Monday Feb 23, 2026

Monday Feb 23, 2026

Tuesday, 29 June 2021 01:41 - - {{hitsCtrl.values.hits}}

Bank lending practices influence the overall structure and stability of a market economy

There’s a famous saying that goes: “You need money to make money.” In modern market economies, the production cycle starts with a sum of money, which is converted into a commodity in the process of production. This commodity is later sold and converted into a larger sum of money than when the cycle began.

There’s a famous saying that goes: “You need money to make money.” In modern market economies, the production cycle starts with a sum of money, which is converted into a commodity in the process of production. This commodity is later sold and converted into a larger sum of money than when the cycle began.

Most underdeveloped countries do not have a ready-made hoard of money available to kick start this cycle of self-perpetuating capital accumulation. This is due to the relative absence of commodity production. Many underdeveloped countries simply trade raw materials in exchange for value-added commodities.

This is where banks come in. Banks normally hold the savings deposits of workers (wages) and companies (profits and rents). However, they also play a role in provisioning credit which is used to lubricate the production cycle. Therefore, bank lending practices can influence the overall structure and stability of a market economy.

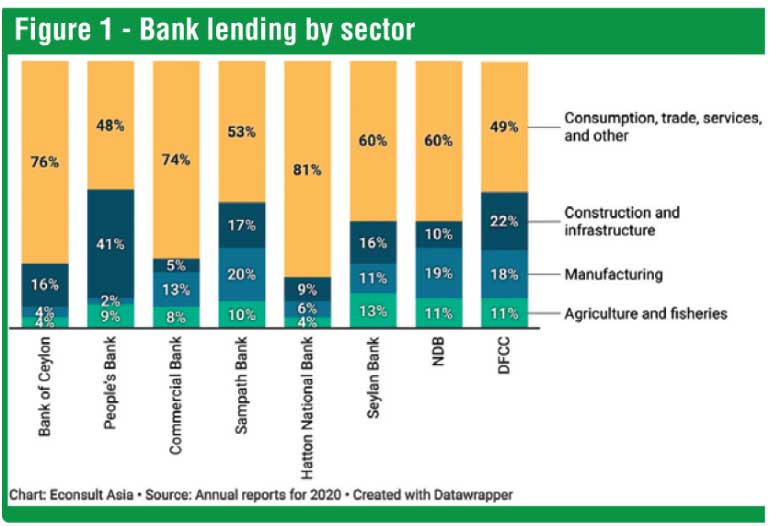

Figure 1 shows data from the 2020 annual reports of eight of the largest commercial banks in Sri Lanka, including state-owned Bank of Ceylon and People’s Bank, privately-owned Commercial Bank, Sampath Bank, Hatton National Bank and Seylan Bank; and NDB and DFCC – formerly state-owned development banks which were privatised.

The chart shows the percentage of each bank’s lending to ‘productive’ sectors of the economy, namely agriculture and fisheries, manufacturing, and construction and infrastructure. Lending to ‘non-productive’ sectors such as consumption, trade, tourism, and services in areas such as finance, healthcare, education and IT have been collapsed into one category and highlighted in yellow for the sake of simplicity.

Figure 2 depicts the sector composition of Sri Lanka’s GDP in 2020. At the outset, it is clear that there is a strong relationship between sector credit allocation in the top 8 commercial banks under study, and the sector composition of the Sri Lankan economy as measured by GDP.

Agriculture makes up 8% of GDP, in line with the 4% to 13% of credit allocation by banks. Industry makes up 26% of GDP, in line with the 15% to 43% of credit allocation by banks to manufacturing, construction and infrastructure. Services make up the bulk, 60%, of GDP, in line with the 53% to 76% of credit allocated by banks to non-productive sectors.

To reiterate the point we began with: bank lending practices influence the overall structure and stability of a market economy.

Backward agriculture, stagnant manufacturing

Agriculture and fisheries, which together make up the largest natural resource base of Sri Lanka (Sri Lanka’s marine Exclusive Economic Zone is almost eight times its landmass), receive among the lowest proportions of credit from most banks. In the absence of appropriate credit facilities, it is impossible for farmers and fishers to acquire the technology needed to modernise production, increase yields, and reduce the drudgery of their labour.

The backwardness of these sectors is therefore not a reflection of the inherent conservatism or indolence of the country’s farmers and fishers, but of credit scarcity created by risk-averse banks. Even state-owned People’s Bank, which was initially established as a means to provide affordable credit for rural development, provides less than 10% of its credit to agriculture.

Credit for manufacturing is similarly low, indicating the startling lack of commodity production – particularly high-value-added commodity production, in the country. State-owned banks score lowest in their support for manufacturing, revealing that pro-manufacturing rhetoric by politicians is yet to translate into concrete action by state institutions.

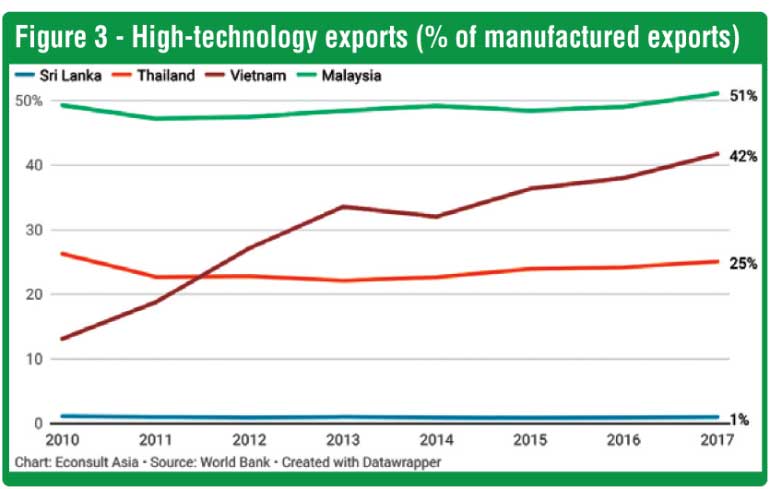

Manufacturing accounts for an abysmal 16% of Sri Lanka’s GDP, compared to an average of above 20% in most Southeast Asian countries. Figure 3 shows that Sri Lanka is scraping the bottom of the barrel when it comes to high-technology exports, compared to peers in Southeast Asia who have forms of development or policy banking to support domestic commodity production.

No development without development banking

Economists and politicians of varying ideological persuasions often talk about the need to modernise agriculture and diversify manufacturing, as a basis on which to create jobs, raise incomes, and overcome a legacy of humiliating underdevelopment. Comparisons to East Asian countries abound, but few emphasise the crucial role played by financial repression in these countries.

Back by state-owned development banks and state-mandated lending targets, East Asian industrialists received ample credit to acquire or develop modern technology, which in turn enabled them to increase production volumes and standards to compete in the global market. In Japan, the Central Bank ordered banks to lend to strategic sectors, in a method known as ‘window guidance’, a practice repeated in both South Korea and Taiwan. Ironically, just as Sri Lanka’s NDB was privatised in the 1980s, trade liberalisation led to the flooding of the local consumer market with Japanese brands which were backed to the hilt by Japanese development banks.

If a production-oriented economic structure can be so beneficial for development, readers may wonder why banks do not lend to such sectors. Surely it would be in their interest to do so? The short answer is that Sri Lanka’s monetary policy has not been stable, creating uncertainty, risk aversion, and the pursuit of short-term profits through financial speculation i.e.: betting on volatile interest and exchange rates.

We will explore these themes in further detail in our forthcoming column.

(This column is written by Shiran Illanperuma, a Research Analyst at Econsult Asia.)