Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 26 July 2021 00:09 - - {{hitsCtrl.values.hits}}

The need to view issues from multiple perspectives has become increasingly important in the new normal

I stepped down as an independent non-executive director of a leading financial institution a few months ago. My nine-year association with it, together with my ongoing involvements with several other firms gave me a wider exposure to governance.

I stepped down as an independent non-executive director of a leading financial institution a few months ago. My nine-year association with it, together with my ongoing involvements with several other firms gave me a wider exposure to governance.

It was a case of enriching myself in shared value creation benefitting the institution in specific and the economic growth in general. Particularly for me, it was a two-way value exchange as I contribute to an institute and bring back that experience to enrich my association with the MBA ‘learning partners’. Today’s column is how I experienced governance, from a broad perspective to board practices.

Overview

Governance is much broader as a concept than the typical corporate governance. According to the United Nations’ Economic and Social Commission for Asia Pacific (ESCAP), it can be defined as the process of decision-making and the process by which decisions are implemented. In essence, it refers to the initiating and implementing decisions. We can see this happening at four levels, viz, international, national, sectoral, and institutional.

The global bodies such as the United Nations advocate governance as a key requirement to ensure ‘a life of dignity for all’ with accelerating progress towards the sustainable development goals. In a national perspective, we can still remember the prospects and problems Sri Lanka experienced during the ‘Yahapalana’ regime. Whether it was a genuine case of exhibiting the expected precepts of ‘good governance’ is still a debatable subject. I opted to use the term ‘exemplary governance’ during my tenure as the Director of the Postgraduate Institute of Management (PIM), where governance has been a key pillar in its ‘edifice of excellence’.

We can see the need to have governance in four broad levels, namely, international, national, sectoral, and institutional. The exemplary governance is much in demand at national levels in many countries including Sri Lanka. It is in fact the interplay between the state, civil society, and corporate sector. I would propose triple Ps to ponder in probing further of such an interplay. They are related to proactivity, predictability, and productivity,

Proactivity related aspects of governance include being forward-looking with a right set of vision, mission, and action. It begins with the aspiration of a desired state (vision) and clearly identifying the reason to reach there (mission) and ensuring the execution of crafted strategies (action). Sad to note the treatment of vision and mission as mere cosmetics by some, disregarding how dynamic nations have reached where they are now with such a proactive approach.

Predictability related aspects of governance include conformance, consistency, and connectedness. It is a case of ensuring professionalism in all fronts in being legal and ethical when decisions are made. Being consistent showing the transparency as opposed to favouritism is also of high importance. Connectedness in my view is the need to have all stakeholders involved in convincing them the need to conform to a set of policies, procedures, and practices. Sad to note the varying presence of the above in many developing states and we are no better.

Productivity related aspects of governance refer to efficiency, effectiveness, and efficacy. How the utterances of leaders are usefully converted into action is what is required. To avoid election manifestos just exhibited during elections and not thereafter, doing the things right (efficiency), doing right things (effectiveness), having the right mindset (efficacy) are all interconnectedly important. In other words, it is a case of ensuring right resource usage (efficiency), right result achievement (effectiveness) and right response with confidence (efficacy).

Rather than lamenting the absence of the above triple Ps, what is required is to start from somewhere. It is far too precious to leave in the hand of politicians whose populist agendas would have many contradictions. One way to find solace, is to see whether we can get inspiration from the eastern roots of governance.

Eastern roots of governance

It is encouraging to see the ‘Dasa Raja Dharma’, or 10 royal virtues offer us a solid base, as opposed to anything that can be criticised as a ‘western conspiracy’. In Kutadanda Sutta (Digha Nikaya) the Buddha explains that in order to eradicate crime, the economic condition of the people should be improved. The relationship between the employer and the employee should be made cordial mainly by the payment of adequate wages, gifts, and incentives. As mentioned in an article by Danister Fernando (www.lankalibrary.com), these 10 ‘exemplary practices’ can be briefly stated as follows:

1. Dana: Liberality, generosity, or charity

2. Sila: Morality – a high moral character

3. Pariccaga: Making sacrifices for greater good of people

4. Ajjava: Honesty and integrity

5. Maddava: Kindness or gentleness

6. Tapa: Restraint of senses and austerity in habits

7. Akkodha: Non-hatred

8. Avihimsa: Non-violence

9. Khanti: Patience and tolerance

10. Avirodha: Non-opposition and non-enmity

It is believed that, after the advent of Buddha Sasana to Sri Lanka, in the reign of King Devanampiya Tissa, in the 3rd century BC, the long line of Buddhist Kings would have kept to ‘Dasa-Raja — Dhamma’ in fostering good governance. Needless to mention whether we see the presence or absence of those in the current day and time. As Martin Luther King said, “Let’s light a candle rather than cursing the darkness.” That is the backdrop where I would move into corporate governance.

Corporate governance in focus

As the Charted Governance Institute of UK and Ireland describes, corporate governance is the system of rules, practices, and processes by which a company is directed and controlled. Sir Adrian Cadbury (1929-2015), who is a global governance pioneer having chaired the development of the world’s first ‘corporate’ governance code in 1992, gives a much simple yet significant definition, ‘the way companies are managed and directed’.

James McRitchie who is the publisher of pioneering website on corporate governance (www.corpgov.net) since 1995, states, “Corporate governance is most often viewed as both the structure and the relationships which determine corporate direction and performance.” He also states that the board of directors is typically central to corporate governance.

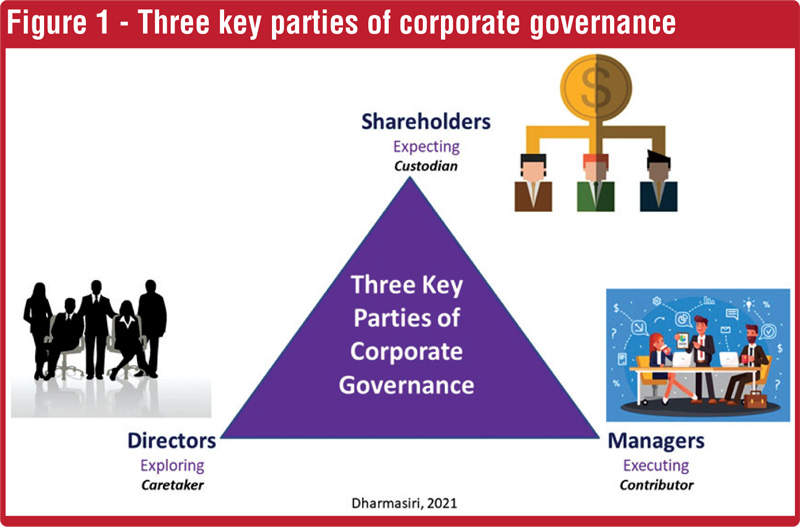

I observe three key parties involved in the corporate governance. Figure 1 depicts my way of conceptualising it.

As Figure 1 illustrates, shareholders are expecting returns as custodians of the organisation, whilst directors are exploring the ways of sustainable growth as caretakers and managers are executing the strategies with associated actions as contributors. The harmonised interplay between the triple C parties, viz, custodians, caretakers, and contributors, is critical to ensure exemplary governance.

Pillars of corporate governance

Pillars of corporate governance

As often mentioned in many literatures, the four pillars of corporate governance are accountability, fairness, transparency, and independence.

The board of directors, both executive and non-executive, dependent and independent are all collectively accountable to the way the corporate is run. It is a serious affair that goes beyond ‘attending meetings and having tea’. Executive directors are more involved in managerial tasks, being full-time engaged with emphasis on planning and implementation. In contrast, the non-executive directors are more involved in governance tasks being part-time engaged with emphasis on advisory and expertise sharing.

Needless to state the high significance of fairness in dealing with all stakeholders, inclusive of employees, customers, shareholders, suppliers, society, and government, etc. With the vibrancy of social media, a firm cannot hide an unfair practice under the carpet. It might be a minor case such as wrongful extension of an expiry date of a product or a major case such as avoiding a huge tax payment to the state. Transparency in declarations stipulated by the law, and dealings with the key stakeholders is essential. Independence of the board of directors in taking the best decision for the organisation without any direct or indirect external influence is the ideal scenario.

In the board, the chairperson provides overall leadership for the corporate whilst the CEO drives results leading the functional experts. Clear division of accountabilities between chairperson and CEO is a must to ensure coherent commitment of both. Balance of power in the board without over-concentration on one individual is another challenging task I see in the Sri Lankan scenario. The tendency to drift away on petty operational matters without the needed focus on strategic issues and policy aspects is a common temptation in the boards. Board members need to follow certain precepts to ensure expected governance.

Seven precepts for board directors

They can be described as the need to be informative, responsive, empathic, strategic, holistic, mature, and humane.

1. Be informative

This is a call to update and upgrade oneself in being up-to-date. In a changing world, this is an absolute must. They are supposed to bring fresh insights to the discussion rather than being mere rubber stamps.

2. Be responsive

Prompt feedback for faster decisions is essential. Despite busy schedules and multiple involvements, one needs to respond swiftly to avoid delays and dire consequences associated.

3. Be empathic

This is a global improvement required as highlighted by many researchers. Respect others’ point of view by way of a reflective listener will not cost you anything. The attitude of ‘my way is highway’ will not be the right way.

4. Be strategic

Demonstrating a futuristic approach is essential for collective success. The needed conceptual skills for both envisioning and evaluating should be demonstrated.

5. Be holistic

The need to view issues from multiple perspectives has become increasingly important in the new normal. Implications of a decision taken, either positive or negative should be objectively assessed.

6. Be mature

The ability to handle constructive feedback is essential in the board room. The maturity in separating a person from his/her point and an individual from his/her idea is needed to avoid unwanted inter-personal conflicts.

7. Be humane

The need to respect the precious human resources as the only alive and vibrant resource that can take command and control over the other resources, should be the way. COVID-19 had shown us the value of ‘lives’ more than the ‘livelihoods’ in a painful manner.

The above seven precepts offer a recipe for revival towards achieving sustained results.

Way forward

“Good corporate governance is about being proper and prosper”, so said Toba Beta, an Indonesian economist. Governance at any front is not smooth sailing. It must face key challenges. For example, dominance vs. democracy in deliberations is a common occurrence. The next column of Humane Results will cover such challenges in relation to the Sri Lankan context.

(The writer, former Director of Postgraduate Institute of Management, can be reached through [email protected], [email protected] or www.ajanthadharmasiri.info.)