Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 24 November 2020 00:23 - - {{hitsCtrl.values.hits}}

The Budget speech 2021 was presented at a time when the country is being severely hit by the COVID-19 pandemic. GDP growth is projected to be down to negative 2% this year. Despite this economic setback, the Government envisages to maintain an inclusive GDP growth rate of 6% per annum over the medium-term while containing inflation to around 5%, according to its macroeconomic program, ‘Vistas of Prosperity and Splendour’.

Less emphasis on COVID-19

Given such optimistic targets, it is somewhat puzzling that the Budget speech does not pay much attention to the COVID-19 pandemic which has paralysed virtually all economic activities by now. Reflecting mixed-up priorities, the Budget has given undue resource allocations at this difficult juncture to some arbitrarily selected projects such as urban townships, sports, road construction and walking paths, which have no direct relevance to revive the pandemic-hit economy, though they may have their own merits during normal times.

A coherent economic recovery strategy, apart from the fiscal and monetary stimulus already granted is the need of the hour to revive the economy from the fallout. The pandemic has severe consequences on the Sri Lankan economy, which had already encountered multiple economic setbacks including low economic growth, fiscal disarrays, balance of payments deficits and foreign debt burden even prior to the health crisis. The pandemic has adversely affected the export sector, domestic production, inward remittances and distribution network. Poor households who are mostly working in the informal sector with irregular income sources have become extremely vulnerable in the present crisis situation.

Escalating fiscal imbalance

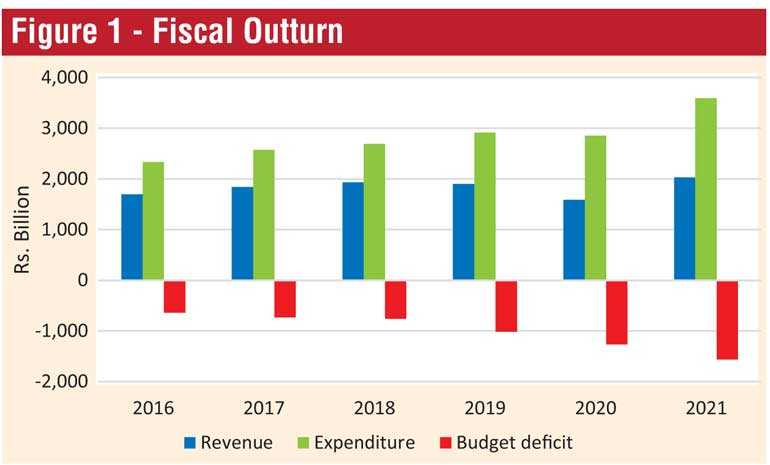

The budget deficit is projected to rise by 24% from Rs. 1,266 b (7.9% of GDP) in 2020 to Rs. 1,565 b (8.9% of GDP) in 2021, reflecting a severe deterioration of the fiscal position (Figure 1). It is expected that the total revenue would rise by 28% in 2021 as against 26% increase in total expenditure. Such exorbitant revenue growth cannot be expected for a single year even during normal times.

The projected increase in revenue is said to be based on the assumption of 5% growth in GDP in 2021. This assumption seems to be over-optimistic considering the negative impact of COVID-19 in years to come, and the country’s limited growth potential experienced even before the outbreak of the pandemic. Slower GDP growth in 2021 means low level of Government revenue, and consequent expansion of the budget deficit much higher than what is expected. Thus, the budget deficit is likely to be 10% of GDP or more in 2021.

Monetary implications of fiscal imbalance

With the rise in the budget deficit, the Government is compelled to rely increasingly on the banking system to finance the deficit. Net bank credit to the Government rose by 46% from Rs. 2,732 b in September 2019 to Rs. 3.980 b in September 2020.

The Central Bank has accommodated Government finance requirements by directly purchasing Treasury Bills at primary auctions. The Central Bank’s net credit to the Government rose by 50.8% from Rs. 383.2 b in September 2019 to Rs. 577.7 b in September 2020.

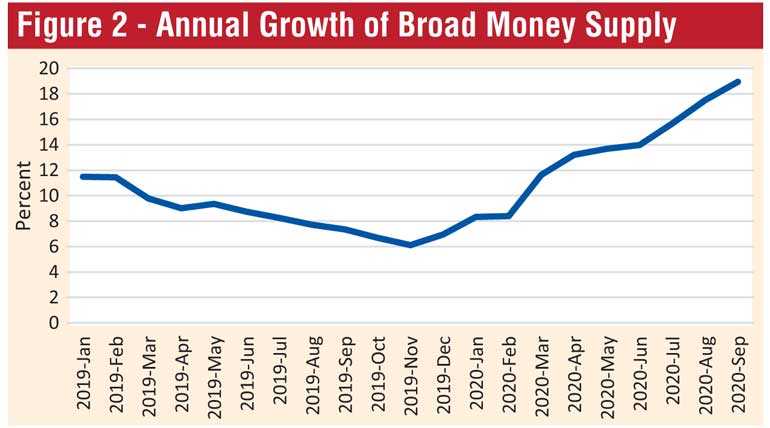

The monetary easing policy adopted by the Central Bank to relieve the households and businesses adversely affected by Covid-19 too accelerated the annual money growth from 7.4% in September 2019 to 19.2% in September 2020 (Figure 2). The monetary easing measures included sequential reductions of the policy interest rates and Statutory Reserve Ratio (SRR), which led to inject substantial liquidity into the market, and to reduce borrowing costs significantly. Concessional credit schemes were also introduced to facilitate the activities of Small and Medium-scale Enterprises (SMEs), alongside debt moratoria granted for businesses and individuals distressed by the pandemic.

Nevertheless, the annual growth of commercial bank credit to the private sector has remained stagnant around 5% reflecting the slow pick up of economic activities. In contrast, net commercial bank credit to the Government rose by 44.9% in the 12-month period ending September 2020. In this background, the excessive money supply growth is bound to create demand pressures augmenting inflation and imports in the coming months.

Inflation-targeting monetary policy missing

Surprisingly, the Budget speech does not make any reference to monetary policy which is vital in achieving macroeconomic stability, and sustaining economic growth. The Central Bank made concerted efforts about two years ago to launch the inflation-targeting monetary policy framework with the expectation of close coordination with fiscal authorities while regaining its independence. I categorically warned in these columns that such efforts would be suicidal for the Central Bank, unless the fiscal sector is aligned with such process committing to low budget deficits.

It is evident by now that inflation-targeting monetary policy is a remote possibility, as such policy is completely neglected not only by the fiscal authorities in the latest Budget Speech, but also by its architect, the Central Bank. Inflation-targeting monetary policy framework is not focused in the Central Bank’s publication, ‘Recent Economic Developments – Highlights of 2020 and Prospects for 2021’.

Understandably, it is not feasible to implement such rule-based policy amidst the current economic crisis, but the Central Bank should have displayed its long-term commitment to run the inflation-targeting monetary policy framework, which was declared with much grandeur not so long ago. That would strengthen the Central Bank’s independence, which is vital to operate monetary policy without undue political interference.

Demand pressures mounting

The easy monetary policy implemented by the Central Bank under the Presidential directive following the pandemic is unlikely to boost production activities significantly as expected, given the inherent weaknesses of enterprises, uncertain macroeconomic environment and imperative health-related precautionary measures imposed by the government including curfews, lockdowns and travel restrictions. The global economic downturn resulting from the pandemic has dampening effects on the export sector.

Further, business decisions in the private sector are mostly based on comparisons of the expected rate of return on investment vis-à-vis opportunity cost of investment. Interest rates represent the opportunity cost while expectations are influenced by many factors including macroeconomic economic environment, technological changes, exchange rate volatility, capacity utilisation, export competitiveness, aggregate demand, fiscal stability, inflation, political stability, business confidence, and cost of production.

The present low interest rate environment encourages consumption, as savings yield low returns. Thus, low interest rates have negative effects on domestic savings. This is reflected in the downfall of domestic savings rate from 24.8% of GDP in the first half of 2019 to 20.8% in the corresponding period of 2020. Meanwhile, private consumption rose from 66.7% of GDP in the first half on 2019 to 70.5% in the same period of 2020. Given the low returns on savings, the surplus-fund holders tend to move to alternative assets such as commodities, real estate and risky financial instruments. Such fund diversions lead to distort investment decisions, and to create asset bubbles harming financial stability.

The rising consumption demand has spill-over effects on domestic production and imports exerting pressures on inflation and balance of payments deficits. Inflation, in addition to cheap credit, makes imports attractive and exports unprofitable, causing further deterioration of the trade balance. Unless the exchange rate is allowed to depreciate freely to achieve external equilibrium, import restrictions become imperative to avoid deterioration of the trade deficit.

This type of inward-looking foreign trade policy seems to be the Government’s policy choice at present, as can be evident from several import controls imposed in recent times. Although such measures are inevitable amidst the pandemic, it must be noted that they have adverse consequences on competitiveness, productivity and export-led growth in the long run. Hence, it is important to phase out import restrictions and to allow free trade.

Policy concerns

Given Sri Lanka’s long track record of low economic growth and macroeconomic imbalances, it is a major policy challenge to mitigate the economic fallout from COVID-19. Budget 2021 does not contain any coherent policy strategy to overcome the crisis. The budget deficit in 2021 is likely to be much higher than what is given in the official projections due to inevitable revenue shortfalls and expenditure overruns amidst the pandemic.

In financing the widening budget deficit, increased reliance on bank borrowings results in liquidity injections, and consequent pressures on the money supply, inflation and balance of payments. The import restrictions imposed recently to arrest the balance of payments deficit might give wrong signals to the market depressing outward-oriented growth. Meanwhile, recourse to foreign borrowings escalates the already heavy external debt burden.

The response of the private sector to monetary easing seems rather weak due to structural factors while cheap credit has tended to encourage extravagant consumption, speculative asset holdings and risky financial dealings. The neglect of inflation-targeting monetary policy launched by the Central Bank about two years ago is a matter of concern from the viewpoint of optimal monetary-fiscal policy mix. A systematic growth strategy, backed by a realistic macroeconomic framework, is essential to recover the economy.

(The author is Emeritus Professor in Economics at the Open University of Sri Lanka)