Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 6 February 2023 00:45 - - {{hitsCtrl.values.hits}}

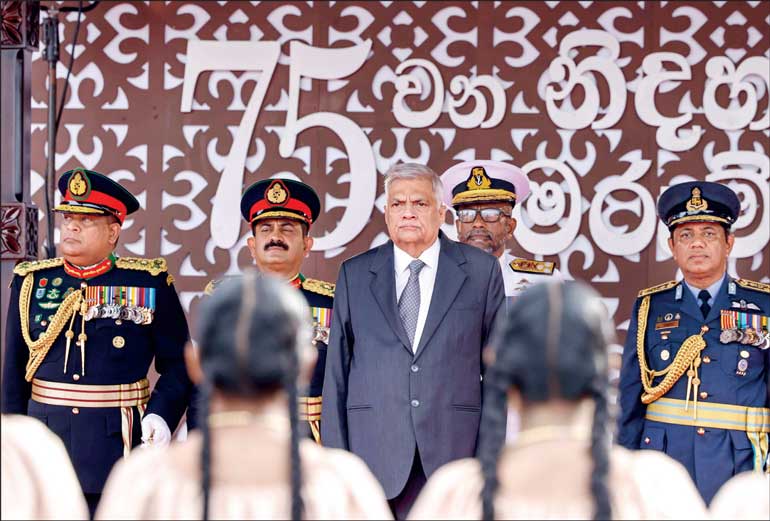

Sri Lanka has celebrated its 75th anniversary of independence. But its economic, social, and political woes are looming over it menacingly

A bankrupted country celebrating independence

A bankrupted country celebrating independence

Sri Lanka celebrated the 75th anniversary of independence from Britain last Saturday. This was done at a time when Sri Lanka had been bankrupted economically and had fallen to an irrecoverable depth politically and socially. Given the present dire state of the economy, many critics had requested President Ranil Wickremesinghe not to spend Government’s hard-earned money for this celebration.

However, the President justified his action that if Sri Lanka does not do it, the rest of the world will judge that Sri Lanka is unable to celebrate even the independence. However, another third world leader from Africa, the Tanzanian President Samia Suluhu Hassan, has cancelled the official celebration of independence and diverted the earmarked sum of $ 445,000 to build dormitories for schools catering to students of special needs (available at: https://apnews.com/article/africa-kenya-east-tanzania-86b2712377fd8ccb9abbdbbf876bd0f6).

Sri Lanka’s celebrations that had costed the coffers nearly Rs. 200 million directly and several times of that amount indirectly are now over, and the country is back to its economic, political, and social woes.

How bad is the country’s situ from the economy’s point?

Macro woe 1: High inflation

On the macroeconomic front, general price level in the economy has accelerated to a very high level. As measured by the Colombo Consumers Price Index, commonly known as CCPI that tracks the price levels in the Colombo district, it has increased by 101 units from 143 in December 2021 to 244 in January 2023. This is a 71% increase over the 13-month period involved, though the Central Bank has said that annually it is just a 54% increase. The Central Bank’s pronouncement is misleading from both the welfare of people and the monetary policy point.

From the welfare side, the cost of living of a household in the Colombo district has increased by 101 units amounting to Rs. 61,000 over this period. What this means is that if the real buying power of a family in December 2021 was Rs. 100, it is now only Rs. 29. That is why there is still public agitation against rising cost of living though the annual change has recorded a marginal decline. People are asking for higher salaries and it has led to social instability which is a killer of long-term economic growth initiatives.

From a monetary policy point, the Central Bank goes not by the headline inflation of 54% but by inflation that is directly determined by the increases in money supply. That inflation is called Core inflation that excludes the increases in food items and transport expenses. That inflation has accelerated on average from 35% in December 2022 to 38% in January 2023. This is a very high rate of inflation to be subdued. Hence, it is too early for the Central Bank to relax its tight monetary policy package which it has introduced since April 2022.

Macro woe 2: Precarious budget

The budgetary situation of the country is still not in good shape. The Government is planning to earn a revenue level of Rs. 3.4 trillion in 2023 as against a gross expenditure of Rs. 11.7 trillion. The latter is made of the Government’s recurrent expenditure, capital expenditure, and the expenditure needed to repay the maturing foreign debt that is not subject to restructuring, and new and maturing Treasury bills and Treasury bonds. That is a massive gap of Rs. 8.3 trillion or 28% of GDP which has been estimated at Rs. 30 trillion for the year.

President Ranil Wickremesinghe is reported to have informed the Cabinet of the dire state of the cash flow of the Treasury in January 2023. Instead of making this complaint, he should take immediate action to cut the size of the Government and extravagant expenses. Strangely, this is the demand made by the country’s international sovereign bondholders too. Without this, there is no peace for the Treasury and consequently for the people

This massive consumption by the Government is a killer on the private sector initiatives. What is to be done is therefore is not merely increasing the tax revenue but a drastic cut of the Government size that will reduce total expenditure which is the real burden falling on the people. President Ranil Wickremesinghe is reported to have informed the Cabinet of the dire state of the cash flow of the Treasury in January 2023. Instead of making this complaint, he should take immediate action to cut the size of the Government and extravagant expenses. Strangely, as explained below, this is the demand made by the country’s international sovereign bondholders too. Without this, there is no peace for the Treasury and consequently for the people.

Bondholders’ demand 1: Shrink the inflated sumo

The ad hoc Sri Lanka international sovereign bondholder group in a letter to the Managing Director of IMF last week has asked for speedy action to shrink the size of the Government, inter alia, as envisaged in the proposed IMF bailout program for Sri Lanka (available at: https://www.prnewswire.com/news-releases/sri-lanka-bondholder-group-letter-to-the-imf-301738080.html). It says that the annual gross financing needs, that is, the shortfall of the gross revenue from the gross expenditure, should not exceed 13% of GDP in the period between 2027 and 2032. The current gross financing need of the Government, as mentioned in the previous para, amounts to 28% of GDP.

What this means is that the Government should have a clear policy of increasing revenue on one side and cutting the gross expenditure, on the other. The gradual curtailment of gross expenditure requires the government to shrink itself, like a sumo fighter whose body has been artificially inflated is shrunk to its normal size. If this is followed, both in the spirit and to the letter, by all successive governments from today, all expenditure programs should be based on a predetermined scale of priorities. The present Government which seeks an IMF bailout may adhere to it. But getting the consent of future governments for such a voluntary shrinking program will be a challenging task.

Macro woe 3: Debt crisis

The current economic crisis was manifested as a foreign exchange crisis that led to the depreciation of the rupee on one side and imposition of drastic import and exchange controls, on the other. The Government sought an IMF bailout rather late but there were some preconditions which it had to fulfil. Most of these conditions have been met except the major one relating to the restructuring of the unsustained public debt.

Out of a total foreign debt of some $ 61 billion, the Government has been planning to restructure only the commercial debt of the central government and what had been borrowed from the bilateral sources. There, China, a major lender, had been uncooperative with the rest of the creditors. After long negotiations, it had offered only a loan moratorium of two years which would indeed increase Sri Lanka’s foreign debt obligations. Hence, the bailout is now notorious for getting postponed every month. Bangladesh which does not have this debt sustainability problem was able to secure the loan within two months. With the non-delivery of the IMF bailout in time, Sri Lanka’s foreign exchange issue has now become more catastrophic.

Macro woe 4: Slowing growth

On the growth side, Sri Lanka’s economy is shrinking every year. Growth had been in the negative range by 9% in 2022 followed by a further negative growth of about 4-5% in 2023. President Ranil Wickremesinghe is planning to make Sri Lanka a developed country by 2048 when Sri Lanka will celebrate the centenary of independence from the British. To reach this goal, it is necessary to increase the per capita income which stands at about $ 3,000 at present to above $ 12,000 by 2048. The underlying minimum growth rate needed to reach this goal is about 8% at a compound rate over the next 25-year period. This requires a concrete economic plan to be implemented by all the successive governments. The plan should aim at converting Sri Lanka to a high-tech export economy, the status which the winners in the future global economy will acquire.

The world is fast moving today toward the Fourth Industrial Revolution or Industry 4.0 or 4IR. Vietnam introduced a time-bound roadmap to in 2020 to become a 4IR country by 2030. If Sri Lanka starts it today, probably it can reach that level by 2040. For this purpose, the abandoned Tech City at Pitipana, Homagama and the connecting high-tech zone from Malabe to Pitipana should be immediately started. It requires capital investment by both the government and the private sector. To release resources for this purpose, the Government should avoid spending hard-earned tax money for tamashas and galas like celebrating independence when the country is economically and financially bankrupt.

This is a formidable challenge, and the clock is ticking down fast toward the day of reckoning. The Ranil Wickremesinghe administration needs to act very fast to avoid this eventuality.

The elusive IMF bailout

The biggest worry of Sri Lanka today is to successfully complete the proposed IMF bailout program. Bangladesh which started negotiations with IMF for a similar package in November 2022 managed to get it by end January 2023 (See: https://www.imf.org/en/News/Articles/2023/01/30/pr2325-bangladesh-imf-executive-board-approves-usd-ecf-eff-and-usd-under-rsf).

The cost of living of a household in the Colombo district has increased by 101 units amounting to Rs. 61,000 over this period. What this means is that if the real buying power of a family in December 2021 was Rs. 100, it is now only Rs. 29. That is why there is still public agitation against rising cost of living though the annual change has recorded a marginal decline. People are asking for higher salaries and it has led to social instability which is a killer of long-term economic growth initiatives

That is because Bangladesh whose total public sector debt is mere 39% of GDP does not have a debt sustainability issue as prior action. Its foreign reserves are at $ 30 billion by March 2023, down from $ 46 billion two years ago, but not near zero level as in the case of Sri Lanka. Hence, it was a cake walk for Bangladesh to access IMF resources. Sri Lanka has completed almost all the preconditions for an IMF bailout except the resolution of the debt sustainability issue. Now it has become an unsolvable problem because of the intransigence of China which holds about 52% of the country’s bilateral debt and the pressure exerted by the sovereign bondholders for additional concessions.

China’s intransigence

The bilateral debt, also known as official aid assistance, is from other donor countries like UK, USA, China, and India. The debt resolution with these countries is negotiated at an informal arrangement with creditors who meet in Paris, France. Hence, that group is known as the Paris Club. China and India are not members of this Club, but India has participated in its meetings earlier as an observer.

In the case of Sri Lanka’s debt rescheduling negotiations, India has expressed its willingness to participate as an observer and go by the decisions made by the Club regarding a cut in the principal or the interest or both. In the terminology of debt restructuring, this is known as a haircut. Hence, it is a compliant country for Sri Lanka.

But China has been reluctant to accept a haircut. That is because if it does so for Sri Lanka, it should extend the same concession all the other countries that have borrowed from China. That amount out there is more than $ 1,500 billion and a 50% haircut amounts to losing about $ 750 billion. Instead, it offered earlier to Sri Lanka a new loan to repay the old loans and carry the new loan in Sri Lanka’s books as a new liability. This was not acceptable to either the Paris Club or the IMF. Now, China has made an alternative offer in which it will suspend the loan recovery for two years, known as a debt moratorium. Since the loan instalments so suspended are added to the principal, it will not reduce the foreign debt liability of Sri Lanka. Instead, it will enhance such liabilities. This is a spanner thrown into the path of Sri Lanka’s debt rescheduling program.

Bondholders’ demand 2: Reorganise domestic debt

Now, international sovereign bondholders who have organised themselves as an ad hoc group have thrown another spanner. As mentioned above, they have written to the Managing Director of IMF seeking three concessions.

One is as explained above, cutting the government to size by shrinking its gross financing needs from the current 28% of GDP to 13% of GDP between 2027 and 2032. This gross financing needs include the new borrowing for continuing with government operations and the money to be borrowed for repaying the maturing debt. Since maturing debt is already in the debt book of Sri Lanka, it cannot be avoided. Hence, to reduce the gross financing needs to 13% of GDP, it is necessary to cut new borrowing, both domestic and foreign, drastically. According to the bondholder group, the domestic debt borrowed by Sri Lanka under the local laws should be ‘reorganised’ to ensure debt sustainability and financial stability. While the term debt reorganising does not mean debt restructuring involving a haircut, it is a reduction of the level of domestic debt voluntarily by reducing the total gross expenditure of the government.

Bondholders’ demand 3: Consult us too

The second is that bondholder group requires IMF to do all the negotiations with Sri Lanka to bind the country to what is agreed. However, the bondholder group also wishes to be consulted in this exercise and be permitted to offer suggestion. What this means is that debt restructuring is no longer a mere Paris Club affair. It is a multiparty consultation involving IMF, Paris Club, Sri Lanka, and Sovereign Bondholders. The third one is the most important request made by the group. It requires IMF to see that the principle of comparable treatment, also known as the principle of equal treatment, is met. What this means is that what is being offered to China should also be given to all other creditors. If this happens, the planned debt restructuring will simply be diluted.

As it is, China has emerged as the holdout creditor – one who would block any restructuring plan – in this exercise.

Time is clicking down fast for Sri Lanka

Sri Lanka has celebrated its 75th anniversary of independence. But its economic, social, and political woes are looming over it menacingly. Any delay in resolving them means moving toward the day of reckoning faster.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)