Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 6 February 2024 00:01 - - {{hitsCtrl.values.hits}}

It is important for central banks to guide the perception and expectations of economic agents towards the desired path of inflation

It is important for central banks to guide the perception and expectations of economic agents towards the desired path of inflation

Improved transparency and credibility of the central bank through effective communication and better public understanding of this communication would be mutually beneficial to maintain low and stable inflation, which is the prime objective of the central bank.

The CBSL fully recognises the importance of transparency and effective communication in shaping inflation expectations of the public. Several efforts are being taken to increase information sharing with the public. In this regard, an updated inflation fan chart is published in the monthly inflation press releases, six monetary policy reviews in the year, and two bi-annual Monetary Policy Reports with detailed explanations

Following the adaption of Flexible Inflation Targeting (FIT) as the monetary policy regime in Sri Lanka, the inflation fan chart has become an integral part of the monetary policy communication at the Central Bank of Sri Lanka (CBSL). Although the fan chart has appeared many times in press releases and publications of the CBSL in recent times, the understanding of the public and other stakeholders of fan charts seem to be limited, thus undermining the purpose of publishing fan charts by the CBSL. This note aims to explain the basics of the inflation fan chart to improve the understanding among wider users of CBSL communication.

Following the adaption of Flexible Inflation Targeting (FIT) as the monetary policy regime in Sri Lanka, the inflation fan chart has become an integral part of the monetary policy communication at the Central Bank of Sri Lanka (CBSL). Although the fan chart has appeared many times in press releases and publications of the CBSL in recent times, the understanding of the public and other stakeholders of fan charts seem to be limited, thus undermining the purpose of publishing fan charts by the CBSL. This note aims to explain the basics of the inflation fan chart to improve the understanding among wider users of CBSL communication.

What is a fan chart?

‘Fan chart’ is not a statistical term. It is a simplified term used to refer probability distribution of a forecast. ‘Fan chart’ became a popular term with its usage by the Bank of England when it started publishing in inflation reports in the late 1990s, shifting discussions of forecast from accuracy of forecast to assessment of risks and uncertainties surrounding the forecast.

Predicting the future is useful in any decision making process. However, predicting future events with precision is an extremely difficult or almost impossible task due to several uncertainties that could occur in the future. Central banks cannot refrain from projecting the future path of key economic variables due to the fear of facing uncertainties in the future and to be blamed for forecasting errors. A fan chart is a tool available to the central banks to communicate projected future path of an economic variable, mainly inflation, along with uncertainties of that projected path. Technically, a fan chart depicts the forecasting distribution of a variable based on the information available at a particular time.

A closer look at inflation fan chart of the CBSL

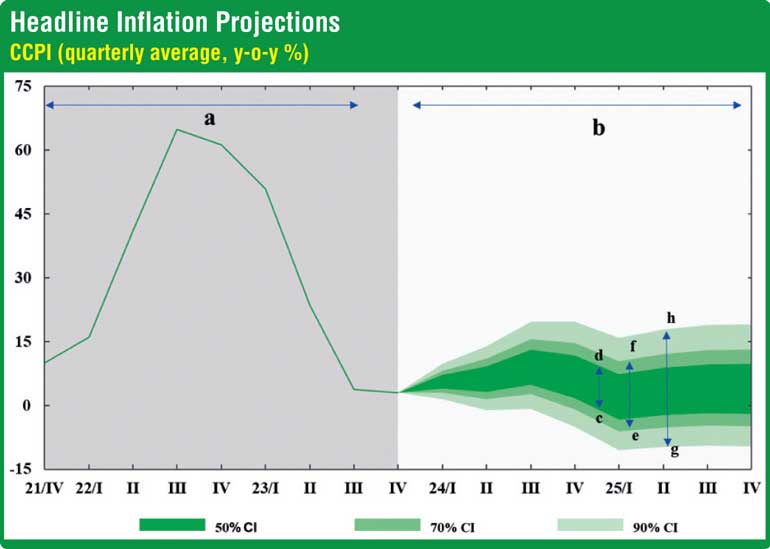

It is important to understand the structure of the inflation chart to gauge the future path of inflation. The Figure illustrates a typical fan chart that appears in the CBSL’s monetary policy communications to the public (the inflation fan chart published in January 2024). The grey area in the chart (area marked in ‘a’) shows realised inflation. One may notice differences in the inflation numbers published monthly by the Department of Census and Statistics based on the Colombo Consumer Price Index (CCPI) and numbers shown in this realised inflation section. The numbers in the inflation fan chart represent the simple average of the monthly inflation for the three months of the corresponding quarter. There are reasons for using quarterly inflation in the inflation fan chart.

The inflation target agreed upon by the Government and the CBSL as per the Monetary Policy Framework Agreement1 aims to maintain quarterly inflation rate at the target of 5%. Thus, close monitoring of quarterly inflation is essential for the CBSL’s monetary policy formulation. The CBSL employs a quarterly projection model (as done by many other central banks as well) for modelling and forecasting key macroeconomic variables, mainly inflation, to guide monetary policymaking. All variables are employed in the model as quarterly averages and the forecast outcome is also produced in quarterly average form. Thus, for the purposes of forecasting inflation and constructing a fan chart, quarterly inflation numbers are used.

The white area in the chart (area marked in ‘b’) shows the projected path of inflation. The label in the X axis refers to the timeline. For example, 23/l refers to the first quarter of 2023 and so on. The actual quarterly inflation data is shown in the chart for a period between the last quarter of 2021 and last quarter of 2023. The forecast area ‘b’ includes the inflation forecast for a period between the first quarter of 2024 and last quarter of 2025 (2-years forecast horizon).

A deeper look at the forecast region is important, as that region contains valuable information of the future trajectory of inflation. The projected path is shown by this area using three shaded areas with different shades of green, rather than a single line as in the case of actual inflation shown in area ‘a’. The reason is the underlying uncertainty in showing precise projections with a single line for the future path, unlike realised inflation. Thus, probability regions are shown by shaded areas with associated uncertainties. The dark green shaded area (area c-d) shows that there is 50 % probability that future inflation for the corresponding period will fall within that region (50 % confidence interval).

Similarly, wider ranges are shown by area e-f and g-h with 70 % and 90% probability levels, respectively. The width of the band is a measure of uncertainty. It is natural to observe a narrower band for the immediate quarters and wider band later as uncertainties increase over time. More than the numbers depicted by the band of the fan chart, what is important is the trajectory of inflation over the medium term. The Figure clearly shows that after a small uptick in inflation due to the administrative tax measures and supply side disruptions in the near term, inflation is expected to reach the targeted range in the medium term. This is the key message the CBSL wishes to communicate to the public.

It is important for central banks to repeatedly communicate as much information as possible in a language easily understood by everyone. Improved communication helps reduce the information gap among the public. Several empirical evidence found that successful central bank communication led to well anchored private sector inflation expectations. Enhancing effective communication helps build trust in central bank among economic agents (credibility of the central bank). Thus, effective communication coupled with greater credibility of the central bank are the key to anchoring inflation expectations

One should be mindful that this path is based on the data and information available as well as staff judgements available at the time of making such projections. The future path could change as and when new information is made available. This is the reason central banks are updating and publishing their revised inflation fan charts as and when necessary. Uncertainties of future paths of inflation have increased substantially in recent times. Unprecedented policy measures taken in Sri Lanka in the recovery phase of the economic crisis also create volatility and uncertainty on inflation movements and projections. For instance, the recent increase in Value Added Tax (VAT) and removal of VAT exemptions are helpful in increasing government revenue but are inflationary in the near term.

Moreover, the uncertain global arena, with geopolitical events, dynamics of global inflation, growth and financial conditions also contribute to uncertainties in the future trajectory of inflation. For instance, global energy prices have become highly volatile due to geopolitical conflicts in recent times. With the implementation of cost reflective pricing mechanism for domestic oil prices and electricity tariff, changes in global energy prices as well as projections of those, directly affect inflation dynamics and inflation projections in Sri Lanka. Therefore, it is reiterated that ‘a forecast is neither a promise nor a commitment’. Rather, it is guidance on the likely future path of inflation based on current assessment to help the public make informed decisions.

Why is it important for an inflation targeting central bank to publish an inflation fan chart?

Information or news channel of monetary policy is increasingly becoming important for central banks to ensure policy actions yield intended outcomes, because the behaviour of the public, the economic agents, decide the actual economic outcomes. Thus, it is important for central banks to guide the perception and expectations of economic agents towards the desired path of inflation. This is popularly known as anchoring inflation expectations. It is important for central banks to repeatedly communicate as much information as possible in a language easily understood by everyone. Improved communication helps reduce the information gap among the public. Several empirical evidence found that successful central bank communication led to well anchored private sector inflation expectations. Enhancing effective communication helps build trust in central bank among economic agents (credibility of the central bank). Thus, effective communication coupled with greater credibility of the central bank are the key to anchoring inflation expectations.

Under the inflation targeting framework a medium-term inflation target is given and a central bank takes monetary policy decisions after careful deliberation of inflation outlook, risks to the forecast, and other key macroeconomic developments and expert judgements. Policy actions take time to bring inflation to the targeted level, known as the transmission lag. The transmission lag takes several months and sometimes more than a year, depending on the nature of the country and development of financial markets.

Assume that in a country with 5% inflation target, inflation projection suggests that inflation could reach above the target level next year and stay persistently high. Since there are several months of transmission lag, the central bank should take monetary policy actions by increasing its policy interest rate now to avoid missing the inflation target in the future. This is possible only when the policy action is fully transmitted to other market interest rates and economic agents behave the same way as the central bank anticipates. Assume that the increase effected in the policy interest rate by the central bank is fully absorbed in the market interest rates (complete interest rate passthrough). Inflation will decline only when demand conditions in the country contract as a result of the policy rate increase.

The central bank’s expectation at the time of increasing policy rate is that economic agents will reduce their demand for consumption and investment and save more as market interest rates are high. In case economic agents do not reduce the demand as the central bank expected but maintain the same level of demand or increase the demand, the actual inflation will be even higher than the level projected. Hence, tight monetary policy action will not be effective in bringing down inflation as expected. This is the main reason for the central banks to communicate its monetary policy actions, the rationale behind the action and anticipated inflation path in the period ahead to anchor inflation expectation of the public towards the desired path.

Why is it important for the public to understand the central bank’s communication?

It is important for the public to understand the message of monetary policy communication. Public hear numerous information and opinions on current and expected future movements of prices. They have the liberty to trust any source, whether it is official, or unofficial opinions not backed by reliable facts.

In the event, when inflation increases mainly due to supply side disruptions, like the increase in vegetable prices being experienced in Sri Lanka due to extreme weather, the central bank may perceive such price increases as temporary. Then the central bank will not increase the policy interest rates, but it will communicate its judgement and the reasoning for not changing the policy interest rates along with the projected inflation path to the public. In the event the public do not understand this message and choose to believe other news that suggest continuous increase in prices, then they will increase their demand for these items more and more now. Increased demand given limited supply will further increase prices.

In the event, when inflation increases mainly due to supply side disruptions, like the increase in vegetable prices being experienced in Sri Lanka due to extreme weather, the central bank may perceive such price increases as temporary. Then the central bank will not increase the policy interest rates, but it will communicate its judgement and the reasoning for not changing the policy interest rates along with the projected inflation path to the public. In the event the public do not understand this message and choose to believe other news that suggest continuous increase in prices, then they will increase their demand for these items more and more now. Increased demand given limited supply will further increase prices

If restaurants and other food processing industries also believe that prices will increase more in the coming weeks and months, they too will increase their demand and prices of their own products. These types of price increases are known as second-round effects. These second-round price increases tend to be more persistent. In general, these second-round price increases do not reduce even after vegetable prices drop later with improved food supply. Finally, inflation increase will become persistent, and the future inflation path will shift upward in contrary to the central bank’s initial assessment. This will eventually induce the central bank to increase interest rates to arrest persistent inflationary pressure.

All these developments will finally affect the public. The public will end up having to pay higher prices and higher interest rate. Thus, adverse inflation expectations, de-anchored inflation expectations, would lead to high and volatile inflation and finally reduce public welfare.

In conclusion, improved transparency and credibility of the central bank through effective communication and better public understanding of this communication would be mutually beneficial to maintain low and stable inflation, which is the prime objective of the central bank.

The CBSL fully recognises the importance of transparency and effective communication in shaping inflation expectations of the public. Several efforts are being taken to increase information sharing with the public. In this regard, an updated inflation fan chart is published in the monthly inflation press releases, six monetary policy reviews in the year, and two bi-annual Monetary Policy Reports with detailed explanations. The next Monetary Policy Report is scheduled to be published by mid-February 2024 with more details on the inflation and growth outlook and risks to such outlooks. Improved understanding of the public of these technical details would help to enhance the reach of the Monetary Policy Report among a wider readership.

Footnote:

1Refer Extraordinary Gazette No. 2352/20 for more details.

(The writer is the Director, Economic Research Department at Central Bank of Sri Lanka.)