Thursday Feb 12, 2026

Thursday Feb 12, 2026

Tuesday, 22 May 2018 00:00 - - {{hitsCtrl.values.hits}}

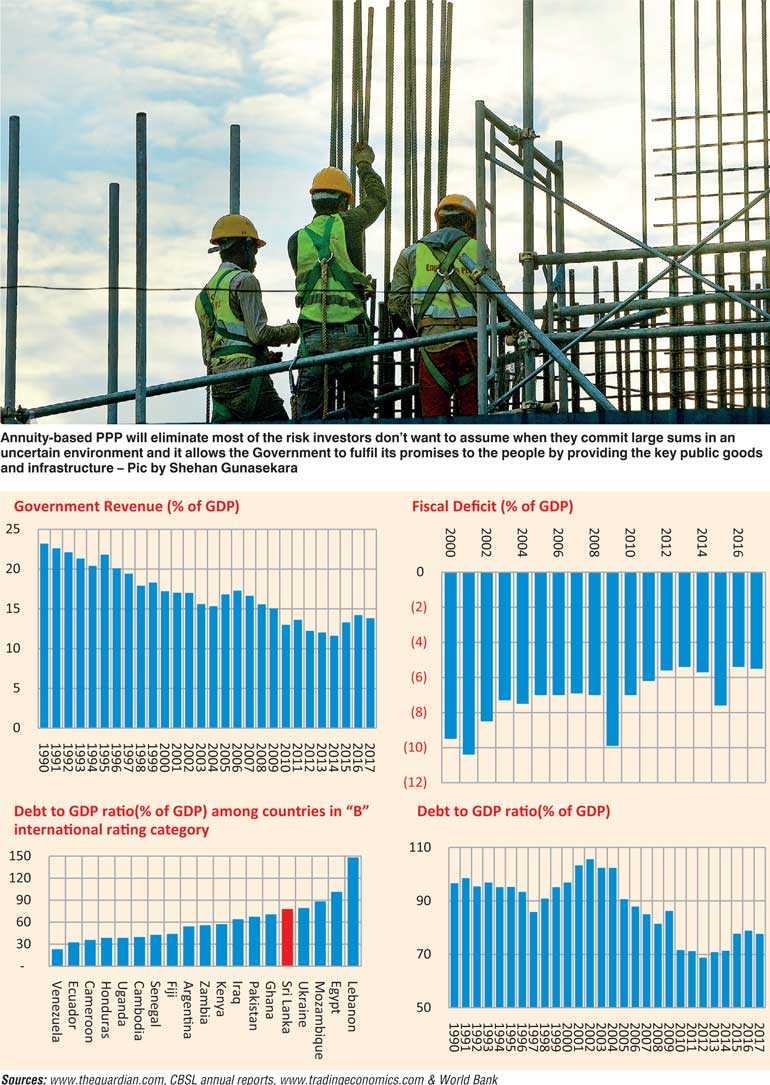

Sri Lanka has primarily relied on public finance for the development of public goods and infrastructure. While running a big government which directly employs nearly 18% of the labour force, financing public infrastructure by the Government is a real challenge. As a result, Sri Lanka is highly indebted compared to its peer group (even among rating category – B). Needless to mention, that as a result of such financial constraints, our infrastructure and their contribution to economic development and growth remains subpar.

Sri Lanka has primarily relied on public finance for the development of public goods and infrastructure. While running a big government which directly employs nearly 18% of the labour force, financing public infrastructure by the Government is a real challenge. As a result, Sri Lanka is highly indebted compared to its peer group (even among rating category – B). Needless to mention, that as a result of such financial constraints, our infrastructure and their contribution to economic development and growth remains subpar.

Our urbanisation rate according to official estimates is around 18.6%. This means that nearly 80% of population lives outside of main cities. To spur the economic growth, there is a greater need for connectivity via roads and railroads for transportation of passengers and goods in between cities and villages.

Infrastructure development requires large upfront investment with a long gestation period for the recovery. Furthermore, pricing of usage of such infrastructure is a sensitive subject and it affects an investors’ returns on capital invested. Therefore, direct investment in infrastructure by profit motivated private investors are limited. However, due to limitations in the public finance, the governments around the world have invited private capital into infrastructure through various Public-Private Partnership (PPP) modalities. PPP models have evolved over the years to address surrounding issues and controlling the cost of such investments.

Primary risk of PPP is the uncertainty on the return on investments. Developers will have to face demand risk among many other risk variants. Apart from the sensitivity of demand to the pricing of such infrastructure, investors are exposed to political risk due to the essential nature of infrastructure facilities. The lenders cannot repossess assets in the case of distress, hence the lenders may demand tighter lending covenants and guarantees by the governments. As a result, the moderns PPP options structure in such a way that the originator, in most cases the government or government-linked entity assumes the demand and pricing risk. In this way, return expectation of investors rank in between equity and debt. Annuity-based PPP is one such structure, adopted worldwide.

India has adopted a hybrid annuity structure for construction of their roads and highways. The main feature of the hybrid annuity structure that the Government assumes the demand and pricing risk while the investor contributes to the majority of project financing and operation.

Indian model significantly reduces the burden of the Government while securing the project upfront. Annuity-based PPP contracts are not considered as a debt. The annuity model ranks in between debt and equity in the risk profile. This allows the government to allocate limited resources more effectively and channel budgetary allocation to needy sectors such as education and healthcare

The variants of annuity model could be utilised in other sectors such as development of public transport, buildings, water and sanitation facilities where it requires a large upfront investment for the construction. This is quite similar to purchasing a vehicle on operating lease, it allows the user to use the facility from the beginning without the upfront investment. The ownership of the assets in this case is not a concern as long as the assets is available for satisfying the utility of the final consumers. The annuity model significantly reduces the uncertainty and reduces the cost of financing such projects. It allows the government with budgetary restrictions to build infrastructure without leveraging its books.

Sri Lanka needs a clearly defined PPP framework for attracting investments into the infrastructure sector. The PPP division created within the Ministry of Finance is an important step towards developing such a framework. The existing procurements guidelines created in the late ’90s requires amendments within the prevailing legal framework in order to accommodate different variants of PPP.

The country has unattainable fiscal targets given our large investment requirements in the development of infrastructure. We will be able to provide a cushions to the budget if we can develop a workable PPP framework which allows different PPP modalities. Annuity-based PPP will eliminate most of the risk investors don’t want to assume when they commit large sums in an uncertain environment and it allows the Government to fulfil its promises to the people by providing the key public goods and infrastructure.

(The writer is a CFA charterholder; capital market specialist and Certified FRM. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)