to rectify the grave flaws in its current financial strategy, and in the meantime to make the people of this country aware of the need to compel the Government to do so, in order to avoid an otherwise inevitable, irrecoverable and catastrophic, grave financial crisis. It is an earnest appeal made in the national interest, above politics.

This article, which is written as an update to the booklet ‘Mulya Agadhayak Abiyesa’ (on the brink of a financial precipice) that was written by me in 2016, is intended to urge the Government to rectify the grave flaws in its current financial strategy, and in the meantime to make the people of this country aware of the need to compel the Government to do so, in order to avoid an otherwise inevitable, irrecoverable and catastrophic, grave financial crisis. It is an earnest appeal made in the national interest, above politics.

The country on the brink of a financial precipice

What we are experiencing today is the deepest-ever financial crisis in the history of this country. The tradition of undisciplined, irresponsible governance of public finance over the years has led the country to an unprecedentedly vicious cycle of exponentially increasing national debt.

One of the prime causes that has led to this crisis is the short-term high interest commercial debt raised by the Government in order to finance certain mega projects that do not generate any meaningful financial or economic returns—either never, or in the near-term—enabling payback of such debt.

This was highlighted in my publication ‘Aalapaalu Arthikaya’ published in 2014. It was also spontaneously expounded by me how and why the tax-cuts introduced by the present Government in December 2019 would mark a point of no return in its undisciplined policy towards public finance.

What are the consequences?

What are the consequences?

Government debt as a percentage of GDP has reached 109.7, as per the official reports of the Central Bank. This is the highest-ever figure in history, and would stand in excess of 113% if the true financial burden of the sovereign bonds issued by the country, rather than their devalued market value, were to be considered in the calculations.

The immediate cause of this unprecedentedly high percentage of public debt has obviously been the collapse of Government revenue by as much as 40% due to those indiscriminate tax-cuts introduced in December 2019, which in turn has also led to a budget deficit of staggering 11.1% of the GDP. Again, the effective budget deficit, when adjusted for the overdue debt service payments, would rise to 14% of GDP.

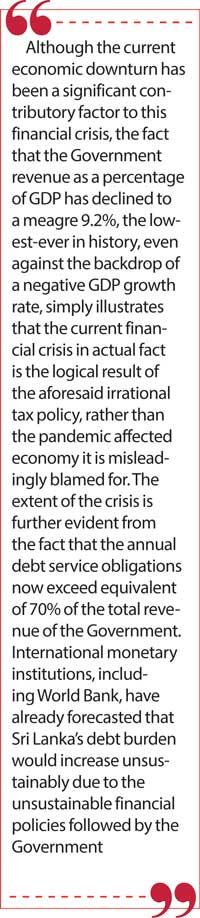

Although the current economic downturn has been a significant contributory factor to this financial crisis, the fact that the Government revenue as a percentage of GDP has declined to a meagre 9.2%, the lowest-ever in history, even against the backdrop of a negative GDP growth rate, simply illustrates that the current financial crisis in actual fact is the logical result of the aforesaid irrational tax policy, rather than the pandemic affected economy it is misleadingly blamed for.

The extent of the crisis is further evident from the fact that the annual debt service obligations now exceed equivalent of 70% of the total revenue of the Government. International monetary institutions, including World Bank, have already forecasted that Sri Lanka’s debt burden would increase unsustainably due to the unsustainable financial policies followed by the Government.

Continued spiralling of Government debt, leading to financial bankruptcy of the country, will be the inevitable consequence of the current policy on public finance, if continued unabated any further. It is to be noted that this policy has also already brought to bear upon us a crucial downgrading in our international creditworthiness ratings, ranking ourselves alongside such high-risk countries as Angola, Mozambique, Congo, Ethiopia, Gabon and Argentina. This has virtually closed our avenues of access to international financial markets.

Given the average annual debt service obligations, which amount to $ 6-7 billion at the current level, the inability to borrow foreign funds for debt servicing simply means that we have been relegated in effect to the status of a country sitting on the brink of bankruptcy.

Where are the current financial strategies of the Government headed?

Where are the current financial strategies of the Government headed?

What is the approach of the Government, and can we as a country be satisfied with its response?

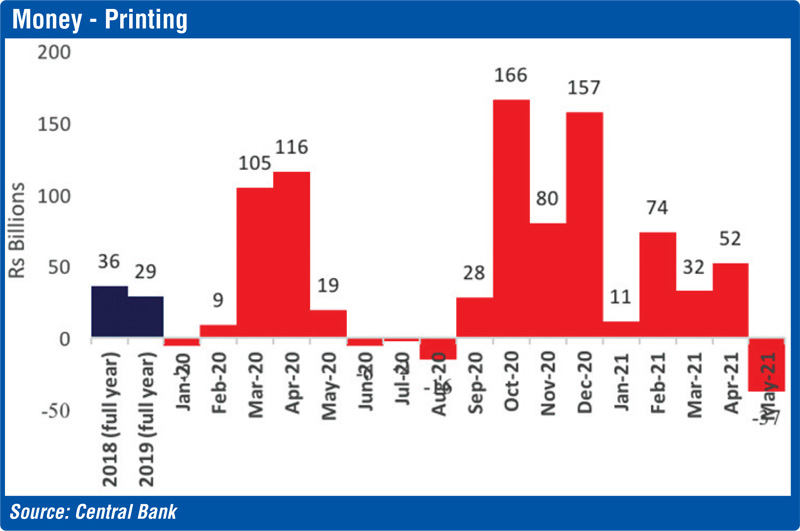

The first response by the Government has been resorting to unrestrained money printing, and borrowing from commercial banks. The Government has printed Rs. 650 billion during 2020, and 169 billion during the first four months of 2021. While the impact of such indiscriminate money printing in exerting inflationary pressures on the cost of living of people, as well as on exchange rates, is already becoming evident, this trend is headed to severely aggravate in the coming months.

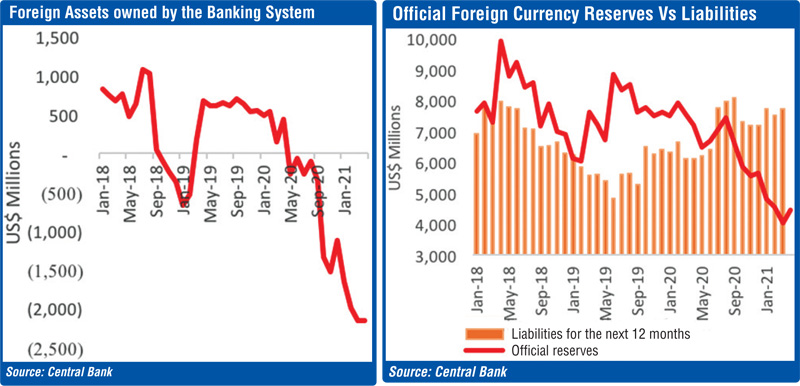

The second response has been utilising the official foreign currency reserves of the Central Bank for debt-servicing, and acquisition of foreign assets of the commercial banks. While this has created undue pressure on the sustenance of the operations of the banking system, concerns have also emerged even about acceptance of the letters of credit issued by the commercial banks.

Further, the official foreign currency reserves of the Central Bank have declined to $ 4 billion, the lowest since 2010, and the Government has no other recourse than to depleting it by further $ 1.5 billion within the next two months for debt-servicing.

In the meantime, the total net assets of the banking system is declining at an alarming rate. There will be severe constraints in importation of such essential goods as petroleum, pharmaceuticals, fertiliser, and capital and intermediate goods—meaning that skyrocketing prices and black markets will become the order of the day.

Though the approach of the Government reminds us of the old adage about the proverbial ‘Induruwe Achariya’, who, trying to mend one defect, ended up creating many, we have no intention of ridiculing the Government’s disastrous approach for political mileage, because, quite regardless of the perpetrators responsible, the people of this country including the generations to come will have to pay a heavy price unless the current crisis is rationally and judiciously managed and resolved.

What are the imperatives?

Stabilising public finance remains a key strategic priority. First and foremost, this necessarily calls for a major reversal in those indiscriminate tax-cuts introduced in December 2019. This would build the confidence of the local and foreign investors, as well as international financial Institutions, on the stability of the country's public finance framework.

A stabilising public finance framework would minimise the need for money-printing, and would stabilise the economy in turn. The other imperative is debt-restructuring—negotiating and agreeing upon with creditors on a restructured debt-service plan, formulated on the basis of a prudent public finance stabilisation plan.

In the meantime, it is also necessary to work closely with international financial institutions in order to gain the confidence of the investors. Failure to do so, and resorting instead to foreign currency swaps with a few chosen countries will only amount to temporary delaying of the impending imminent explosion, paving the way, in the process, to outright sale of land and other valuable national assets to foreigners. Therefore, stabilisation of public finance and debt-restructuring stand as non-negotiable strategic imperatives at the moment.

None of those measures will be ‘popular’ moves, and would entail difficult experiences in the years to come. However, evading the restructuring measures proposed above, and any attempts to continue with business as usual with the current policies, could only spell unprecedentedly grave, irrecoverable, financial and economic disaster.

It is the responsibility of all concerned not to allow the tragedy that befell such resource-rich countries as Venezuela and Zimbabwe, in the face of irresponsible macro-economic management, to befall Sri Lanka. It is also crucially important that the political leadership and the bureaucratic ranks resort to exemplary practices of austerity, rather than seeking to burden the general public alone.

Proof of leading by example rather than precept must be clearly evident, before a possible explosion of the acute social unrest that has been rapidly growing—on the one hand due to fostering of a Government-sponsored class of business elite comprising political cronies, at the expense of the broader business community, and on the other hand due to gross politicisation of the handling of the COVID-19 pandemic.

In the meantime, there observed is an acute tendency of exodus of hundreds of thousands of educated youth, while those with sufficient wealth to afford are increasingly securing resident visas in other countries. If this trend continues, we run the risk of ending up as an uncivilised desert depleted of a resourceful citizenry.

This is an hour that this nation most profoundly demands a ‘rise to the occasion’ by all of its resourceful and capable men and women. The time has come to force the Government to change its doomed economic strategy.

We urge the Government again to adopt a prudent strategy on public finance on the basis of the principles outlined above, with the consent of the people; and we pledge our unconditional support for the same as we believe that not doing so will unfortunately be in nobody’s interest, and would lead to everybody’s regret.