Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 20 February 2024 00:38 - - {{hitsCtrl.values.hits}}

Providing credit facilities under microfinance to the poor and underprivileged could be considered as a powerful tool in alleviating poverty

A new Micro Finance and Credit Regulatory Bill has been tabled in Parliament towards regulating the existing money lending business of various entities to protect borrowers from any unfairness. The proposed bill, it has been reported, will repeal the Microfinance Act No: 16 of 2016.

A new Micro Finance and Credit Regulatory Bill has been tabled in Parliament towards regulating the existing money lending business of various entities to protect borrowers from any unfairness. The proposed bill, it has been reported, will repeal the Microfinance Act No: 16 of 2016.

At present it has been revealed there are close to 11,000 institutions involved in lending for this sector and only five among them are registered. The remainder operate on their own without abiding by the rules and regulations imposed by the Regulators. Some of these entities involved in money lending charge exorbitant interest ranging from 40% to a staggering 200% as reported in the media.

At this opportune moment I am prompted in giving an insight and sharing some of my thoughts towards assisting the MSME (Micro, Small and Medium Enterprises) inclusive of many ‘start-ups’ in availing facilities from banks which will be beneficial to all stakeholders particularly the relevant authorities mandated to assist this sector. The accessibility of microfinance to the MSME sector is considered difficult due to their inability to provide acceptable collateral which compels them to seek the assistance of money lenders.

The recent VAT increase which has affected everyone and diminished their purchasing power, will compel people, mainly low-income households to venture into alternate avenues towards enhancing their income and this is the time hidden talents will come out. Providing credit facilities under microfinance to the poor and underprivileged could be considered as a powerful tool in alleviating poverty and improving the lifestyle of the aforesaid category apart from the economic benefits the country could derive.

In a recent talk show one of the panellists engaged in MSME remarked banks ask for various information and at times it is only the blood report which is pending. This is an unfair allegation and far from reality. On the contrary banks infuse blood to ailing ventures by giving them many concessions even going to the extent of giving technical advice towards resurrecting such ailing ventures free of cost. Banks have assisted many successful ventures based on the viability of the projects.

Impediments faced by the MSME sector

Let me take a simple example. Priya and Sriya (not their real names), are two sisters whose livelihood was affected due to the recent pandemic and the economic crisis which affected every citizen of the country. Instead of worrying, they ventured in making beautiful lamp shades with innovative designs for which there was a big demand as the cost of production is very low. The eldest sister Priya is a degree holder. She used her expertise and was able to successfully market these lampshades “online” overseas which resulted in large orders. This naturally required substantial finance to purchase essential raw materials and additional resources to execute the orders. None of the sisters possess any assets.

Towards meeting the increased demand due to lack of finance, they are tempted to seek the assistance of money lenders towards executing their orders on time. Needless to say such an approach will compel them to borrow at exorbitant rate of interest which will result in their cost of production going high resulting in the loss of competitiveness. This is the predicament faced by many MSMEs as there is some trepidation on their part to approach the banks and other financial institutions due to lack of collateral which is a justifiable reason. Financial institutions too are reluctant to lend them due to the high risks involved.

The aforementioned case is the reality faced by many of the individuals under the MSME sector. There are many such individuals with very valuable possession of innovative ideas. Due to their inability to offer any acceptable collateral, as most of them do not possess assets of their own they are not in a position to seek the assistance nor approach a financial institution other than a money lender. Needless to say such high cost of borrowing will result in their inability to repay the facility while they will not be in a position to compete due to the high cost apart from the physiological effect they will face without any peace of mind. Some have even taken their own lives unable to bear the agony in meeting their commitments. This is the reality of the existing situation.

MSME sector backbone of the economy

The MSME sector which is considered as the backbone of the economy, is categorised as high risk sector by the financial institutions. Most of these entrepreneurs are dependent on one single personality without any succession plan. The moment the aforesaid personality is out of the scene due to death or disability, the facility granted will face the risk of non-payment and fall into the NPA category. This is one of the main reasons and reluctance of banks and financial institutions to assist such category of borrowers. They may feel comfortable to grant facilities to professionals with dependable income, against acceptable security or in some cases on clean basis, i.e., without any security as the possibility of default is considered remote. This will not only ensure the safety of their exposure, it will greatly minimise their follow-up costs on post monitoring towards recovery.

Towards achieving this task and boosting their asset portfolio many financial institutions assign targets to their marketing personnel to aggressively canvass such facilities. The borrowers of this category are greatly benefitted and there are no benefits to the country nor to the economy as it only benefits the individual borrower. Target achievers of banks and financial institutions are recognised and rewarded. All such facilities are approved instantly due to less documentation, easy evaluation process, etc., in contrast to the microfinance sector, as granting facilities to this sector is a tedious process.

The prevailing environment, it should be noted, has resulted in the change of consumer behaviour and a shift towards e-commerce. This is a major challenge to the brick and mortar retailers, as thy find it difficult to survive due the high operational costs. On the contrary this will be a boost to the MSME sector in minimising their operational costs.

Survey on three-wheelers and its reality

According to a survey done by the National Human Resources Development Council of Sri Lanka (NHRDC), 1.059 million three-wheelers are registered with the Registrar of Motor Vehicles and out of this only an estimated 200,000 are being utilised for domestic purposes. The remainder are driven by 9.8% of our employed population which totals to 8.2 million. Most of the three-wheel drivers are reported to be able bodied young men who could be gainfully employed in more productive assignments in contributing towards the economy of the country. It has been revealed nearly one-third of them are in the age group of 30 to 35 and majority of them have completed GCE (OL) while 8% have acquired A/L or higher qualifications.

Due to their lack of financial avenue and as there are no other alternatives they avail facilities from financial institutions to purchase a three-wheeler by entering into contractual agreements. This in certain instances results in the seizure of their vehicles due to their inability to service their commitments which is a very common phenomenon. Most of the three-wheel operators according to the survey are aware of their predicament of lack of social recognition apart from the job security and inability to derive a dependable income.

What does this survey reveal? The inability of the aforesaid category to obtain financial assistance to venture into any viable projects motivate them to avail other avenues for their livelihood which has deprived the country of benefiting from their knowledge which will no doubt be a major value addition to the economy of the country. Needless to say many of them possess innovative ideas which are not tapped due to lack of financial avenue.

Mechanism towards assisting the MSME sector

Banks and financial institutions could assist the individual entrepreneur who possesses such innovative ideas. There are many such ventures and entrepreneurs in need of financial assistance under microfinance particularly three-wheel drivers many of whom possess innovative ideas.

This sector seeking financial assistance could be granted a Pledge Loan under which the raw materials and finished goods could be held under pledge for the financial institution in overcoming the difficulty faced by this sector in providing acceptable security. The necessity of collateral does not arise as the entire responsibility of managing this venture, notably the recovery of the facility will be vested with the officials of the bank.

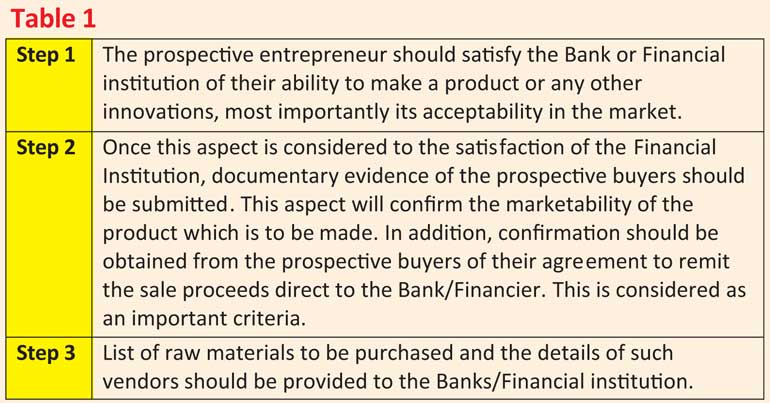

Furnished in Table 1 are a set of guidelines which could be adopted by the financial sector to assist the individuals under the Microfinance category.

Once the given steps 1, 2 and 3 are fully adhered to the satisfaction of the financier, they could consider the facility favourably and all such facilities should be short-term finance which could be managed effectively.

However, it will be subject to a strict follow-up mechanism, few of which are stated below:

Important follow-up

The above are simple guidelines towards assisting the MSME sector depending on the acceptability of each category. It should be noted effective follow-up mechanism and inspections are an essential component in microfinance and its success and the recovery of the exposure depends mainly on such follow-up mechanism. If this mechanism is effectively adhered to, the prospect of any failure or the facility going bad or default could be considered as remote.

Mitigation of major risk

However, it should be emphasised, all of us are aware, the major risk, which is beyond the control of the financier in microfinance, is the lack of succession plan of these entrepreneurs and the risk faced by the financiers due to the absence of the borrower as a result of an unforeseen circumstance arising due to the death or disability of the entrepreneur. Such risks could be mitigated, by linking the facility with a life Insurance policy covering the life of the individual entrepreneur, as this sector appears to be a neglected category.

This will not only ensure the safety of the Bank’s exposure; it will be beneficial to the borrower as a compulsory saving for his future and relieve the dependents in case of any unforeseen eventuality.

Effective insurance cover to minimise the risk

Some time ago I had the opportunity of conducting a workshop for officials involved in microfinance. This workshop was organised by a leading organisation to enhance the knowledge of the officials involved in microfinance. The above guidelines were explained to them in detail. The audience were impressed of the guidelines explained by me particularly obtaining a life Insurance cover to be linked to the facility to overcome the risk which could arise on the death or disability of the entrepreneur. Insurance cover will give adequate comfort to the banks and financial institutions in case of an unforeseen eventuality. Most of the officials involved in microfinance (non-bankers) do not appear to be aware of the benefits available in linking the facility with an insurance cover.

Opportunity for the insurance industry

The insurance industry should explore the possibility of introducing special life insurance covers, with disability benefits, to this sector at affordable cost and the term could be extended to the maximum. What matters is the comfort it will provide in case of an eventuality to the financiers and the dependents of the entrepreneurs. This is the concern faced by many financiers involved in microfinance.

This life Insurance cover should not be equated to the Term Decreasing/Mortgage reducing policy, which is obtained by banks to secure mainly the Housing Loan facilities. Such policies protect only the loan in the eventuality of death and if the borrower survives after the settlement of the facility the amount expended by way of premium, which in most cases is a one single substantial premium goes waste.

The insurance sector should make use of the existing environment in introducing innovative life insurance covers with wider benefits exclusively designed for MSME sector. This will mitigate the risks faced by banks and financial institutions in assisting the entrepreneurs under microfinance.

If such policies are available and linked to MSME, it will be a major boost to the MSME sector.

Marketing and identification of MSME under microfinance

Banks and financial institutions should utilise the existing environment to identify the entrepreneurs who could be assisted under the microfinance. The expertise of the marketing personnel of the banks and financial institutions could be availed to identify such category in need of assistance which will be a major boom to the economy.

Needless to say the global pandemic, which thankfully now appears to be manageable and under control in Sri Lanka in addition to the existing economic impediments have deprived many people especially the daily wage earners and individuals involved in small scale entrepreneurships. Owners of three-wheelers, school vans and the daily paid workers, food suppliers are the worst hit, in addition to the travel and hospitality industry all of which are severely affected. It has been revealed a total of five million people inclusive of their families and dependents under the aforesaid category are affected without any income nor purchasing power. It has been further stated 62% of our workforce are unskilled.

Many of them utilised the recent lockdowns in venturing into several innovations. They had ample time to tap their knowledge and explore various innovations due to the forced lockdowns and restrictions of their movements. Innovations should be encouraged with effective mechanism.

The authorities have recognised the importance of the MSME sector which has received their utmost priority and the regulators have stipulated at least 20% of the portfolio of banks should be channelled to this sector which is a prudent decision. This will not only generate employment, it will also result in saving and bringing in valuable Foreign Exchange to the country. The decision taken by the Government to prohibit the importation of certain non-essential items which are and could be manufactured locally is a good and timely move which will boost the local economy. There is no necessity to import such items if locally produced items of similar quality is available in the country. One has to visit a supermarket or a departmental store to observe the vast amount of imported consumer durables available at much higher prices than the local products. The affluent category still prefers and desire to purchase such items due to their strong purchasing power.

The recent stipulation to the State sector to give priority to the local manufacturers and suppliers in procurement contract is a timely move. This will not only prevent the outflow of valuable foreign reserves at a time when the country is faced with a crisis situation, it will in addition boost the local entrepreneurs in generating more employment opportunities.

Moving away from security-based lending

Microfinance are normally collateral-free short-term facilities. The time is now opportune for banks and financial institutions to move away from security-based lending and consider such MSME sectors under microfinance, against strict supervision and monitoring, depending on the viability of the project of each individual. The case which is stated at the outset of this article is the reality of the situation faced by many of the individuals under the MSME sector. However, this doesn’t mean banks don’t consider facilities for such sectors. They do consider, strictly on supervision and effective monitoring system.

During my own banking career, I have come across many such ventures, where the banks have granted facilities on strict monitoring and supervision guidelines. Many such entrepreneurs have today become household names with strong Brands and earn valuable foreign exchange to the country. Some of them have even expanded their business operations to several neighbouring countries.

Banks consider various types of securities prior to the approval of a facility. This is one of the most important criteria in taking a credit decision as they are handling their depositor’s money. If they mishandle they will be out of business. There is a famous saying “anyone can grant a loan and only an expert can recover”.

This is a true reflection of a banker in appraising a credit facility. A facility could go bad and beyond salvation, due to a variety of reasons. The bankers are conscious of their obligation and responsibility, prior to the disbursement of a facility. Further, once a facility is categorised as NPA (Non-performing Advance) considerable management time and legal expenditure have to be incurred by the banks towards the recovery. In certain instances, if the recovery of the interest component is very remote the banks will utilise their optimum resources to recover at least the capital. In a worst case scenario, they will be compelled to “write off” such facilities, if the recovery is considered remote.

Movable assets as collateral

There is some misconception, that banks do not accept movable assets as security. The reality is, banks do accept such assets as security even though the risk is very high apart from the post management costs which compels effective follow-up to ensure such assets obtained as security are intact during the tenure of the facility. Such compulsion does not exist in immovable asset as such assets will always remain intact.

Major contributory factors towards NPA of MSME sector

Facilities granted by banks could go bad and move into NPA due to a variety of reasons. Furnished below are some of the common factors which contribute towards NPA (Non-performing advance) mainly in relation to the microfinance which are based on my own experience in the banking field.

The above factors are all manageable and will not arise in microfinance if effective follow-up machinery is in place and the entire responsibility will be vested with the officials of the financial institutions.

Impact of ‘parate action’ on microfinance

The borrowers under microfinance need not fear of any ‘parate action’ against them due to a variety of reasons. First and foremost, banks could go for ‘parate action’ only in cases where the original facility granted was well above Rs. 5 million exclusive of any interest component. A majority of the borrowers under microfinance will be within this limit hence there is no risk of any ‘parate action’.

The amendment to the act permits banks to go for ‘parate action’ even against the collateral of movable assets. However, such a course of action is not feasible as the movables unlike in the case of immovables could disappear overnight and the total assets could become zero overnight. Banks will not be able to locate the assets in case of any eventuality.

Effectiveness of Credit Information Bureau

The Credit Information Bureau (CRIB) maintains the data of all facilities granted by the banks and financial institutions. It has been reported the CRIB manages close upon 10 million facilities of 6.7 million individuals on a monthly basis. This does not deter the banks from entertaining any facilities if a prospective borrower reflects in CRIB as a defaulter unable to meet their commitments on time. This is a very valuable tool for the banker to ascertain the integrity of the prospective borrowers.

There is a misconception among some once a personality reflects in CRIB due to delayed payments they are unable to get credit facilities from banks. This is not the reality. It is the responsibility of the banks to consider such requests provided they are satisfied with the ability of the borrower and the viability of the projects notwithstanding their reflection in CRIB. Reflection in CRIB is ONLY a cautionary note. However, it should be emphasised the decision to grant or reject a facility is the responsibility of the banks/financial institutions and it is a responsibility solely vested with them.

In today’s context the submission of a CRIB report is even compulsory and an important document prior to the recruitment of any personnel to the banks, as it provides an effective confirmation of the prospective employee’s integrity and credit worthiness. This is an important component in recruiting quality staff.

However, this tool will not be available for the MSME sector, as most of them will be new to the banking relations, without having any previous records of banking.

Once the data of telecommunication and utility services are brought into CRIB, it will be an important tool in identifying the prospective borrowers creditworthiness, even though they may have not had any prior banking relationships. This will also target the sectors under MSME since all of them would have availed telecommunication and utility services which is a priority under today’s context.

The need of the hour

Microfinance mainly targets the poor and vulnerable for self-employment projects in generating income and take care of themselves which has proven to be successful in many countries in eliminating poverty. Sri Lanka is reputed to have produced several leading global and local entrepreneurs with strong brands. They have created greater value to their products due to the acceptability of their products and services, thanks to the assistance rendered by banks and financial institutions.

The allocation of Rs. 50 billion from the Government’s 2024 Budget from a concessional loan from the ADB, together with the proposed setting up of a National Credit Guarantee Institution will be a major boost for the SME sector. Similar Credit Guarantee scheme was in operation many years ago which mitigated possible risks faced by the banks in assisting this sector.

If effective steps are taken, we could expand and assist the microfinance sector, identify their potential, which will boost our export market and economy, while generating employment to many due to the current economic crisis.