Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 21 October 2022 00:01 - - {{hitsCtrl.values.hits}}

The President as the Minister of Finance (the Ministry supervising the Central Bank and the SEC) has a great opportunity to drive the financial sector reforms agenda, thereby giving a very strong signal to the financial markets that the Government is ready to support genuine investor appetite and provide competitive businesses the freedom to create wealth and grow

Introduction

Introduction

Banks have become the biggest worry for most governments post-pandemic, especially in a man-made bankrupt country like Sri Lanka, where high price levels are getting entrenched. Those responsible for this mayhem in other markets by now would have lost their private assets. Unfortunately in Sri Lanka, no one is held accountable despite the economic mayhem and some continue regardless.

Banks generally accept deposits and make loans and derive a profit from the difference in the interest rates paid and charged to depositors and borrowers respectively. The process performed by banks of taking in funds from a depositor and then lending them out to a borrower is known as financial intermediation. Through the process of financial intermediation, certain assets are transformed into different assets or liabilities. As such, financial intermediaries channel funds from people who have extra money or surplus savings (savers) to those who do not have enough money to carry out a desired activity (borrowers). Banking thrives on the financial intermediation abilities of financial institutions that allow them to lend money and receive money on deposit.

The bank is the most important financial intermediary in the economy as it connects surplus and deficit economic agents. Banks are vital institutions in any society as they significantly contribute to the development of an economy through facilitation of business. Banks also create money and also facilitate the growth of savings in the economy and are instruments of the government’s monetary strategy, among many others.

The most important service is the provision of credit. Credit fuels economic activity by allowing businesses to invest beyond their cash on hand, households to purchase homes without saving the entire investment in advance, and enables governments to smooth out their spending by mitigating the cyclical pattern of tax revenues and to invest in huge public infrastructure projects. Therefore the key role for a financial institution is to facilitate investment and employment to sustain the long-term economic growth of the country.

Development goals

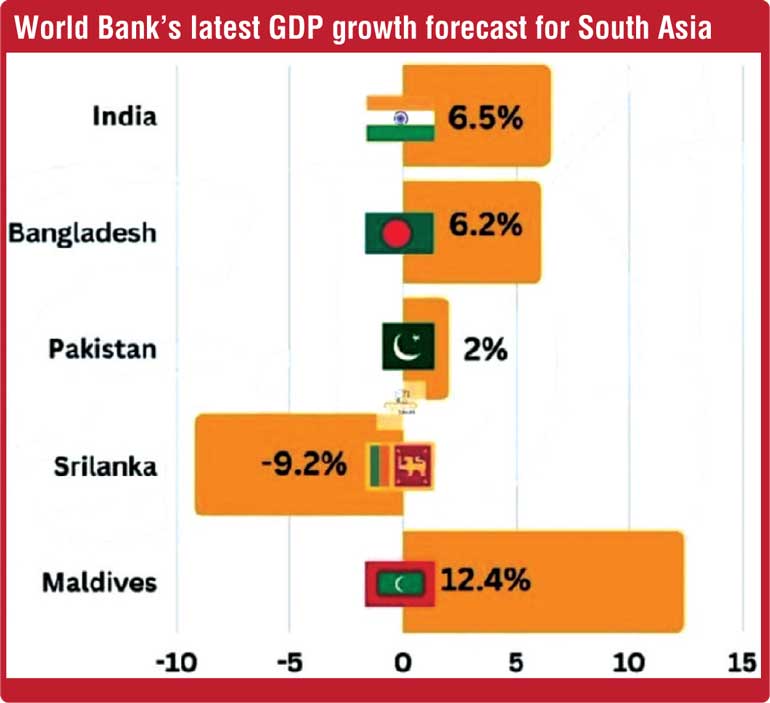

Sri Lanka has already recorded a negative 9% GDP growth in 2022. The country will certainly be challenged if we continue to look for infrastructure spending through public sector budgets even though the expectation is that public spending will continue to remain a significant part of future infrastructure financing. The reality is the share of public spending cannot continue at such a high level. As the total investment grows, it will put further pressure on public budgets. In addition, debt sustainability will also constrain public spending, especially given our high borrowings – both local and overseas. Therefore, the key role for public finance will be to facilitate private sector investment—by signalling policy commitment and covering shortfalls in revenues due to pricing and social constraints.

The other challenge we have is that most commercial banks in Sri Lanka are averse to cumbersome project preparation requirements and have limited capacity in-house to evaluate complex projects. To add to this apparent lack of appetite, banks in Sri Lanka also don›t have the balance sheet size to leverage large scale projects and lack adequate knowledge, experience and capacity in financing/lending instruments, which are suited for such purposes.

Lending to Government

Lending to Government

Then the other issue is lending to the Government. There has been a significant increase in lending to state-controlled entities by the banks in the last five years – Water Board, UDA, RDA. Most of these state-owned enterprises (SOEs) have insufficient revenue generating capacity to service these loans and hence there is a Treasury Guarantee. While this is technically considered risk free until the sovereign default, in practice it is an unequal relationship since in the event of Treasury not allocating funds to those agencies through the budget or not paying up under the guarantee, there is very little the banks can do to enforce and get cash which it will need to service their liabilities.

There is no regulatory imposed limit on how much of such lending is permitted since it is possible to get exemption from Single Borrower Limit. Often these borrowings do not get captured in government debt [debt/GDP ratios, etc.,] as these are not managed by the Public Debt Department. Therefore, non-revenue generating government agencies should either get funds allocated from funds raised by the government through the Public Debt Department or by issuing listed debentures directly to the market. The exposure of banks to these entities needs to be capped or eliminated over time. Jeanne Gobat, a Senior Economist in the IMF points out, “Bank safety and soundness are a major public policy concern, and government policies have been designed to limit bank failures and the panic they can ignite.”

Banking reforms

Corporate governance requirements generally in Sri Lanka have been very rule based and prescriptive and so are several other regulations and taken together they inhibit the ability of banks often to differentiate from others to offer a superior value proposition. Therefore, some of the regulatory directions need to be revised. Generally, the problem is that all changes are regulator driven and not business driven. There is often no proper cost benefit analysis of new regulations when they are introduced and the regulatory costs have become a big burden for banks. While changes are sometimes advised in advance, most often the regulator has been inflexible when submissions have been raised.

Some of the key indicators in the past have been manipulated to benefit the government agenda: e.g. capital adequacy – zero risk weight attached to pawning advances and GOSL borrowings or GOSL guaranteed borrowings. Another is the foreign currency borrowings of the Government of Sri Lanka (GOSL) from Sri Lanka banks; liquidity – illiquid long-term foreign currency debt instruments of the GOSL are considered liquid assets although there is no secondary market. If the market realities of these are factored into the balance sheets of some of the banks, Sri Lanka’s banking sector could look very different. Money recovery laws which have a significant impact on the cost of capital of lenders also need to be reformed. The banking sector stability without doubt is an important driver of gross domestic product (GDP) and therefore, the government policy should now pay more attention to banking sector soundness by getting advice beyond the Central Bank.

Conclusion

Sri Lanka 2025, needs a minimum of four strong banks with an assets base exceeding Rs. 2 trillion each, to get us to a $ 100+ billion economy. Therefore, the Government should push for consolidation keeping in view synergies and benefits of merger and their commercial judgment, with the Government role purely as that of a facilitator. However in certain institutions there is certainly a need to get rid of board toxicity and the management deterioration. Therefore, in the final analysis, the President as the Minister of Finance (the ministry supervising the Central Bank and the SEC) has a great opportunity to drive the financial sector reforms agenda, thereby giving a very strong signal to the financial markets that the Government is ready to support genuine investor appetite and provide competitive businesses the freedom, to create wealth and grow.

(Reference Too Big to Fail by Andrew Ross Sorkin and https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwjjwJjunO76AhUz6HMBHVZrDksQFnoECAcQAQ&url=http%3A%2F%2Fwww.themorning.lk%2Fcould-banks-survive-amidst-indebtedness-and-deficits%2F&usg=AOvVaw0WXWiktnethdus7j6_xqya)