Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 7 August 2023 00:00 - - {{hitsCtrl.values.hits}}

As Sri Lanka struggles to come out of the economic crisis with a -7.8% GDP growth registered last year, quarter 1,2023 saw a GDP decline of -11.5% with many experts predicting that the economy is bottoming out. The Asian Development Bank (ADB) forecasts that 2023 will end up at a -3% GDP trajectory, while in 2024 we would bounce back to a +1.3% growth which is good news. Although the numbers can be motivating, the reality at the household end does not augur the same. The poor has surged to 7 million people in Sri Lanka from 3 million which is almost 31% of the population as per a LIRNEasia research study.

75% households reduce consumption

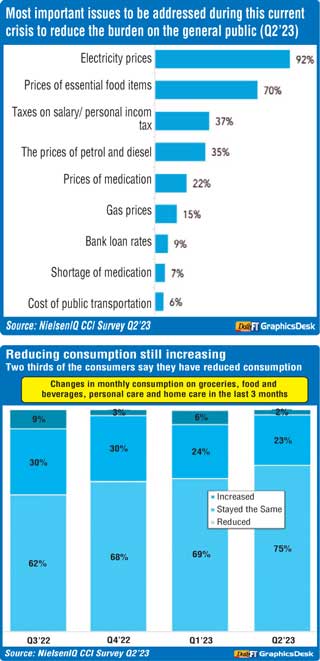

The latest Nielsen Research study revealed that 75% of consumers have reduced their consumption of groceries, food and beverage, personal care and home care products in the last three months as against the 69% in quarter 1, 2023. This means the disposable income is yet challenged even though the Government reports that the inflation is at 6.3% in July,2023 as against the 70% registered in September last year. What is worrying is that high nutrition food such as milk powder has seen a reduction in purchase in 82% of households (up from 75% in Q1,2023). Fish and meat contraction of consumption has shot up to 76% of households. A point to note is that the consumer segment that was increasing consumption of household products crashed from 6% of households last quarter to 2% in Q2,2023.

The latest Nielsen Research study revealed that 75% of consumers have reduced their consumption of groceries, food and beverage, personal care and home care products in the last three months as against the 69% in quarter 1, 2023. This means the disposable income is yet challenged even though the Government reports that the inflation is at 6.3% in July,2023 as against the 70% registered in September last year. What is worrying is that high nutrition food such as milk powder has seen a reduction in purchase in 82% of households (up from 75% in Q1,2023). Fish and meat contraction of consumption has shot up to 76% of households. A point to note is that the consumer segment that was increasing consumption of household products crashed from 6% of households last quarter to 2% in Q2,2023.

The LIRNEasia report stated that 27percent of adults restricted their meals to feed the children. In the estate sector poverty is as high as 51% which is the reality. Sadly, the people who are responsible for taking wrong policy decisions such as delaying the decision to go for the International Monetary Fund (IMF) help are yet at large without justice done. The alert to the economy was given a heads up way back in 2019 in Parliament, which is documented in the Hansard too as only an addition to academia. It is clear that the political hierarchy does not want to pursue this agenda even though scientifically it has been proven that populist moves such as, cutting taxes and banning organic fertiliser by the Gotabaya administration led to a severe toll on the macro economic balance of the country that was already fighting the economic impact from the Covid-19 crisis.

Utility bills killing consumers

A deep dive into consumer sentiments reveal that over 50% of the households do not have spare cash and whenever they can free up money, they pay off debts and credit card bills. The increasing concern is the payment of utility bills. Q2,2023 saw a spike in prices of ‘utility bills’ as per the Nielsen study and the recent price increase of petrol in the month of July and 30% plus increase on water charges would aggravate the issue at the household end. Even though the inflation numbers see a drastic drop statistically, strangely it has not been reflected at the consumer basket end. Maybe, this scenario might get corrected in the near future but, the pressure of the increasing utility prices would outweigh the net gain, given that water, electricity and telephone services are essential. Incidentally, a point to note is that consumers are consciously reducing the talk time on mobile and telephone. Subscriptions in fixed and mobiles have dropped mainly due to the pressure on the wallet.

A deep dive into consumer sentiments reveal that over 50% of the households do not have spare cash and whenever they can free up money, they pay off debts and credit card bills. The increasing concern is the payment of utility bills. Q2,2023 saw a spike in prices of ‘utility bills’ as per the Nielsen study and the recent price increase of petrol in the month of July and 30% plus increase on water charges would aggravate the issue at the household end. Even though the inflation numbers see a drastic drop statistically, strangely it has not been reflected at the consumer basket end. Maybe, this scenario might get corrected in the near future but, the pressure of the increasing utility prices would outweigh the net gain, given that water, electricity and telephone services are essential. Incidentally, a point to note is that consumers are consciously reducing the talk time on mobile and telephone. Subscriptions in fixed and mobiles have dropped mainly due to the pressure on the wallet.

The LIRNEasia study reveals that almost 32% of families have sold their household assets to keep the family fire burning. Almost 6% of them have not sent their children to school. To be specific 203,000 children do not attend school, to which fact the hierarchy of the country is oblivious to. Some children do not have exercise books or use pages from old books. It is the ground reality.

Smart consumer

In this backdrop, we see a new trend emerging where Sri Lankan housewives are turning to be smart consumers. They want to access more data, compare the prices of different suppliers and are getting less influenced by catchy advertising and fast talking salesmen. A smart consumer is very cognizant of their spending limits, they understand their rights and responsibilities as a consumer and are slow in making decisions as they want to do research before making a purchase.

Deep dive - smart consumer

If one does a deep dive into this concept we gather how a Sri Lankan housewife practices three types of behaviour.

1) Financial Responsibility- they stick to their budget after paying utility bills which are essentials. When they buy on credit they have a fall back plan in case they get into a financial crunch at the end of the month. A particular behaviour seen is that all bills are retained for future reference.

2) Informed decisions - housewives now do their own home work such as, read reviews, check the reputation of sellers and study the details of contracts before signing. They tend to check all warranties and guarantees before making a purchase. They also tend to avoid convincing salesmen.

3) No risks- given the low disposable income today's housewife will not take any risks by trying out new sellers. They stick to the trusted grocery shop near their residence or the frequently visited supermarket. If there is an offer they know their rights as consumers and check all prices on the shelf especially, given the frequent price revision of manufacturers.

Learning to live

Given the ‘ Smart consumer’ mentality nestling into the Sri Lankan housewife, we see how families have begun to live life again in the last two months. Even though the reality is that spare cash is not found, there has been an increase in purchasing clothes and taking family vacations and outings across the country. In urban markets visiting restaurants or using an Uber/PickMe for home delivery of food has seen an increase even though the purchases are made only once in a quarter. Money spent on children's tuition and sports is on the rise but this is due to necessity rather than choice.

Good news

The good news is that the Nielsen study reveals that almost 60% of people have not thought about migrating. Only 20% have entertained the idea of migrating from the country in the backdrop of over a million Sri Lankans having taken wing overseas as per the Ministry of Immigration. The IT industry has been the worst hit from migration with countries like Australia attracting the cream of IT talent.

From a macro end we have received an approximate $1 billion tourism receipts in the first half of the year while foreign remittances reached $3 billion, denoting that the end of the year would see $7 billion only from remittances.

With some astute strategies in tourism, I believe Sri Lanka can hit $4 billion tourism receipts by the end of next year. Sadly, the alleged corruption on the global tourism tender that was reported in the media last week, took away the shine on brand Sri Lanka. This is where the current leadership fails even though the IMF stipulates that beating corruption is one of the mandates of the 17th Sri Lanka- IMF agreement.

Way forward

While there is a silver lining among the dark clouds, from the economic development perspective ‘corruption’ remains the elephant in the room. Currently, fingers are pointed at the Health Ministry and now the Tourism Ministry which does not augur well for the country. Another area that needs focus is Sri Lanka exports as the Minister announced that exports would contract by -22% this year which means it would shave off another three billion dollar income to the country. In this backdrop we have no option but to become a Smart Consumer.

(The above thoughts are strictly the personal views of the author and do not reflect the organisations that he serves).